|

市場調查報告書

商品編碼

1444385

智慧感測器 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Smart Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

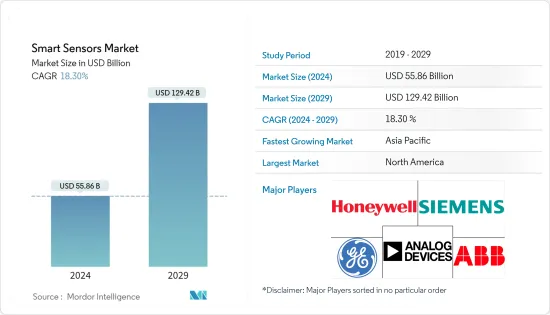

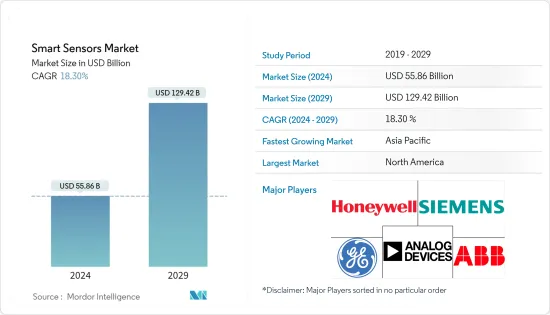

2024年智慧感測器市場規模預估為558.6億美元,預估至2029年將達1,294.2億美元,預測期內(2024-2029年)CAGR為18.30%。

感測器已成為各種應用中最重要且使用最廣泛的組件之一。過去幾年,對性能和效率的需求不斷成長,推動了智慧感測器的普及。

主要亮點

- 智慧感測器可用於記錄溫度或壓力加速度的波動,這對於流程以及機器對機器通訊和分析等先進 IT 解決方案非常重要。這些技術也應用於汽車、國防、體育和電子產業,以及智慧電網、智慧城市和智慧環境(森林滅火、雪位監測和地震早期檢測)。

- 這些感測器比傳統感測器有了巨大的改進,因為它們可以自動收集環境資料,同時大大降低了錯誤率。在預測期內,由於物聯網的使用和滲透率不斷上升,車輛自動化程度更高以及智慧穿戴式健康監測設備的出現,智慧感測器市場預計將成長。

- IIoT 連線創新也受到遠端、低功耗廣域網路(LPWAN)技術的推動,包括 NB-IoT、LTE-M、LoRa 和 Sigfox。低功耗設備可以使用物聯網感測器的 LPWAN 在更大的區域內無線傳輸資料包,這對於製造工廠來說是必要的。

- 此外,世界各國政府透過有利的規則和對國際企業投資的獎勵措施來促進市場擴張,預計這將加速市場擴張。

- 此外,在 COVID-19 之後,由於企業更加關注滿足物聯網快速加速帶來的智慧技術需求激增,預計市場在未來幾年將出現成長率復甦。世界各地的基礎設施,例如智慧城市和智慧電網。此外,疫情也促使更多企業採用尖端物聯網技術更新基礎設施,確保未來再次爆發疫情時生產不受影響。

- COVID-19 的爆發加速工業 4.0 的採用,推動各行業的企業進入物聯網技術和工作流程的更先進狀態,使用感測器對生產、服務間隔改變的維護、新工作要求的人力資源、透過對客戶個人用例的新的、深入的了解來進行行銷。

全球智慧感測器市場趨勢

溫度感測器見證高成長

- 智慧溫度感測器是一種整合元件,由溫度感測器、偏壓電路和類比數位轉換器(ADC)組成。溫度感測器可偵測熱量以確保製程保持在指定範圍內,確保應用程式的安全使用或在處理酷熱、風險或難以到達的測量場所時滿足先決條件。

- 由於電子產品向數位化轉變,物聯網和工業物聯網的出現進一步加速了智慧溫度感測器的發展。此外,感測產業的數位革命促進了製造商使用低介面數位技術開發新型溫度感測器。工業領域溫度感測器的使用不斷增加,進一步表明溫度感測器市場將在預估期間內持續發展。

- 智慧感測器被認為是家庭和建築自動化網路的重要組成部分,因為它們幫助智慧型裝置了解其環境。溫度感測器是家庭和建築自動化中最常用的感測器之一。這些感測器包含在暖通空調、火災偵測警報系統、照明控制系統和智慧恆溫器中,可自動調節和維持溫度。

- 溫度感測器因其成本低、尺寸緊湊且易於使用而廣泛應用於各種行業,包括汽車、住宅、醫療、環境、食品加工和化學行業。

- 溫度感測器在智慧家庭中最典型的應用是智慧恆溫器。預測預測,由於消費者興趣的成長、適度的技術突破和更廣泛的可及性,對智慧家庭的需求將急劇成長。

- 例如,ABB 於2021年10月推出了新型FusionAir 智慧感測器,這是一種非接觸式房間感測器,可減少室內空氣污染。最好的房間控制感測器可以監測溫度、濕度、二氧化碳(CO2)和揮發性有機化合物( VOC),這將整體提高室內空氣品質並降低接觸病毒的危險。該感測器為使用者提供健康、安全和舒適的環境,同時解決人們對室內空氣品質日益成長的擔憂。

亞太地區將見證顯著成長

- 由於汽車、消費性電子和醫療保健等各種最終用戶產業的發展和擴張,預計亞太地區在預測期內將顯著成長。不斷成長的技術使用和政府對基礎設施發展的日益重視將增加該地區對智慧感測器的需求。

- 由於中國、印度、日本、韓國和該地區其他國家的需求非常大,預計該地區將成為智慧感測器的最大市場。作為半導體和汽車等眾多行業(生產家用電器、手機、筆記型電腦和周邊設備)的生產中心,中國製造業在過去幾年中急劇擴張。

- 因此,該領域感測設備的製造和行銷顯著增加。物聯網車輛連接創新由 NB-IoT、LoRa、LTE-M 和 Sigfox 等遠端、低功耗廣域網路(LPWAN)技術推動。根據汽車產業的要求,物聯網感測器的 LPWAN 使低功耗設備能夠在更遠的距離內無線傳輸資料包。

- 印度是一個發展中國家,政府在尖端技術和智慧基礎設施方面投入大量資金。隨著如此快速的進步,智慧感測器廣泛應用於國家的智慧型手機、汽車和醫療保健系統等領域。過去幾年,該國高階技術產品的使用顯著成長,包括嚴重依賴智慧感測器的智慧型手機和穿戴式裝置。

- 近年來,印度和中國連網裝置的使用顯著增加,包括穿戴式科技、智慧家庭、連網汽車和自動駕駛汽車。未來幾年,智慧感測器市場預計將受到互聯設備需求成長的推動。

- Cisco預測,到2023年,印度將有約 21 億台連網設備。由於廉價智慧型手機的普及和更合理的網路訂閱,印度的網路使用者數量預計將超過 9 億。智慧型手機使用量的增加將推動市場的擴張。

- 此外,中國要求工業現代化的政治壓力推動對智慧製造產品(包括無線感測器網路和智慧感測器)的需求。中國感測器技術製造商目前經歷淘金熱。中國工業對高階工具機、智慧感測器等技術的需求量大。

全球智慧感測器產業概況

智慧感測器市場競爭非常激烈,市場上有許多國內外參與者。主要參與者採取產品創新、併購等策略來擴大影響力並維持市場地位。該市場的主要參與者包括Honeywell International、ABB Ltd、Analog Devices inc.和 GE 等。

2022年 11月,Stirling議會推出最大規模的物聯網智慧感測器,讓 5 萬名屋主及早收到環境問題通知和更好的能源消耗。每個家庭中放置的環境感測器將即時向議會發出任何潮濕、黴菌、通風或其他潛在問題的警報,並提供早期預警。他們還將讓租戶了解需要多少能源來為房屋供暖。

2022年 9月,Advantech發布了 WISE-2410 LoRaWAN 無線狀態監測感測器,可獨立檢測設備振動,隨時間追蹤其表面溫度,並確定其振動特性。這些複雜的光電感測器,例如複雜的位置感測器,經常用於工業自動化。這些感測器廣泛用於工業、醫療和航空應用,因為它們可以發現物體結構的模式和變化。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 對能源效率和節約的需求不斷成長

- 消費性電子產品的需求不斷成長

- 醫療保健和汽車產業對智慧感測器的更高需求

- 小型化和無線功能的技術進步

- 市場限制

- 部署成本相對較高

- 與傳統感測器相比,設計複雜

- 價值鏈分析

- 產業吸引力 - 「波特五力分析」

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

- COVID-19 影響分析

第5章 市場細分

- 類型

- 流量感測器

- 濕度感測器

- 位置感測器

- 壓力感測器

- 溫度感應器

- 其他類型

- 科技

- 微機電系統

- 互補金屬氧化物半導體

- 光譜學

- 其他技術

- 組件

- 類比數位轉換器

- 數位類比轉換器

- 擴音器

- 其他組件

- 應用

- 航太和國防

- 汽車和交通

- 衛生保健

- 工業自動化

- 建築自動化

- 消費性電子產品

- 其他應用

- 地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 亞太地區其他地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 公司簡介

- ABB Ltd

- Honeywell International

- Eaton Corporation

- Analog Devices Inc.

- Infineon Technologies AG

- NXP Semiconductors NV

- ST Microelectronics

- Siemens AG

- TE Connectivity Ltd

- Legrand Inc.

- General Electric

- Vishay Technology Inc.

第7章 投資分析

第8章 市場機會與未來趨勢

The Smart Sensors Market size is estimated at USD 55.86 billion in 2024, and is expected to reach USD 129.42 billion by 2029, growing at a CAGR of 18.30% during the forecast period (2024-2029).

Sensors have become one of the most crucial and widely used components in various applications. The increasing demand for performance and efficiency has helped in the rising adoption of smart sensors over the past few years.

Key Highlights

- Smart sensors can be used to record fluctuations in temperature or pressure acceleration, which are crucial for a process, and in advanced IT solutions like machine-to-machine communication and analytics. These technologies are also used in the automotive, defense, sports, and electronic industries, as well as smart grids, smart cities, and smart environments (forest fire suppression, snow level monitoring, and earthquake early detection).

- These sensors are a huge improvement over traditional sensors since they allow for the automatic collection of environmental data with a much-reduced error rate. Over the forecast period, the market for smart sensors is anticipated to rise due to rising IoT use and penetration, more vehicle automation, and smart wearable health monitoring devices.

- IIoT connectivity innovation is also being driven by long-range, low-power wide-area network (LPWAN) technologies, including NB-IoT, LTE-M, LoRa, and Sigfox. Low-power devices may transmit data packets wirelessly over a larger region with LPWANs for IoT sensors, which is necessary for a manufacturing facility.

- Additionally, governments all over the world are promoting market expansion through advantageous rules and incentives for international enterprises to invest, which is anticipated to accelerate market expansion.

- Additionally, following COVID-19, the market is anticipated to experience a recovery in its growth rate in the years to come as a result of companies increasing their focus on meeting the surge in demand for smart technologies brought on by the rapid acceleration of IoT-based infrastructures, such as smart cities and smart grids, around the world. Additionally, the pandemic has prompted more businesses to update their infrastructure with cutting-edge IoT technology in order to ensure that production is unaffected in the event that another epidemic strikes in the future.

- The COVID-19 outbreak was accelerating the adoption of Industry 4.0, driving businesses from all sectors into a more advanced state of IoT technology and workflow using sensors that have an impact on production, maintenance with altered service intervals, human resources with new job requirements, and marketing with new and in-depth knowledge of customers' individual use cases.

Global Smart Sensors Market Trends

Temperature Sensors to Witness High Growth

- A smart temperature sensor is an integrated device that consists of a temperature sensor, bias circuitry, and an analog-to-digital converter (ADC). A temperature sensor detects heat to ensure a process maintains within a specified range, ensuring safe application usage or satisfying a prerequisite while dealing with severe heat, risks, or inaccessible measuring places.

- The development of smart temperature sensors has been further accelerated by the emergence of IoT and IIoT as a result of the shift in electronics toward digitalization. Additionally, the digital revolution in the sensing industry has facilitated manufacturers' development of new temperature sensors using low-interface digital technology. The rising use of temperature sensors in the industrial sector further indicates that the market for temperature sensors will develop over the course of the projected period.

- Smart Sensors are regarded as an essential component of the home and building automation network since they assist smart devices in learning about their environment. The temperature sensor is among the most popular sensors used in home and building automation. These sensors are included in HVAC, fire detection alarm systems, lighting control systems, and smart thermostats to regulate and maintain temperature automatically.

- Temperature sensors are widely used in a variety of industries, including the automotive, residential, medical, environmental, food processing, and chemical ones, due to their low cost, compact size, and ease of use.

- The most typical application for temperature sensors in a smart home is a smart thermostat. Forecasts predict that demand for smart homes will rise sharply as a result of growing consumer interest, modest technological breakthroughs, and greater accessibility.

- For Instance, ABB introduced its new FusionAir Smart Sensor, a touch-free room sensor to lessen indoor air pollution, in October 2021. The best room control sensors can monitor the temperature, humidity, carbon dioxide (CO2), and volatile organic compounds (VOCs), which will enhance indoor air quality overall and lower the danger of exposure to viruses. This sensor offers healthy, secure, and cozy surroundings for users while addressing growing concerns about indoor air quality.

Asia Pacific to Witness the Significant Growth

- Asia-Pacific is anticipated to experience significant growth over the forecast period due to the development and expansion of various end-user sectors, including automotive, consumer electronics, and healthcare. Growing technological usage and the government's increased emphasis on infrastructure development will raise the need for smart sensors in this region.

- The region is anticipated to be the largest market for smart sensors due to China, India, Japan, South Korea, and other nations in the region exhibiting a significantly high demand. As the hub of production for numerous industries, such as semiconductors and automotive, which produce household appliances, cellphones, laptops, and peripheral gadgets, China's manufacturing sector has expanded dramatically over the past few years.

- As a result, there has been a significant increase in the manufacture and marketing of sensing devices in this area. IoT vehicle connectivity innovation is fueled by long-range, low-power wide-area networks (LPWAN) technologies like NB-IoT, LoRa, LTE-M, and Sigfox. As required by the automobile industry, LPWANs for IoT sensors enable low-power devices to wirelessly stream data packets across greater distances.

- India is a developing nation with significant government investment in cutting-edge technology and intelligent infrastructure. With such rapid advancements, smart sensors are being widely used in the nation's smartphones, cars, and healthcare systems, among other things. The use of high-end technological items in the nation has grown significantly over the last few years, including smartphones and wearables that heavily rely on smart sensors.

- India and China have seen a noticeable increase in the use of connected gadgets in recent years, including wearable technology, smart homes, connected autos, and autonomous vehicles. Over the coming years, the market for smart sensors is anticipated to be driven by the increase in demand for connected devices.

- Cisco predicts that there will be about 2.1 billion internet-connected gadgets in India by 2023. Due to the rising availability of inexpensive smartphones and more reasonable internet subscriptions, the number of internet users in the country is predicted to surpass 900 million. This increase in smartphone use will fuel the market's expansion.

- Furthermore, the political pressure on China to modernize its industries is driving up demand for smart manufacturing products, including wireless sensor networks and smart sensors. Chinese manufacturers of sensor technologies are currently experiencing a gold rush. High-end machine tools, intelligent sensors, and other technology are in high demand in China's industry.

Global Smart Sensors Industry Overview

The smart sensors market is very competitive, with many national and international players in the market. The major players follow strategies like product innovation, mergers, and acquisitions to expand their reach and hold their market position. The major players in the market are Honeywell International, ABB Ltd, Analog Devices inc., and GE, among others.

In November 2022, Stirling Council's largest IoT smart sensor rollout gives 50K homeowners early notification of environmental issues and better energy consumption. Environmental sensors placed in every home will alert the council in real time of any moisture, mold, ventilation, or other potential issues and provide early warning. They will also let the tenant realize how much energy is needed to heat their home.

In September 2022, Advantech released WISE-2410 LoRaWAN Wireless Condition Monitor sensors that can independently detect equipment vibration, track the temperature of its surface over time, and ascertain its vibration characteristics. These sophisticated photoelectric sensors, such as sophisticated position sensors, are frequently employed in industrial automation. These sensors are extensively used in industrial, medical, and aeronautical applications because they can spot patterns and changes in an object's structure.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Energy Efficiency and Saving

- 4.2.2 Increasing Demand for Consumer Electronics Products

- 4.2.3 Higher Demand for Smart Sensors in the Healthcare and Automotive Industries

- 4.2.4 Technology Advancements in Miniaturization and Wireless Capabilities

- 4.3 Market Restraints

- 4.3.1 Relatively High Deployment Costs

- 4.3.2 Complex Design compared to Traditional Sensors

- 4.4 Value Chain Analysis

- 4.5 Industry Attractiveness - 'Porter's Five Forces Analysis'

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 COVID-19 Impact Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Flow Sensor

- 5.1.2 Humidity Sensor

- 5.1.3 Position Sensor

- 5.1.4 Pressure Sensor

- 5.1.5 Temperature Sensor

- 5.1.6 Other Types

- 5.2 Technology

- 5.2.1 MEMS

- 5.2.2 CMOS

- 5.2.3 Optical Spectroscopy

- 5.2.4 Other Technologies

- 5.3 Component

- 5.3.1 Analog-to-Digital Converter

- 5.3.2 Digital-to-Analog Converter

- 5.3.3 Amplifier

- 5.3.4 Other components

- 5.4 Application

- 5.4.1 Aerospace and Defense

- 5.4.2 Automotive and Transportation

- 5.4.3 Healthcare

- 5.4.4 Industrial Automation

- 5.4.5 Building Automation

- 5.4.6 Consumer Electronics

- 5.4.7 Other Applications

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Rest Asia Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd

- 6.1.2 Honeywell International

- 6.1.3 Eaton Corporation

- 6.1.4 Analog Devices Inc.

- 6.1.5 Infineon Technologies AG

- 6.1.6 NXP Semiconductors N.V.

- 6.1.7 ST Microelectronics

- 6.1.8 Siemens AG

- 6.1.9 TE Connectivity Ltd

- 6.1.10 Legrand Inc.

- 6.1.11 General Electric

- 6.1.12 Vishay Technology Inc.