|

市場調查報告書

商品編碼

1433759

全球物聯網感測器市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)IoT Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

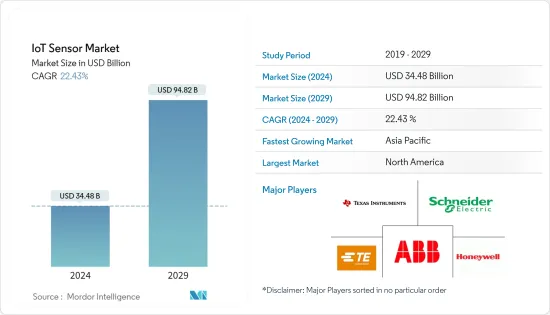

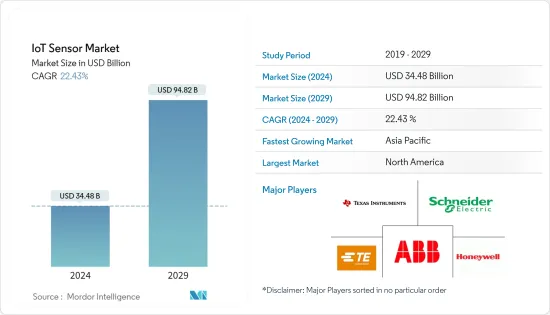

據預測,2024年全球物聯網感測器市場規模預計為344.8億美元,2029年達到948.2億美元,在預測期內(2024-2029年)年複合成長率為22.43%。

新興的應用程式和經營模式,加上設備成本的下降,正在顯著推動物聯網的採用。因此,許多連網型設備不斷湧現,包括聯網汽車、機器、儀表、穿戴式裝置和家用電器。根據愛立信的一項研究,到 2021 年將連接的 280 億台設備中,有近 160 億台將是物聯網設備。這一強勁成長預計將受到對連網型生態系統部署和 3GPP蜂巢式物聯網技術標準化的日益關注的推動。

主要亮點

- 歐洲和中國等地區的工業 4.0 舉措是物聯網部署以及物聯網感測器的主要驅動力。據Accenture稱,60%的製造業企業已經在進行物聯網計劃,超過30%處於早期採用階段。此外,物聯網感測器成本的下降也是預測期內推動此技術採用的重要因素之一。

- 此外,智慧城市計畫也有助於推動對物聯網感測器的需求。新加坡已經推出了基於感測器的老年人監控系統,如果在辦公室工作的家庭成員年邁的父母或住在家裡的家屬健康狀況惡化或表現出異常行為,該系統會向在辦公室工作的家庭成員發出警報,幫助您接收。

- 此外,現場設備、感測器和機器人的進步預計將擴大市場範圍。物聯網技術正在克服製造業的勞動力短缺問題。對於越來越多的組織來說,機器人化等工業4.0技術的使用已成為日常業務的一部分。

- 例如,採用較小的晶片/晶圓和先進製造設備開發的新一代物聯網感測器提供了更大的彈性、連接性和效率。連網型工廠基礎設施的未來將需要低功耗願景,這將支援適合建構 IIoT 環境的基礎設施升級,並鼓勵業界採用補充需求的解決方案。

- 同時,最近爆發的新冠肺炎 (COVID-19) 疫情擾亂了全球供應鏈和多種產品的需求。物聯網感測器的採用預計將在 2020年終受到影響。此外,由於中國等國家停產,2-3月多個產業出現多種產品短缺的情況。然而,隨著社交距離在很長一段時間內成為常態,預計各種行業將越來越依賴自動化解決方案。例如,智慧零售有潛力變得非常流行。

物聯網感測器市場趨勢

汽車和運輸業推動市場成長

- 汽車巨頭、網路安全供應商、晶片製造商和系統整合商之間最近的業務聯盟和合資企業正在穩步推動全球汽車行業進入自動駕駛時代。

- 這表明,高度(4 級)、完全(5 級)自動駕駛汽車的出現最早在 2020 年是不可避免的。車輛之間用於「決策」的正確通訊預計需要車輛連接來正確吸收和理解視覺、地理、語音和其他資料。

- 隨著智慧城市的興起,我們預計將看到 Car2Car 連接和先進車輛管理的出現,從而擴大物聯網感測器的範圍。這推動了智慧感測器技術的快速創新和採用,從而推動了對物聯網感測器的需求。

- 梅賽德斯-奔馳、大眾、沃爾沃、豐田和谷歌等公司擴大投資開發具有豐富功能的智慧汽車,以提供更安全、更方便和舒適的駕駛體驗。根據納斯達克的數據,到 2030 年,無人駕駛汽車可能會主導市場。此外,DHL SmarTrucking 的目標是到 2028 年建立一支由 10,000 輛物聯網卡車組成的車隊。預計這將在預測期內推動物聯網感測器的採用。

- 物聯網也大規模地改變了汽車、運輸和物流產業。預防性維護、連網型行動性和即時資料存取是推動所研究領域採用物聯網的關鍵因素。近年來,全球物聯網運輸和物流支出呈指數級成長。

- 物聯網使許多運輸機構能夠繪製最有效的路線並最大限度地提高燃料使用率,使物流公司能夠追蹤出貨,並使停車Start-Ups能夠即時監控可用停車位。物聯網設備正在部署在交通堵塞控制系統中,例如汽車遠端資訊處理系統、運輸業者使用的預訂系統、安全性和監控系統以及遠端車輛監控系統。

北美佔據主要市場佔有率

- 北美是最大的市場之一,因為該地區擁有多家知名供應商,且各行業最早採用物聯網技術。該地區的許多公司正在採用物聯網來了解產品性能並避免代價高昂的故障和低效的定期維護停機。

- 該地區物聯網的使用也是受訪市場的主要驅動力。例如,根據史丹佛大學和 Avast 的研究,北美家庭的物聯網設備密度是世界上最高的。值得注意的是,該地區 66% 的家庭至少安裝了一台物聯網設備。此外,25% 的北美家庭擁有不只一台設備。

- 此外,諸如支援物聯網的醫用穿戴溫度感測器等設備已經部署,這些設備可以將資料遠端傳輸到中央監控系統。醫務人員可以根據趨勢和閾值識別患者和房間並發出警報,並做出相應的回應。

- 此外,加拿大的最終用戶也正在投資這個市場。例如,加拿大能源部門正在採購連網感測器來監控各種活動,包括發電廠、電網和智慧家庭電錶。然而,根據2020年北美中小企業先進製造業調查,加拿大企業在採用先進技術方面落後於美國同業。

- 此外,隨著 ADAS 系統需求的增加,該地區對物聯網感測器的需求預計也會成長。德意志銀行預計,到2021年,美國ADAS產量將達到1,845萬台。

物聯網感測器產業概述

物聯網感測器市場較為分散,多家感測器製造商都在努力保持競爭力。這加劇了市場競爭。市場公司正在採取合作夥伴關係、產品開拓、併購和收購等策略活動來獲得市場佔有率。

- 2020 年 7 月:德克薩斯(TI) 推出業界首款零漂移霍爾效應電流感測器 TMCS1100 和 TMCS110。據該公司稱,這種新型感測器可以隨著時間和溫度的變化實現最低的漂移和最高的精度。它還為工業馬達驅動器、太陽能逆變器、能源儲存設備和電源等交流電或直流高電壓系統提供可靠的 3kVrms 隔離。

- 2020 年 6 月 TE Connectivity 推出 LVDT 位置感測器。這些感測器根據 ICT 非公路設備和工業工具機的液壓應用要求提供標準和自訂解決方案。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 評估 COVID-19 對物聯網感測器市場的影響

- 市場促進因素

- 由於成本和尺寸減小,物聯網感測器的使用增加

- 擴大工業 4.0 和連網型設備的應用

- 市場限制因素

- 人們對資料安全的擔憂日益加深

第5章市場區隔

- 按類型

- 壓力

- 溫度

- 化學

- 運動/接近

- 其他類型

- 按最終用戶

- 衛生保健

- 汽車/交通

- 製造業/工業

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 德國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 其他亞太地區

- 世界其他地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第6章 競爭形勢

- 公司簡介

- ABB Ltd

- Schneider Electric SE

- TE Connectivity

- Robert Bosch GmbH

- OMRON Corporation

- Sensata Technologies

- Honeywell International Inc.

- TDK Corporation

- STMicroelectronics NV

- Texas Instruments Inc.

第7章 投資分析

第8章市場的未來

The IoT Sensor Market size is estimated at USD 34.48 billion in 2024, and is expected to reach USD 94.82 billion by 2029, growing at a CAGR of 22.43% during the forecast period (2024-2029).

The new emerging applications and business models, coupled with the falling device costs, have been significantly driving the adoption of IoT. Consequently, many connected devices - connected cars, machines, meters, wearables, and consumer electronics. According to the Ericsson study, of the 28 billion total devices connected by 2021, close to 16 billion will be IoT devices. This robust growth is expected to be driven by the increased focus on deploying a connected ecosystem and the standardization of 3GPP cellular IoT technologies.

Key Highlights

- Industry 4.0 initiatives across regions like Europe, China, etc., are the major drivers of the IoT deployments, and therefore, the IoT sensors. According to Accenture, 60% of the manufacturing companies are already engaged in IoT projects, and more than 30% are at an early deployment stage. Moreover, the decreasing cost of IoT sensors is one of the prominent factors that would fuel the technology's adoption over the forecast period.

- Besides, smart city initiatives are also instrumental in driving the demand for IoT sensors. Singapore has already implemented a sensor-based Elderly Monitoring System that helps office working family members to receive alerts when the health condition of their home living elderly parents or dependents deteriorates or exhibits abnormal behaviors.

- Further, the advancements in field devices, sensors, and robots are expected to expand the market's scope. IoT technologies are overcoming the labor shortage in the manufacturing sector. For more and more organizations, using Industry 4.0 technologies, like robotization, is part of day-to-day operations.

- For instance, the new-gen IoT sensors, developed on smaller chips/wafers and evolved fabrication units, offer better flexibility, connectivity, and efficiency. It is deemed necessary for upcoming connected factory infrastructure to be visioned, with less power consumption, and are expected to prompt industry to adopt solutions that help them upgrade their infrastructure suited for creating an IIoT environment and complement the demand.

- On the other hand, owing to the recent outbreak of COVID-19, the global supply chain and demand for multiple products have been disrupted. The IoT sensor adoption is expected to be influenced by the end of 2020. Moreover, due to the production shutdown in countries like China, multiple industries have observed a shortage of various products during February and March. However, with the prolonged period of "social distancing," becoming a norm is expected to drive the reliance on automated solutions in various industries. Smart retail, for instance, could see a tremendous boost.

IoT Sensor Market Trends

Automotive and Transportation Industry to Drive the Market Growth

- The automotive sector across the globe is steadily transitioning toward an autonomous era, owing to the recent business collaborations and joint ventures among automotive giants, cybersecurity providers, chip makers, and system integrators.

- This indicates the inevitable advent of highly (Level 4) and fully (Level 5) autonomous vehicles, at the earliest, by 2020. Vehicle connectivity is expected to become necessary for proper communication among vehicles for 'decision-making' proper assimilation and comprehension of visual, geographical, audio, and other data.

- As smart cities emerge, Car2Car connectivity and advanced fleet management are expected to emerge, thus, providing scope for IoT sensors. This has fuelled rapid innovation and the adoption of intelligent sensor technology, driving the demand for IoT sensors.

- Companies such as Mercedes-Benz, Volkswagen, Volvo, Toyota, and Google Inc. are increasingly investing in developing smart cars with rich features that deliver safer, convenient, and comfortable driving experiences. According to a NASDAQ, driverless cars are likely to dominate the market by 2030. Moreover, DHL SmarTrucking aims to build a fleet of 10,000 IoT- enabled trucks by 2028. This is expected to boost the adoption of IoT sensors over the forecast period.

- IoT is also bringing a massive revolution in the automotive, transportation, and logistics industries. Access to preventative maintenance, connected mobility, and real-time data access are significant factors driving IoT adoption in the studied segment. The global IoT transportation and logistics spending almost increased by an exponential rate in the recent times.

- The IoT has enabled many transportation organizations to map the most efficient routes, maximize fuel usage, logistics companies track-and-trace their shipments, and parking start-ups to monitor their available spots in real-time. IoT devices are deployed in traffic congestion control systems in telematics systems within motor vehicles, reservation and booking systems used by transport operators, security and surveillance systems, and remote vehicle monitoring systems.

North America to Account for a Significant Market Share

- North America is one of the largest markets due to several established vendors in the region and the earliest adoption of IoT technology in various industries. Most of the companies in this region are increasingly adopting IoT to keep track of their offering's performance, thus, avoiding costly breakdowns or inefficient routine maintenance shutdowns.

- The usage of IoT in the region is also significantly driving the studied market. For instance, according to a study by Stanford University and Avast, North American homes have the highest density of IoT devices in any region in the world. Notably, 66% of homes in the region have at least one IoT device. Additionally, 25% of North American homes boast more than two devices.

- Further, devices like IoT-enabled medical wearable temperature sensors that transmit data remotely to a central monitoring system are already implemented. Medical staff is alerted based on trends and thresholds, identifying the patient and room, and can respond accordingly.

- Additionally, end-users in Canada have also been investing in the market. For instance, the Canadian energy sector has been procuring internet-connected sensors toward monitoring a range of activities across generating plants, distribution networks, and smart home meters. However, compared to the United States, Canadian companies have been slower to adopt advanced technologies, as per the 2020 Advanced Manufacturing survey of SMEs in North America.

- Further, the demand for IoT sensors in the region is anticipated to grow with the increasing demand for ADAS systems. According to Deutsche Bank, the US ADAS unit production volume will reach 18.45 million by 2021.

IoT Sensor Industry Overview

The IoT sensor market is fragmented, with several sensor manufacturers striving to maintain a competitive edge. This factor is, thereby, intensifying the competition in the market. Players in the market adopt strategic activities such as partnerships, product development, mergers, and acquisitions to capture the market share.

- July 2020: Texas Instruments Incorporated launched the industry's first zero-drift Hall-effect current sensors, TMCS1100 and TMCS110. The new sensors can enable the lowest drift and highest accuracy over time temperature, according to the company. In contrast, they provide reliable 3-kVrms isolation, especially for AC or DC high-voltage systems such as industrial motor drives, solar inverters, energy storage equipment, and power supplies.

- June 2020: TE Connectivity launched the LVDT position sensor. These sensors provide standard and custom solutions based on the hydraulic application requirements of ICT off-highway equipment and industrial machine tools.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Assessment of COVID-19 Impact on IoT Sensor Market

- 4.5 Market Drivers

- 4.5.1 Rising use of IoT sensors due to reduced cost and size

- 4.5.2 Increasing applications of Industry 4.0 and connected devices

- 4.6 Market Restraints

- 4.6.1 Rising concerns related to data security

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Pressure

- 5.1.2 Temperature

- 5.1.3 Chemical

- 5.1.4 Motion/Proximity

- 5.1.5 Other Types

- 5.2 By End User

- 5.2.1 Healthcare

- 5.2.2 Automotive and Transportation

- 5.2.3 Manufacturing / Industrial

- 5.2.4 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 South Korea

- 5.3.3.4 India

- 5.3.3.5 Rest of the Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Latin America

- 5.3.4.2 Middle-East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd

- 6.1.2 Schneider Electric SE

- 6.1.3 TE Connectivity

- 6.1.4 Robert Bosch GmbH

- 6.1.5 OMRON Corporation

- 6.1.6 Sensata Technologies

- 6.1.7 Honeywell International Inc.

- 6.1.8 TDK Corporation

- 6.1.9 STMicroelectronics NV

- 6.1.10 Texas Instruments Inc.