|

市場調查報告書

商品編碼

1444419

寵物食品包裝 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Pet Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

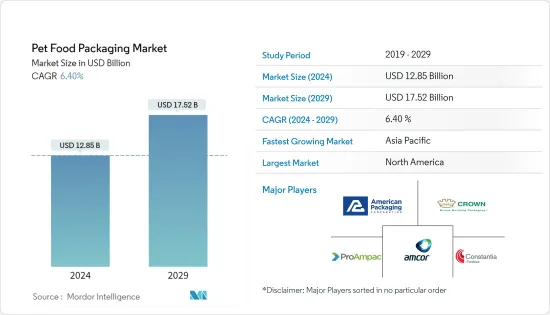

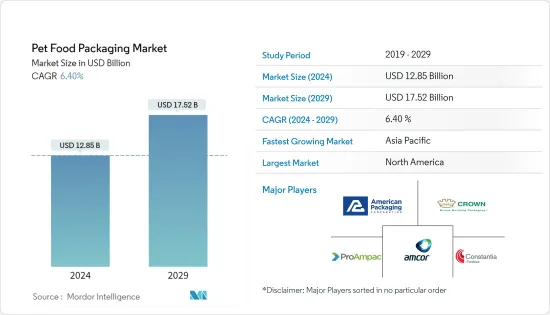

寵物食品包裝市場規模預計到2024年為128.5億美元,預計到2029年將達到175.2億美元,在預測期內(2024-2029年)CAGR為6.40%。

由於人們擴大將寵物視為伴侶,而主人對維護寵物健康的意識不斷增強,寵物食品包裝市場正在獲得越來越多的關注。人們對寵物健康的日益關注正在推動防溢和先進寵物食品包裝的採用,以保持寵物食品包裝的品質。

主要亮點

- 隨著社會契約的轉變,將寵物視為忠實的家庭成員越來越成為一種社會規範,優質寵物食品類別的成長和發展已成為自然的結果。新品牌的出現和 SKU 的激增帶來了引人注目的包裝,正在推動寵物食品行業的發展。

- 具有優質保護和高清印刷的軟包裝和更輕的容器可幫助加工商利用蓬勃發展的寵物飼養業,並對濕零食、高蛋白質含量和更多補充品等趨勢做出反應。隨著美國寵物食品生產在 FSMA 的監管下變得更加安全,包裝體現出透明度,透過窗戶展示食品並突出天然成分。

- 塑膠袋廣泛用於寵物食品的包裝。然而,由於環境問題和塑膠包裝法規的影響,寵物食品行業中此類包裝的採用率正在下降。

- 近幾個月來,由於許多國家因 COVID-19 的疫情而實行封鎖,寵物食品包裝市場的產品需求受到了雙重影響。受新冠肺炎 (COVID-19) 影響,包裝製造商面臨一系列預計只會在短期內出現的問題。封鎖的一些影響包括供應鏈中斷、製造過程中使用的原料缺乏、勞動力短缺、價格波動可能導致最終產品的產量膨脹並超出預算、運輸問題等。

- 在印度等一些國家,收養寵物在疫情期間已經成為一種趨勢,並且已經成為一種持續的趨勢。例如,印度報紙和亞馬遜Prime Video 在2022 年4 月開展的一項收養活動允許個人將流浪動物收養到自己的家庭中,並建議人們需要收養流浪動物,而不是在品種上花費大量資金,其中許多品種都不是適合印度氣候。此類措施將利用該國寵物食品包裝市場。

寵物食品包裝市場趨勢

乾寵物食品類型成長最快

- 寵物食品根據其最終水分含量分為三種類型,即濕的、半濕的和乾的(也稱為粗磨食品)。烘焙飼料、顆粒飼料和膨化飼料是乾寵物食品的幾種類型,其中膨化食品最受歡迎。穀物、肉類、家禽、雞蛋和蔬菜副產品通常與其他脂質、維生素和礦物質一起用作寵物食品生產的原料。

- 乾寵物食品通常包括擠壓食品、烘焙食品(粗磨食品)或片狀食品。在儲存方面,乾燥寵物食品儲存在陰涼、乾燥的環境中,以防止維生素的破壞和脂肪的氧化。因為脂肪氧化會導致酸敗。乾狗糧還可以幫助維持狗狗的牙齒健康,因為咀嚼乾糧有助於減少牙垢堆積。

- 此外,乾寵物飲食中主要含有澱粉(增味劑)成分,水分含量低於 20%,蛋白質成分含量有限。水分含量為 8-9% 的乾寵物食品通常質地乾燥且脆,而水分含量為 10-15% 的其他配方則質地較軟。

- 由於其低水分活度和由此產生的微生物穩定性,乾燥寵物食品具有較長的保存期限。然而,乾寵物食品對寵物的吸引力通常不如濕或半濕寵物食品,可能是因為它們的風味吸引力較低。相反,由於乾燥寵物食品的質地,有些寵物可能更喜歡乾燥寵物食品。這推動了乾寵物食品包裝市場的成長。

- 乾燥寵物食品通常不是包裝要求很高的產品,知名品牌都提供紙袋包裝的乾燥寵物食品。雀巢普瑞納等公司正在探索新的包裝方法,包括新的紙基材料和試點可重複使用的包裝系統,客戶可以攜帶容器來盛裝乾燥寵物食品。

- 近年來,該市場在全球範圍內出現了一些合作夥伴關係和企業擴張。這有助於乾燥寵物食品包裝公司在不斷成長的市場中競爭。

北美將佔據最大佔有率

- 北美對寵物食品包裝的需求可能與該地區擴大收養寵物和搜救犬有關。根據美國寵物產品協會(APPA)2021-2022年全國寵物主人調查顯示,約70%的美國家庭,約9,050萬個家庭擁有寵物。

- 收養寵物和救助動物的增加也引發包裝產業對寵物食品的優質化和安全性進行集思廣益。這種袋子或容器使製造商在貓狗主人中脫穎而出,他們想要永續的選擇、個性化的寵物飲食以及甚至人類也覺得有吸引力的成分。

- 寵物人性化是重塑寵物照護產業的最大趨勢之一。 Mondi 進行的一項調查顯示,75% 的受訪者打算花更多錢,並對採用永續包裝的品牌更有好感。此外,品牌尋求能夠補充其在寵物食品行業企業價值觀的解決方案,其中永續性是首要關注點。

- 乾燥寵物食品袋需要獨特的結構。多層袋的內層應保護內容物,外層應美觀且無油漬滲透到內層。

- 因此,Mondi 等公司提供了 BarrierPack Recyclable 等寵物食品包裝解決方案。這些預製袋和 FFS 捲材構成塑膠層壓材料,可在接受軟包裝的區域和透過商店回收進行回收。它是在不影響功能的情況下完成的。

- 此外,巴斯夫美國公司正在利用其水性乳液 JONCRYL HPB 1702 打造更永續的寵物食品包裝。它可以永續地提供寵物食品市場所需的耐油脂性能和食品安全認證。 JONCRLY HPB 1702 透過柔印、凹印或棒塗,即使在折疊和壓痕後,在室溫和高達 60°C 的高溫下也能提供出色的耐油脂性。

寵物食品包裝產業概況

市場上存在多家企業,加劇了競爭程度。預計在預測期內,這種競爭的強度將相當高。該市場的一些主要參與者包括 Amcor Limited、American Packaging Corporation、ProAmpac LLC、ProAmpac LLC、Constantia Flexibles Group GmbH 和 Crown Holdings。隨著寵物食品產品的創新和寵物食品包裝市場競爭的加劇,製造商選擇優質和永續的包裝來吸引更多客戶。

- 2022年8月:Amcor宣布收購了捷克共和國一家世界級的軟包裝工廠。該工廠的戰略位置立即增強了 Amcor 滿足歐洲軟包裝網路強勁需求和客戶成長的能力。該工廠是 DG Pack 於 2019 年委託進行的綠地開發項目,配備最先進的專業設備,適用於咖啡和寵物食品等有吸引力的區隔市場。

- 2022 年 5 月:Coveris 與法國天然優質寵物食品製造商 Ultra Premium Direct 合作,為 Protein Boost 寵物食品系列生產單一材料和可回收聚乙烯 (PE) 袋。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

- COVID-19 對產業影響的評估

第 5 章:市場動態

- 市場促進因素

- 優質品牌產品的需求增加

- 提高維護寵物健康的意識

- 市場限制

- 越來越多採用食品安全法規

第 6 章:寵物食品市場格局

- 寵物食品產業概況

- 寵物食品的類型

- 依動物類型分類的寵物食品

第 7 章:市場區隔

- 依材質

- 紙和紙板

- 金屬

- 塑膠

- 依產品類型

- 袋

- 折疊紙盒

- 金屬罐

- 包包

- 其他類型

- 依食物類型

- 乾糧

- 濕糧

- 冷藏和冷凍

- 依動物分類

- 狗糧

- 貓食

- 其他動物食品

- 依地理

- 北美洲

- 歐洲

- 亞太

- 拉丁美洲

- 中東和非洲

第 8 章:競爭格局

- 公司簡介

- Amcor PLC

- American Packaging Corporation

- Crown Holdings

- ProAmpac LLC

- Constantia Flexibles Group GmbH

- Coveris Holdings

- Polymerall LLC

- Mondi PLC

- Sonoco Products Company

- Berry Global Inc.

- Ardagh Group SA

- Wipak

- Silgan Holdings Inc.

第 9 章:投資分析

第 10 章:市場的未來

The Pet Food Packaging Market size is estimated at USD 12.85 billion in 2024, and is expected to reach USD 17.52 billion by 2029, growing at a CAGR of 6.40% during the forecast period (2024-2029).

The pet food packaging market is gaining traction due to the growing adoption of pets as companions and the increasing awareness about maintaining a pet's health among owners. The rising concerns about pets' health are boosting the adoption of spill-proof and advanced pet food packaging to maintain pet food packaging quality.

Key Highlights

- As the social contract shifts and treating pets as faithful family members become more of a social norm, the growth and development of the premium pet food category have emerged as a natural consequence. The emergence of new brand players and the proliferation of SKUs unleashing dramatic packaging is driving the pet food industry.

- Flexible packages and lighter containers with premium protection and HD printing help processors tap into booming pet ownership and react to trends like wet treats, high protein content, and more supplements. As US pet food production becomes safer under FSMA, the packaging reflects transparency, showing the food through windows and highlighting natural ingredients.

- Plastic bags are widely used in the packaging of pet food. However, the adoption rate for such packaging in the pet food industry is declining due to environmental concerns and regulations on plastic packaging.

- The pet food packaging market has witnessed a double impact on product demand in recent months owing to the lockdowns imposed in many countries due to the outbreak of COVID-19. With COVID-19, packaging manufacturers were flooded with a pool of issues that were anticipated to be only for the short term. Some of the effects of lockdown include supply chain disruptions, lack of availability of raw materials used in the manufacturing process, labor shortages, fluctuating prices that could cause the production of the final product to inflate and go beyond budget, shipping problems, etc.

- The adoption of pet animals has become a trend during the pandemic in a few countries, such as India, and has become an ongoing trend. For instance, an adoption drive conducted by The Hindu and Amazon Prime Video in April 2022 allowed individuals to adopt stray animals into their families, and people were advised of the need to adopt strays instead of spending immense amounts on breeds, many of which are not fitted to the Indian climate. Such initiatives would leverage the market for pet food packaging in the country.

Pet Food Packaging Market Trends

Dry Pet Food Type to Witness Fastest Growth

- Pet foods come in three types, depending on their final moisture content, namely wet, semi-moist, and dry (also called kibble). Baked, pelleted, and extruded feeds are a few types of dry pet foods, with extruded foods being the most popular. Grain, meat, poultry, eggs, and vegetable by-products are typically utilized as raw ingredients in pet food production, along with additional lipids, vitamins, and minerals.

- Dry pet foods generally include extruded, baked (kibbles), or flaked. In terms of storage, dry pet foods are stored in a chill, dry environment to prevent the destruction of vitamins and the oxidation of fats. Because oxidation of fats leads to rancidity. Dry dog food is also used to help keep the dog's teeth healthy since chewing dry food helps to reduce tartar buildup.

- Moreover, farinaceous (flavor enhancers) elements predominantly make up dry pet diets with a moisture content of less than 20% and a limited amount of proteinaceous ingredients. Dry pet foods with a moisture content of 8-9% often have a dry and brittle texture, whereas other formulations with a moisture content of 10-15% have a softer texture.

- Due to their low water activity and consequent microbiological stability, dry pet foods have a long shelf life. However, dry pet foods are typically less appealing to pets than moist or semi-moist pet foods, probably due to their low flavor appeal. In contrast, some pets may prefer dry pet foods due to their textural qualities. This drives the growth of the dry pet food packaging market.

- Dry pet food has not conventionally been a demanding product to package, with prominent brands offering dry pet food in paper bags. Companies like Nestle Purina are exploring new packaging methods, including new paper-based materials and piloting reusable packaging systems where customers can bring their containers to take dry pet food.

- The market witnessed several partnerships and corporate expansions at the global level in recent years. This helped the dry pet food packaging companies to compete in the growing market.

North America to Hold the Largest Share

- The demand for pet food packaging in North America can be correlated with the increasing adoption of pets and rescue dogs in the region. According to the National Pet Owners Survey of 2021-2022 by the American Pet Products Association (APPA), about 70% of US households, or about 90.5 million families, own pets.

- The increase in the adoption of pets and rescue animals also led the packaging industry to brainstorm on the premiumization and safety of pet food products. The bag or container makes manufacturers stand out with cat and dog owners who want sustainable options, personalized pet diets, and ingredients that even humans find appealing.

- Pet humanization is one of the biggest trends reshaping the pet care industry. A survey conducted by Mondi suggested that 75% of the respondents intend to spend more and feel more favorable toward brands with sustainable packaging. Moreover, brands seek solutions that complement their corporate values in the pet food industry, with sustainability being the prime concern.

- Dry pet food bags require unique construction. The inner layer of the multiwall bag should protect the contents, and the outer layer needs to be aesthetically pleasing with no grease stains permeating through the inner layer.

- Therefore, Companies like Mondi offer pet food packaging solutions such as BarrierPack Recyclable. These premade pouches and FFS roll-stock constitute plastic laminates that are recyclable in areas where flexible packaging is accepted and through store drop-off. It is done without compromising functionality.

- Moreover, BASF America is creating more sustainable pet food packaging with its water-based emulsion, JONCRYL HPB 1702. It can sustainably deliver the grease-resistant properties and food safety certifications demanded by the pet food market. Applied via flexographic, gravure, or rod, JONCRLY HPB 1702 provides excellent grease resistance at room temperature and elevated temperatures of up to 60°C, even after folding and creasing.

Pet Food Packaging Industry Overview

The market contains multiple companies, which intensifies the level of competition. This intensity of competitive rivalry is expected to be moderately high over the forecast period. Some key players in this market are Amcor Limited, American Packaging Corporation, ProAmpac LLC, ProAmpac LLC, Constantia Flexibles Group GmbH, and Crown Holdings. With innovation in pet food products and rising competition in the pet food packaging market, manufacturers opt for quality and sustainable packaging to attract more customers.

- August 2022: Amcor announced that it had acquired a world-class flexible packaging plant in the Czech Republic. The site's strategic location immediately increased Amcor's ability to satisfy strong demand and customer growth across its flexible packaging network in Europe. The plant is a greenfield development commissioned by DG Pack in 2019 and features state-of-the-art specialized equipment for attractive segments, including coffee and pet food.

- May 2022: Coveris partnered with Ultra Premium Direct, a French manufacturer of natural premium pet food, on mono-material and recyclable polyethylene (PE) bags for the Protein Boost pet food product range.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Premium and Branded Products

- 5.1.2 Increasing Awareness about Maintaining Pet's Health

- 5.2 Market Restraints

- 5.2.1 Increasing Adoption of Food Safety Regulations

6 PET FOOD MARKET LANDSCAPE

- 6.1 Pet Food Industry Overview

- 6.2 Types of Pet Food

- 6.3 Pet Food by Animal Type

7 MARKET SEGMENTATION

- 7.1 By Material

- 7.1.1 Paper and Paperboard

- 7.1.2 Metal

- 7.1.3 Plastic

- 7.2 By Product Type

- 7.2.1 Pouches

- 7.2.2 Folding Cartons

- 7.2.3 Metal Cans

- 7.2.4 Bags

- 7.2.5 Other Types

- 7.3 By Type of Food

- 7.3.1 Dry Food

- 7.3.2 Wet Food

- 7.3.3 Chilled and Frozen

- 7.4 By Animal

- 7.4.1 Dog Food

- 7.4.2 Cat Food

- 7.4.3 Other Animal Food

- 7.5 By Geography

- 7.5.1 North America

- 7.5.2 Europe

- 7.5.3 Asia-Pacific

- 7.5.4 Latin America

- 7.5.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Amcor PLC

- 8.1.2 American Packaging Corporation

- 8.1.3 Crown Holdings

- 8.1.4 ProAmpac LLC

- 8.1.5 Constantia Flexibles Group GmbH

- 8.1.6 Coveris Holdings

- 8.1.7 Polymerall LLC

- 8.1.8 Mondi PLC

- 8.1.9 Sonoco Products Company

- 8.1.10 Berry Global Inc.

- 8.1.11 Ardagh Group SA

- 8.1.12 Wipak

- 8.1.13 Silgan Holdings Inc.