|

市場調查報告書

商品編碼

1444825

能源領域的預測性維護 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029 年)Predictive Maintenance in the Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

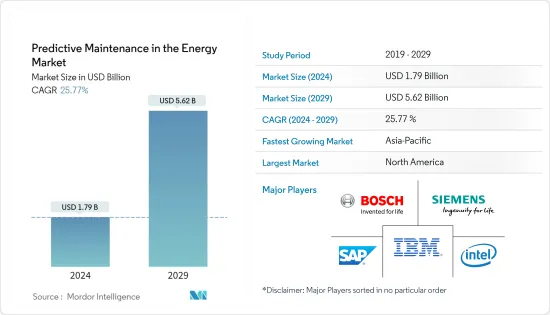

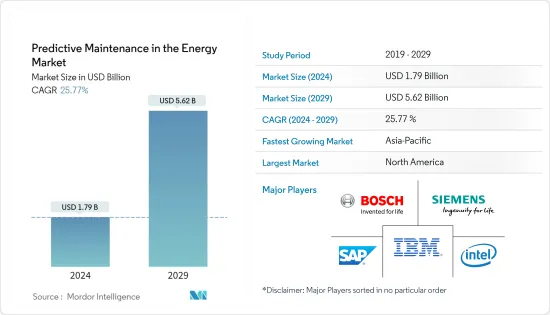

能源市場預測維護規模預計到 2024 年為 17.9 億美元,預計到 2029 年將達到 56.2 億美元,預測期內(2024-2029 年)CAGR為 25.77%。

主要亮點

- 預測性維護 (PdM) 平台最近獲得了市場關注。 PdM 解決方案與新的或現有的機械基礎設施整合,以評估機器健康狀況並檢測即將發生故障的跡象。 PdM 整合可確保投資回報 (ROI),並使組織能夠透過啟用全球遠端機器監控來實現並超越永續發展目標。

- 預測性維護大大幫助能源產業提高資產效率。巨量資料分析、物聯網(IoT)和雲端資料儲存等新興技術使工業設備和感測器能夠將基於狀態的資料發送到集中伺服器,使故障檢測更加實用和直接。正常運作時間的增加、維護成本的降低、意外故障和備件庫存同時推動和繁榮了市場。此外,減少維修和大修時間對於預測性維護市場的成長至關重要。

- 大多數能源公司都是資產密集型企業。確保這些資源正常運作以向消費者提供能源需要時間和精力。機器學習技術(例如決策樹)可用於最佳化設備的運行,進而最佳化整個系統的運作。同樣,類似的演算法可以自動將預防性維護計劃轉變為預測性維護計劃。它還允許邊際定價、時移和資產利用,從而允許產生和交付能源。

- 預測性維護服務和解決方案在機器故障之前發出警報。整合業務資訊、感測器資料和企業資產管理 (EAM) 系統可實現從反應性維護服務和解決方案快速過渡到預測性維護服務和解決方案。

- 然而,高安裝成本、環境問題、營運成本上升、消費者期望上升以及導致錯誤請求的資料誤解等因素阻礙了預測性維護市場的成長。由於越來越需要更好地洞察使用情況和性能模式以幫助做出更好的決策,這些課題提高了各種分析工具的採用率。

- COVID-19 對市場產生了重大影響。全球經濟放緩對市場既有正面的影響,也有負面的影響。例如,能源消耗下降是由於封鎖造成的,這損害了市場。然而,由於疫情期間人員短缺和供應鏈中斷,該行業的企業試圖保持機器的良好運作狀態。

能源市場趨勢中的預測性維護

解決方案領域預計將顯著成長

- 在能源領域,對客製化工業預測性維護解決方案的需求不斷增加,主要用於遠端監控操作。大資料在分析流程、資產和重型設備方面也發揮了重要作用。

- SAP、IBM 和 Microsoft 等多家供應商活躍在市場中,並根據組織的需求提供客製化的預測性維護解決方案和服務。這些解決方案可以幫助組織保護其關鍵設備並在生產力方面獲得競爭優勢。

- 人工智慧 (AI) 和機器學習 (ML) 使組織能夠全面了解其營運並產生見解,幫助解決行業中一些最具破壞性的課題。由於能源產業公司產生大量巨量資料,具有前瞻性思維的企業投資於監控和預測分析工具,以幫助充分利用這些資料的潛力。據 Gartner 稱,到預測期內,該行業 40% 的新型監控系統將使用物聯網 (IoT) 來實現智慧操作。

- 由於煤炭資源的枯竭,發電業正從煤炭轉向太陽能和風能。由於氣候條件的變化,大多數國家對燃煤電廠進行嚴格監管。隨著電力消耗的增加,發展中國家投資先進技術和設備以擴大生產能力。

- 預測性維護解決方案的部署預計將使最終用戶能夠提高生產力,同時透過最大化創新維護活動來最大限度地減少發電行業的故障。亞太發展中國家的發電產業需要更高的效率、更好的控制和更快的監控,以減少營運故障的可能性。

- 對再生能源發電(特別是風力渦輪機、離岸風電場和太陽能發電場)的投資推動了中國和印度等國家預測性維護解決方案市場的成長。

北美將佔據重要市場佔有率

- 能源市場的預測性維護以北美為主,其次是歐洲。這是由於許多服務提供者的存在、技術進步以及預防性維護知識的增加等根本因素所造成的。加拿大和美國等已開發經濟體日益重視技術進步的研發 (R&D),刺激了整個地區對預測性維護解決方案的需求。根據美國能源資訊署(US EIA)預計,2020年至2040年間,能源消耗總量將成長5%。

- 企業必須提高能源效率並減少停機時間才能保持獲利。這推動了公用事業和能源領域的資料分析市場。日益嚴重的環境問題和對永續能源投資的增加將影響市場成長。

- 其他推動市場成長的因素包括增加對人工智慧(AI)和機器學習(ML)的投資以減少資產停機時間和維護成本、物聯網(IoT)的採用、延長機械和設備整體使用壽命的需要、感測器價格的下降、感測器技術的進步以及高速網路技術的發展。此外,監管合規性一直是美國採用物聯網 (IoT) 技術的重要動力。美國能源法案(EA)的通過加快了追蹤永續能源消耗的腳步。

- 能源產業是美國最大的產業之一,正在吸引大量投資。例如,根據彭博新能源財經(BNEF)報道,美國預計未來20年將在再生能源產能上投資約7,000億美元。預計這些因素將推動預測性維護市場的成長。

- 隨著環境、社會和治理 (ESG) 策略的加強,能源產業仍然是交易活動的目標。儘管宏觀經濟壓力可能會給北美能源、電力和公用事業公司帶來各種估值課題,但整體投資者興趣仍然很高。例如,摩根大通斥資 78 億美元(78 億美元)收購了 South Jersey Industries。同樣,ArcLight Clean Energy Transition Corp 斥資 15 億美元(15 億美元)收購了 OPAL Fuels LLC。這促進了北美預測性維護的成長。

能源產業的預測性維護概述

許多國內和國際公司使預測性維護在能源市場上極具競爭力。市場集中度中等,重要企業透過產品創新、併購等策略擴大市場主導地位。 IBM 公司、SAP SE、羅伯特博世有限公司和西門子公司是該市場的一些主要參與者。

2022年6月,西門子收購了Senseye,該公司為工業公司提供預測性維護和資產智慧。透過收購 Senseye,西門子擴大了其在創新預測維護和資產智慧領域的產品組合。 Senseye 是一家提供以結果為導向的預測性維護解決方案的製造商和工業公司。 Senseye 的預測性維護解決方案可將非計劃機器停機時間減少 50%,並將維修人員的工作效率提高 30%。

2022 年 5 月,日立有限公司推出了由 Hitachi Energy 和 Hitachi Vantara 開發的 Lumada Inspection Insights,以幫助企業實現資產檢查自動化並推進永續發展目標。新方法採用人工智慧 (AI) 和機器學習 (ML) 來評估資源、危險和各種影像類型,以解決失敗的多種原因。

此外,2022 年 1 月,IBM 宣布收購環境績效管理資料和分析軟體供應商 Envizi。此次收購擴大了IBM 對人工智慧(AI) 支援的軟體不斷成長的投資,例如IBM Maximo 資產管理解決方案、IBM Environmental Intelligence Suite 和IBM Sterling 供應鏈解決方案,以幫助組織創建更具彈性和永續的營運和供應鏈。

此外,此次收購擴大了公司的產品和服務範圍。隨著對雲端為基礎的服務的需求不斷成長,IBM Cloud 廣泛的服務和專業知識可協助全球智慧企業轉變流程、吸收新技術和功能,並快速抓住新的市場機會。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 市場促進因素

- 增加能源領域投資

- 擴大採用自動化

- 市場課題

- 部署成本較高

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

- 評估 COVID-19 對市場的影響

第 5 章:市場區隔

- 透過提供

- 解決方案

- 服務

- 依部署模型

- 本地部署

- 雲

- 依地區

- 北美洲

- 歐洲

- 亞太

- 拉丁美洲

- 中東和非洲

第 6 章:競爭格局

- 公司簡介

- IBM Corporation

- SAP SE

- Siemens AG

- Intel Corporation

- Robert Bosch GmbH

- Accenture PLC

- ABB Ltd

- Schneider Electric

- Banner Engineering Corp.

- GE Automation & Control

第 7 章:投資分析

第 8 章:市場機會與未來趨勢

The Predictive Maintenance in the Energy Market size is estimated at USD 1.79 billion in 2024, and is expected to reach USD 5.62 billion by 2029, growing at a CAGR of 25.77% during the forecast period (2024-2029).

Key Highlights

- The predictive maintenance (PdM) platform has recently gained market traction. PdM solutions are integrated with new or existing machinery infrastructure to assess machine health and detect signs of impending failure. PdM integration ensures return on investment (ROI) and enables organizations to meet and exceed sustainability goals by enabling global remote machine monitoring.

- Predictive maintenance is significantly assisting the energy industry in improving asset efficiency. Emerging technologies such as big data analytics, the Internet of Things (IoT), and cloud data storage enable industrial equipment and sensors to send condition-based data to a centralized server, making fault detection more practical and direct. The increase in uptime, lower maintenance costs, unexpected failures, and spare part inventory have propelled and flourished the market simultaneously. Furthermore, reducing repair and overhaul times is critical for the predictive maintenance market's growth.

- The majority of energy companies are asset-intensive businesses. It takes time and effort to ensure that these resources work correctly to provide energy to consumers. Machine learning techniques, such as decision trees, can be used to optimize the operation of the equipment and, by extension, the entire system. Similarly, comparable algorithms can automate the transformation of preventative maintenance programs into predictive ones. It also allows for marginal pricing, time shifting, and asset utilization, allowing energy to be generated and delivered.

- Predictive maintenance services and solutions send out an alert before the machine fails. Integrating business information, sensor data, and enterprise asset management (EAM) systems allow for the rapid transition from reactive to predictive maintenance services and solutions.

- However, factors such as high installation costs, environmental concerns, rising operating costs, rising consumer expectations, and data misinterpretation leading to false requests hinder predictive maintenance market growth. Because of the growing need for better insights into usage and performance patterns to help make better decisions, these challenges increase the adoption rate of various analytics tools.

- COVID-19 significantly impacted the market. The global economic slowdown had both positive and negative consequences for the market. For example, the drop in energy consumption was caused by the lockdowns, which hurt the market. However, due to a lack of personnel and a disrupted supply chain during the outbreak, companies operating in the industry attempted to keep the machinery running in good condition.

Predictive Maintenance in the Energy Market Trends

Solutions Segment is Anticipated to Witness Significant Growth

- In the energy sector, there has been an increase in demand for customized industrial predictive maintenance solutions, primarily for remote monitoring operations. Big data has also played an essential role in analyzing processes, assets, and heavy equipment.

- Several vendors, including SAP, IBM, and Microsoft, are active in the market, offering customized predictive maintenance solutions and services based on the needs of organizations. These solutions can help organizations protect their critical equipment and gain a competitive advantage in productivity.

- Artificial intelligence (AI) and machine learning (ML) enable organizations to gain complete visibility of their operations and generate insights that can aid in the resolution of some of the industry's most disruptive challenges. Because of the volume of big data generated by energy sector companies, forward-thinking businesses invest in monitoring and predictive analytics tools that help leverage this data to its full potential. According to Gartner, 40% of new monitoring and control systems in this sector will use Internet of Things (IoT) to enable intelligent operations by the forecasted period.

- Due to the depletion of coal resources, the power generation industry is shifting away from coal and toward solar and wind energy. Because of changing climatic conditions, most countries strictly regulate coal power plants. As electricity consumption rises, developing countries invest in advanced technologies and equipment to expand their production capacities.

- The deployment of predictive maintenance solutions is expected to empower end users to increase productivity while minimizing failures in the power generation industry by maximizing innovative maintenance activities. The power generation industry in the Asia-Pacific developing countries requires higher efficiency, better control, and faster monitoring to reduce the likelihood of operational failure.

- Investments in renewable energy generation, particularly wind turbines, offshore wind farms, and solar farms, have fueled the predictive maintenance solutions market growth in countries such as China and India.

North America to Occupy a Significant Market Share

- The predictive maintenance in the energy market is dominated by North America, followed by Europe. This is due to underlying factors such as the existence of many service providers, technological advancements, and increased knowledge of preventative maintenance. The growing emphasis on research & development (R&D) for technological advances in developed economies such as Canada and the United States has fueled demand for predictive maintenance solutions throughout the region. According to the United States Energy Information Administration (US EIA), the total energy consumption rate is expected to rise by 5% between 2020 and 2040.

- Businesses must provide energy efficiency and reduce downtime to remain profitable. This drives the data analytics market in utilities and energy. Rising environmental concerns and increased investments in sustainable energy will impact market growth.

- Other factors driving market growth include increased investment in artificial intelligence (AI) and machine learning (ML) to reduce asset downtime and maintenance costs, adoption of the Internet of things (IoT), the need to extend the overall lifespan of machinery and equipment, declining sensor prices, advancements in sensor technology, and the evolution of high-speed networking technologies. Furthermore, regulatory compliance has been a significant driver of the Internet of things (IoT) technology adoption in the United States. The passage of the Energy Act (EA) in the United States has sped up efforts to track sustainable energy consumption.

- The energy industry, one of the largest in the United States, is attracting significant investment. For example, according to Bloomberg New Energy Finance (BNEF), the United States is expected to invest approximately USD 7,00,000 million in renewable energy capacity over the next 20 years. These factors are expected to boost the growth of the predictive maintenance market.

- The energy sector remains a target for deal activity as environmental, social, and governance (ESG) strategies are strengthened. General investor interest remains high, although macroeconomic pressures could pose various valuation challenges for North American energy, power, and utility companies. For instance, J.P. Morgan paid USD 7.8 billion (USD 7,800 million) for South Jersey Industries. Similarly, ArcLight Clean Energy Transition Corp paid USD 1.5 billion (USD 1,500 million) to acquire OPAL Fuels LLC. This boosts the growth of predictive maintenance in North America.

Predictive Maintenance in the Energy Industry Overview

Numerous domestic and international firms make predictive maintenance in the energy market extremely competitive. The market is moderately concentrated, with significant players expanding their market dominance through strategies such as product innovation and mergers and acquisitions. IBM Corporation, SAP SE, Robert Bosch GmbH, and Siemens AG are some of the market's major players.

In June 2022, Siemens acquired Senseye, which provides industrial companies with predictive maintenance and asset intelligence. With the acquisition of Senseye, Siemens expanded its portfolio in innovative predictive maintenance and asset intelligence. Senseye is a manufacturer and industrial company that offers outcome-oriented predictive maintenance solutions. The predictive maintenance solution from Senseye allows for a 50% reduction in unplanned machine downtime and a 30% increase in maintenance staff productivity.

In May 2022, Hitachi Ltd. launched Lumada Inspection Insights, developed by Hitachi Energy and Hitachi Vantara, to help businesses automate asset inspection and advance sustainability goals. The new approach employs artificial intelligence (AI) and machine learning (ML) to evaluate resources, hazards, and various image types to address multiple reasons for failure.

Moreover, in January 2022, IBM announced the acquisition of Envizi, a data and analytics software provider for environmental performance management. This acquisition expands IBM's growing investments in artificial intelligence (AI)-powered software, such as IBM Maximo asset management solutions, IBM Environmental Intelligence Suite, and IBM Sterling supply chain solutions, to assist organizations in creating more resilient and sustainable operations and supply chains.

Furthermore, the acquisition broadens the company's product and service offerings. With rising demand for cloud-based services, IBM Cloud's broad range of services and expertise assist the world's smarter businesses to transform their processes, assimilate new technologies and capabilities, and pivot quickly to new market opportunities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Investments in the Energy Sector

- 4.2.2 Increasing Adoption of Automation

- 4.3 Market Challenges

- 4.3.1 Higher Deployment Cost

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 impact on the Market

5 MARKET SEGMENTATION

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Model

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By Region

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 SAP SE

- 6.1.3 Siemens AG

- 6.1.4 Intel Corporation

- 6.1.5 Robert Bosch GmbH

- 6.1.6 Accenture PLC

- 6.1.7 ABB Ltd

- 6.1.8 Schneider Electric

- 6.1.9 Banner Engineering Corp.

- 6.1.10 GE Automation & Control