|

市場調查報告書

商品編碼

1445755

日本即時支付 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Japan Real Time Payment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

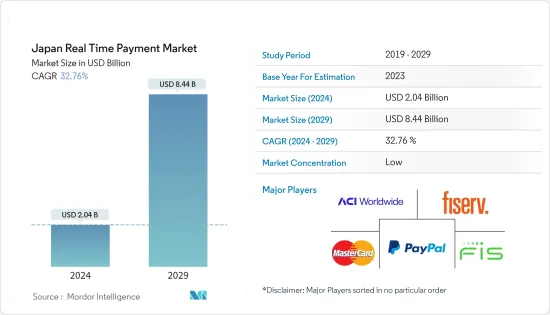

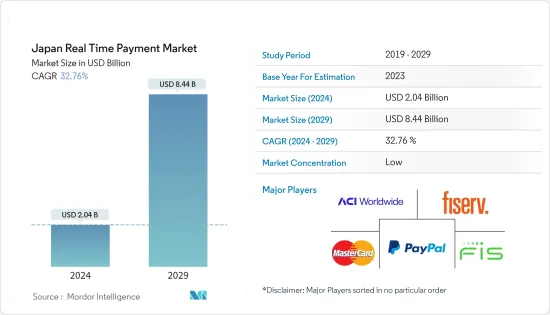

日本即時支付市場規模預計到 2024 年為 20.4 億美元,預計到 2029 年將達到 84.4 億美元,在預測期內(2024-2029 年)CAGR為 32.76%。

由於消費者擴大採用速度和便利性,以及創新和監管支援的支付解決方案不斷從現金轉向,即時支付系統正在激增。

主要亮點

- 智慧型設備的日益普及和線上零售商務的蓬勃發展推動了即時支付在該國的快速採用。此外,即時支付浪潮的興起反映了消費者對即時交易的需求不斷成長,這是由於智慧型手機和其他連接設備的普及而推動的,這刺激了消費者對即時性的期望。

- 日本政府的多項舉措,包括財政激勵、標準化和基礎設施發展,也促進了即時支付市場的成長。例如,政府計劃透過數位平台推出工資平台,這可能會進一步促進消費者的採用。此外,政府也制定了到 2025 年將無現金支付比例從約 20% 增加到約 40% 的目標。

- 然而,人們對現金(傳統方法)的較大依賴、實施成本以及消費者需求較低(因為他們更喜歡傳統支付系統)是課題日本即時支付市場成長的因素。

- 一些市場參與者正在擴大其在該國的即時支付系統的供應。 2022年12月,Adyen在日本推出統一商務解決方案,提供連結不同線上、線下銷售管道的支付平台。供應商的此類推出預計將在預測期內推動市場成長。

- COVID-19大流行的爆發極大地影響了即時支付市場。隨著國家對數位轉型的重視和先進的技術基礎設施,即時支付解決方案得到了廣泛採用。此外,疫情加速了無現金支付方式的趨勢,促使行動支付解決方案和電子錢包的更多使用。隨著公司競相提供更方便、更安全的解決方案,這也有助於刺激即時支付產業的創新。

日本即時支付市場趨勢

數位支付的採用將推動市場

- 數位支付已被廣泛採用,並且在該國越來越受歡迎。最常用的數位支付方式包括2D碼支付、行動支付、非接觸式卡片支付等。這種採用是由數位支付平台提供的便利性和更高的安全性所推動的。

- 數位支付透過多種方式提供快速高效的支付基礎設施,包括即時轉帳、即時處理、輕鬆對帳以及方便的用戶訪問,從而有助於促進即時支付。根據 FIS 的數據,2021 年日本銷售點現金支付佔有率年減 15%,而前一年則較去年同期下降 7.8%。消費者選擇數位支付以避免在疫情期間接觸貨幣。

- 日本政府表示,預計到 2025 年,無現金交易將佔日本所有交易的至少 40%,比 2021 年成長 20% 左右。它認為,擴大數位支付將促進該國旅遊業並刺激金融部門創新。這最終將促使對即時支付的更大需求。

- 此外,日本政府計劃在 2023 年春季之前推出一個企業無需透過銀行帳戶即可數位化支付薪資的系統,30% 的企業正在考慮實施該系統。這些舉措進一步支持了即時支付市場的成長。

- 日本的年輕人口正在成為消費經濟的重要組成部分,並要求改變數位化以適應他們對科技友善的習慣。此外,透過給予消費者獎勵和現金回扣來推動數位支付採用的大規模政治努力可能會增加日本數位支付的採用。

智慧型手機滲透率的提高推動市場發展

- 日本智慧型手機普及率的提高在行動支付、行動銀行、增加可訪問性和改善用戶體驗等各種方式的即時支付成長中發揮關鍵作用。它透過使消費者更容易獲得和方便的數位支付方式來促進市場成長。

- 在日本,到 2021 年,約 92% 的 30 歲至 39 歲的人將使用智慧型手機上網。在 20 多歲的人中,這一比例略低。根據總務省的數據,80 歲及以上的老年人中只有 12.1% 使用手機上網(日本)。

- 日本總務省 2021 年 9 月進行的一項調查顯示,個人資訊或瀏覽器歷史記錄外洩是迄今為止日本受訪者在使用網路時感到不安全的最常見原因,超過90%的人都提到過。繼隱私問題之後,電腦病毒攻擊和虛假帳單或詐欺也隨之而來。

- 此外,調查也顯示,大多數日本人在使用網路時感到焦慮,而老一輩更容易有這種感覺。預計這種趨勢將阻礙日本各人口群體的即時支付市場的成長。洩漏個人資訊也會影響年輕人的支付習慣。

- 隨著智慧型手機的普及增加了該國商品和服務的買賣,行動商務的成長也促進了市場的成長。根據行動內容論壇的數據,截至 2021 年,日本行動商務市場規模達到約 4.9 兆日圓。

日本即時支付產業概況

由於市場上有許多參與者,日本即時支付市場較為分散。由於客戶口味的快速變化,該市場已成為一個有吸引力的選擇,吸引了大量的投資。由於巨大的成長潛力,服務提供者正在實施擴張、合作、協議、收購等策略性措施。

2022 年 8 月,任務關鍵型即時支付軟體的全球領導者 ACI Worldwide 宣布與日本領先的中央國內支付網路 Japan Card Network, Inc. (CARDNET) 達成協議,以實現其數位支付基礎設施的現代化。該協議將使 ACI 與 CARDNET 合作,為 CARDNET 的客戶提供最新的數位支付技術和下一代解決方案。

2022 年 3 月,全球支付服務領導者 Worldline 宣布進入日本,將為日本各地的零售商處理信用卡付款。日本是一個經濟成熟、非常安全、消費習慣保守的國家,卡支付發展潛力大。此外,2022 年 3 月,Worldline 將業務擴展到日本,目前為當地企業提供信用卡支付處理服務。為了在日本實現成長,這家法國支付供應商與當地支付解決方案和網路服務供應商 (NSP) Vesca 合作。 Vesca 將作為該國的技術推動者,充當 Worldline 的接受層。 Worldline 計劃於 2022 年初推出其服務。這些服務將包括信用卡獲取以及銷售點卡受理和處理。據該公司稱,該公司希望在接下來的幾個月內提高其電子商務能力。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

- 該國支付格局的演變

- 該地區無現金交易成長相關的主要市場趨勢

- COVID-19 對市場的影響評估

第 5 章:市場動態

- 市場促進因素

- 智慧型手機普及率提高

- 政府措施正在加速即時支付解決方案的採用

- 市場課題

- 支付安全相關問題

- 現有對現金的依賴

- 市場機會

- 鼓勵數位支付成長的政府政策變化

- 數位支付產業的主要法規和標準

- 全球監管格局

- 具有潛在監管障礙的商業模式

- 發展空間取代不斷變化的商業格局

- 主要案例研究和用例分析

第 6 章:市場區隔

- 依付款方式

- 對等

- 點對點

第 7 章:競爭格局

- ACI Worldwide Inc.

- Fiserv Inc.

- Paypal Holdings Inc.

- Mastercard Inc.

- FIS Global

- VISA Inc.

- Apple Inc.

- Alipay (Ant Financial)

- SIA SpA

- Finastra

第 8 章:投資分析

第 9 章:市場的未來

The Japan Real Time Payment Market size is estimated at USD 2.04 billion in 2024, and is expected to reach USD 8.44 billion by 2029, growing at a CAGR of 32.76% during the forecast period (2024-2029).

Real-time payment systems were proliferating due to increased consumer adoption for speed and convenience and the continued shift away from cash with payment solutions enabled by innovation and regulation.

Key Highlights

- The growing adoption of smart devices and booming online retail commerce drive the rapid adoption of real-time payments in the country. Also, the rising tide of real-time payments reflects growing consumer demand for real-time transactions, driven due to the ubiquity of smartphones and other connected devices, which have catalyzed consumer expectations for immediacy.

- Several initiatives by the Japanese government, including financial incentives, standardization, and infrastructure development, are also adding growth to the real-time payment market. For instance, the government is planning to introduce a platform for wages through a digital platform which could further contribute to the adoption among consumers. Also, the government has set a target of growing cashless payments to around 40% of all transactions by 2025, up from approximately 20%.

- However, the larger dependence of the population on cash (traditional method), cost of implementation, and low consumer demand as they prefer traditional payment systems are the factors challenging the growth of the real-time payment market in Japan.

- Several market players are expanding their offering of real-time payment systems in the country. In December 2022, Adyen launched its unified commerce solution in Japan to provide a payment platform that connects different online and offline sales channels. Such introductions from the vendors are expected to fuel the market growth during the forecast period.

- The outbreak of the COVID-19 pandemic greatly impacted the real-time payment market. With the country's focus on digital transformation and its advanced technology infrastructure, real-time payment solutions had widespread adoption. Additionally, the pandemic accelerated the trend toward cashless payment methods, leading to greater use of mobile payment solutions and e-wallets. This also helped spur innovation in the real-time payment industry as companies compete to offer more convenient and secure solutions.

Japan Real-Time Payment Market Trends

Digital Payment Adoption Will Drive the Market

- Digital payments have been widely adopted and are growing in popularity in the country. Mostly used digital payment methods include QR code payments, mobile payments, contactless card payments, and others. This adoption is driven by the convenience and increased security offered by digital payment platforms.

- Digital payments are helping to facilitate real-time payments by providing a fast and efficient payment infrastructure in various ways, including instant transfer, real-time processing, easy reconciliation, and convenient access to the users. According to FIS, Japan's share of cash point-of-sale payments fell 15% yearly (YoY) in 2021, compared to a 7.8% YoY reduction the year before. Consumers have opted for digital payments to avoid touching currency during the pandemic.

- According to the government of Japan, cashless transactions are expected to account for at least 40% of all transactions in Japan by 2025, up around 20% from 2021. It believes that expanding digital payments will boost tourism and stimulate financial sector innovation in the country. This will eventually lead to a greater demand for real-time payments.

- Furthermore, the Japanese government is planning to introduce a system for companies to pay salaries digitally without going through bank accounts by spring 2023, and 30% of companies are considering implementing this system. Such initiatives are further supporting the growth of the real-time payment market.

- The younger population in Japan is becoming a significant part of the consumer economy and demanding a change to digital to match their technology-friendly habits. Also, massive political efforts to bring digital payment adoption by giving consumer rewards and cash rebates are likely to grow the adoption of digital payments in Japan.

Increased Smartphone Penetration to drive the Market

- Increasing smartphone penetration in Japan is playing a key role in the growth of real-time payments in various ways, such as mobile payments, mobile banking, increased accessibility, and improved user experience. It is contributing to market growth by making digital payment methods more accessible and convenient for consumers.

- In Japan, about 92% of persons aged 30 to 39 will use smartphones to access the internet in 2021. In the case of those in their twenties, the percentage was slightly lower. According to the Ministry of Internal Affairs and Communications, only 12.1% of those aged 80 and older used cell phones to access the internet (Japan).

- According to a survey conducted by the Ministry of Internal Affairs and Communications (Japan) in September 2021, a leak of one's personal information or browser history was by far the most common reason for Japanese respondents to feel insecure when using the internet, with more than 90% mentioning it. Computer virus attacks and fake billings or frauds followed privacy concerns.

- Furthermore, the survey revealed that most people in Japan feel anxious when using the internet, with the older generations having a higher tendency to feel this way. Such trends are expected to hamper the growth of the real-time payments market in every demography of the Japanese population. Leaking personal information is something that can also impact the payments habit of the younger population.

- The growth of M-commerce is also contributing to the market growth as the smartphone penetration increased the buying and selling of goods and services in the country. According to the Mobile Content Forum, the m-commerce market size in Japan reached around JPY 4.9 trillion as of 2021.

Japan Real-Time Payment Industry Overview

The Japanese real-time payment market is fragmented due to the presence of many players operating in the market. The market has become an attractive choice due to rapidly changing customer tastes, attracting considerable investment. Because of the immense potential growth, service providers are undergoing strategic initiatives such as expansion, partnership, agreement, acquisitions, etc.

In August 2022, ACI Worldwide, the global leader in mission-critical, real-time payments software, announced an agreement with Japan's leading central domestic payment network, Japan Card Network, Inc., CARDNET, to modernize its digital payments infrastructure. The agreement would see ACI work with CARDNET to provide the latest digital payments technology and next-generation solutions to CARDNET's customers.

In March 2022, Worldline, a global leader in payments services, announced its entrance into Japan, where it will handle credit card payments for retailers across the country. Japan has large development potential for card payments because it is an economically mature, very secure nation with conservative consumer habits. Also, in March 2022, Worldline expanded its business into Japan, where it now provides credit card payment processing to local businesses. For its growth in Japan, the French payment provider teamed with local payment solutions and network service provider (NSP) Vesca. Vesca will serve as a technical enabler in the country, acting as Worldline's acceptance layer. Worldline intends to launch its service in early 2022. These services will comprise credit card acquisition and point-of-sale card acceptance and processing. According to the corporation, the company wants to increase its e-commerce capabilities in the following months.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness- Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Evolution of the Payments Landscape in the Country

- 4.4 Key Market Trends Pertaining to the Growth of Cashless Transaction in the Region

- 4.5 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Smartphone Penetration

- 5.1.2 Government Initiatives are Accelerating the Adoption of Real-Time Payment Solutions

- 5.2 Market Challenges

- 5.2.1 Payment Security Related Concerns

- 5.2.2 Existing Dependence on Cash

- 5.3 Market Opportunities

- 5.3.1 Changes in Government Policies Encouraging the Growth of Digital Payments

- 5.4 Key Regulations and Standards in the Digital Payments Industry

- 5.4.1 Regulatory Landscape Across the World

- 5.4.2 Business Models with Potential Regulatory Roadblocks

- 5.4.3 Scope for Development in Lieu of Evolving Business Landscape

- 5.5 Analysis of Major Case Studies and Use-Cases

6 Market Segmentation

- 6.1 By Type of Payment

- 6.1.1 P2P

- 6.1.2 P2B

7 COMPETITIVE LANDSCAPE

- 7.1 ACI Worldwide Inc.

- 7.2 Fiserv Inc.

- 7.3 Paypal Holdings Inc.

- 7.4 Mastercard Inc.

- 7.5 FIS Global

- 7.6 VISA Inc.

- 7.7 Apple Inc.

- 7.8 Alipay (Ant Financial)

- 7.9 SIA SpA

- 7.10 Finastra