|

市場調查報告書

商品編碼

1444850

網際網路通訊協定電視 (IPTV):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029 年)Internet Protocol Television (IPTV) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

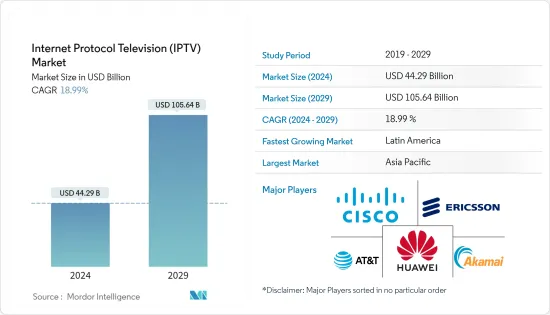

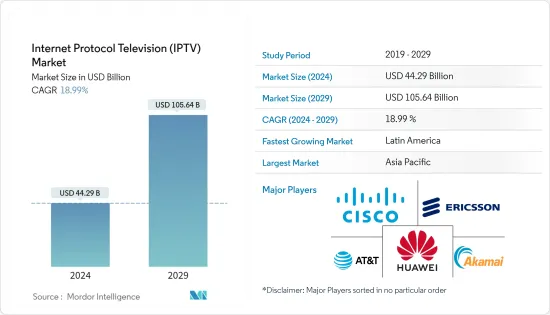

網際網路通訊協定電視(IPTV)市場規模預計到2024年為442.9億美元,在預測期內(2024-2029年)預計到2029年將達到1056.4億美元,年複合成長率為18.99%。

主要亮點

- 市場正在從有線和衛星電視等傳統廣播模式轉向基於網際網路的串流媒體。網際網路通訊協定電視 (IPTV) 將在此過渡階段發揮關鍵作用。由於通訊技術的改進和網路架構的進步,這些發展也對市場產生正面影響。

- 技術進步導致 IPTV用戶增加,以及對高畫質頻道和隨選視訊服務的需求增加。隨著新市場的拓展,合約數量也不斷增加。由於基於網際網路的串流媒體服務的普及不斷提高,預計該市場將進一步擴大。

- 本公司提供Over-the-Top了OTT 服務、視訊通話/會議、智慧家庭技術和視訊遊戲的複雜交付成果。這些公司採取的這些優勢策略吸引了客戶,導致用戶增加,促進了IPTV市場的成長。

- 此外,印度等新興國家政府支持數位電視的措施正在刺激更多的普及。然而,由於當地有線電視和衛星電視的競爭,由於缺乏低成本、高品質、無抖動服務的基礎設施,IPTV的採用仍然受到一定程度的限制,特別是在開發中國家和低度開發國家。

網際網路通訊協定電視 (IPTV) 市場趨勢

硬體產業佔主要市場佔有率

- 世界各地的經濟成長正在增加這些國家人民的可支配收入並改善人們的生活方式,特別是在新興國家。由於這些經濟變化,全球網路普及顯著提高。

- 這些因素推動了電視服務消費者對更好的用戶體驗的需求,無論是在品質還是在行動觀看選項方面。思科預測,到 2022 年,全球網路到電視的流量將佔消費者網路視訊流量的 18%,低於 2017 年的 25%。此外,直播的興起增加了網路的使用,使得網路的傳播普及。這是這一趨勢的促成因素。

- 截至2022年7月末,網路普及已達63%。北歐的網路普及最高,98%的人口可以上網。相較之下,亞太地區的網路用戶數量最多,其次是北美。

- 隨著廉價網路資料的出現,消費者要求高品質的電視體驗,從而推動了全球網際網路通訊協定電視 (IPTV) 市場硬體的成長。

亞太地區預計將出現顯著成長

- 由於該地區寬頻普及的提高和內容消費行為的變化,Over-the-Top和網路通訊協定電視 (IPTV) 正在獲得越來越多的關注。這種影響在印度和中國等亞洲國家最為明顯,2022會計年度GDP成長率將分別達到7%和2.8%。此外,該地區的主要國家印度和中國正在經歷快速的都市化,這對IPTV的採用起著關鍵作用。家庭內部。

- 內容投資的增加正在創造好萊塢以外的新內容。印度正日益成為內容中心之一,為當地和全球消費生產大量材料。此外,自 2010 年以來該地區智慧型手機用戶的增加也增加了對行動裝置上 IPTV 服務的需求。該地區智慧型手機用戶數量佔全球智慧型手機用戶數的一半,到2022年將突破60億大關。

- 此外,印度政府的數位轉型舉措,例如有線電視數位化和直接到戶(DTH)服務,也推動了IPTV在該國的採用。網路服務供應商的出現改變了印度的IPTV場景,該公司向其客戶提供免費的IPTV直播訂閱。我們預計其他公司也會效仿,從而增加該地區對行動 IPTV 服務的需求。

網際網路通訊協定電視 (IPTV) 產業概覽

由於提供硬體設定和 IPTV 服務系統的廠商數量不斷增加,網際網路通訊協定電視 (IPTV) 市場的趨勢既整合又分散。市場也變得更加垂直整合,電視製造商與電信業者合作提供內建機上盒,這將加速 IPTV 的採用。

2023 年 11 月,Enghouse Networks 宣佈為加拿大薩斯喀徹爾的 Ile-a-la-Crosse Communications Society Inc. (ICSI) 提供新的 IPTV 服務。儘管野火威脅全部區域的通訊基礎設施,但該服務還是創建並推出了。 2023 年 8 月,ICSI 與 Enghaus 接洽,該公司在薩斯喀徹爾省西北部提供電視服務。由於經濟原因,有線電視服務的訊號供應商計劃在六週內關閉該服務,因此 ICSI 立即需要替代解決方案。

2023 年 10 月,M7 Deutschland 將擴大與奧地利網路營運商 LIWEST 的長期合作關係。除了提供免費電視、付費電視和外語頻道的介紹有線電視外,M7 現在還向網路營運商提供完整的 IPTV 許可權,包括高級功能。因此,LIWEST可以透過添加高清解析度電影片道來擴展其IPTV平台,讓觀眾觀看具有互動電視附加元件功能的電視節目。進階功能包括具有重新啟動和播放功能的時移電視。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件和可交付成果

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素與阻礙因素簡介

- 市場促進因素

- 高清頻道和隨選視訊需求

- 與IPTV服務打包的互動服務

- 有利的政府舉措

- 市場限制因素

- 來自有線和衛星電視營運商的競爭

- 發展中地區缺乏提供無延遲和無抖動服務的基礎設施

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 按類型

- 硬體

- 服務

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭形勢

- 公司簡介

- Akamai Technologies, Inc.

- AT&T Inc.

- Cisco Systems Inc.

- Ericsson AB

- Huawei Technologies Co., Ltd.

- Verizon Communications

- ARRIS International Plc

- Moftak Solutions

- Sterlite Tech

- Tripleplay Services Ltd.

第7章 投資分析

第8章市場機會及未來趨勢

The Internet Protocol Television Market size is estimated at USD 44.29 billion in 2024, and is expected to reach USD 105.64 billion by 2029, growing at a CAGR of 18.99% during the forecast period (2024-2029).

Key Highlights

- The market is shifting from traditional broadcasting modes such as cable or satellite TV to internet-based streaming. Internet Protocol Television (IPTV) plays a significant role in this transitional phase. With improved communication technology and advancements in network architecture, these developments have also positively impacted the market.

- Technological advancements have led to increased IPTV subscribers and a growing demand for HD channels and video-on-demand services. The subscription numbers are also rising due to new market expansion. The increasing penetration of Internet-based streaming services is expected to drive the market further.

- Companies offer complex deliverables combined with over-the-top (OTT) services, video calling/conferencing, smart home technologies, and video games. Such lucrative strategies adopted by these companies attract clients, leading to an increase in subscribers and driving IPTV market growth.

- Moreover, government initiatives in developing countries like India that favor digital television fuel the adoptiincreasingelevision. However, competition from local cable TV and satellite TV, due to their lower cost and lack of infrastructure for quality and jitter-free service, is limiting the adoption of IPTV to an extent, especially in developing and underdeveloped countries.

Internet Protocol Television (IPTV) Market Trends

Hardware segment to acquire major market share

- The growing economies across the world are increasing the disposable income of the population in those countries, which is improving people's lifestyles, especially in developing countries. As a result of these economic changes, internet penetration has drastically improved across the globe.

- These factors have led to increased demand from television service consumers for better user experiences regarding both quality and on-the-go viewing options. Cisco predicted that globally, Internet-video-to-TV traffic would account for 18% of consumer Internet video traffic by 2022, down from 25% in 2017. The rise of live streaming also led to increased Internet usage, making Internet penetration a vital factor in this trend.

- As of the end of July 2022, the Internet penetration rate reached 63%. North Europe has the highest internet penetration rate, with 98% of the population having Internet access. In contrast, the Asia-Pacific region has the highest number of Internet users, followed by North America.

- With the availability of cheap internet data, consumers are demanding high-quality television experiences, driving the growth of the hardware in the internet protocol television market worldwide.

Asia-Pacific Expected to Grow Significantly

- Over-the-top and Internet-protocol-television (IPTV) are gaining traction driven by increasing broadband penetration and changing content consumption behaviors in the region. The effect can be significantly observed in Asian countries like India and China, representing 7% and 2.8% GDP growth rates in FY 2022. Further, rapid urbanization in India and China are the major countries in the region and play a significant role in adopting IPTV in households.

- Rising investment in content has led to the creation of new content offering which is beyond Hollywood. Increasingly, India is becoming one of the content hubs, with a wealth of material being created for consumption locally and worldwide. Also, the growth of smartphone users in the region since 2010 has fuelled the demand for IPTV services in mobile devices. The number of smartphone users in its region is half that of global smartphone users, which has crossed the mark of 6 billion in the year 2022.

- Moreover, Indian government initiatives towards digital transformation, such as digitization of cable TV and Direct-to-Home (DTH) services, are also favoring the adoption of IPTV in the country. The advent of network service providers has changed the IPTV scenario in India, with the company providing free IPTV live subscriptions to its customers. With other companies following suit, the demand for mobile-based IPTV services is expected to increase in the region.

Internet Protocol Television (IPTV) Industry Overview

The Internet protocol television (IPTV) market trend is consolidated but inclining towards fragmentation with the increasing number of players offering the hardware setup and IPTV service systems. Also, the market is undergoing vertical integration as TV manufacturers are partnering with telecom companies providing built-in set-up-box encouraging the adoption of IPTV.

In November 2023, Enghouse Networks announced it delivered its new IPTV service to Ile-a-la-Crosse Communications Society Inc. (ICSI) in Saskatchewan, Canada. The service was created and launched despite wildfires threatening telecommunications infrastructure throughout the region. In August 2023, Enghouse was approached by ICSI, which provides TV services in northwestern Saskatchewan. The signal provider for their cable TV service planned to shut down the service in six weeks for economic reasons, and ICSI needed an alternative solution immediately.

In October 2023, M7 Deutschland is expanding its long-standing partnership with Austrian network operator LIWEST. In addition to the introductory cable TV offer with free TV, pay-TV, and foreign-language channels, M7 now supplies the network operator with full IPTV license rights, including advanced functions. LIWEST can thus expand its IPTV platform with additional TV channels in HD resolution, which enable viewers to consume TV programs with interactive TV add-on functions. The advanced features include time-shifted TV via restart and replay.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Deliverables

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Demand for High-Definition Channels and Video On-Demand

- 4.3.2 Interactive Services Packaged Along with IPTV Services

- 4.3.3 Favorable Government Initiatives

- 4.4 Market Restraints

- 4.4.1 Competition from Cable TV and Satellite TV Operators

- 4.4.2 Lack of Infrastructure in Developing Regions to Offer Delay and Jitter-free Service

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Hardware

- 5.1.2 Service

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Akamai Technologies, Inc.

- 6.1.2 AT&T Inc.

- 6.1.3 Cisco Systems Inc.

- 6.1.4 Ericsson AB

- 6.1.5 Huawei Technologies Co., Ltd.

- 6.1.6 Verizon Communications

- 6.1.7 ARRIS International Plc

- 6.1.8 Moftak Solutions

- 6.1.9 Sterlite Tech

- 6.1.10 Tripleplay Services Ltd.