|

市場調查報告書

商品編碼

1445434

貨運:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Freight Forwarding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

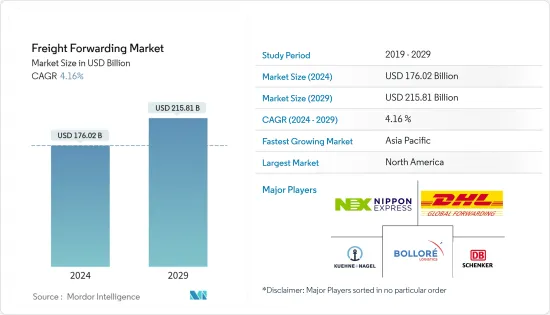

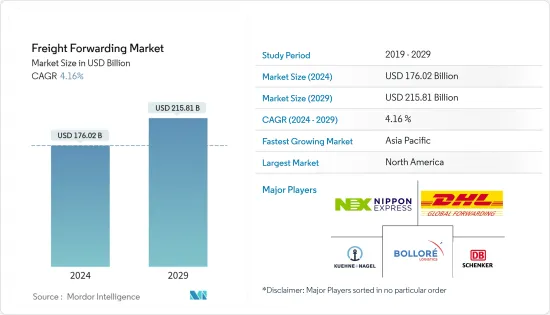

2024年貨運市場規模預計為1760.2億美元,預計到2029年將達到2158.1億美元,在預測期內(2024-2029年)年複合成長率為4.16%成長。

主要亮點

- 市場是由不同地區發生的巨大交易量所驅動的。此外,國內航空貨運的恢復也推動了市場的成長。

- 2022年一系列的黑天鵝事件凸顯了靈活、有彈性的供應鏈對於貨運代理產業的重要性。這些意外事件可能會對供應鏈產生巨大的破壞性影響。從COVID-19大流行的持續影響,到蘇伊士運河堵塞和烏克蘭戰爭,供應鏈近年來屢經考驗。勞動力短缺、運力問題、通貨膨脹和需求高峰也是貨運市場的挑戰。供應鏈面臨著比以往更加多樣化和不可預測的挑戰和問題。 2023 年也不會有什麼不同,國內和國際貨運代理比以往任何時候都更需要保持彈性並為任何可能發生的情況做好準備。

- 敏捷性、彈性和可見性通常都得益於數位化,並且對於抵禦風暴至關重要。貨運代理可以利用正確的技術以及資料收集和分析能力來提高效率。他們也處於有利地位,可以利用顛覆時期之外出現的機會。由於地緣政治緊張局勢和通膨上升,人們普遍預期 2023 年將是經濟放緩的一年。國際貨幣基金組織(IMF)預計,全球經濟成長預計將從2021年的6.0%放緩至2022年的3.2%和2023年的2.7%。同時,世界貿易組織最近將2023年全球貿易成長預測修正為1.0%。這比之前的 3.4% 有所下降。許多市場動力的喪失將對營運商客戶產生重大影響。

- 除了貨船恢復營運外,更多的航空客運能力也正在重返市場。 2023 年,國際航空旅行預計將恢復到疫情大流行前的水平。感染率仍然較低,但仍高於大流行前的水平。除非需求增加,否則預計 2023 年第一季利率將下降。由於消費者需求疲軟減少了庫存和銷售,需求仍然很低,並且在旺季期間沒有激增的徵兆。這種模式預計將持續到 2023 年初。涉及中國、美國、俄羅斯、烏克蘭和歐洲的貿易限制將進一步扼殺和擾亂全球供應鏈。供應商正在中國、東南亞和南亞以外尋找替代採購地點。

- 物流經理告訴客戶,海運市場的復甦速度快於預期。值得注意的是,從難以滿足前所未有的大流行病需求的供應鏈到需求環境疲軟以及船舶和貨櫃貨運市場供應過剩的轉變,可能會導致全球經濟長期低迷。為了對抗通貨膨脹,世界各地的中央銀行都在提高利率。包括聯準會在內的各國央行的目標之一是減少需求,從而降低供應鏈價格,該價格已達到歷史新高並嚴重加劇了通貨膨脹。但由於供需再平衡可能適得其反,貨幣政策已陷入停滯。

貨運市場趨勢

跨境海運貿易成長推動市場

由於多重衝擊對全球經濟帶來壓力,預計全球貿易將在 2022 年下半年失去動力,並在 2023 年保持疲軟。世貿組織經濟學家目前預計 2022 年全球商品貿易量將成長 3.5%,高於 4 月的 3.0%。不過,預計2023年將成長1.0%,較先前預測的3.4%大幅下降。由於多種原因,主要國家的成長預計將放緩,進口需求預計將放緩。俄羅斯和烏克蘭衝突造成的能源價格上漲可能會減少歐洲家庭支出並增加製造成本。美國的金融緊縮可能會影響對利率敏感的支出,例如住宅、汽車和固定投資。

加拿大商品進口繼 2022 年 1 月下降 7.5% 後,2022 年 2 月成長 3.9%。同時,2022年2月出口成長2.8%,主要是由於能源產品出口增加。受此影響,加拿大全球商品貿易順差從1月的31億美元降至2月的27億美元。 2月基礎化學品、工業化學品、塑膠和橡膠產品進口成長5.6%,其中化肥、農藥和其他化學品進口創紀錄(成長18.4%)是推動因素。最近發生的一系列事件影響了該行業,包括中國產量下降、俄羅斯新的化肥出口配額以及烏克蘭衝突。這些事件引起了人們對這些產品的可用性和成本的擔憂,從而導致加拿大化肥進口的典型舉動。

2022年對於貨櫃運輸業的從業人員來說是盈利的一年。隨著疫情的結束,預計出貨狀況將比過去兩年更加穩定。 2022年國際貨櫃出口量成長約2-3%。這不僅是去年訂單積壓的原因,也與航運業復甦緩慢有關。此外,未來幾個月,全球港口堵塞預計將恢復正常。然而,這在很大程度上取決於大流行,因為新的 COVID-19 爆發可能會使情況變得更糟。

航空貨運量的增加將節省時間並推動市場成長

航空貨運業目前面臨多項挑戰,包括飛機停飛、航線減少、需求減少等。一些跨國航空貨運公司報告稱,與大流行期間相比,需求減少。電商旺季已經開始,距離假期季節開始還有不到兩個月的時間。然而,儘管時機如此,航空貨運業的消費者需求卻在下降,與過去兩年貨物需求的激增形成鮮明對比。簡而言之,由於多種因素,航空貨運公司預計 2022 年第四季將表現疲軟。

客戶需求正在推動全通路技術的發展趨勢。航空公司正在認知到有必要超越傳統的機場到機場航線,航空公司和其他相關人員也已經認知到提供端到端協助的好處。隨著這種趨勢的恢復,航空公司和托運人之間的協議可能會進一步發展。航空運輸未來很可能採取全通路策略,更容易以有限的運能和合理的定價來競爭。除了航空貨運領域的機會外,還有其他挑戰,因為重大權益為貨運和客運以及各行業的公司帶來了招聘危機。

貨運代理行業概況

貨運代理市場呈碎片化,由全球、區域和本地參與者組成。當地中小型企業仍然以小型車隊和儲存空間服務市場。然而,前 20 名公司佔據市場主導地位,佔市場總量的 50% 以上。該市場的主要企業包括 DHL Global Forwarding、Kuehne+Nagel International AG、DB Schenker、DSV、Expeditors International 等。貨運代理市場正穩定成長,機會無所不在,要求企業擁抱科技、數位化,提高業務規模和效率。對公司來說,擁有遍布全球的強大網路非常重要。外國投資者對東協物流市場的併購興趣日益濃厚。由於商業和貿易活動的增加,全球物流公司正在向東協地區擴張。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

- 分析方法

- 調查階段

第3章執行摘要

第4章市場洞察動態

- 目前的市場狀況

- 市場概況

- 市場動態

- 促進因素

- 電子商務銷售導致需求增加

- 抑制因素

- 燃料成本增加

- 機會

- 物流行業數位化

- 促進因素

- 價值鏈/供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 洞察貨運技術進步

- 全球貨運代理市場概況

- 貨運代理市場的數位化

- 貨運代理市場價格分析及收益分析

- 貨運代理市場的區域洞察

- COVID-19 對市場的影響

第5章市場區隔

- 按運輸方式

- 航空貨物運輸

- 海運

- 公路貨運

- 鐵路貨運

- 依客戶類型

- B2B

- B2C

- 按用途

- 工業和製造業

- 零售

- 衛生保健

- 油和氣

- 食品和飲料

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 其他亞太地區

- 拉丁美洲/中東/非洲

- 巴西

- 南非

- GCC

- 其他拉丁美洲/中東/非洲

- 北美洲

第6章 競爭形勢

- 公司簡介

- Kuehne+Nagel International AG

- DB Schenker

- Bollore Logistics

- DHL Global Forwarding

- Nippon Express Co., Ltd.

- Dsv Global Transports and Logistics

- The Maersk Group

- CH Robinson

- Panalpina

- United Parcel Service

- FedEx Corp.

- Walmart Group

- MGF(Manitoulin Global Forwarding)

- Hellmann Worldwide Logistics

- Expeditors International

- Dachser

- Imerco

- Sinotrans India Private Limited

- CEVA Logistics

- Uber Freight LLC*

第7章 市場的未來

第8章附錄

The Freight Forwarding Market size is estimated at USD 176.02 billion in 2024, and is expected to reach USD 215.81 billion by 2029, growing at a CAGR of 4.16% during the forecast period (2024-2029).

Key Highlights

- The market is driven by the huge trade volumes occurring across different regions. Furthermore, the resumption of internal air freight has propelled the market growth.

- The influx of black swan events in 2022 underscored the importance of flexible and resilient supply chains for the freight forwarding industry. These unanticipated events can have a massively disruptive impact on supply chains. Supply chains have been repeatedly tested in recent years, from the ongoing effects of the COVID-19 pandemic to the Suez Canal obstruction and the war in Ukraine. Staffing shortages, capacity issues, inflation, and demand peaks were also challenges for the freight market. Supply chains are facing more diverse and unpredictable challenges and issues than ever before. The year 2023 will be no different, and the need for domestic and international freight forwarders to be resilient and prepared for anything has never been greater.

- Agility, flexibility, and visibility, all of which are often aided by digitalization, are essential for weathering a storm. Freight forwarders can improve efficiency with the right technology and the ability to collect and analyze data. They are also better positioned to capitalize on opportunities that arise outside of times of disruption. With geopolitical tensions and rising inflation, 2023 is widely expected to be a year of economic slowdown. According to the International Monetary Fund (IMF), global economic growth will slow from 6.0% in 2021 to 3.2% in 2022 and 2.7% in 2023. Meanwhile, the World Trade Organization recently revised its global trade growth forecast for 2023 to 1.0%, down from 3.4% previously. This loss of momentum in many markets will have a significant impact on the customers of freight forwarders.

- In addition to the resumption of freighter schedules, more airline passenger capacity is returning to the market. In 2023, international air travel is expected to return to pre-pandemic levels. While rates are still higher than pre-pandemic levels, they are still low. Rates are expected to fall in the first quarter of 2023 unless demand increases. Demand is still low, with no signs of a peak-season surge, as inventories and sales are down due to weak consumer demand. This pattern is expected to continue into early 2023. Trade restrictions involving China, the United States, Russia, Ukraine, and Europe will suffocate and disrupt global supply chains even further. Suppliers are looking for alternative sourcing locations other than China, Southeast Asia, and South Asia.

- Logistics managers are informing clients that the ocean freight market is correcting itself faster than expected. The transition from a supply chain that struggled to keep up with unprecedented pandemic demand to a weak demand environment and a freight market that is now oversupplied with both ships and containers highlights the risk of a prolonged global economic downturn. To combat inflation, central banks around the world are raising interest rates. One goal of central banks, including the Federal Reserve, is to reduce demand, which is lowering supply chain prices, which were at record highs and were a significant contributor to inflation. However, monetary policy is treading water because a supply-demand rebalancing can backfire.

Freight Forwarding Market Trends

Growth in Cross-Border and Sea Trade Driving the Market

As multiple shocks weigh on the global economy, global trade is expected to lose momentum in the second half of 2022 and remain subdued in 2023. WTO economists now forecast a 3.5% growth in global merchandise trade volumes in 2022, up from 3.0% in April 2022. However, they predict a 1.0% increase in 2023, a significant decrease from the previous estimate of 3.4%. Import demand is expected to soften as growth in major economies slows for a variety of reasons. High energy prices caused by the Russia-Ukraine conflict will reduce household spending and raise manufacturing costs in Europe. Monetary policy tightening in the United States will have an impact on interest-sensitive spending in areas such as housing, automobiles, and fixed investment.

Canada's merchandise imports increased by 3.9% in February 2022, following a 7.5% decline in January 2022. Meanwhile, exports increased by 2.8% in February 2022, owing primarily to increased exports of energy products. As a result, Canada's global merchandise trade surplus fell from USD 3.1 billion in January to USD 2.7 billion in February. Imports of basic and industrial chemicals, plastics, and rubber products increased 5.6% in February, owing in part to record-high imports of fertilizers, pesticides, and other chemical products (+18.4%). A slew of recent events has had an impact on this industry, including lower Chinese output, new Russian fertilizer export quotas, and the Ukraine conflict. These occurrences raise concerns about the availability and cost of these products, resulting in a typical movement for Canadian fertilizer imports.

For those working in the container shipping industry, 2022 was a profitable year. The end of the pandemic is expected to make the shipping scenario more stable than it has been in the previous two years. The volume of international container exports increased by around 2-3% in 2022. This is due not only to last year's backlogs but also to the maritime shipping sector's slow recovery. Furthermore, port congestion is expected to normalise in the coming months around the world. However, this was heavily dependent on the pandemic, as another COVID-19 outbreak could worsen the situation.

Increasing Air Freight to Reduce Time Propelling the Market Growth

The air freight industry is currently dealing with several issues, including grounded planes, route reductions, and a drop in demand. Some multinational air freight companies are reporting a drop in demand compared to the pandemic period. The peak season for e-commerce has already begun, with less than two months until the start of the holiday season. However, despite the time of year, the air freight sector is experiencing a drop in consumer demand, as opposed to the previous two years' burgeoning demand for goods. Simply put, air freight companies anticipate a subdued fourth quarter of 2022 due to several factors.

Customer needs are fueling a growing trend toward omnichannel techniques. Airlines are recognising the need to expand their operations beyond traditional airport-to-airport routes, and airlines and other stakeholders are already recognizing the benefits of providing end-to-end assistance. As this trend resumes, agreements between airlines and shippers are likely to prosper. Air shipment will most likely adopt an omnichannel strategy in the future, making it easier to compete for limited cargo capacity and reasonable pricing. In addition to the opportunities for air cargo, there are additional challenges, with the significant concession feigning recruitment crises for the business on both freight and passenger positions, as it is for various sectors.

Freight Forwarding Industry Overview

The freight forwarding market is fragmented with a mix of global, regional, and local players. Small- and medium-sized local players still serve the market with small fleets and storage spaces. However, the top 20 players dominate the market, accounting for more than 50% of the total market. Leading players in the market include DHL Global Forwarding, Kuehne + Nagel International AG, DB Schenker, DSV, Expeditors International, and many more. As the freight forwarding market is growing steadily and there exists abundant opportunity, the players need to embrace technologies, become more digitized, and increase the scale and efficiency of their operations. Having a strong network spanning the globe is important for companies. International investors are increasingly interested in mergers and acquisitions in the ASEAN logistics market. Global logistics companies have been expanding in the ASEAN region because of increased commerce and trade activities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Method

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Overview

- 4.3 Market Dynamics

- 4.3.1 Drivers

- 4.3.1.1 Increasing Demand From E-commerce Sales

- 4.3.2 Restraints

- 4.3.2.1 Increasing Fuel Costs

- 4.3.3 Opportunities

- 4.3.3.1 Digitalizing the Logistics Industry

- 4.3.1 Drivers

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Technological Advancements in Freight Forwarding

- 4.7 Overview of Global Freight Forwarding Market

- 4.8 Digitalisation of Freight Forwarding Market

- 4.9 Pricing Analysis and Revenue analysis of Freight Forwarding Market

- 4.10 Regional insights onFreight Forwarding Market

- 4.11 Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Mode Of Transport

- 5.1.1 Air Freight Forwarding

- 5.1.2 Ocean Freight Forwarding

- 5.1.3 Road Freight Forwarding

- 5.1.4 Rail Freight Forwarding

- 5.2 By Customer Type

- 5.2.1 B2B

- 5.2.2 B2C

- 5.3 By Application

- 5.3.1 Industrial And Manufacturing

- 5.3.2 Retail

- 5.3.3 Healthcare

- 5.3.4 Oil And Gas

- 5.3.5 Food And Beverages

- 5.3.6 Other Applications

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 South Korea

- 5.4.3.4 India

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 LAMEA

- 5.4.4.1 Brazil

- 5.4.4.2 South Africa

- 5.4.4.3 GCC

- 5.4.4.4 Rest of LAMEA

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Overview

- 6.2 Company Profiles

- 6.2.1 Kuehne + Nagel International AG

- 6.2.2 DB Schenker

- 6.2.3 Bollore Logistics

- 6.2.4 DHL Global Forwarding

- 6.2.5 Nippon Express Co., Ltd.

- 6.2.6 Dsv Global Transports and Logistics

- 6.2.7 The Maersk Group

- 6.2.8 C.H. Robinson

- 6.2.9 Panalpina

- 6.2.10 United Parcel Service

- 6.2.11 FedEx Corp.

- 6.2.12 Walmart Group

- 6.2.13 MGF (Manitoulin Global Forwarding)

- 6.2.14 Hellmann Worldwide Logistics

- 6.2.15 Expeditors International

- 6.2.16 Dachser

- 6.2.17 Imerco

- 6.2.18 Sinotrans India Private Limited

- 6.2.19 CEVA Logistics

- 6.2.20 Uber Freight LLC*