|

市場調查報告書

商品編碼

1444893

紅外線感測器 - 市場佔有率分析、行業趨勢與統計、成長預測(2024 - 2029)Infrared Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

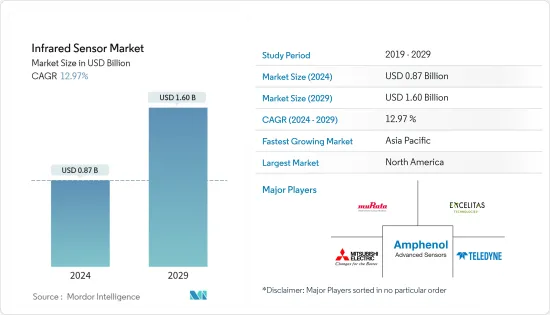

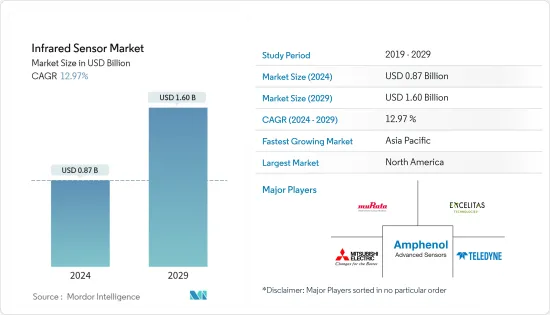

紅外線感測器市場規模預計到 2024 年為 8.7 億美元,預計到 2029 年將達到 16 億美元,在預測期內(2024-2029 年)CAGR為 12.97%。

在過去十年中,連網汽車、機器和穿戴式裝置等技術的快速進步導致感測器的部署,這些感測器從物理環境中獲取輸入,在檢測到特定資訊時執行預定義的功能。微機電系統技術的出現,透過微製造和微加工技術,實現了感測器領域機械和機電元件的小型化,幫助業界降低了感測器的尺寸、功耗和成本。感測器。

主要亮點

- 汽車產業正在成為紅外線感測器的重要投資者和採用者。儘管汽車產業在過去兩年中經歷了衰退,但自動駕駛汽車的成長趨勢和政府法規強制要求 ADAS 系統是推動該產業採用紅外線技術的一些主要因素。主動紅外線感測器可作為接近感測器,通常用於車輛障礙物檢測系統。

- 安全和監控是紅外線探測器(尤其是熱釋電紅外線感測器)的其他主要應用。全球視訊監控的不斷成長趨勢為市場供應商提供了巨大的機會。近日,德里政府表示,將在閉路電視攝影機計畫第二階段安裝14萬台設備。此外,閉路電視攝影機計畫第二階段還將安裝另外 14 萬個(14 萬個)監控設備。

- LiDAR技術的發展為市場廠商提供了新的機會。 Sick AG 等許多公司正在投資開發紅外線 LiDAR 感測器,以提供更準確、更可靠的距離感測和測量,特別是在汽車行業具有課題性的環境條件下。波鴻魯爾大學也正在研究紅外線感測器,透過提供有關藥物與其目標蛋白之間相互作用的近即時資訊來設計新的、更有效的藥物。

- 在對抗新冠肺炎 (COVID-19) 疫情的過程中,過去一年裡,全球市場上紅外線感測器的數量不斷增加。預計記錄溫度資料並將資訊傳回中央醫療資料庫的紅外線感測器、微測輻射熱計和熱電堆將迅速擴大規模。

紅外線 (IR) 感測器市場趨勢

近紅外線 (NIR) 將佔據重要市場佔有率

- 全球對近紅外線 (NIR) 成像的需求不斷成長,通常取代夜視的熱視覺或遠紅外線 (FIR) 視覺。包含近紅外線感測器的相機可以偵測與可見光譜直接相鄰的光的波長。與熱成像相機不同,近紅外線相機可以像可見光譜中的相機一樣檢測光子,只是波長不同。夜間近紅外光譜中有更多可偵測到的光子,這使得近紅外線相機對於夜視很有價值。

- 歐洲新車評估計畫 (Euro NCAP) 宣布將從 2022 年開始向那些在新車中提供兒童存在檢測作為標準功能的製造商提供補償(例如,用於監控車內無人看管兒童安全的感測系統)。汽車製造商和供應商面臨著快速有效地實施感測技術的壓力,近紅外線光源的作用和性能在車輛中變得越來越重要。預計這一因素將增加對近紅外線感測器的需求。

- 與熱視覺相比,近紅外線視覺已經獲得了很高的需求。熱視覺僅檢測熱。它不擅長產生清晰的圖像來促進半自治或完全自治。此外,近紅外線感測器已在生物醫學工程中得到應用。

- 紅外線 (IR) 透明電極(特別是在近紅外線範圍內)的開發對於提高特定光電裝置的效率和開拓其他新興領域的應用至關重要,例如紅外光電探測器、紅外線開關裝置、感測器和調製器電信。隨著對無損、準確、快速的食品品質和安全分析的需求不斷增加,NIR(近紅外線)應用不斷增加。因此,近紅外線技術不斷升級,以提高性能,並使科學家和食品供應鏈中的所有利益相關者更負擔得起。

亞太市場將顯著成長

- 由於中國、日本和韓國等經濟體的成熟電子工業和不斷進步的技術進步,亞太地區是紅外線感測器成長最快的市場。此外,該地區也是最大的消費性電子產品生產國和消費國。

- 在過去幾年中,該地區物聯網 (IoT) 的普及率不斷提高,消費者對更好的能源管理系統的偏好也不斷提高。諸如此類的因素正在推動對智慧家庭自動化技術的需求,這反過來又增加了對紅外線感測器的需求。例如,電視使用紅外線感測器來解碼遙控器傳輸的訊號。據techarch稱,2022年進行的一項調查顯示,智慧電視在印度所有智慧家庭設備中的滲透率最高,達73%,因而帶動了紅外線感測器市場的需求。

- 該地區的許多企業都在研發紅外線感測器,這可能會帶來包裝行業的進步。例如,橫河電機公司開發的WG51S2紅外線感測器用於測量和控制薄膜和片材的厚度,以確保產品品質。

- 遠紅外線 (FIR) 使車輛能夠完整、可靠地偵測道路及其周圍環境。近日,印度產業及國內貿易推廣部門顯示,印度汽車業的外國直接投資流入額約16億美元。相機和自動駕駛汽車中紅外線感測器的多功能性不斷增強,推動了市場的成長。

- 亞太地區主要市場參與者的存在、快速工業化(主要是在製造業)、對更好的安全和監控系統的需求增加、紅外線探測器在住宅和消費電子行業的應用增加以及政府在航空航太和航空航太領域的舉措的增加國防部門推動了市場的成長。

紅外線 (IR) 感測器產業概覽

紅外線感測器市場競爭激烈。研發、合作、合作和收購的高額費用是區域公司為維持激烈競爭所採取的主要成長策略。市場上的主要參與者包括村田製造公司、Teledyne FLIR Systems, Inc.、Excelitas Technologies Corp、Melexis NV、Austria Micro Systems (AMS) AG、Amphen Advanced Sensors、Advanced Energy Industries Inc.、橫河電機公司、Sick AG等。更多的。

- 2022 年 12 月-通用原子航空系統公司與洛克希德馬丁公司和戰術空中支援公司合作,進行了多平台紅外線感測的飛行展示。據通用原子航空系統公司稱,此次試飛是使用GA-ASI的MQ-20復仇者飛機系統和兩架配備洛克希德下一代戰術紅外線和追蹤感測器的F-5高級虎式飛機進行的。

- 2022 年 10 月 - 戰術空中支援公司 (Tactical Air) 與洛克希德馬丁公司合作,完成了 TacIRSTTM 的初步飛行測試,TacIRSTTM 是一種新型嵌入式遠端紅外線搜尋和追蹤感測器 (IRST)。這項舉措使 Tactical Air 的 F-5 Advanced Tiger 成為第一架飛行和測試 TacIRST 的戰鬥機,這是該公司正在進行的聯合開發計劃的一部分。整合戰術空中紅外線搜尋和追蹤感測器對於支援美國空軍對手合約和美國海軍的 F-5AT 高級威脅複製系統的發展至關重要。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭激烈程度

- COVID-19 對紅外線感測器市場的影響

第 5 章:市場動態

- 市場促進因素

- 無線通訊需求不斷成長

- 對家庭自動化產品和智慧型設備的需求不斷成長

- 市場課題

- 製造成本高

第 6 章:市場區隔

- 依類型

- 近紅外線 (NIR)

- 紅外線的

- 遠紅外線 (FIR)

- 依最終用戶產業

- 衛生保健

- 航太和國防

- 汽車

- 商業應用

- 製造業

- 油和氣

- 其他最終用戶產業

- 依地理

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第 7 章:競爭格局

- 公司簡介

- Murata Manufacturing Co. Ltd

- Teledyne FLIR Systems, Inc.

- Excelitas Technologies Corp

- Melexis NV

- Austria Micro Systems (AMS) AG

- Amphenol Advanced Sensors

- Advanced Energy Industries Inc.

- Yokogawa Electric Corporation

- Sick AG

- Honeywell International Inc.

- Teledyne Imaging

- Mitsubisihi Electric Corporation

- Leonardo DRS

第 8 章:投資分析

第 9 章:市場的未來

The Infrared Sensor Market size is estimated at USD 0.87 billion in 2024, and is expected to reach USD 1.60 billion by 2029, growing at a CAGR of 12.97% during the forecast period (2024-2029).

Rapid technological advancements, such as connected cars, machines, and wearables, over the past decade have led to the deployment of sensors to take input from the physical environment to perform predefined functions upon detecting specific information. The emergence of micro-electromechanical systems technology has resulted in the miniaturization of mechanical and electro-mechanical elements in the field of sensors with micro-fabrication and micro-machining techniques that have aided the industry to reduce the size, power consumption, and cost of sensors.

Key Highlights

- The automotive industry is emerging as a significant investor and adopter of infrared sensors. Although the automotive sector has been witnessing a recession for the last two years, the growing trend of autonomous vehicles and government regulations mandating ADAS systems are some of the major factors driving the adoption of infrared technology in the sector. Active infrared sensors act as proximity sensors and are commonly adopted for vehicle obstacle-detection systems.

- Security and surveillance are other primary applications of infrared detectors, especially pyroelectric infrared sensors. The growing trend for video surveillance across the globe is providing a massive opportunity to market vendors. Recently, the Delhi government stated that it is to install 140,000 devices under the second phase of the CCTV camera project. Additionally, another 1.4 lakhs (140,000) surveillance devices will be installed in the second phase of the CCTV camera project.

- The development of LIDAR technology is providing new opportunities to market vendors. Many companies, such as Sick AG, are investing in developing infrared LiDAR sensors to deliver more accurate and reliable distance sensing and measurement, especially in challenging environmental conditions in the automotive sector. Ruhr-University Bochum is also researching infrared sensors to design new and more efficient drugs by providing near-real-time information about the interaction between a drug and its target protein.

- Battling the COVID-19 pandemic, the market has witnessed an increased proliferation of IR sensors globally over the past year. It is anticipated that IR sensors, microbolometers, and thermopiles that record temperature data and relay that information back to a central medical database will scale up rapidly.

Infrared (IR) Sensor Market Trends

Near Infrared (NIR) To Hold Significant Market Share

- Near-infrared (NIR) imaging is growing in demand globally, typically replacing thermal or far-infrared (FIR) vision for night vision. Cameras comprising NIR sensors can detect the wavelengths of light directly adjacent to the visible light spectrum. Unlike thermal cameras, NIR cameras can detect photons like cameras in the visible light spectrum, just at a different wavelength. More detectable photons are in the NIR spectrum at night, making NIR cameras valuable for night vision.

- The European New Car Assessment Programme (Euro NCAP) has announced that it will compensate manufacturers that offer Child Presence Detection as a standard feature in new vehicles beginning in 2022 (for instance, sensing systems to monitor the safety of children left unattended in cars). Automakers and suppliers are under pressure to quickly and effectively implement sensing technologies, with the role and performance of NIR light sources gaining new significance within the vehicle. This factor is anticipated to boost the demand for the NIR sensors.

- When compared to thermal vision, NIR vision has been gaining high demand. Thermal vision only detects heat. It's not good at producing crisp, clear images to facilitate semi- or full autonomy. Also, the NIR sensors have been witnessing adoption in biomedical engineering.

- The development of infrared (IR) transparent electrodes (specifically in the near-infrared range) is crucial for improving the efficiency of specific optoelectronic devices and opening up applications in other emerging areas, like IR photodetectors, IR switching devices, sensors, and modulators for telecommunication. NIR (Near Infrared) applications are rising as demand for non-destructive, accurate, and rapid food quality and safety analysis is increasing. Consequently, NIR technology is continuously being upgraded to improve performance and make it more affordable for scientists and all stakeholders in the food supply chain.

Asia Pacific Market to Witness Significant Growth

- Asia Pacific is the fastest-growing market for infrared sensors, owing to the established electronics industry and increasing technological advancements in economies such as China, Japan, and South Korea. Also, the region is the largest producer and consumer of consumer electronics.

- Over the past few years, the region has been witnessing increasing Internet of Things (IoT) penetration and growing consumer preference toward better energy management systems. Factors such as these are driving the demand for smart home automation technology, which, in turn, boosts the demand for IR sensors. TVs, for instance, use an infrared sensor to decode the signals transmitted by remote control. According to techarch, a survey conducted in 2022 showed that smart TVs had the highest penetration rate among all the smart home devices at 73% in India, thus driving the demand for the infrared sensors market.

- Many enterprises in this region are spending on R&D to develop infrared sensors that could bring advancements in the packaging industry. For instance, the WG51S2, an infrared sensor developed by Yokogawa Electric Corporation, is used to measure and control the thickness of films and sheets to ensure product quality.

- Far infrared (FIR) gives vehicles complete, reliable detection of the road and its surroundings. Recently, according to the Department for Promotion of Industry and Internal Trade (India), the automobile sector in India saw an equity inflow from foreign direct investments worth approximately 1.6 billion U.S. dollars. The increased versatility of infrared sensors in cameras and autonomous automobiles drives the market's growth.

- The presence of key market players in Asia Pacific, rapid industrialization, primarily in manufacturing sectors, increase in demand for better security and monitoring systems, augmented application of infrared detectors in the residential and consumer electronics sector, and rise in government initiatives in the aerospace and defense sector has fueled the market growth.

Infrared (IR) Sensor Industry Overview

The Infrared Sensor Market is highly competitive. The high expense on research and development, partnerships, collaborations, and acquisitions are the prime growth strategies adopted by the regional companies to sustain the intense competition. Key players in the market are Murata Manufacturing Co. Ltd, Teledyne FLIR Systems, Inc., Excelitas Technologies Corp, Melexis NV, Austria Micro Systems (AMS) AG, Amphenol Advanced Sensors, Advanced Energy Industries Inc., Yokogawa Electric Corporation, Sick AG, and many more.

- December 2022 - General Atomics Aeronautical Systems Inc. worked with Lockheed Martin and Tactical Air Support in collaboration to conduct a flight demonstration of multi-platform infrared sensing. According to General Atomics Aeronautical Systems Inc, the test flight was carried out using GA-ASI's MQ-20 Avenger aircraft system and two F-5 Advanced Tigers equipped with Lockheed's next-generation tactical infrared and track sensors.

- October 2022 - Tactical Air Support Inc. (Tactical Air) collaborated with Lockheed Martin and completed initial flight testing of TacIRSTTM, a new class of embedded, long-range infrared search-and-track sensors (IRST). This step made Tactical Air's F-5 Advanced Tiger the first fighter aircraft to fly and test TacIRST as part of the company's ongoing joint developmental program. Integrating tactical air infrared search-and-track sensors is critical to the evolution of its F-5AT advanced threat replication system supporting the U.S. Air Force adversary contracts and the U.S. Navy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Infrared Sensor Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Need for Wireless Communications

- 5.1.2 Growing Demand for Home Automation Products and Smart Devices

- 5.2 Market Challenges

- 5.2.1 High Manufacturing Cost

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Near Infrared (NIR)

- 6.1.2 Infrared

- 6.1.3 Far Infrared (FIR)

- 6.2 By End User Industry

- 6.2.1 Healthcare

- 6.2.2 Aerospace and Defense

- 6.2.3 Automotive

- 6.2.4 Commercial Applications

- 6.2.5 Manufacturing

- 6.2.6 Oil and Gas

- 6.2.7 Other End User Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Murata Manufacturing Co. Ltd

- 7.1.2 Teledyne FLIR Systems, Inc.

- 7.1.3 Excelitas Technologies Corp

- 7.1.4 Melexis NV

- 7.1.5 Austria Micro Systems (AMS) AG

- 7.1.6 Amphenol Advanced Sensors

- 7.1.7 Advanced Energy Industries Inc.

- 7.1.8 Yokogawa Electric Corporation

- 7.1.9 Sick AG

- 7.1.10 Honeywell International Inc.

- 7.1.11 Teledyne Imaging

- 7.1.12 Mitsubisihi Electric Corporation

- 7.1.13 Leonardo DRS