|

市場調查報告書

商品編碼

1444714

微生物農藥 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Microbial Pesticides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

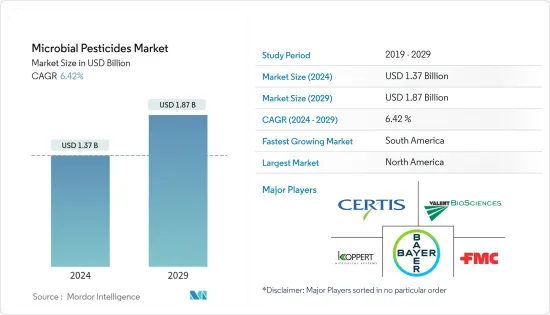

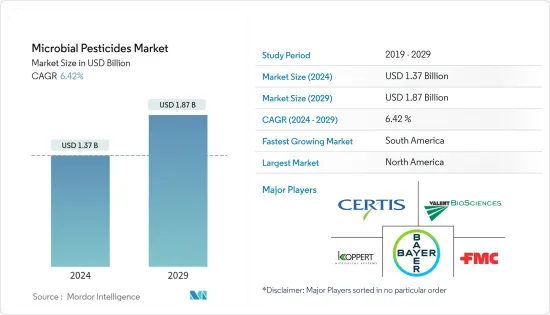

微生物農藥市場規模估計到2024年為 13.7 億美元,預計到2029年將達到 18.7 億美元,在預測期內(2024-2029年)CAGR為 6.42%。

主要亮點

- 雖然化學或合成農藥在作物保護中的流行仍在繼續,但對人類和動物健康以及環境的擔憂在推動微生物農藥的成長方面發揮關鍵作用。一些國家對進口數量採取嚴格的措施,重點是監管農藥殘留數量。由於對食品安全和品質的需求不斷成長,微生物農藥比合成農藥越來越受歡迎。

- 當納入害蟲綜合管理計劃(IPM)時,微生物農藥的使用將在很大程度上減少對合成農藥的需求,而不會影響作物產量。根據聯合國糧食及農業組織(FAO)的資料,2021年收穫總面積為14.65億公頃,高於上年的14.427億公頃,原因是農作物生產需求增加,且微生物和昆蟲侵擾很少。

- 隨著耕地面積的減少,技術變革是提高農業生產力的主要促進因素。隨著收入的增加、知識的增加和溝通管道的改善,許多國家的消費者需要透過有機方法生產的低成本高品質食品。同時,對採用保護自然資源、限制環境壓力以及更關注農村生存能力和動物福利的技術生產食品的需求也在增加。因此,各國政府堅持採用新的農業技術來實現永續農業系統。

微生物農藥市場趨勢

增加有機土地和採用新農業技術

- 新農業技術的不斷採用使得微生物農藥等產品的田間應用更加安全。主流農業對永續農業的支持和接受促使農民盡量減少化學農藥的使用,節省成本、生產力和環境。在永續農業中使用微生物農藥解決了一些環境和社會問題,並為種植者、勞工和消費者提供了創新和經濟上可行的機會。這是微生物農藥市場成長的主要驅動力之一。

- 根據有機貿易協會(OTA)統計,2020年美國有機銷售額為619.2億美元,較上年增加12.4%。如果從經濟角度將有機銷售額的成長率與美國整個食品和非食品市場(其成長率不到一半,即 4.9%)進行比較,消費者行為向有機產品的轉變是顯而易見的。

- 有機食品之所以受到歡迎,是因為它是在農業系統中生產的,所提供的食品不含有毒農藥、合成肥料和基因改造生物(GMO)。因此,有機產品被認為是高品質的,並且對健康和環境來說更安全。

北美主導市場

- 隨著人們對化學除草劑和殺蟲劑的影響的認知不斷提高,可以採用生物除草劑作為替代品,特別是對於綜合雜草管理。生物除草劑是由植物毒素、病原體和其他微生物組成的除草劑。它被用作生物雜草控制。

- 生物除草劑是從真菌、細菌和原生動物等微生物中獲得的化合物和次級代謝物,或具有植物毒性的植物殘留物、萃取物或源自其他植物物種的單一化合物。該地區的需求受到多種因素的推動,包括人們對綠色農業實踐的興趣增加以及許多傳統產品因重新註冊和/或性能問題而流失。

- 產品開發也促進了微生物農藥的需求。目前市面上有更好的生物活性成分和產品,可以與傳統化學農藥競爭和補充。人們對永續糧食生產的認知不斷增強,農民對化學品過度使用的擔憂以及化學作物保護費用的不斷增加,推動了微生物生物農藥產業的發展。這種知識的增加反映在美國蓬勃發展的生物產業,這為使用微生物農藥提供了絕佳的機會。

- 此外,2021年6月,EPA註冊了五種含有貝萊斯芽孢桿菌菌株RTI301和/或枯草芽孢桿菌菌株RTI477(新的微生物活性成分)的生物農藥產品。這些生物農藥產品包括兩種製造產品和三種最終用途產品,利用天然細菌來保護幼苗和/或農作物免受真菌生長。 EPA 也得出結論,已註冊用途的產品不會影響任何非目標物種。因此,美國環保署在該國批准新微生物成分的積極舉措是微生物農藥市場成長的促進因素。

微生物農藥產業概況

微生物農藥市場極度分散,大量公司控制大部分市場佔有率,還有一些小公司和自有品牌。 Bayer CropScience AG、FMC Corporation、Koppert Biological Systems、Valent Biosciences Corporation 和 Certis USA LLC 是研究市場中的一些知名公司。新產品發布、合作和收購是該國市場領先公司採取的主要策略。除了創新和擴張之外,研發投資和開發新穎的產品組合可能成為未來幾年的關鍵策略。該公司之間為開發微生物農藥而進行的重大收購表明,對生物基產品的關注迅速增加。市場參與者該市場進行大量投資,以在不斷擴大的市場中實現生物研究部門的多元化。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 市場限制

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

第5章 市場細分

- 成分類型

- 細菌農藥

- 真菌類殺蟲劑

- 病毒農藥

- 其他成分類型

- 產品類別

- 微生物殺菌劑

- 微生物殺蟲劑

- 其他產品類型

- 應用

- 穀物及穀物

- 豆類和油籽

- 水果和蔬菜

- 其他應用

- 地理

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 西班牙

- 英國

- 法國

- 德國

- 俄羅斯

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 亞太地區其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 非洲其他地區

- 北美洲

第6章 競爭格局

- 最常用的策略

- 市佔率分析

- 公司簡介

- Valent BioSciences

- Certis USA LLC

- Bio Works Inc.

- Agri Life

- Marrone Bio Innovations

- Novozymes Biologicals

- Bayer CropScience

- Sumitomo Chemical Co. Ltd

- IsAgro Spa

- De Sangosse

- FMC Corporation

第7章 市場機會與未來趨勢

The Microbial Pesticides Market size is estimated at USD 1.37 billion in 2024, and is expected to reach USD 1.87 billion by 2029, growing at a CAGR of 6.42% during the forecast period (2024-2029).

Key Highlights

- While the prevalence of chemical or synthetic pesticides in crop protection is continuing, concerns about human and animal health and the environment are playing key roles in driving the growth of microbial pesticides. Several countries are adopting a stringent approach concerning the number of imports, focusing on regulating the number of pesticide residues. Due to the growing demand for food safety and quality, microbial pesticides are gaining popularity over their synthetic counterparts.

- When incorporated into an integrated pest management program (IPM), the use of microbial pesticides will reduce the need for synthetic pesticides to a very large extent without affecting crop yield rates. According to the Food and Agriculture Organization (FAO), the total area harvested in 2021 accounted for 1,465.0 million hectares, higher than the previous year with 1,442.7 million hectares due to increased demand for crop production with little microbiological and insect infestation.

- Technological change is the major driving factor for boosting agricultural productivity as arable land decreases. With higher incomes, greater knowledge, and improved communication channels, consumers in many countries demand low-cost food with high quality produced through organic methods. At the same time, the demand for food to be produced using techniques that conserve natural resources, limit environmental pressures, and pay greater attention to rural viability and animal welfare is also increasing. Therefore, governments insist on adopting new farm technologies for sustainable farming systems.

Microbial Pesticides Market Trends

Increasing Organic Land and Adaptation of New Farming Technologies

- The increasing adaptation of new farm technologies led to safer field applications of products like microbial pesticides. Sustainable farming support and acceptance within mainstream agriculture drive farmers toward minimizing the use of chemical pesticides, thereby saving costs, productivity, and the environment. The use of microbial pesticides in sustainable agriculture addresses several environmental and social concerns and offers innovative and economically viable opportunities for growers, laborers, and consumers. This is one of the major drivers for the market's growth of microbial pesticides.

- According to Organic Trade Association (OTA), in 2020, Organic sale in the United States was USD 61.92 billion, with a growth rate of 12.4% from the previous year. If we compare this growth rate of organic sales from an economic perspective with the total United States market for food and non-food products, which grew at less than half the rate, at 4.9%, the consumer behavior shift towards organic is clear.

- Organic food has gained popularity because it is produced in an agricultural system that provides food free from toxic pesticides, synthetic fertilizers, and genetically modified organisms (GMOs). So organic products are seen as being of high quality and are considered safer for both health and the environment.

North America Dominates the Market

- With increasing awareness of the effects of chemical herbicides and pesticides, bioherbicides can be adopted as an alternative, especially for integrated weed management. Bioherbicides are herbicides consisting of phytotoxins, pathogens, and other microbes. It is used as biological weed control.

- Bioherbicides are obtained as compounds and secondary metabolites from microbes such as fungi, bacteria, and protozoa, or phytotoxic plant residues, extracts, or single compounds derived from other plant species. Demand in the region is driven by a number of factors, including the increased interest in green agricultural practices and the loss of many conventional products to reregistration and/or performance issues.

- Product development has also driven up the demand for microbial pesticides. Better biological active ingredients and products are available in the present market that can compete with and complement conventional chemical pesticides. The microbial biopesticide sector is driven by a growing awareness of sustainable food production, farmers' concerns about excessive chemical use, and the rising expense of chemical crop protection. This increased knowledge is reflected in the booming biological sector in the United States, which provides an excellent opportunity to use microbial pesticides.

- Furthermore, in June 2021, EPA registered five biopesticide products containing Bacillus velezensis strain RTI301 and/or Bacillus subtilis strain RTI477, new microbial active ingredients. These biopesticide products consisted of two manufacturing and three end-use products, utilizing natural bacteria to protect seedlings and/or agricultural crops from fungal growth. EPA also concluded the products with registered uses would not affect any nontarget species. Thus, such active initiatives taken by the EPA to approve new microbial ingredients in the country are a driving factor for the growth of the microbial pesticide market.

Microbial Pesticides Industry Overview

The market for microbial pesticides is extremely fragmented, with a large number of firms controlling the majority of the market share, along with several small companies and private labels. Bayer CropScience AG, FMC Corporation, Koppert Biological Systems, Valent Biosciences Corporation, and Certis USA LLC are some of the prominent companies in the market studied. New product launches, partnerships, and acquisitions are the major strategies adopted by the leading companies in the market in the country. Along with innovations and expansions, investments in R&D and developing novel product portfolios will likely be crucial strategies in the coming years. The major acquisitions between companies to develop microbial pesticides indicate that the focus on bio-based products is increasing rapidly. The players in the market are investing heavily in this market to diversify their biological research divisions in the expanding marketplace.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Ingredient Type

- 5.1.1 Bacteria-based Pesticides

- 5.1.2 Fungi-based Pesticides

- 5.1.3 Virus-based Pesticides

- 5.1.4 Other Ingredient Types

- 5.2 Product Type

- 5.2.1 Microbial Fungicide

- 5.2.2 Microbial Insecticide

- 5.2.3 Other Product Types

- 5.3 Application

- 5.3.1 Grains & Cereals

- 5.3.2 Pulses & Oilseeds

- 5.3.3 Fruits & Vegetables

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Spain

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Germany

- 5.4.2.5 Russia

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Valent BioSciences

- 6.3.2 Certis USA LLC

- 6.3.3 Bio Works Inc.

- 6.3.4 Agri Life

- 6.3.5 Marrone Bio Innovations

- 6.3.6 Novozymes Biologicals

- 6.3.7 Bayer CropScience

- 6.3.8 Sumitomo Chemical Co. Ltd

- 6.3.9 IsAgro Spa

- 6.3.10 De Sangosse

- 6.3.11 FMC Corporation