|

市場調查報告書

商品編碼

1437492

移動式碾碎和分類機:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029)Mobile Crushers And Screeners - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

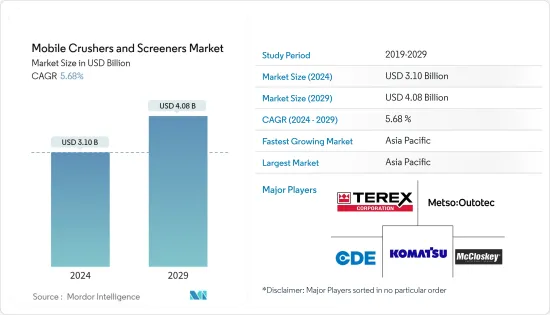

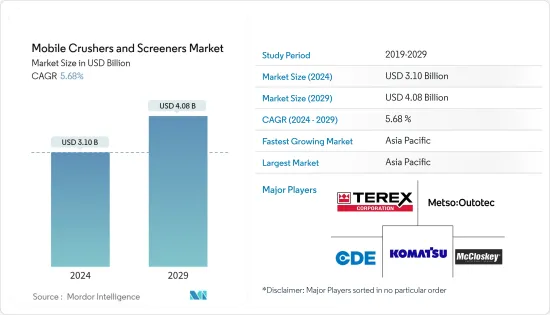

移動式碾碎和分類機市場規模預計到 2024 年為 31 億美元,在預測期內(2024-2029 年)預計到 2029 年將達到 40.8 億美元,複合年成長率為 5.68%。

主要亮點

- 移動式碾碎和分類機是安裝在輪子或卡車上的固定式破碎機和篩分機的一種。這些是新興的碾碎裝置,在預測期內顯示出較高的成長潛力。由於這些岩石碾碎可以在生產現場內和生產現場之間輕鬆移動,因此它們在骨料作業、骨料生產、回收和其他幾個最終用戶行業中的應用需求不斷成長。

- 推動所研究市場成長的關鍵因素是對降低運輸和燃料成本的需求不斷成長,因為移動式碾碎可以輕鬆運輸並安裝在短期使用的地點。移動式碾碎的成本效益隨著碾碎的路線和採石場的距離而成比例增加,這會影響整體營運成本,從而促進其採用。

- 近年來,由於開發其使用案例的技術發展,移動式碾碎的功能也得到了顯著擴展。例如,移動式碾碎和篩分機擴大用於露天礦場。因此,預計各地區採礦活動的增加也將為預測期內所研究市場的成長創造良好的前景。

- 對移動式碾碎和分類機不斷成長的需求促使供應商推出創新解決方案。供應商也專注於整合自動化和物聯網等先進技術,以增強這些設備的功能。例如,維特根集團於 2023 年 8 月推出了最新型號的移動式碾碎MOBIREX MR 100(i) NEO/NEOe。破碎機是一種全電子機械,設計用於在建築工地的有限區域內運作。業務範圍包括加工軟質到中硬的天然石材以及各種回收應用,例如加工碎石、混凝土和瀝青。總體而言,各行業對緊湊型多功能破碎機和分類機的需求不斷成長,以及移動式碾碎和分類機用例的擴大,預計將在預測期內繼續推動市場成長。

- 然而,移動式碾碎和分類機市場的成長受到基礎設施缺乏的限制(這在開發中地區很明顯),以及在全球環境問題日益嚴重的情況下設備的高碳排放。

- 冠狀病毒感染疾病(COVID-19) 的爆發嚴重影響了移動式碾碎和篩分機主要終端用戶產業的成長,包括建築、採礦和回收。然而,隨著幾乎所有地方取消與冠狀病毒相關的限制,所有主要最終用戶行業都出現了強勁成長,這將在預測期內為受調查的市場帶來機會。

移動式碾碎與分類機市場趨勢

面向集中加工規模最大的最終用戶產業

- 骨料,也稱為“惰性顆粒材料,例如沙子、礫石和碎石”,有時也稱為“建築骨料”。骨料加工過程根據所需的特定材料而有所不同,但通常涉及兩個關鍵步驟:萃取和篩檢。此外,大多數骨料加工通常涉及碾碎。

- 對建築材料的需求不斷成長以及對高效加工方法的需求促使移動式碾碎和篩子在骨料加工中的使用增加。移動式碾碎和分類機提供了一種方便且經濟高效的解決方案來滿足這一需求,因為它們允許承包在現場處理材料並消除將材料往返於固定加工設施的麻煩。

- 建設產業的快速成長對移動式碾碎和篩分機的需求起到了重要的推動作用。這些設備廣泛應用於住宅、商業和工業建築計劃,可有效處理大量材料並直接在現場回收建築廢棄物。此外,移動式碾碎和篩分機由於其機動性、便利性和有效性,非常適合大規模施工作業。這些使得建築商無需將材料往返碾碎設施,從而最大限度地減少廢棄物並降低成本。

- 綠色建築和永續建築實踐的成長趨勢凸顯了回收和再利用材料的重要性,從而直接影響了對移動破碎機和篩選機的需求。隨著建設產業的新計畫和維修的擴展,對這些機器的需求預計將繼續增加。

- 對水泥、預拌混凝土(RMC)、碎石、瀝青、沙子和礫石等骨料的需求正在增加。因此,越來越需要生產這些材料來滿足這種需求。據印度品牌股權基金會稱,預計2022會計年度印度水泥產量將每年增加12%左右。這可歸因於農村地區住宅需求的不斷成長以及政府對基礎設施發展的重視。

- 近幾十年來,履帶式碾碎站經歷了重大發展,設計不斷更新以滿足市場需求。對混凝土和瀝青等回收材料的日益重視,促使骨料加工產業對小型移動式碾碎的強勁需求。

亞太地區預計將錄得顯著成長

- 中國擁有世界上最大的建築市場之一。政府法規和政策的變化正在對該市場產生重大影響。基礎設施投資的刺激預計將在未來幾年持續,並將繼續成為行業成長的關鍵驅動力。

- 中國的「十四五」規劃重點在於交通、能源、水務和新型都市化領域的新型基礎設施計劃。 ITA估計,「十四五」發展規劃期間(2021-2025年),新增基礎設施投資總額將約為27兆元(4.2兆美元)。

- 印度建設產業預計將在 2023 年獲得顯著提振,並將受到 2023/2024 預算中資本支出大幅增加的刺激。在最新預算中,政府將總支出增加了7.5%,從2022/2023會計年度的估計41.9兆盧比(5,222億美元)增加到2023/2024會計年度的45兆盧比(5,616億美元)。

- 此外,政府還將對印度國營國家公路局 (NHAI) 的撥款增加了 14%,達到 1.6 兆盧比(202 億美元)。印度也宣布對鐵道部的鐵路基礎設施投資創紀錄的 2.4 兆盧比(299 億美元)。由於基礎設施計劃的投資,骨料和水砂產量的增加增加了對破碎機和篩網等資本設備的需求,預計將在未來幾年推動市場上漲。

- 建築業是日本經濟的重要組成部分。據日本國土交通省稱,2022會計年度日本的建築投資總額預計將佔GDP的12.3%。日本擁有世界上最廣泛的城市基礎設施。日本的基礎設施發展策略在多個階段都強調平衡經濟成長和永續性的重要性。

- 由於亞太國家採礦和建設活動的增加,預計移動碾碎和分類機市場在預測期內將大幅成長。它廣泛用於採石場應用,因為採石場是所有基礎設施計劃的母產業。亞太地區商業、工業和住宅領域基礎設施的不斷發展將支持預測期內的市場成長。

移動式碾碎和分類機產業概況

移動式碾碎和分類機市場正在出現碎片化,特雷克斯公司、美卓公司、CDE Sekai、日本小松公司礦業公司和麥克洛斯基國際有限公司等主要公司進入市場。這些公司正在實施合作和收購等策略,以加強其產品系列確保永續市場。競爭力。

2023 年 8 月,維特根集團推出了 MOBIREX MR 100(i) NEO/NEOe,標誌著最先進的移動衝擊式碾碎NEO 系列的開始。在 NEOe 版本中,這款適應性強且高效的機器完全依靠電力運作。

此外,2023 年 2 月,Capital Aggregates 旗下子公司 Capital Materials Quarries 安裝了第四台 Finlay J-1175 顎式破碎機,擴大了業務範圍。以有效減少和調整建築材料骨料尺寸的能力而聞名,這項新增功能增強了其向密蘇裡州中部和西南部承包提供優質產品的能力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

- 產業價值鏈分析

- 評估宏觀趨勢對市場的影響

第5章市場動態

- 市場促進因素

- 礦山機械需要降低運輸成本並提高彈性

- 快速都市化帶動建設產業崛起

- 市場課題/限制

- 機械碳排放的影響

第6章市場區隔

- 依類型

- 全新

- 翻新

- 依機器類型

- 移動式破碎機(顎式、圓錐式、衝擊式等)

- 移動式篩分機(振動式、旋轉式等)

- 依最終用戶產業

- 採礦、冶金

- 聚合處理

- 其他最終用戶產業

- 依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Terex Corporation

- Metso Corporation

- CDE Global

- Komatsu Mining Corporation

- McCloskey International Ltd

- Hartl Holding GmbH

- Kleemann GmbH(Wirtgen Group)

- Portafill International Ltd

- Sandvik AB

- Rubble Master HMH GmbH

- SBM Mineral Processing GmbH

- Tesab Engineering Ltd

- IROCK Crushers

- Astec Industries, Inc.

第8章投資分析

第9章 未來展望

The Mobile Crushers And Screeners Market size is estimated at USD 3.10 billion in 2024, and is expected to reach USD 4.08 billion by 2029, growing at a CAGR of 5.68% during the forecast period (2024-2029).

Key Highlights

- Mobile crushers and screeners are a form of stationary crushers and screeners, which are mounted either on wheels or on tracks. They are emerging crushing equipment, showing high potential for growth over and beyond the forecast period. As these rock-crushing machines are easily movable on and between production sites, their demand has witnessed continuous growth in mining operations, aggregates production, recycling, and applications across several other end-user industries.

- A significant factor driving the growth of the market studied is the growing demand for reduced transportation and fuel costs, as mobile crushers can be easily transported and installed at places intended to be used for a short period. The cost efficiency of mobile crushers increases proportionally to the routes to the crushers and the distances in the quarries, which influences the overall operational cost, thereby driving their adoption.

- In recent years, the capabilities of mobile crushers have also expanded significantly owing to the technological developments developing their use cases. For instance, mobile crushers and screeners are increasingly finding applications in open pit mines. Hence, the increasing mining activities across various regions are also anticipated to create a favorable outlook for the studied market's growth during the forecast period.

- The growing demand for mobile crushing and screening equipment encourages vendors to launch innovative solutions. Vendors are also focusing on integrating advanced technologies, such as automation and IoT, to enhance the capabilities of these devices. For instance, in August 2023, the Wirtgen Group introduced its latest model of mobile crushers, the MOBIREX MR 100(i) NEO/NEOe. The crusher is an all-electric machine designed to operate in confined areas on construction sites. The spectrum of operations includes soft to medium-hard natural stone processing and various recycling applications, including processing debris, concrete, and asphalt. Overall, the growing demand for compact and versatile crushers and screeners across various industries and the expanding use cases of mobile crushers and screeners are anticipated to continue to drive the market's growth during the forecast period.

- However, the market growth for mobile crushers and screeners is restricted by inadequate infrastructure facilities, which are more prominent across the developing regions, and by the high carbon footprint of the equipment, as environmental concerns are increasing globally.

- The outbreak of COVID-19 has significantly impacted the growth of major end-user industries of mobile crushers and screeners, including construction, mining, and recycling, among others. However, with COVID-related restrictions removed almost everywhere, all the major end-user industries have been witnessing robust growth, which is anticipated to drive opportunities in the market studied during the forecast period.

Mobile Crushers And Screeners Market Trends

Aggregate Processing to be the Largest End-user Industry

- Aggregates, also known as "inert granular material such as sand, gravel, or crushed stone," are sometimes referred to as "construction aggregates." The process of aggregate processing can vary depending on the specific material required, but it generally involves two essential steps: extraction and screening. Additionally, crushing is often involved in most of the aggregate processing.

- The rising demand for construction materials and the need for efficient processing methods have led to the increasing use of mobile crushers and screeners in aggregate processing. Mobile crushers and screeners provide a convenient and cost-effective solution to meet this demand, as they allow contractors to process materials on-site and avoid the hassle of transporting materials to and from a fixed processing facility.

- The rapid growth of the construction industry plays a vital role in driving the demand for mobile crushers and screeners. These devices are widely utilized in residential, commercial, and industrial construction projects to efficiently handle substantial volumes of materials and recycle construction waste directly at the site. Additionally, due to their mobility, convenience, and effectiveness, mobile crushers and screeners are highly suitable for extensive construction undertakings. They enable builders to cut costs by minimizing waste and eliminating the need for transporting materials to and from crushing facilities.

- The growing trend of green building and sustainable construction practices highlights the importance of recycling and reusing materials, thereby directly impacting the necessity for mobile crushers and screeners. With the construction industry expanding due to new projects and renovation endeavors, there will be an ongoing increase in the demand for these machines.

- There is a growing demand for aggregate materials such as cement, ready-mix concrete (RMC), crushed stone, asphalt, sand, and gravel. As a result, there is an increasing necessity to produce these materials in order to meet this demand. According to the Indian Brand Equity Foundation, it was projected that in FY 2022, cement production in India would experience a yearly rise of approximately 12%. This can be attributed to the increasing need for rural housing and the government's emphasis on infrastructure development.

- In recent decades, there has been significant evolution in tracked crushing plants, with continuous updates to their designs to meet the market's demand. The increasing emphasis on recycling concrete and asphalt, among other materials, has created a strong demand for smaller and more mobile crushers in the aggregate processing industry.

Asia Pacific is Expected to Register Significant Growth

- China has one of the largest construction markets in the world. Changes in government regulations and policies have significantly impacted this market. Stimulus investment in infrastructure, which is expected to continue over the next few years, will remain a significant driver of industry growth.

- The 14th Five-Year Plan of China focuses on new infrastructure projects in the transport, energy, water, and new urbanization sectors. According to the ITA estimates, during the 14th Five Year Development Plan period (2021-2025), investments in new infrastructure would total around CNY 27 trillion (USD 4.2 trillion).

- The construction industry in India is expected to receive a significant boost in 2023, which will be stimulated by an enormous increase in capital expenditure as part of the FY 2023/2024 Budget. In its latest budget, the government increased its total spending by 7.5%, from an estimated INR 41.9 trillion (USD 522.2 billion) in FY 2022/2023 to INR 45 trillion (USD 561.6 billion) in 2023/2024.

- Additionally, the government has raised its allocation to the state-owned National Highway Authority of India (NHAI) by 14% to INR 1.6 trillion (USD 20.2 billion). India has also announced record high investment in railway infrastructure at INR 2.4 trillion (USD 29.9 billion) for the Ministry of Railways. Because of the increased production of aggregates and M-sand due to investment in infrastructure projects, the demand for capital equipment such as Crushers and Screens is expanding, which means that the market is expected to rise over the years ahead.

- The construction sector is an essential component of the Japanese economy. According to the MLIT (Japan), the total investment in construction in Japan was estimated to be 12.3% of GDP in FY 2022. Japan has the world's most extensive urban infrastructure. In response to many phases, the Japanese strategy for infrastructure development has highlighted the importance of striking a balance between economic growth and sustainability.

- The mobile crushers and screeners market growth is anticipated to be high during the forecast period, owing to increased mining and construction activities in the Asia Pacific countries. They are widely used in stone quarry applications as it is the parent industry of all infrastructure projects; the increasing infrastructure development in commercial, industrial, and residential sectors in Asia-Pacific will support the market growth during the forecast period.

Mobile Crushers And Screeners Industry Overview

The mobile crushers and screeners market exhibits fragmentation, hosting major players like Terex Corporation, Metso Corporation, CDE Global, Komatsu Mining Corporation, and McCloskey International Ltd. These players are implementing strategies such as partnerships and acquisitions to enrich their product portfolios and secure a sustainable competitive edge.

In August 2023, the Wirtgen Group introduced the MOBIREX MR 100(i) NEO/NEOe, marking the inception of the NEO line-a state-of-the-art mobile impact crusher. This highly adaptable and efficient machine operates entirely on electricity in its NEOe version.

Furthermore, in February 2023, Capital Materials Quarries, a division of Capital Aggregates, expanded its operations by incorporating a fourth Finlay J-1175 Jaw Crusher. Renowned for its capacity to effectively reduce and size aggregates for construction materials, this addition enhances its capabilities in delivering quality products to contractors across central and southwestern Missouri.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Reduced Transportation Costs and Greater Flexibility in Machinery of the Mining Industry

- 5.1.2 Rise of the Construction Industry Due to Rapid Urbanization

- 5.2 Market Challenges/restraints

- 5.2.1 Effects of Carbon Emission from Machinery

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 New

- 6.1.2 Refurbished

- 6.2 By Machinery Type

- 6.2.1 Mobile Crusher (Jaw, Cone, Impact, etc.)

- 6.2.2 Mobile Screener (Vibratory, Gyratory, etc.)

- 6.3 By End-user Industry

- 6.3.1 Mining and Metallurgy

- 6.3.2 Aggregate Processing

- 6.3.3 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Terex Corporation

- 7.1.2 Metso Corporation

- 7.1.3 CDE Global

- 7.1.4 Komatsu Mining Corporation

- 7.1.5 McCloskey International Ltd

- 7.1.6 Hartl Holding GmbH

- 7.1.7 Kleemann GmbH (Wirtgen Group)

- 7.1.8 Portafill International Ltd

- 7.1.9 Sandvik AB

- 7.1.10 Rubble Master HMH GmbH

- 7.1.11 SBM Mineral Processing GmbH

- 7.1.12 Tesab Engineering Ltd

- 7.1.13 IROCK Crushers

- 7.1.14 Astec Industries, Inc.