|

市場調查報告書

商品編碼

1445435

先進 IC 載板 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029 年)Advanced IC Substrates - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

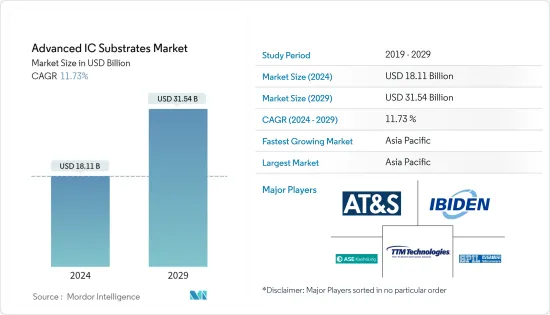

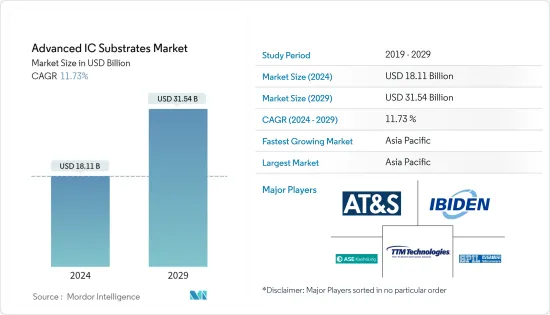

先進IC載板市場規模預計到2024年為181.1億美元,預計到2029年將達到315.4億美元,在預測期內(2024-2029年)CAGR為11.73%。

廠商不斷改進其封裝技術,以滿足更小占地面積、更高效能和更低功耗的嚴格要求。對消費性電子產品和行動通訊設備的需求促使電子製造商提供更緊湊、更攜帶的產品。

小型化的日益發展趨勢正在推動對先進封裝的需求。 5G 的出現影響了過去幾年的需求,隨著採用通訊技術的國家擴大在 5G 基地台和 HPC 中使用 FCBGA,預計 5G 的出現將繼續下去。

FCBGA 預計將在市場需求中佔據很大佔有率,因為它具有佈線密度可用性,並且可以進行調整以實現最大電氣性能。該市場的主要參與者包括 Unimicron、ASE Group、IBIDEN 和 SCC。例如,欣興科技和景碩正在擴大其基板產能。欣興微電子宣布,截至2022年,將投資總計200億新台幣用於先進覆晶基板的研發和產能擴張。

除此之外,全球消費和工業領域對物聯網的需求預計將增加對 IC 基板的需求不斷成長。根據網路和電視協會預測,2020年,全球物聯網設備數量預計將達到501億台,工業物聯網需求預計在未來幾年將超過消費者需求。預計此類發展將對市場產生正面影響。

先進基板產業遵循小型化、更高整合度和更高性能的趨勢。因此,正在進行的 ED 和 SLP 封裝領域的多家參與者正在進行巨額投資,並對此類技術表現出越來越大的興趣。

更高的功率密度和電路板整合度帶來了散熱優勢,從而進一步提高了系統可靠性。由於汽車應用的廣泛採用,此類技術為市場帶來了巨大的價值。

它們還推動電信和基礎設施領域的發展,其中 ED 是提高硬體效率的合適基板解決方案。因此,參與者正在對新工廠進行巨額投資,預計 ED 將成為主要產品成分。

儘管 IC 基板具有潛力,但偏好的變化可能會減緩市場成長。例如,一些公司利用具有多個 RDL 的矽中介層來實現邏輯和 HBM 之間的更好連接。其他人使用帶有 RDL 的基板上扇出。 FCBGA 需要基板供應商、晶圓凸塊以及用於 RDL 以及組裝和測試的晶圓製造能力。但 FO WLP 僅需要組裝和晶圓廠來進行 RDL 以及晶圓凸塊和測試。因此,業界正見證向 FOWLP 的轉變。

COVID-19 大流行期間商業/企業工作方式和消費者行為的變化刺激了對某些類型產品的需求,預計將打開新市場和市場途徑。例如,隨著越來越多的企業升級其安全性並增加雲端活動,對有線通訊中使用的半導體的需求仍在成長。許多網路上的視訊串流也增加了固定寬頻的使用。

先進IC載板市場趨勢

行動裝置和消費性電子產品將佔據主要市場佔有率

- 對行動通訊設備和消費性電子產品的需求正在推動行動和消費性電子產品製造商創造更小、更攜帶的產品。日益成長的小型化趨勢正在推動對先進封裝的需求。

- 行動裝置和消費性電子產品功能的不斷增加,以及智慧型裝置和智慧型穿戴裝置的日益普及,是預計在預測期內推動先進 IC 基板採用的一些主要因素。人工智慧和高效能運算等尖端技術以及高效能行動裝置(包括 5G)的日益採用推動了對先進 IC 基板的需求。

- 此外,智慧型手機佔據了相當大的市場佔有率,隨著5G智慧型手機的出現,需求預計將進一步增加。三星等跨國公司擴大投資半導體業務,以成為 5G 智慧型手機領域的傑出智慧型手機供應商。中國資訊通訊研究院 (CAICT) 的報告顯示,2022 年 1 月,由於價格下降提振需求,中國相容 5G 網路的智慧型手機出貨量成長 63.5%,達到 2.66 億部。報告也稱,5G智慧型手機出貨量佔中國出貨量的75.9%,高於40.7%的全球平均。

- 智慧手錶和健身手環等智慧穿戴裝置的日益普及及其功能的不斷增加也推動了行動和消費領域的成長。例如,2021 年 4 月,Fitbit 宣布推出新款 Luxe 健身追蹤器,一款無依鈕追蹤器。 Android 和 iOS 裝置都支援它。它還支援 Google 快速配對,以便更快速地與 Android 裝置配對,並在與手機配對時支援連接 GPS。這些進步預計將進一步滿足 FC CSP 的需求。

- 除此之外,由於智慧家庭的滲透率不斷提高,預計智慧家電在預測期內將出現大量應用並出現銷售成長。許多消費性電子公司也加大了對市場研究的投資,以開發更節能的積體電路。

中國將見證顯著成長

- 預計未來幾年中國積體電路產業將快速成長,同時要求加強研發投入,加強自主創新,以建立相對完整的半導體產業鏈體系。

- 根據中國半導體產業協會的數據,2021年1月至9月,中國積體電路產業收入達6,858.6億元人民幣(1,084億美元),較去年同期成長16.1%。該國還擴大了積體電路產業的產能。國家統計局數據顯示,2021年中國積體電路產量3,594億片,年增33.3%,成長速度較2020年翻倍。

- 此外,根據 CNBC 2022 年 12 月的報道,中國正在為其半導體行業製定超過 1 兆元人民幣(1,430 億美元)的一攬子支持計劃,這是實現晶片自給自足並對抗美國的重要一步”此舉旨在減緩其技術進步。北京計劃推出預計將是其最重要的財政刺激方案之一,在五年內分配,主要以補貼和稅收抵免的形式,以加強國內的半導體生產和研究活動。

- 此外,2023年3月,中國IC載板製造商Thinktrans尋求透過A輪融資籌集5億元人民幣至10億元人民幣(7,245萬美元至1.449億美元)。 Thinktrans 在內部設計和製造 IC 載板,並將其直接銷售給三類客戶:IDM、OSAT 和設計公司。雖然該公司的大部分客戶都位於大中華區,但執行長也將美國、日本和韓國視為持續擴張的潛在市場。

- 中國政府對半導體產業的日益重視促使對先進IC基板的需求增加。該國制定了積極的成長策略,計劃到 2025 年透過國內生產滿足中國 70% 的半導體需求。此外,政府的技術獨立第 14 個五年計畫(2021-2025 年)也支持這一目標。

先進IC載板產業概況

先進IC載板市場競爭適中,由幾個主要參與者組成。主導市場的參與者包括 ASE Group、TTM Technologies Inc.、Kyocera Corporation、Siliconware Precision Industries 和 Ibiden。市場上的現有參與者正在努力透過迎合 5G 電信、高效能資料等新技術來保持競爭優勢。中心、緊湊型電子設備等

2023年2月,韓國LG Innotek宣布全面加速業務活動,瞄準覆晶球柵陣列(FC-BGA)基板市場。該公司最近在「CES 2023」上首次推出了最新的 FC-BGA。在FC-BGA的開發上,公司積極利用超精細電路、高整合陣列、高多層基板匹配、無芯技術等技術。

2023 年 1 月,LG Innotek 在全新的龜尾工廠舉行慶祝活動,該工廠將生產 FC-BGA。 LG Innotek正在龜尾四號工廠建造最新的FC-BGA生產線,該工廠於2022年6月購買,總建築面積約22萬平方公尺。 LG Innotek打算加速FC-BGA的開發。預計今年上半年,新廠將擁有完善的生產體系,2023年下半年將開始全面投產。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭激烈程度

- 產業價值鏈分析

- COVID-19 對產業影響的評估

第 5 章:市場動態

- 市場促進因素

- 先進基板在物聯網設備製造上的應用不斷增加

- 半導體元件小型化趨勢日益明顯

- 市場限制

- 製造過程的複雜性

第 6 章:市場區隔

- 依類型

- FC球柵陣列

- 光纖通訊光熱發電

- 依應用

- 行動和消費者

- 汽車和交通

- 資訊科技和電信

- 其他應用

- 依地理

- 美國

- 中國

- 日本

- 韓國

- 台灣

- 世界其他地區

第 7 章:競爭格局

- 公司簡介

- ASE Kaohsiung (ASE Inc.)

- AT&S Austria Technologies & Systemtechnik AG

- Siliconware Precision Industries Co. Ltd

- TTM Technologies Inc.

- Ibiden Co. Ltd

- Kyocera Corporation

- Fujitsu Ltd

- JCET Group

- Panasonic Holding Corporation

- Kinsus Interconnect Technology Corp.

- Unimicron Corporation

第 8 章:投資分析

第 9 章:市場機會與未來趨勢

The Advanced IC Substrates Market size is estimated at USD 18.11 billion in 2024, and is expected to reach USD 31.54 billion by 2029, growing at a CAGR of 11.73% during the forecast period (2024-2029).

Players are continuously advancing their packaging technologies to cater to stringent requirements with a smaller footprint, higher performances, and lower power consumption. The demand for consumer electronics and mobile communication devices drives electronics manufacturers to deliver more compact and portable products.

The increasing trend of miniaturization is driving the demand for advanced packaging. The advent of 5G, which influenced the demand over the past few years, is expected to continue as the use of FCBGA in 5G base stations and HPCs is increasing in countries adopting communication technology.

FCBGA is expected to hold a significant share of the market demand, owing to its routing density availability, as it can be tuned for maximum electrical performance. The key players in the market are Unimicron, ASE Group, IBIDEN, and SCC. For instance, Unimicron and Kinsus are expanding their substrate capacities. Unimicron has announced that it would be investing a total of TWD 20 billion in R&D and expansion of its production capacity for advanced flip-chip substrates through 2022.

Apart from this, the global demand for IoT, in both the consumer and industrial spaces, is expected to add to the increasing demand for the IC substrate. According to the Internet and Television Association, the global number of IoT devices by 2020 is expected to reach 50.1 billion, and industrial IoT demand is expected to exceed consumer demand over the coming years. Such developments are expected to influence the market positively.

The advanced substrate industry follows miniaturization trends, greater integration, and higher performance. Owing to this, several players across the ongoing ED and SLP packaging are making huge investments and showing an increased interest in such technologies.

The higher power density and board integration result in thermal benefits, thereby enabling further improvements in system reliability. Such technologies bring massive value to the market due to extended adoption across automotive applications.

They also drive the telecom and infrastructure segment, where ED is a suitable substrate solution for increased hardware efficiency. Due to this, players are investing huge amounts in new plants where ED is expected to be the main product constituent.

Despite the potential of IC substrates, changing preferences are likely to slow down market growth. For instance, some companies utilize a silicon interposer with multiple RDLs for a better connection between logic and HBM. Others use fan-out-on-substrate with RDLs. FCBGA needs a substrate supplier, wafer bumps, and wafer fab capacity for RDLs and assembly and testing. But FO WLP only requires assembly and wafer fabs for RDLs and wafer bumps and testing. Hence, the industry is witnessing a shift toward FOWLP.

Changes in business/enterprise working style and consumer behavior during the COVID-19 pandemic have fuelled demand for some types of products, and it is expected to open both new markets and routes to market. For instance, demand for semiconductors used in wired communication is still growing as more enterprises are upgrading their security and increasing cloud activities. Video streaming across many networks has also increased fixed broadband usage.

Advanced IC Substrate Market Trends

Mobile Devices and Consumer Electronics to Hold Major Market Share

- The demand for mobile communication devices and consumer electronics is pushing manufacturers of mobile and consumer electronics to create products that are smaller and more portable. The growing trend of miniaturization is driving demand for advanced packaging.

- The increasing functionality of mobile devices and consumer electronics products, as well as the growing popularity of smart devices and smart wearables, are some of the major factors anticipated to drive the adoption of advanced IC substrates during the forecast period. The increasing adoption of cutting-edge technologies like AI and HPC and high-performance mobile devices (including 5G) drives demand for advanced IC substrates.

- Furthermore, smartphones command a significant share of the market, and with the advent of 5G smartphones, the demand is expected to increase even further. Global companies, like Samsung, are increasingly investing in the semiconductor business to become prominent smartphone vendors in the 5G smartphone space. In January 2022, China's shipments of smartphones compatible with 5G networks increased by 63.5% to 266 million in 2021 as falling prices boosted demand, according to the report by the China Academy of Information and Communications (CAICT). The report also stated that 5G smartphone shipments accounted for 75.9% of Chinese shipments, higher than the global average of 40.7%.

- The increasing adoption of smart wearables, like smartwatches and fitness bands, and their increasing functionality are also expanding the growth of the mobile and consumer segments. For instance, in April 2021, Fitbit announced its new Luxe fitness tracker, a buttonless tracker. It is supported on Android and iOS devices. It also supports Google Fast Pair for pairing more quickly with Android devices and supports connected GPS while paired to the phone. These advancements are expected to further develop the need for FC CSP.

- Besides this, smart appliances are expected to see significant applications and observe growth in their sales during the forecast period, owing to the increasing penetration of smart homes. Many consumer electronic companies are also increasing their investments in the market studied to develop more energy-efficient ICs.

China to Witness Significant Growth

- China's IC industry is expected to witness rapid growth in the coming few years while calling for increasing R&D input and strengthening independent innovation as part of the broader objective to establish a relatively complete semiconductor industry chain system.

- As per the China Semiconductor Industry Association, the revenue of China's integrated circuit industry reached CNY 685.86 billion (USD 108.4 billion) during the January-September 2021 period, up 16.1% on a yearly basis. The country also scaled up its production capacities in the IC industry. According to the National Bureau of Statistics, China produced 359.4 billion units of ICs in 2021, up 33.3% year-on-year, doubling the growth rate in 2020.

- Moreover, as per a report by CNBC in December 2022, China was working on a more than CNY 1 trillion (USD 143 billion) support package for its semiconductor industry, in a major step towards self-sufficiency in chips and to counter the United States' moves aimed at slowing its technological advances. Beijing has planned to roll out what is expected to be one of its most significant fiscal incentive packages, allocated over five years, mainly as subsidies and tax credits, to strengthen semiconductor production and research activities at home.

- Moreover, in March 2023, Thinktrans, a China-based manufacturer of IC substrates, was seeking to raise CNY 500 million to CNY 1 billion (USD 72.45 million to USD 144.9 million) in Series A funds. Thinktrans designs and manufactures IC substrates in-house and sells them directly to three groups of clients: IDMs, OSATs, and design houses. While most of the company's clients are based in Greater China, the CEO has also identified the US, Japan, and South Korea as potential markets for continued expansion.

- The growing emphasis on the semiconductor industry by the government of China is leading to an increase in demand for advanced IC substrates. The country has an aggressive growth strategy to meet 70% of China's semiconductor demand with domestic production by 2025. Additionally, the government's 14th Five-Year Plan (2021-2025) for technology independence also supports the objective.

Advanced IC Substrate Industry Overview

The advanced IC substrates market is moderately competitive and consists of a few major players. The players dominating the market are ASE Group, TTM Technologies Inc., Kyocera Corporation, Siliconware Precision Industries Co. Ltd., and Ibiden Co. Ltd. The existing players in the market are striving to maintain a competitive edge by catering to newer technologies such as 5G telecommunication, high-performance data centers, compact electronic devices, etc.

In February 2023, South Korea-based LG Innotek announced that it acclerated its business activities on a full scale to target the Flip-Chip Ball Grid Array (FC-BGA) substrate market. The company recently unveiled the latest FC-BGA for the first time at 'CES 2023'. For the development of FC-BGA, the company is actively utilizing technologies such as the ultra-fine circuit, high-integration array, high-multi-layer substrate matching, and coreless technologies.

In January 2023, LG Innotek celebrated at the brand-new Gumi plant, which will manufacture FC-BGA. LG Innotek is building the newest FC-BGA production lines in the Gumi No. 4 factory, which was purchased in June 2022 and had a total gross area of about 220,000 square meters. Innotek LG intends to accelerate the development of FC-BGA. By the first half of this year, the new plant is expected to have a sophisticated production system in place, and in the second half of 2023, full-scale production will begin.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Application of Advanced Substrate in Manufacturing of IoT Equipment

- 5.1.2 Increasing Trend of Miniaturization in Semiconductor Devices

- 5.2 Market Restraints

- 5.2.1 Complexity in the Manufacturing Process

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 FC BGA

- 6.1.2 FC CSP

- 6.2 By Application

- 6.2.1 Mobile and Consumer

- 6.2.2 Automotive and Transportation

- 6.2.3 IT and Telecom

- 6.2.4 Other Applications

- 6.3 By Geography

- 6.3.1 United States

- 6.3.2 China

- 6.3.3 Japan

- 6.3.4 South Korea

- 6.3.5 Taiwan

- 6.3.6 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ASE Kaohsiung (ASE Inc.)

- 7.1.2 AT&S Austria Technologies & Systemtechnik AG

- 7.1.3 Siliconware Precision Industries Co. Ltd

- 7.1.4 TTM Technologies Inc.

- 7.1.5 Ibiden Co. Ltd

- 7.1.6 Kyocera Corporation

- 7.1.7 Fujitsu Ltd

- 7.1.8 JCET Group

- 7.1.9 Panasonic Holding Corporation

- 7.1.10 Kinsus Interconnect Technology Corp.

- 7.1.11 Unimicron Corporation

![全球PCB市場IC載板:趨勢、機遇與競爭分析[2023-2028]](/sample/img/cover/42/1289720.png)