|

市場調查報告書

商品編碼

1445671

金融科技區塊鏈 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Fintech Blockchain - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

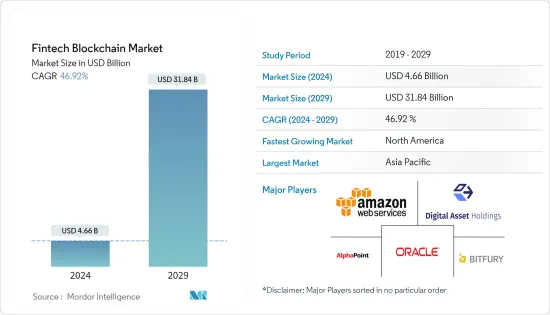

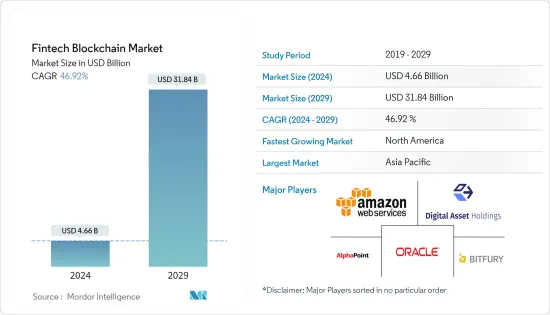

金融科技區塊鏈市場規模預計到 2024 年為 46.6 億美元,預計到 2029 年將達到 318.4 億美元,在預測期內(2024-2029 年)CAGR為 46.92%。

由於多種因素,區塊鏈相關的金融科技產業一直在經歷成長,例如加密貨幣和 ICO 市值的上升、對分散式帳本技術的需求不斷增加以及金融機構採用先進的區塊鏈解決方案。金融業的數位轉型也促進了金融科技區塊鏈的成長,因為數位銀行技術和用於客戶服務的自動聊天機器人的需求不斷成長。

主要亮點

- 採用加密貨幣和數位代幣進行支付預計將進一步提振市場。許多金融科技組織也開始採用區塊鏈技術,以簡化其業務流程,減少詐欺活動,並提高為客戶提供的服務品質。 Ripple 和其他基於區塊鏈的平台正在引起人們的興趣,預計這將在未來獲得更大的接受度。

- 穩定幣也越來越受歡迎,因為它們增加了流動性、節省成本和穩定性,它們是未來 DeFi 協議的一個令人著迷的例子。預計 DeFi 和區塊鏈技術將在未來兩年內促進一系列產業的創新。

- COVID-19大流行對全球許多產業產生了負面影響,與區塊鏈相關的金融科技產業也不例外。封鎖和供應鏈中斷使產業參與者難以預測金融科技區塊鏈產業的復甦。然而,危機帶來的系統性變化預計將對該行業產生重大影響。儘管面臨課題,金融科技區塊鏈市場預計在未來幾年將繼續成長。

金融科技區塊鏈市場趨勢

區塊鏈在保險領域的使用增加預計將推動市場發展

- 區塊鏈技術透過改變營運方式並提供一系列好處,例如降低成本、增強客戶體驗、提高效率、提高透明度等,正在徹底改變保險業。對於準備好迎接這項轉型的金融科技公司和保險提供者來說,這都是一個重大機會。

- 區塊鏈的主要優勢之一是它能夠提供透明且值得信賴的交易資訊,使其成為驗證保險索賠真實性至關重要的理想資料存儲庫。這會增強人們對流程的信任,並使保險提供者能夠就可承保的索賠百分比做出準確的決定。

- 2022 年 5 月,一家名為 Superscript 的英國新創公司和一家總部位於倫敦的保險市場經紀商 Lloyd's 推出了專門針對加密業務的名為「Daylight」的保險產品。該產品包括技術責任和網路保險,防止勒索軟體攻擊和無意版權侵權等各種風險。

- 此外,隨著物聯網(IoT)技術的興起,互連設備產生的資料量呈指數級成長。這需要一種能夠有效管理大量資料的技術。區塊鏈使保險提供者能夠透過允許設備相互通訊和點對點管理來安全地管理這些複雜的網路,而不是依賴昂貴的資料中心進行處理和儲存。這種方法更具成本效益,預計將推動未來市場的成長。

北美將經歷顯著成長並推動市場

- 全球跨國支付歷來受到嚴格監管和高昂成本的影響。然而,區塊鏈等分散式帳本技術的出現有助於降低其中一些成本並提高可追溯性。金融科技供應商正在迅速開發提供線上金融服務的新平台,全球金融科技公司正在與美國、墨西哥和加拿大境內的當地行動營運商、匯款業者和銀行合作。

- 最近的COVID-19疫情爆發加速了銀行業數位轉型的需求。由於人們被迫使用線上服務並限制銀行訪問,許多銀行公司與金融科技供應商合作,提供差異化和有競爭力的服務。未來,數位客戶體驗預計將成為競爭優勢的主要領域,並可能推動市場發展。

- 金融科技供應商提供的區塊鏈技術最顯著的好處之一是減少金融界的詐欺和網路攻擊。區塊鏈使金融科技企業能夠透過去中心化網路共享或傳輸安全且未更改的訊息,有助於遏制資料外洩和其他詐欺活動。這種增加的安全性和透明度有助於在金融機構與其客戶之間建立信任。

金融科技區塊鏈產業概況

金融科技區塊鏈市場競爭激烈,主導者包括亞馬遜網路服務、AlphaPoint Corporation、Bitfury Group Limited、Oracle Corporation 和 Digital Asset Holdings。這些參與者致力於透過策略合作措施擴大全球客戶群,以提高市場佔有率和獲利能力。然而,中小型公司也透過新產品創新和獲得新合約來展示自己的存在。

2023 年 1 月,銀行即服務平台 Striga 推出了一款新產品——適用於新銀行、DeFi 和 Web3 應用程式的加密貨幣入口和出口 API。該平台的目標是簡化持有或提取比特幣的流程,讓更多客戶更容易購買和交易加密貨幣。新推出的加密貨幣到法定貨幣或法定貨幣到加密貨幣的 API 可以整合到任何金融科技或加密貨幣產品中。

2022 年 1 月,開源、去中心化保險協議和生態系統 Etherisc 推出了區塊鏈支援的保險應用程式。該應用程式可以自主發布保單並對旅行延誤和取消執行支付,並且透過區塊鏈支付程式 Gnosis Chain(以前稱為 xDai Chain)處理支付。保險申請的初始付款方式是美元支持的美元硬幣。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:執行摘要

第 3 章:研究方法

第 4 章:市場動態

- 市場概況

- 市場促進因素

- 變革性和高度智慧的可程式區塊鏈平台的研發活動不斷增加

- 銀行業應用擴大採用區塊鏈技術,例如支付、智慧合約等。

- 降低總擁有成本

- 市場課題

- 不確定的監管標準和框架

- 市場機會

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

- COVID-19 的影響

第 5 章:市場區隔

- 依提供者

- 中介軟體提供者

- 應用和解決方案提供商

- 基礎設施和協議提供者

- 依應用

- 支付、清算和結算

- 兌換及匯款

- 智慧合約

- 身分管理

- 合規管理/KYC

- 其他應用

- 依組織規模

- 大型企業

- 中小企業

- 依垂直行業

- 銀行業

- 非銀行金融服務

- 保險

- 依地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太

- 中國

- 印度

- 日本

- 亞太其他地區

- 中東和非洲

- 北美洲

第 6 章:競爭格局

- 供應商市佔率

- 併購

- 公司簡介

- AlphaPoint Corporation

- Bitfury Group Limited

- Oracle Corporation

- Amazon Web Services, Inc.

- Digital Asset Holdings LLC

- Cambridge Blockchain, LLC

- Circle Internet Financial Limited

- Coinbase, Inc.

- Accenture Plc

- Earthport Plc

- Factom, Inc.

- GuardTime AS

- IBM Corporation

- Microsoft Corporation

- RecordesKeeper

- Ripple Lab Inc.

第 7 章:市場的未來前景

The Fintech Blockchain Market size is estimated at USD 4.66 billion in 2024, and is expected to reach USD 31.84 billion by 2029, growing at a CAGR of 46.92% during the forecast period (2024-2029).

The blockchain-related fintech industry has been experiencing growth due to various factors, such as the rising market cap of cryptocurrencies and ICOs, increasing demand for distributed ledger technology, and adoption of advanced blockchain solutions in financial institutions. The digital transformation of the financial industry is also contributing to the growth of the fintech blockchain, as digital banking technologies and automated chatbots for customer service are experiencing rising demand.

Key Highlights

- The adoption of cryptocurrencies and digital tokens for making payments is expected to boost the market further. Many fintech organizations have also started adopting blockchain technology to make their business procedures easier, reduce fraudulent activity, and enhance the quality of service provided to their customers. Ripple and other blockchain-based platforms are gaining interest, which is anticipated to lead to greater acceptance in the future.

- Stablecoins are also gaining popularity as they increase liquidity, cost savings, and stability, and they are a fascinating example of DeFi protocols in the future. DeFi and blockchain technology are expected to foster innovation across a range of industries in the next two years.

- The COVID-19 pandemic negatively impacted many industries globally, and the blockchain-related fintech industry is no exception. Lockdowns and supply chain disruptions made it difficult for industry participants to predict the resurgence of the fintech blockchain industry. However, systemic changes brought on by the crisis are anticipated to have a significant impact on this sector. Despite the challenges, the fintech blockchain market is expected to continue growing in the coming years.

Fintech Blockchain Market Trends

Increasing Use of Blockchain in the Insurance Sector is expected to Drive the Market

- Blockchain technology is revolutionizing the insurance industry by transforming operations and providing a range of benefits, such as cost reduction, enhanced customer experiences, increased efficiency, greater transparency, and more. This represents a significant opportunity for both fintech companies and insurance providers that are ready to embrace this transformation.

- One of the key advantages of blockchain is its ability to provide transparent and trustworthy information about transactions, making it an ideal repository for data that is crucial in verifying the authenticity of insurance claims. This instills trust in the process and enables insurance providers to make accurate decisions about the percentage of the claim that can be covered.

- In May 2022, a UK-based startup called Superscript and Lloyd's, a London-based insurance market broker launched a specialized insurance product called "Daylight" for crypto businesses. This offering includes technology liability and cyber insurance, protecting against various risks such as ransomware attacks and unintentional copyright infringement.

- Furthermore, with the rise of Internet of Things (IoT) technology, the amount of data generated by interconnected devices is increasing exponentially. This requires a technology that can efficiently manage large volumes of data. Blockchain enables insurance providers to manage these complex networks securely by allowing devices to communicate and manage each other peer-to-peer rather than relying on expensive data centers for processing and storage. This approach is much more cost-effective and is expected to drive the market's growth in the future.

North America Will Experience Significant Growth and Drive the Market

- Global cross-border payments have traditionally been subject to tight regulations and high costs. However, the emergence of distributed ledger technology, such as blockchain, has helped to reduce some of these costs and improve traceability. Fintech vendors are rapidly developing new platforms for the provision of online financial services, and global financial technology companies are partnering with local cellular operators, money transfer operators, and banks across the borders of the United States, Mexico, and Canada.

- The recent COVID-19 outbreak accelerated the demand for digital transformation in the banking sector. As people were forced to use online services and limit their bank visits, many banking companies collaborated with fintech vendors to offer differentiated and competitive services. In the future, digital customer experience is expected to be the primary area of competitive advantage and is likely to drive the market.

- One of the most significant benefits of blockchain technology offered by fintech vendors is the reduction of fraud and cyber-attacks in the financial world. Blockchain helps to curb data breaches and other fraudulent activities by enabling fintech businesses to share or transfer safe and unaltered information through a decentralized network. This added security and transparency could help to build trust between financial institutions and their customers.

Fintech Blockchain Industry Overview

The fintech blockchain market is highly competitive, with dominant players such as Amazon Web Services, AlphaPoint Corporation, Bitfury Group Limited, Oracle Corporation, and Digital Asset Holdings. These players are focusing on expanding their customer base globally through strategic collaborative initiatives to increase their market share and profitability. However, mid-size to smaller companies are also making their presence known through new product innovations and securing new contracts.

In January 2023, Striga, a banking-as-a-service platform, launched a new product - crypto on-ramp and off-ramp APIs for neo banks, DeFi, and Web3 apps. The platform's objective is to simplify the process of holding or withdrawing Bitcoin and make it easier for more customers to purchase and trade cryptocurrency. The newly introduced crypto-to-fiat or fiat-to-crypto APIs can be integrated into any fintech or cryptocurrency product.

In January 2022, Etherisc, an open-source, decentralized insurance protocol and ecosystem launched a blockchain-backed insurance application. The application can autonomously issue policies and execute payouts for travel delays and cancellations, and payments are processed through the blockchain payments program Gnosis Chain (formerly xDai Chain). The initial payment option for the insurance application is the U.S. dollar-backed USD Coin.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising R&D Activities for Transformative and Highly Intelligent Programmable Blockchain Platform

- 4.2.2 Increasing Adoption of Blockchain Technology for Applications in Banking Sector Such As Payments, Smart Contracts, Etc.

- 4.2.3 Reduced Total Cost of Ownership

- 4.3 Market Challenges

- 4.3.1 Uncertain Regulatory Standards and Frameworks

- 4.4 Market Opportunities

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19

5 MARKET SEGMENTATION

- 5.1 By Provider

- 5.1.1 Middleware Providers

- 5.1.2 Application and Solution Providers

- 5.1.3 Infrastructure and Protocol Providers

- 5.2 By Application

- 5.2.1 Payments, Clearing, and Settlement

- 5.2.2 Exchanges and Remittance

- 5.2.3 Smart Contract

- 5.2.4 Identity Management

- 5.2.5 Compliance Management/ KYC

- 5.2.6 Other Applications

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium-Sized Enterprises

- 5.4 By Verticals

- 5.4.1 Banking

- 5.4.2 Non-Banking Financial Services

- 5.4.3 Insurance

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles*

- 6.3.1 AlphaPoint Corporation

- 6.3.2 Bitfury Group Limited

- 6.3.3 Oracle Corporation

- 6.3.4 Amazon Web Services, Inc.

- 6.3.5 Digital Asset Holdings LLC

- 6.3.6 Cambridge Blockchain, LLC

- 6.3.7 Circle Internet Financial Limited

- 6.3.8 Coinbase, Inc.

- 6.3.9 Accenture Plc

- 6.3.10 Earthport Plc

- 6.3.11 Factom, Inc.

- 6.3.12 GuardTime AS

- 6.3.13 IBM Corporation

- 6.3.14 Microsoft Corporation

- 6.3.15 RecordesKeeper

- 6.3.16 Ripple Lab Inc.