|

市場調查報告書

商品編碼

1445837

資料安全 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Data Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

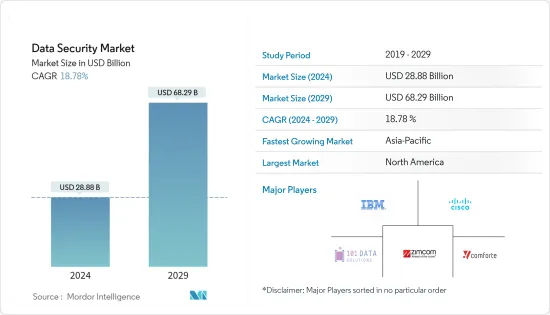

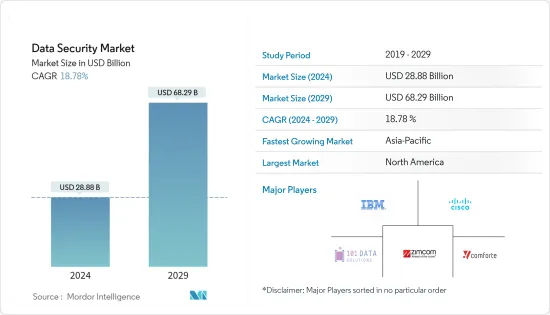

資料安全市場規模預計到 2024 年為 288.8 億美元,預計到 2029 年將達到 682.9 億美元,在預測期內(2024-2029 年)CAGR為 18.78%。

由於資訊應用,包括儲存和挖掘海量或商業資料,數據量不斷成長。這些應用程式是動態的和多功能的。資料安全對於保持資料的真實性和完整性以及防止攻擊至關重要。此外,駭客正在部署 Odinaff、Danabot、Camubot、Backswap 等惡意軟體,這增加了資料面臨安全威脅的脆弱性,促使企業和客戶需要更有效的安全解決方案。

主要亮點

- 根據戰略與國際研究中心 (CSIS) 和 McAfee 的數據,網路犯罪每年對全球造成約 6,000 億美元的損失,佔全球 GDP 的 0.8%,包括資料損壞和破壞、金錢盜竊、財產損失、智慧財產權盜竊和其他部門。預計安全和漏洞管理軟體和服務的開發將因這些原因而加速。

- 由於數位化趨勢和數位資料產生的不斷成長,對資料安全市場的需求不斷成長。在過去的幾十年裡,數位資料的創建急劇擴展,並且這種趨勢預計將持續下去。智慧型手機和筆記型電腦等數位裝置的日常使用不斷增加是促使數位資料產生增加的主要因素之一。此外,由於物聯網 (IoT) 的日益普及以及許多物聯網設備產生的資料,資料安全市場也不斷擴大。

- 企業在進行數位轉型時,都會受到嚴格的法律(例如 GDPR、PCI DSS、ISO 等)的約束,以保護系統免受資料洩露,無論組織所在的部門或行業如何。法規和合規性要求企業實施高效的安全解決方案,這支持資料安全市場的擴大。

- 實施資料審計、資料即時警報、資料風險評估、資料最小化和清除陳舊資料資料安全技術可以幫助組織防止洩漏、降低風險並維持保護性安全措施以防止資料遺失。

- 在從各種來源收集的結構化和非結構化資料中尋找和分析敏感資料已成為一個重要問題,預計這將阻礙市場成長。此外,年輕新創企業的網路安全預算必須增加,以實施新一代防火牆(NGFW)和進階威脅防護(ATP)技術。由於資金短缺和投資有限等重大問題,新興經濟體的小型企業需要協助採用資料安全解決方案。

- 由於許多員工在家工作並連接公司的資料(這一點更為重要),政府、公共和私營企業已推出許多措施來克服 COVID-19 期間的網路釣魚企圖。此外,在大流行期間,第三方應用程式的使用顯著成長。由於所有這些因素,IT 基礎設施現在更容易受到病毒和網路攻擊。企業被迫加強安全措施,這使全球資料安全市場受益。例如,自去年 12 月以來,與 COVID-19 相關的魚叉式網路釣魚電子郵件攻擊增加了 67%。

資料安全市場趨勢

資料安全技術是最大的資產

- 強大的資料安全策略可以幫助組織保持合規性並減少零售、金融、醫療保健和政府等各行業面臨的威脅。當遵循機密性、完整性和可用性原則使用時,資料將成為最有價值的資源,可以幫助組織改善決策、實施策略計劃以及與客戶和業務合作夥伴建立更牢固的聯繫。

- 資料安全技術包括防火牆、身份驗證和授權、加密、資料脫敏、基於硬體的安全性、資料備份和復原以及資料擦除。它在業務營運、發展和財務方面發揮著至關重要的作用。透過保護資料,公司可以防止資料外洩和聲譽受損,並更好地滿足監管要求。根據 ThoughtLab 的報告,去年資料外洩事件數量增加了 15.1%。此外,IDG 報告稱,68% 的 CIO 預計未來幾年將在資料安全方面投入更多資金。

- 人工智慧和多雲端服務在資料安全方面發揮著重要作用。隨著資料網路釣魚和網路攻擊的數量每天都在增加,人工智慧 (AI) 可以幫助安全營運分析師領先於威脅和危險,做出關鍵決策並修復問題。由於當今的企業正在從眾多來源累積資料,因此保護資訊對公司來說至關重要。資料安全中的人工智慧和機器學習可以幫助安全分析師減少當局防止資料竊取所花費的時間。由於人工智慧和機器學習專注於透過使用提供給他們的演算法來保護訊息,因此他們還可以了解如何對特定威脅進行分類。透過此類技術,這些技術可以快速掃描系統的異常行為,並確定異常是否歸類為潛在威脅。

- 大多數尖端企業都依賴多雲端服務。它們利用許多雲端運算服務供應商的優勢,為組織提供多種可能性的全面安全解決方案。這項服務為公司提供了更大的靈活性、改進的成本管理和增強的彈性。使用多雲端技術和流程從單一介面監控和管理不同公有雲的工作負載的能力減少了資料外洩並提高了資料安全性。

- 雲端資料安全軟體可保護使用雲端服務或基於雲端的應用程式儲存的資訊。這些工具可以透過實施雲端存取控制和儲存策略來促進資料安全。公司利用這些工具來實施安全協定、監控存取並保護儲存在雲端應用程式中和透過雲端應用程式傳輸的資訊。

亞太地區見證市場擴張

- 由於網際網路技術的快速普及以及各行業設備數量的增加,預計資料安全解決方案的需求將在預測期內成長。美國國家資訊與通訊技術研究所也預計,這些連接設備上的攻擊和資料釣魚將會增加。此類事件推動公司開發能夠預測此類事件發生可能性的解決方案,從而推動資料安全市場的發展。

- 由於服務於國內和國際客戶的大型企業的存在,亞太地區政府和企業對安全相關產品(包括 VPN、端點保護和安全測試)的投資增加。

- 亞洲市場的一個突出趨勢是擴大使用物聯網設備(例如 BYOD)來存取醫療保健、銀行、旅遊、飯店服務等。這種不斷成長的趨勢預示著資料安全產業的重大機會。根據 SPDI 規則,包括密碼、財務資訊、醫療記錄等在內的敏感個人資料應受到保護,除非涉及合法目的,否則不得濫用於任何個人需求。因此,需要實施有效的資料安全技術以避免資料遺失。

- 隨著雲端運算、行動技術和社群媒體的成長,有關資料安全漏洞的通報在亞太國家變得普遍。例如,去年7月,五眼國家(美國、加拿大、英國、澳洲和紐西蘭)與北約一起對一系列惡意網路攻擊表示擔憂,例如微軟Exchange駭客攻擊和針對美國的網路攻擊。震動了醫學研究機構和大學。

資料安全產業概況

在競爭激烈的資料安全產業中,湧現出許多知名企業。一些最著名的企業現在控制著市場佔有率。然而,隨著安全服務的發展,新公司在市場上變得越來越普遍,並擴大了其業務的地理範圍。根據所需的資料安全級別,企業對儲存在各種系統中的資料變得更加認真和了解。因此,中小企業正在利用 IBM、McAfee、Intel、Cybereason、Verizon、AT&T 等公司的服務。

- 2022 年 6 月,資料安全和分析領域的先驅 Varonis Systems, Inc. 宣布推出新功能,以提高 Amazon Simple Storage Service (S3) 的安全性和資料可見性,為客戶提供單一管理平台來保護跨域的關鍵資料他們的 IaaS 和 SaaS 生態系統。

- 2022 年 3 月,IT 和資料安全管理解決方案領域的領導者Syxsense 推出的行動裝置管理(MDM) 解決方案包括對行動端點進行有效管理所需的所有工具,包括裝置註冊、庫存和組態管理、應用程式部署回滾、資料容器化和遠端設備鎖定/重置/擦除,允許技術專家擦除遺失或被盜設備中的敏感資料,以提供資料安全。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 市場促進因素

- 數位化趨勢和數位數據生產的興起

- 資料安全技術的增加

- 市場限制

- 識別和分析敏感資訊和昂貴的安裝

- 產業價值鏈分析

- 產業吸引力 - 波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

- COVID-19 對市場影響的評估

第 5 章:市場區隔

- 依組件

- 解決方案

- 服務

- 依部署

- 雲

- 本地

- 依組織規模

- 中小企業

- 大型企業

- 依最終用戶產業

- 零售

- 衛生保健

- 製造業

- 銀行、金融服務和保險

- 政府

- 資訊科技與電信

- 其他最終用戶產業

- 地理

- 北美洲

- 歐洲

- 亞太

- 拉丁美洲

- 中東和非洲

第 6 章:競爭格局

- 公司簡介

- IBM Corporation

- Cisco Systems Inc

- 101 Data Solutions

- Microsoft Corporation

- Zimcom Internet Solutions

- Comforte AG

- Thales

- Lepide USA Inc

- Varonis Systems Inc

- Checkpoint Software Technologies Ltd

- Oracle Corporation

第 7 章:投資分析

第 8 章:市場機會與未來趨勢

The Data Security Market size is estimated at USD 28.88 billion in 2024, and is expected to reach USD 68.29 billion by 2029, growing at a CAGR of 18.78% during the forecast period (2024-2029).

Data volumes have been growing because of information applications, including storing and mining massive or commercial data. These applications are dynamic and multifunctional. Data Security is crucial for preserving the authenticity and integrity of the data as well as for preventing attacks. Additionally, hackers are deploying malware like Odinaff, Danabot, Camubot, Backswap, etc., which has increased data vulnerability to security threats, leading businesses and customers to demand more effective security solutions.

Key Highlights

- According to the Center for Strategic and International Studies (CSIS) and McAfee, cybercrimes cost the globe around USD 600 billion annually, or 0.8% of global GDP, and encompass data damage and destruction, money theft, lost property, intellectual property theft, and other sectors. The development of security and vulnerability management software and services is anticipated to be accelerated by such causes.

- The need for the data security market has grown due to rising digitalization trends and digital data generation. The creation of digital data has dramatically expanded over the last few decades, and this trend is anticipated to continue. The growing daily use of digital devices like smartphones and laptops is one of the main factors causing this rise in digital data generation. Additionally, the Data Security Market has expanded due to the rising popularity of the Internet of Things (IoT) and the data produced by numerous IoT devices.

- Strict laws, like GDPR, PCI DSS, ISO, and others, are being placed on businesses as they go through a digital transformation to protect systems from data breaches, irrespective of the sector or industry that the organization operates. Regulations and compliances require enterprises to implement efficient security solutions, which supports the expansion of the data security market.

- Implementing data security technologies like Data Auditing, Data Real-time Alerts, Data risk assessment, Data minimization, and Purging of stale data could help organizations prevent breaches, reduce risk, and sustain protective security measures to prevent data loss.

- Finding and analyzing sensitive data among the structured and unstructured data collected from various sources has become a significant concern, which is expected to hamper the market growth. Moreover, young start-ups' cybersecurity budgets must be increased to implement Next-Generation Firewalls (NGFWs) and Advanced Threat Protection (ATP) technologies. Small businesses in emerging economies need help adopting data security solutions due to significant concerns, including a shortage of capital and limited investment.

- Since many employees work from home and connect the company's data, which is more important, government, public, and private businesses have launched many initiatives to overcome phishing attempts during COVID-19. Additionally, the use of third-party applications has grown significantly during the pandemic. As a result of all these factors, IT infrastructure is now more susceptible to viruses and cyberattacks. Companies have been compelled to enhance security measures, which has benefited the global data security market. For instance, spear-phishing email attacks related to COVID-19 have increased by 67% since December last year.

Data Security Market Trends

Data Security Technologies As the Greatest Asset

- A robust data security strategy could help organizations stay compliant and reduce exposure to threats in various industries, including retail, finance, healthcare, and government. When used following the principles of confidentiality, integrity, and availability, data would be the most valuable resource that helps organizations improve decisions, carry out strategic initiatives, and build stronger bonds with clients and business partners.

- Data security technologies include firewalls, authentication and authorization, encryption, data masking, hardware-based security, data backup and resilience, and data erasure. It plays a vital role in business operations, development, and finances. By protecting data, companies can prevent data breaches and damage to reputation and better meet regulatory requirements. According to the ThoughtLab report, there was a rise of 15.1% in the number of data breaches in the previous year. Also, IDG reports that 68 percent of CIOs anticipate spending more on data security over the upcoming years.

- AI and multi-cloud services play a significant part in data security. Artificial intelligence (AI) assists security operations analysts in keeping ahead of threats and hazards to make crucial decisions and remediate problems as data phishing and cyberattacks increase in volume daily. As enterprises today are accumulating data from numerous sources, securing information is of utmost importance for companies. AI and ML in data security can assist security analysts in reducing the time taken by authorities to prevent data thefts. As AI and ML focus on securing information by working with algorithms provided to them, they can also learn about how specific threats are classified. With such techniques, these technologies can quickly scan through the abnormal behavior of the system and determine if abnormalities classify as potential threats.

- The majority of cutting-edge businesses rely on multi-cloud services. These take advantage of many cloud computing service providers to provide an organization with a comprehensive security solution from a wide range of possibilities. This service gives firms more flexibility, improved cost management, and increased resilience. The ability to monitor and manage workloads across different public clouds from a single interface using multi-cloud technologies and processes reduces data breaches and improves data security.

- Cloud data security software secures information stored using cloud services or cloud-based applications. These tools can facilitate data security by enforcing cloud access control and storage policies. Companies utilize the tools to implement security protocols, monitor access, and protect information stored within and transferred through cloud applications.

Asia-Pacific witnessed Market Expansion

- Data security solutions are anticipated to grow in demand during the forecast period due to the quick uptake of Internet technologies and the increased number of devices across various industries. An increase in attacks and data phishing on these connected devices was also projected by the National Institute of Information and Communication Technology. Such occurrences drive the market for data security by pushing companies to develop solutions that allow them to predict the possibility of such incidents.

- Investments by governments and corporate enterprises in security-related products, including VPN, endpoint protection, and security testing, have increased in the Asia Pacific region due to the availability of large businesses that serve domestic and international clients.

- A prominent trend in the Asian market is the growing use of IoT devices, such as BYOD, to access healthcare, banking, travel, hospitality services, etc. This ever-increasing trend indicates a significant opportunity for the data security industry. According to SPDI Rules, sensitive and personal data that includes passwords, financial information, medical records, etc., should be protected and cannot be misused for any individual needs unless involved in legitimate purposes. Hence effective data security techniques are to be implemented to avoid data loss.

- With an increase in cloud computing, mobile technology, and social media, reports on data security breaches have become prevalent in Asia Pacific countries. For instance, in July last year, the Five Eyes countries (the U.S., Canada, the U.K., Australia, and New Zealand), along with NATO, expressed concerns over a series of malicious cyberattacks, such as the Microsoft Exchange Hacks and cyberattacks that shook medical research institutes and universities.

Data Security Industry Overview

There are numerous prominent companies in the fiercely competitive data security Industry. Some of the most famous players now control the market regarding market share. However, as security services develop, new companies are becoming more prevalent on the market and extending their geographic reach for their businesses. Depending on the level of data security required, businesses are becoming more conscientious and aware of the data stored in various systems. As a result, small and medium enterprises are taking advantage of services from firms like IBM, McAfee, Intel, Cybereason, Verizon, AT&T, etc.

- In June 2022, Varonis Systems, Inc., a pioneer in data security and analytics, announced new features to improve safety and boost data visibility in Amazon Simple Storage Service (S3), which gives customers a single pane of glass to protect critical data across their IaaS and SaaS ecosystem.

- In March 2022, The Mobile Device Management (MDM) solution from Syxsense, a leader in IT and data security management solutions, includes all the tools required to apply effective management to mobile endpoints, including Device Enrolment, Inventory, and Configuration Management, Application Deployment and Rollback, Data Containerization, and Remote Device Lock/Reset/Wipe, allowing Technology expertise to wipe sensitive data from lost or stolen devices to provide data security.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Digitization Trends and Digital Data Production

- 4.2.2 Increase in Data Security Technologies

- 4.3 Market Restraints

- 4.3.1 Identifying and Analyzing Sensitive Information and Costly Installation

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assesment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment

- 5.2.1 Cloud

- 5.2.2 On-premises

- 5.3 By Organization Size

- 5.3.1 Small and Medium Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End-user Industry

- 5.4.1 Retail

- 5.4.2 Healthcare

- 5.4.3 Manufacturing

- 5.4.4 Banking, Financial Services and Insurance

- 5.4.5 Government

- 5.4.6 IT & Telecommunications

- 5.4.7 Other End-user Industries

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Cisco Systems Inc

- 6.1.3 101 Data Solutions

- 6.1.4 Microsoft Corporation

- 6.1.5 Zimcom Internet Solutions

- 6.1.6 Comforte AG

- 6.1.7 Thales

- 6.1.8 Lepide USA Inc

- 6.1.9 Varonis Systems Inc

- 6.1.10 Checkpoint Software Technologies Ltd

- 6.1.11 Oracle Corporation