|

市場調查報告書

商品編碼

1444249

全球生物種子處理 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Global Biological Seed Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

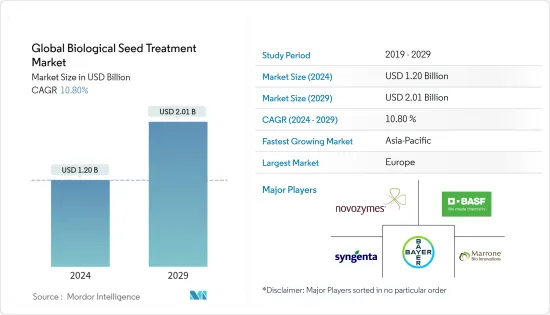

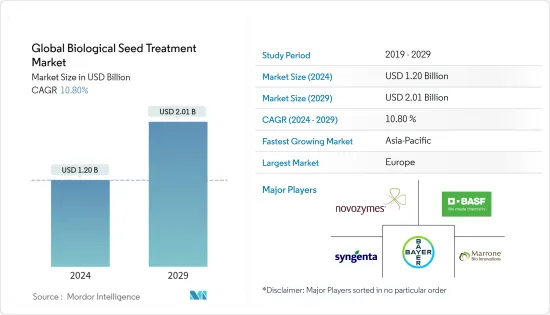

預計2024年全球生物種子處理市場規模為12億美元,預計2029年將達到20.1億美元,在預測期間(2024-2029年)CAGR為10.80%。

COVID-19 為製造暫時停頓和供應鏈中斷帶來了課題。儘管如此,在封鎖後的最初幾週內,農業化學品的必需品的生產活動被允許,包括許多國家歸類為必需品的種子處理農藥。因此,COVID-19 對所研究市場的影響預計是短期的。由於農民搶購,農化企業利潤較前一年實現兩位數成長。

擴大使用自然處理方法被認為是處理種子的環境友善選擇。為了提高生產力而擴大使用生物底漆技術、有機農業的成長趨勢以及參與者在研發活動上投入更多資金來設計生物產品正在推動全球生物種子處理市場的發展。然而,政府監管障礙、生物種子處理成本高和可用性低正在阻礙農業酵素市場。根據功能,全球市場大致分為種子保護和種子強化。旨在保護種子的生物種子處理可在幼苗階段有針對性地控制某些害蟲和真菌病害。

此外,生物種子處理還可用於多種作物,如穀物、油料種子和蔬菜,以控制多種害蟲。不斷擴大的農業實踐和對優質農產品的需求預計將推動該地區生物種子處理市場的成長。此外,已開發國家對關鍵活性成分的禁令是推動歐洲地區該市場成長的主要因素。因此,環保選擇的增加、有機農業的趨勢以及有利的監管環境預計將推動預測期內研究市場的成長。

生物種子處理市場趨勢

有機農業的上升趨勢

促進生物種子處理市場成長的關鍵因素之一包括有機農業的崛起趨勢。有機農業在 187 個國家實行,2019 年,有機農業研究所 (FiBL) 至少有 310 萬農民對 7,230 萬公頃農業土地進行了有機管理。在過去幾年中,有機農業面積顯著增加。全球有機農業用地面積增加,2020 年為7,490 萬公頃,高於2017 年的6,950 萬公頃。2019 年,有機農業用地面積領先的地區是大洋洲(3,590 萬公頃,佔世界有機農業用地的一半)和歐洲( 1650萬公頃,23%)。拉丁美洲有 830 萬公頃(11%),其次是亞洲(590 萬公頃,8%)、北美洲(360 萬公頃,5%)和非洲(200 萬公頃,3%)。在全球範圍內,有機產業持續快速發展。

由於 COVID-19,消費者對本地、安全和有機食品的認知有所提高,許多國家報告有機產品的銷售增加。然而,對有機產品的需求正在蓬勃發展,這不僅是因為具有健康意識的消費者的增加,還因為收入的成長和耕作方式的改進使有機作物更加健壯。因此,對有機食品的需求不斷增加,增加了世界各地有機農業的面積。此外,政府也強調使用生物防治方法進行疾病管理。

有機農業實踐的普及推動了生物種子處理的採用,特別是在政府控制的農業社區。農民要求儘早評估田間表現,以了解其作物概況的處理規範。因此,隨著消費者對健康、環境、品質和安全意識的不斷增強,有機農業實踐的不斷興起,再加上有利的政府政策,預計將在預測期內以驚人的速度推動生物肥料市場的發展。

歐洲生物種子處理的消費量增加

蟲害攻擊的增加、對提高作物生產力的需求、主要參與者的技術進步以及透過使用生物種子處理技術增加收入正在促使預測期內歐洲地區市場的成長。根據西班牙2020 年LIVESEED 項目,有機出口產品(例如阿爾梅里亞和穆爾西亞的辣椒)對非基因改造或有機種子的需求不斷成長,以提供保證出口需求和高作物產量的產品,從而增加了生物種子處理的使用隨著生物殺菌劑、生物殺線蟲劑和生物農藥在全球範圍內推廣國內品種,進一步推動了預測期內所研究市場的需求。

散黑穗病是影響英國穀類作物的主要病害之一。此病害在大麥中最為突出,在小麥中較為罕見。隨著使用芽孢桿菌屬生物處理的種子,人們越來越關注預防這種疾病的真菌侵襲,這促使了未來幾年研究市場的成長。此外,法國推出了一項名為「Ecophyto 2018」的計劃,旨在到2018年減少50%的合成化學品消耗,這推動了市場對生物基農業投入品的需求。德國研究機構一直在廣泛致力於推廣生物種子處理解決方案,以提供永續的解決方案。弗勞恩霍夫有機電子研究所推出了種子電子處理技術,這是一種現代、環保的方法,無需化學成分,並獲得了 DLG 獎。國家實體 Biologische Bundesanstalt 將其描述為化學選礦的替代方法。

生物種子處理行業概況

全球生物種子處理市場適度整合,研究市場中的主要參與者包括先正達、拜耳作物科學、巴斯夫、諾維信和 MarroneBio Innovations。根據回顧期間觀察到的主要發展,產品發布是市場主導企業最常採用的策略。所研究的市場中的主要參與者正在增加其產品組合併擴大其業務,以透過推出創新產品來維持其在市場中的地位。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 市場促進因素

- 市場限制

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

第 5 章:市場區隔

- 功能

- 種子保護

- 種子強化

- 其他功能

- 作物類型

- 穀物和穀物

- 油籽

- 蔬菜

- 其他作物類型

- 地理

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 西班牙

- 英國

- 法國

- 德國

- 俄羅斯

- 義大利

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 印度

- 泰國

- 越南

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 北美洲

第 6 章:競爭格局

- 最常用的策略

- 市佔率分析

- 公司簡介

- BASF SE

- Bayer Cropscience AG

- Bioworks Inc.

- Syngenta AG

- Agrauxine by Lesaffre

- Germains Seed Technology

- Koppert Biological Systems

- Novozymes

- Marrone Bio Innovations

- Groundwork BioAg

第 7 章:市場機會與未來趨勢

第 8 章:評估 COVID-19 對市場的影響

The Global Biological Seed Treatment Market size is estimated at USD 1.20 billion in 2024, and is expected to reach USD 2.01 billion by 2029, growing at a CAGR of 10.80% during the forecast period (2024-2029).

COVID-19 caused challenges with respect to a temporary pause in manufacturing and supply chain disruption. Nevertheless, post the lockdown in the first few weeks, manufacturing action was allowed for essential goods with agrochemicals, including seed treatment pesticides classified under essential goods in many countries. Therefore, the impact of COVID-19 on the market studied is anticipated to be short-term. Due to panic buying by farmers, agrochemical firms have had double-digit profits compared to the previous year.

The increasing use of natural treatment methods is witnessed as an environment-friendly option for treating seeds. The increasing use of bio-priming techniques for improved productivity, increasing trend of organic farming, and players investing more in R&D activities to design biological products are driving the global market for biological seed treatment. Nevertheless, government regulatory barriers, high biological seed treatment costs, and low availability are hampering the agriculture enzyme market. Based on function, the global market has broadly been segmented into seed protection and seed enhancement. Biological seed treatments aimed at seed protection deliver targeted control of certain pests and fungal diseases during the early seedling stage.

Additionally, biological seed treatments are used on multiple crops, like grains and cereal, oil seeds, and vegetables, to control a variety of pests. The expanding agricultural practices and requirement for high-quality agricultural produce are factors that are projected to drive the biological seed treatment market growth in this region. Further, the government policies adopted by developed countries for the ban on key active ingredients are the major factors promoting the growth of this market in the Europe region. Hence, the increased adoption of environment-friendly options, the trend of organic farming, and a favorable regulatory environment are anticipated to drive the growth of the market studied during the forecast period.

Biological Seed Treatment Market Trends

Rising Trend of Organic Farming

One of the key factors enhancing the biological seed treatment market growth includes the rising trend of organic farming. Organic agriculture is practiced in 187 countries, and 72.3 million hectares of agricultural land were managed organically by at least 3.1 million farmers by the Research Institute of Organic Agriculture (FiBL) in 2019. Over the past few years, the area under organic farming has significantly increased across the world and was recorded at 74.9 million hectares in 2020, up from 69.5 million hectares in 2017. In 2019, the regions with the leading organic agricultural land areas are Oceania (35.9 million hectares, which is half the world's organic agricultural land) and Europe (16.5 million hectares, 23%). Latin America has 8.3 million hectares (11%), followed by Asia (5.9 million hectares, 8%), North America (3.6 million hectares, 5%), and Africa (2 million hectares, 3%). On a global scale, the organic sector continued to develop rapidly.

Due to COVID-19, consumer awareness of local, safe, and organic food increased, with many countries reporting increasing sales of organic products. However, the demand for organic products is thriving, not only due to a rise in health-conscious consumers but also the growing incomes and improved farming practices that make organic crops more robust. Consequently, the increasing demand for organic food has increased the area under organic farming across the world. In addition, the government is emphasizing the use of biological control methods for disease management.

The proliferation of organic agricultural practices has driven the adoption of biological seed treatment, especially among government-controlled farming communities. Farmers demand an early evaluation of field performance to understand the treatment specification of their crop profile. Hence, the rising organic farming practices with the growing awareness among consumers over health, environmental, quality, and safety, coupled with favorable government policies, is anticipated to boost the biofertilizers market at a phenomenal rate in the forecast period.

Higher Consumption of Biological Seed Treatment in Europe

The increasing insect pest attacks, need for better crop productivity, technological advancements by major players, and increasing incomes with the use of biological seed treatment techniques are leading to the growth of the European region in the market during the forecast period. According to the LIVESEED Project Spain 2020, the rising demand for non-GMO or organic seeds for organic export produces (e.g., peppers in Almeria and Murcia) to offer a product that guarantees export demand and high crop yield enhances the usage of biological seed treatment with bio fungicides, bio nematicides, and biopesticides to promote domestic varieties globally, is further boosting the demand for the market studied during the forecast period.

Loose smut is one of the prominent diseases affecting the cereal crops in the United Kingdom. The disease is most prominent in barley and rare in wheat. The increased concern to prevent the fungal attack of this disease, with the use of biologically treated seeds by Bacillus species, is leading to the growth of the market studied in the coming years. In addition, France introduced a scheme called 'Ecophyto 2018', which aimed at reducing 50% of the synthetic chemical consumption by 2018, which has pushed the demand for bio-based agricultural inputs within the market. German research institutes have been extensively working on advancing biological seed treatment solutions to provide sustainable solutions. Fraunhofer Institute for Organic Electronics launched an electron treatment of seeds, a modern, environmentally friendly method that works without chemical ingredients, and won a DLG award. It was described by the state entity Biologische Bundesanstalt as an alternative method for chemical dressing.

Biological Seed Treatment Industry Overview

The global biological seed treatment market is moderately consolidated, with major players such as, Syngenta, Bayer Crop Science, BASF, Novozymes, and MarroneBio Innovations in the market studied. As per the key developments observed during the review period, product launches are the most adopted strategies by dominant players in the market. Major players in the market studied are increasing their product portfolio and expanding their business to maintain their position in the market by launching innovative products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Function

- 5.1.1 Seed Protection

- 5.1.2 Seed Enhancement

- 5.1.3 Other Functions

- 5.2 Crop Type

- 5.2.1 Grains and Cereal

- 5.2.2 Oil Seeds

- 5.2.3 Vegetables

- 5.2.4 Other Crop Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Germany

- 5.3.2.5 Russia

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Thailand

- 5.3.3.5 Vietnam

- 5.3.3.6 Australia

- 5.3.3.7 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Bayer Cropscience AG

- 6.3.3 Bioworks Inc.

- 6.3.4 Syngenta AG

- 6.3.5 Agrauxine by Lesaffre

- 6.3.6 Germains Seed Technology

- 6.3.7 Koppert Biological Systems

- 6.3.8 Novozymes

- 6.3.9 Marrone Bio Innovations

- 6.3.10 Groundwork BioAg