|

市場調查報告書

商品編碼

1444942

電訊領域的區塊鏈:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Blockchain in Telecom - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

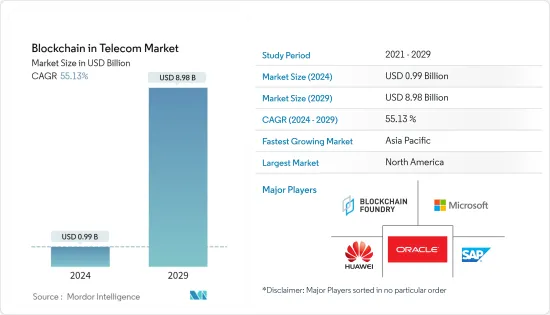

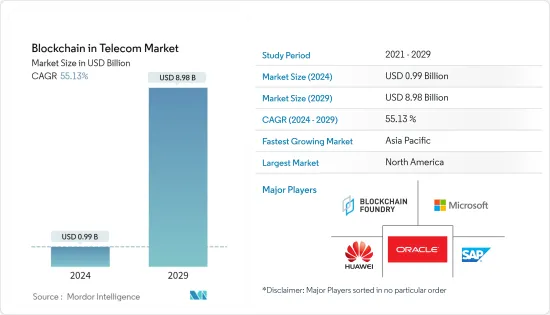

預計到2024年,電訊領域區塊鏈的市場規模將達到9.9億美元,在預測期內(2024-2029年)預計到2029年將達到89.8億美元,年複合成長率預計為55.13%。

在電訊業,區塊鏈在防止詐騙、保護用戶身份以及支援下一代網路服務和物聯網連接解決方案方面發揮著至關重要的作用,這極大地推動了市場的發展。

主要亮點

- 5G 的普及將加速電訊領域的區塊鏈實施,因為 5G 有助於快速可靠的區塊鏈操作。區塊鏈技術提供強大的加密功能,以更安全、檢驗的方式在網路上記錄和儲存資料。這使得資訊透明並防止篡改。因此,區塊鏈技術可望幫助各電訊公司增強網路安全、降低營運成本、促進市場成長。

- 此外,通訊或電訊詐騙是犯罪活動快速成長的領域。根據歐洲刑警組織歐洲網路犯罪中心和趨勢科技的數據,電訊詐騙每年造成的損失約 327 億美元。這給執法部門帶來了新的挑戰。區塊鏈幫助電訊服務供應商檢測和防止詐欺,以指數方式推動市場成長。

- 此外,在印度等新興經濟體,通訊監管機構實施區塊鏈技術來遏制垃圾簡訊的有效性正在各種重要用例中進行測試,例如 Aadhar 身份驗證、財產和車輛所有權記錄以及直接徵稅。政府為政府建立透明和值得信賴的框架。去年三月,電子和資訊技術部發布了一份關於區塊鏈技術的政策草案,該草案將規範其在各種公共和私人用例中的部署。印度電訊監管局 (TRAI) 也推出了分銷商帳本技術 (DLT)。這是目前區塊鏈技術用於控制垃圾簡訊流量的最重要用例之一。

- 但另一方面,可擴展性和互通性是區塊鏈技術全面採用所需的一些關鍵因素。只有在產業標準制定後,這才有可能實現,而我們正處於後期階段。電訊業需要大規模採用區塊鏈技術的幫助,這可能會阻礙市場成長。

- 疫情的爆發凸顯了電訊基礎設施的重要性。電訊衛生緊急情況給電訊服務帶來了新的壓力,這表明它們在緊急情況下可以發揮的重要作用不僅僅是簡單的連接。除了冠狀病毒大流行之外,隨著對虛擬和線上服務的需求增加,預計世界將對新的金融科技服務產生濃厚的興趣。在電訊業,疫情增加了擴展數位基礎設施和資料驅動服務的需求。電訊公司越來越關注網路彈性和可靠性,尤其是在投資 5G 時。

電訊的區塊鏈市場趨勢

智慧合約主導市場

- 智慧合約允許在滿足某些條件時執行電腦程式碼。電訊業預計將得到廣泛採用,因為它為申請、供應鏈管理和漫遊等內部業務的自動化提供了空間。

- 部署智慧合約來管理所有與漫遊相關的申請可以透過防止詐欺的流量來顯著節省成本。區塊鏈還可以透過智慧合約消除中介機構,從而為身分管理解決方案付加價值。這可以減少漫遊詐騙、降低成本並實現即時付款。這使得電訊能夠透過防篡改、檢驗的交易和向最終客戶的即時更新來快速解決爭議。

- 2022 年 3 月,STC 巴林推出官方 Chainlink 節點。它旨在為智慧合約提供訪問真實世界資料的安全來源和快速的鏈下計算的能力。這使得 STC 巴林成為中東和北非 (MENA) 地區第一家部署 Chainlink 節點的大型電訊公司,加強了該地區和全球智慧合約生態系統的發展。

- 此外,5G 技術是區塊鏈如何改變電訊產業的關鍵例子之一。例如,在 5G 技術中,智慧合約允許使用基於區塊鏈的解決方案來簡化最終用戶和網路之間的整個配置。為了安全地實施 5G,連接裝置接收的資料必須可靠且不受各種形式的惡意干擾。此外,為了使5G充分發揮潛力並防範大規模安全漏洞,區塊鏈可以實現去中心化、防篡改、即時的資料傳輸檢驗。

- 據 5G Americas 稱,在可預見的未來,5G 用戶數量預計將持續穩定成長,到 2026年終將達到 50 億用戶。其中包括從現在到明年全面發展7億用戶,明年到後年9億用戶。

亞太地區將經歷最高的成長

- 亞太地區擁有龐大的市場潛力,主要得益於印度和中國等國家的行動付款興起。印度見證了許多電訊轉向這種模式,特別是在收益計畫之後。例如,該國的主要電信業者Jio 和 Airtel 提供數位錢包,以支援客戶之間的支付。因此,這些公司採用區塊鏈來處理交易可以使錢包更安全、更便宜,從而有可能顯著擴大市場。

- 中國電信、中國移動和中國聯通已加入中國資訊通訊研究院的可信賴區塊鏈計劃,該計劃利用區塊鏈技術增強電訊業的營運和安全性。預計兩家公司將專注於與物聯網資料共用和客戶身份驗證相關的基於區塊鏈的應用程式。

- 此外,由於目前世界正捲入關於 WhatsApp 政策變化的隱私爭議,印度的通訊即服務(CPaaS) 產業正在擴展到商業行動簡訊、電子郵件以及企業和服務供應商。正準備為其業務通訊引入端對端加密。

- 例如,明年,CPaaS 供應商 Tanla Platforms 與微軟合作推出了名為 Wisely 的邊緣到邊緣的全球區塊鏈網路。它的創建目的是直接從企業向通訊業者發送加密短信,該公司還聲稱它將顛覆現有的商業通訊聚合模式。

- 在日本,Start-Ups也在開發區塊鏈解決方案,以實現基於智慧型手機的安全匯款,而無需正式的銀行文件。例如,日本新興企業Telcoin 利用區塊鏈使通訊業者更容易提供匯款服務。 Telcoin 錢包基於以太坊區塊鏈構建,允許行動用戶即時進行全球匯款,無論其本地行動服務供應商為何。因此,採用標準化的區塊鏈平台將電訊充分實現該技術的價值,並為該地區更快的採用鋪平道路,從而顯著推動市場成長。

電訊區塊鏈產業概述

市場集中,很少有主要供應商在整個電信通訊業提供區塊鏈解決方案。供應商還獲得投資者資金以進一步支持創新的區塊鏈服務。

- 2022 年 11 月:資訊科技 (IT) 服務公司 Tech Mahindra 和電訊分析解決方案供應商Subex 合作,為全球電訊部署基於區塊鏈的解決方案。這些解決方案透過最大限度地減少整體合規性問題,減少詐欺並提高通訊服務供應商(CSP) 的營運效率。

- 2022 年 2 月:印度領先的通訊解決方案供應商Bharti Airtel 宣布,在獲得適用法律授權的情況下,收購了 Airtel 新創加速器計畫下的區塊鏈即服務公司 Aqilliz 的策略股權。 Airtel 的目標是在快速成長的廣告技術、數位娛樂和各種數位市場產品中大規模部署 Aqilliz 的先進區塊鏈技術。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 專注於電訊詐騙偵測與預防推動市場成長

- 市場限制因素

- 缺乏業界標準

第6章市場區隔

- 目的

- 身分管理

- 付款和申請

- 智慧合約

- 連接配置

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- Blockchain Foundry Inc.

- Huawei Technologies Co. Ltd.

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- ShoCard Inc.(Ping Identity)

第8章投資分析

第9章市場的未來

The Blockchain in Telecom Market size is estimated at USD 0.99 billion in 2024, and is expected to reach USD 8.98 billion by 2029, growing at a CAGR of 55.13% during the forecast period (2024-2029).

In the telecom industry, blockchain plays a very significant role in preventing fraud, securing user identities, and supporting next-generation network services and IoT connectivity solutions, which in turn is driving the market significantly.

Key Highlights

- The increasing adoption of 5G is a catalyst for blockchain implementation in telecom, as 5G is helping in quick and reliable blockchain operations. Blockchain technology provides robust encryption to record and store the data on the network in a more secure and verifiable way. It makes the information transparent and tamper-proof. Thus, Blockchain technology is expected to help various telecom companies boost their network security and reduce operational costs, driving the market's growth.

- Moreover, telecommunications or telecom fraud is a fast-growing field of criminal activity. According to Europol's European Cybercrime Centre and Trend Micro, telecom fraud costs around USD 32.7 billion annually. It represents a new challenge for law enforcement agencies. Blockchain can help in fraud detection and prevention for communication service providers, exponentially fueling the market's growth.

- Furthermore, in emerging countries such as India, the effectiveness of telecom regulator's deployment of blockchain technology for curbing spam SMSs has set an example for the government to build a transparent and trustworthy framework for various critical use cases such as Aadhar authentication, property, and vehicle ownership records and direct tax collection among others. In March last year, the Ministry of Electronics and IT released a draft policy on blockchain technology to regulate its deployment in various public and private use cases. The telecom regulatory authority of India (TRAI) has also deployed distributor-ledger technology (DLT), which is currently one of the most significant use cases of blockchain technology to control spam SMS traffic.

- However, on the other hand, scalability and interoperability are the several critical factors necessary for the overall adoption of blockchain technology. This is only possible when industry standards are set, which is at a lagging phase. The Telecom sector needs help with the mass adoption of blockchain technology, which can hinder the market's growth.

- The onset of the pandemic has highlighted the criticality of telecom infrastructure. The global health emergency is placing new pressures on telecom services and suggesting a pivotal role they can play beyond simple connectivity in emergency scenarios. Beyond the coronavirus pandemic, the world is expected to see substantial interest in new fintech services as the growing demand for virtual and online services continues to build. Within the telecommunications industry, the pandemic is driving the need for expanding digital infrastructure and data-driven services. Telecom companies increasingly focus on network resiliency and reliability, particularly in 5G investments.

Blockchain in Telecom Market Trends

Smart Contract to Dominate the Market

- Smart contracts allow computer code to execute when specific conditions are met. The telecom industry is expected to witness significant adoption as it provides scope for automation in its internal operations, like billing, supply chain management, and roaming.

- Deploying smart contracts to manage all the billing related to roaming can lead to significant cost savings, as it provides prevention against fraudulent traffic. Blockchain can also add value to identity management solutions by cutting out intermediaries through smart contracts. This helps reduce roaming frauds, cost savings, and instant settlements. It helps telecom players to resolve disputes quickly through tamper-proof verifiable transactions and real-time updates to end customers.

- In March 2022, STC Bahrain introduced its official Chainlink node, which intends to offer smart contracts with access to a secure source of real-world data and fast off-chain computations. This makes STC Bahrain the first major telecom in the Middle East and North Africa (MENA) region to introduce a Chainlink node, enhancing the development of the smart contract ecosystem both in the area and throughout the globe.

- Moreover, 5G technology is one of the significant instances of how blockchain would change the telecommunication industry. For instance, in 5G technology, smart contracts can streamline the overall provisioning between the end user and the networks with a blockchain-based solution. For 5G to be implemented securely, the data received by connected devices must be reliable and free from various malicious interference. Further, to enable 5G to reach its full potential and protect against large-scale security breaches, blockchain can deliver decentralized, tamper-proof, and real-time verification of data transmission.

- As per 5G Americas, Solid growth in 5G subscriptions is expected to continue into the foreseeable future, reaching 5 billion subscriptions by the end of 2026. That includes the overall development of 700 million subscriptions from the current to next year and 900 million by next-to-next year.

Asia Pacific to Witness the Highest Growth

- The Asia-Pacific region boasts tremendous potential for the market, primarily owing to the growing prominence of mobile payments in countries such as India and China. India, specifically after the demonetization scheme, has witnessed many telecom operators shifting toward this model. For instance, Jio and Airtel, the country's leading telcos, offer digital wallets to enable customer-to-customer payments. Thus, the adoption of blockchain to handle the transactions by these companies could make their wallets more secure and cheaper, driving the market significantly.

- China Telecom, China Mobile, and China Unicom have joined the CAICT's Trusted Blockchain Initiative, which would use blockchain technology to bolster operations and security in the telecom industry. The companies are expected to focus on blockchain-based apps that relate to IoT data sharing and customer identity verification.

- Further, as the world is currently embroiled in a privacy debate over WhatsApp's policy changes, India's communication platform as a service (CPaaS) industry has been gearing up for the adoption of end-to-end encryption of commercial mobile SMSes, emails, and all other types of business communication between the enterprises and service providers.

- For instance, next year, CPaaS provider Tanla Platforms, in partnership with Microsoft, launched its edge-to-edge global blockchain network called Wisely, which was made for sending encrypted SMSes directly from enterprises to the telecom operators, which the company also claims to disrupt the existing aggregator model of commercial communication.

- In Japan, too, startups are developing blockchain solutions that enable secure smartphone-based money transfers that do not require formal banking documentation. For instance, a Japanese startup Telcoin leverages blockchain to facilitate telecommunication operators to provide money transfer services. Telcoin Wallet, built on the Ethereum blockchain, allows mobile users to make global transfers instantly, irrespective of local mobile service providers. Hence, adopting a standardized blockchain platform will help operators fully realize the technology's value and pave the path for faster adoption within the region, driving the market's growth significantly.

Blockchain in Telecom Industry Overview

The market is concentrated, with few significant vendors offering blockchain solutions across the telecommunication industry. The vendors are also receiving investors' funds, further helping in innovative blockchain services.

- November 2022 - Information technology (IT) services firm Tech Mahindra and telecom analytics solutions provider Subex have joined hands to roll out blockchain-based solutions for telecom operators globally. These solutions would mitigate fraud and drive operational efficiencies for communication service providers (CSP) by minimizing overall compliance issues.

- February 2022 - Bharti Airtel, India's premier communications solutions provider, declared that it had acquired a strategic stake in Aqilliz, a Blockchain as a Service Company under the Airtel Startup Accelerator Program, subject to applicable statutory approvals. Airtel aims to deploy Aqilliz's advanced blockchain technologies at a larger scale across its fast-growing Adtech, Digital Entertainment, and various Digital Marketplace offerings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 impact on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Focus on Telecom Fraud Detection and Prevention is Driving the Market Growth

- 5.2 Market Restraints

- 5.2.1 Lack of Industry Standards

6 MARKET SEGMENTATION

- 6.1 Application

- 6.1.1 Identity Management

- 6.1.2 Payment and Billing

- 6.1.3 Smart Contract

- 6.1.4 Connectivity Provisioning

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Blockchain Foundry Inc.

- 7.1.2 Huawei Technologies Co. Ltd.

- 7.1.3 Microsoft Corporation

- 7.1.4 Oracle Corporation

- 7.1.5 SAP SE

- 7.1.6 ShoCard Inc. (Ping Identity)