|

市場調查報告書

商品編碼

1445431

數位地圖 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Digital Map - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

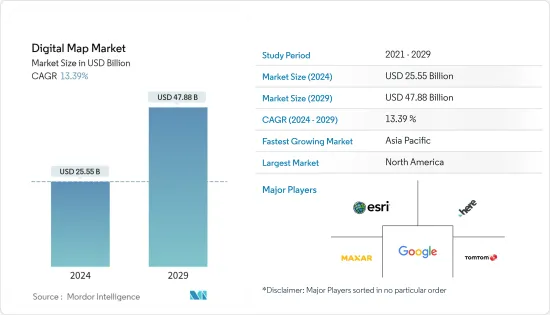

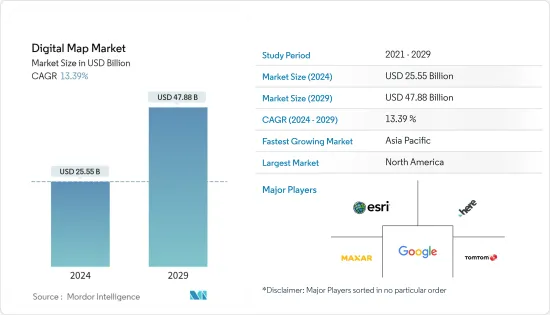

2024年數位地圖市場規模估計為255.5億美元,預計到2029年將達到478.8億美元,在預測期內(2024-2029年)CAGR為13.39%。

汽車產業中先進導航系統應用的成長、地理資訊系統(GIS)需求的激增以及連接設備和網際網路的採用增加是推動數位地圖市場成長的一些主要因素。

主要亮點

- 近年來,數位地圖技術在能源電力、汽車、物流、交通、政府、建築、電信等各個行業中找到了潛在的應用前景,提供了先進的GIS、地圖分析和即時追蹤系統。物流和運輸行業是最重要的行業之一,部署先進的數位地圖解決方案,透過減少正常運行時間和尋找有效的送貨路線來增強營運。

- 此外,數位地圖技術還提供端到端地圖解決方案,例如位置資訊、即時更新、技術協作和分析,以實現更好的地理地圖輸出。隨著網際網路和智慧型手機、平板電腦和互動式顯示器等連接設備在全球人口中擴大採用基於地圖的應用程式,數位地圖市場預計在未來幾年將以健康的速度成長。

- 此外,從汽車到家用電器,世界轉向為消費者提供即時資料追蹤和基於位置的操作解決方案的連網設備,顯著推動市場成長。根據《富比士》報道,到2025年,全球物聯網(IoT)連接設備安裝量預計將達到 754.4 億台,這將為整個預測期內的市場帶來廣泛的利潤豐厚的成長機會。

- 然而,傳統地圖與現代 GIS 系統整合的整體複雜性的增加可能是限制市場成長的一個因素。

數位地圖市場趨勢

GIS 和 GNSS 需求激增影響數位地圖技術的採用

- 地理資訊系統(GIS)和全球導航衛星系統(GNSS)是數位地圖解決方案中的強大技術。隨著 GIS 和 GNSS 供應商開發基於行動的地理空間感測器平台,數位地圖解決方案透過向量開發和地圖模擬技術變得更加先進。

- 擴大電信網路和無線連接利用 GIS 驅動的地圖來獲得用戶可存取性和即時地圖執行。資料分析也是透過時空資料和多維連接增強地理標誌應用的新興領域之一。此外,GIS 技術透過模擬預測、規劃、景觀分析、行動管理和物件追蹤來提高數位測繪能力,預計將在預測期內推動數位地圖解決方案的成長。

- 近年來部署的各種全球導航衛星系統(例如GLONASS)或開發的(例如BeiDou和Galileo)將加強衛星定位對人們日常生活的影響。因此,汽車、其他車輛和智慧型手機中消費者級定位的應用和需求大幅成長。此外,市場上主要參與者見證各種產品創新和推出,作為其改善業務和影響力以接觸客戶並滿足他們對多種應用的需求的策略的一部分。

- 例如,今年9月,Aurora Insight宣布推出天基射頻干擾(RFI)監測服務,可對全球GNSS訊號漏洞或干擾發出警報。因此,Aurora 採用獨特的干擾監測方法,為組織提供全球資料層,告知 GNSS 客戶潛在的有害干擾。基於地圖的工具還可以幫助組織了解不斷變化的無線環境,同時提供全球干擾狀態的整體視圖。

- 根據歐洲 GNSS 機構的資料,去年全球導航衛星系統(GNSS)設備的安裝量約為 65 億台,預計到2031年底將增至約 106 億台。全球導航衛星系統(GNSS)市值約1505億美元。因此,隨著全球導航衛星系統(GNSS)設備安裝量的整體上升,預計市場在整個預測期內將出現指數級成長。

亞太地區是數位地圖市場成長最快的地區

- 亞太地區是市場成長最快的地區之一。這主要是由於電子商務行業的興起,對數位地圖的大量需求預計將成為該市場的其他主要驅動力之一。 Flipkart 和阿里巴巴等主要電子商務公司已投資於全球定位系統(GPS)追蹤和地理資訊系統(GIS)解決方案。阿里巴巴投資了定位平台 PlaceIQ,該平台使用位置作為識別和建模消費者行為的實用工具。

- 印度、中國、新加坡、日本、澳洲和韓國等國家近年來在技術採用方面發生了重大轉變。所有這些亞洲國家在電子商務應用、行動資料覆蓋範圍、城市規劃、供應鏈和物流管理以及環境監測方面擴大使用數位地圖解決方案,這將影響未來幾年數位地圖的採用。

- 此外,該地區的遊戲公司是全球先進 AR 技術的主要採用者之一。引進在虛擬環境中玩的複雜遊戲是基於 GIS 的系統的主要應用領域之一。儘管中國在遊戲領域佔據主導地位,但以遊戲收入計算,日本是第三大市場,每年創造超過 1,400 萬美元。

- 該地區汽車行業的成長預計將成為未來市場的主要驅動力之一。日產、豐田和本田等公司引領自動駕駛汽車的下一波變革,已經開發出類似於 2 級 ADAS 系統的技術。這是 TomTom BV 等公司提供的高精地圖解決方案的主要應用領域之一,目前在韓國和日本等國家佔有重要地位。

- 此外,電信公司中國移動宣布發布超過47款支援5G網路的行動終端,其中包括AR/VR,由華為、三星、Vivo、Oppo等34家合作夥伴開發。中國移動也提到,目前全國已有1,000萬人使用5G網路,預計2025年這數字將達到6億。預計這將有助於該地區採用基於 GIS 的定位解決方案。

數位地圖產業概況

由於一些區域和全球參與者憑藉其在數位地圖解決方案方面的技術專長主導市場,全球數位地圖市場預計將得到鞏固。 Collins Bartholomew Ltd、Digital Map Products, Inc.、Digital Mapping Solutions、DMTI Spatial、ESRI Business Information Solutions, Inc.、Google LLC(Alphabet Inc.)、HERE Technologies、Lepton Software、Mapbox、MapData Services Pty Ltd、Maxar Technologies( DigitalGlobe)、ThinkGeo LLC 和TomTom International BVBV 是當前市場上的一些主要參與者。然而,所有這些參與者都參與了競爭性策略發展,例如合作夥伴關係、新產品創新和市場擴張,以獲得全球數位地圖市場的領導地位。

- 2022年 11月 - AGI 成員 UNL Global 和 Genesys International 宣佈建立策略合作夥伴關係,共同創建一個由印度高精度 3D 數位地圖提供支援的超本地化定位技術平台。該聯盟將為整個印度市場帶來先進的地理空間和地圖解決方案。

- 2022年 7月 - Magic Leap, Inc. 與現實捕捉和數位工廠解決方案領域的全球領導者 NavVis 宣佈建立策略合作夥伴關係,在複雜的企業環境中提供大規模擴增實境(ARAR)應用程式。兩家公司將 Magic Leap 的先進空間運算平台與 NavVis 的行動地圖系統和空間資料平台相整合,目的是增強 ARAR 應用程式在各個關鍵產業(包括汽車製造、零售和公共部門)的整體使用率。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力 - 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

- 產業價值鏈分析

第5章 市場動態

- 市場促進因素

- 先進導航系統在汽車產業的應用成長

- 地理資訊系統(GIS)需求激增

- 互聯設備和網際網路的採用率不斷提高

- 市場限制

- 傳統地圖與現代 GIS 系統整合的複雜性

- 技術簡介

- 病媒管理

- 分析

- 即時追蹤

- 資料整合

- 其他應用

第6章 市場細分

- 依解決方案

- 軟體

- 服務

- 依部署

- 本地部署

- 雲端

- 依行業分類

- 汽車

- 工程與建築

- 物流運輸

- 能源與公用事業

- 電信

- 其他行業

- 地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 印度

- 亞太其他地區

- 世界其他地區

- 北美洲

第7章 競爭格局

- 公司簡介

- Collins Bartholomew Ltd

- Digital Map Products, Inc.

- Digital Mapping Solutions

- DMTI Spatial

- ESRI Business Information Solutions, Inc.

- Google LLC(Alphabet Inc.)

- HERE Technologies

- Lepton Software

- Mapbox

- MapData Services Pty Ltd

- Maxar Technologies(DigitalGlobe)

- ThinkGeo LLC

- TomTom International BV

第8章 投資分析

第9章 市場機會與未來趨勢

The Digital Map Market size is estimated at USD 25.55 billion in 2024, and is expected to reach USD 47.88 billion by 2029, growing at a CAGR of 13.39% during the forecast period (2024-2029).

Growth in the application of the advanced navigation system in the automotive industry, the surge in demand for Geographic Information Systems (GIS), and increased adoption of connected devices and the internet are some of the major factors driving the growth of the digital map market.

Key Highlights

- In recent years, digital map technology has found a potential place in various industries such as energy & power, automobile, logistics, transportation, government, construction, telecommunication, and others, offering advanced GIS, map analytics, and real-time tracking systems. Logistics and transportation sectors are one of the most crucial sectors deploying advanced digital map solutions to augment their operations through reduced up-time and finding effective delivery routes.

- Additionally, digital map technology offers end-to-end map solutions such as location information, real-time update, technology collaboration, and analytics for better geo-mapping outputs. As the internet and connected devices such as smartphones, tablets, and interactive displays are experiencing higher adoption for map-based applications among the global population, the market for digital maps is expected to grow at a healthy rate in the coming years.

- Moreover, from automotive vehicles to home appliances, the world is moving towards connected devices which provide real-time data tracking and location-based operation solution to consumers, driving the market's growth significantly. According to Forbes, the Internet of Things (IoT) connected devices installed base worldwide is expected to reach 75.44 billion devices by 2025, which in turn will bring a broad range of lucrative growth opportunities for the market throughout the forecast period.

- However, the rise in the overall complexity of the integration of traditional maps with modern GIS systems might be a factor that could restrain the market's growth.

Digital Map Market Trends

Surge in Demand for GIS and GNSS to Influence the Adoption of Digital Map Technology

- Geographic Information Systems (GIS) and Global navigation satellite systems (GNSS) are potent technologies in digital map solutions. As the GIS and GNSS vendors are developing mobile-based geospatial sensor platforms, digital map solutions are becoming more advanced with vector development and map simulation techniques.

- Expanding telecom networks and wireless connectivity is leveraging GIS-powered maps to gain user accessibility and real-time map execution. Data analytics is also one of the emerging areas to augment the application of GIs with spatiotemporal data and multidimensional connectivity. Moreover, GIS technology advances digital mapping capability with simulation forecasting, planning, landscape analysis, mobility management, and object tracking, which is anticipated to fuel the growth of digital map solutions in the forecast period.

- Various Global Navigation Satellite Systems (GNSS) deployed (such as GLONASS) or under development in recent times (such as BeiDou and Galileo) would reinforce the impact of satellite positioning in the daily lifestyles of people. Hence, there lies a massive growth in the applications and requirements for consumer-level positioning in cars, other vehicles, and smartphones. Moreover, the market is witnessing various product innovations and launches by key players as part of its strategy to improve business and their presence to reach customers and meet their requirements for multiple applications.

- For instance, in September this year, Aurora Insight declared the launch of a space-based radio frequency interference (RFI) monitoring service that could alert GNSS signal vulnerabilities or interferences worldwide. Aurora thus takes a unique approach to interference monitoring by delivering organizations with a global layer of data that informs GNSS customers of potentially harmful interference. The map-based tool can also help keep organizations informed about the ever-changing wireless environment while delivering a holistic view of the global state of interference.

- As per the European GNSS Agency, last year, the installed base of global navigation satellite system (GNSS) devices worldwide stood at around 6.5 billion units and is thus predicted to rise to about 10.6 billion devices by the end of 2031. Last year, the global navigation satellite system (GNSS) market was valued at approximately 150.5 billion USD. Hence, with the overall rise in the installed base of global navigation satellite system (GNSS) devices globally, the market is expected to witness exponential growth throughout the forecast period.

Asia-Pacific is the Fastest Growing Region for Digital Map Market

- Asia-Pacific is one of the fastest-growing regions in the Market. It is primarily due to the rise in the E-commerce sector, considerably requiring digital maps is expected to be one of the other major driving forces for this Market. Companies like Flipkart and Alibaba, major e-commerce players, have invested in Global Positioning System (GPS) tracking and geographic information system (GIS) solutions. Alibaba invested in the location platform PlaceIQ, which uses location as a utility to identify and model consumer behavior.

- Countries including India, China, Singapore, Japan, Australia, and South Korea have seen a significant shift in technological adoption in recent years. Increased utilization of digital map solutions for e-commerce applications, mobile data coverage, urban planning, supply chain & logistics management, and environmental monitoring in all these Asian countries will influence the adoption of digital maps in the coming years.

- Moreover, the gaming companies in the region are some of the primary adopters of advanced AR technologies globally. The introduction of sophisticated games being played in virtual environments is one of the major application areas for GIS-based systems. Though China dominates the gaming sector, Japan is the third largest Market according to game revenue and generates over USD 14 million a year.

- The growth of the automotive sector in the region is expected to be one of the primary drivers of the Market in the future. Leading the next wave of change in automated vehicles, players like Nissan, Toyota, and Honda have already developed technology similar to Level-2 ADAS systems. This is one of the major areas of application for HD Map solutions offered by players like TomTom BV, which now have a major presence in countries like South Korea and Japan.

- Furthermore, China Mobile, a telecom company, has announced to release of over 47 mobile ends supporting 5G networks, including AR/VR, developed by 34 partners, including Huawei, Samsung, Vivo, and Oppo. China Mobile has also mentioned that 10 million people are already using the 5G network, and the figure is expected to reach 600 million by 2025 in the country. This is expected to aid the region's adoption of GIS-based location solutions.

Digital Map Industry Overview

As some regional and global players dominate the market with their technological expertise in digital map solutions, the global market for digital maps is expected to be consolidated. Collins Bartholomew Ltd, Digital Map Products, Inc., Digital Mapping Solutions, DMTI Spatial, E.S.R.I. Business Information Solutions, Inc., Google L.L.C. (Alphabet Inc.), HERE Technologies, Lepton Software, Mapbox, MapData Services Pty Ltd, Maxar Technologies (DigitalGlobe), ThinkGeo L.L.C., and TomTom International B.V.B.V. are some of the major players present in the current market. However, all these players are involved in competitive strategic developments such as partnerships, new product innovation, and market expansion to gain leadership positions in the global digital map market.

- November 2022 - A.G.I. members U.N.L. Global and Genesys International declared a strategic partnership to create a hyperlocal Location Technology Platform powered by a high-accuracy 3D digital map of India. The alliance would bring advanced Geospatial and mapping solutions to the entire Indian market.

- July 2022 - Magic Leap, Inc., and NavVis, a global leader in reality capture and digital factory solutions, declared a strategic partnership to provide large-scale Augmented Reality (A.R.A.R.) applications in complex enterprise environments. Integrating Magic Leap's advanced spatial computing platform with NavVis's mobile mapping systems and spatial data platform, the two companies target to augment the overall usage of A.R.A.R. applications across various key industries, including automotive manufacturing, retail, and the public sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Application for Advanced Navigation System in Automotive Industry

- 5.1.2 Surge in Demand for Geographic Information System (GIS)

- 5.1.3 Increased Adoption of Connected Devices and Internet

- 5.2 Market Restraints

- 5.2.1 Complexity in Integration of Traditional Maps with Modern GIS System

- 5.3 Technology Snapshot

- 5.3.1 Vector Management

- 5.3.2 Analytics

- 5.3.3 Real-Time Tracking

- 5.3.4 Data Integration

- 5.3.5 Other Applications

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 On-Premise

- 6.2.2 Cloud

- 6.3 By Industry

- 6.3.1 Automotive

- 6.3.2 Engineering & Construction

- 6.3.3 Logistics & Transportation

- 6.3.4 Energy & Utilities

- 6.3.5 Telecommunication

- 6.3.6 Other Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Rest of the World

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Collins Bartholomew Ltd

- 7.1.2 Digital Map Products, Inc.

- 7.1.3 Digital Mapping Solutions

- 7.1.4 DMTI Spatial

- 7.1.5 ESRI Business Information Solutions, Inc.

- 7.1.6 Google LLC (Alphabet Inc.)

- 7.1.7 HERE Technologies

- 7.1.8 Lepton Software

- 7.1.9 Mapbox

- 7.1.10 MapData Services Pty Ltd

- 7.1.11 Maxar Technologies (DigitalGlobe)

- 7.1.12 ThinkGeo LLC

- 7.1.13 TomTom International B.V.