|

市場調查報告書

商品編碼

1444155

三聚氰胺:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Melamine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

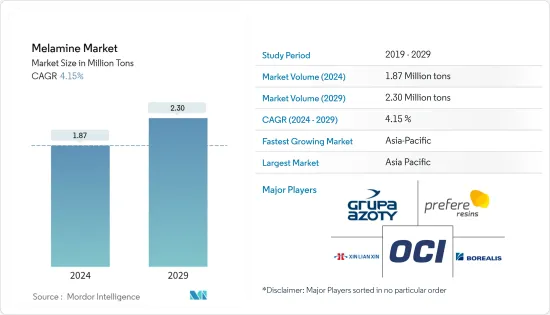

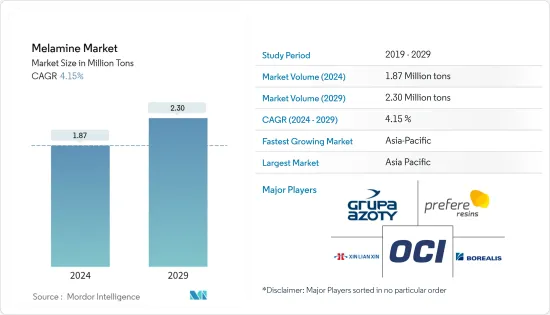

預計2024年三聚氰胺市場規模為187萬噸,預計2029年將達230萬噸,在預測期間(2024-2029年)年複合成長率為4.15%。

三聚氰胺市場受到 2020 年 COVID-19感染疾病的負面影響。 2021年市場有所改善。建築和汽車製造活動從封鎖中復甦,導致對層壓板、油漆和塗料以及木材黏劑等建築材料的需求增加。建設產業正在迅速復甦,預計未來幾年將進一步成長,可能會增加對三聚氰胺的需求。

主要亮點

- 短期內,建設產業對層壓板、塗料和木材黏劑的需求不斷成長預計將推動市場成長。

- 液化木材、大豆、粉末塗料等替代品的出現,以及消費者對三聚氰胺模塑材料甲醛排放的日益擔憂,預計將阻礙市場成長。

- 然而,三聚氰胺基泡沫的成長趨勢可能會在未來帶來機會。

- 亞太地區主導全球市場,最大的消費來自中國和印度。

三聚氰胺黏劑市場趨勢

層壓板市場佔據主導地位

- 三聚氰胺樹脂是一種聚合物,可用作層壓板的外層或裝飾層,以及用於製造櫃檯和桌面、廚櫃、地板材料、家具等。

- 三聚氰胺樹脂具有硬度、透明度、耐污性、不變色和整體耐用性。在該應用中,用於飽和覆蓋層或裝飾片材的樹脂是透過每莫耳三聚氰胺約2莫耳甲醛反應來製備的。

- 這些板材通常應用於牆壁、柱子、桌面、家具、懸吊天花板等表面裝飾計劃。

- 據加拿大建築協會稱,建築業是加拿大最大的雇主之一,為國家的經濟成功做出了重大貢獻。它是國家經濟的支柱。根據加拿大建築協會的數據,建築業僱用了超過 140 萬人,每年為加拿大經濟創造約 1,410 億美元的收入。此外,該產業佔該國內生產總值(GDP)的7.5%。

- 根據美國人口普查資料,2022 年 2 月的建築支出總額約為 17,044 億美元,而 2022 年 1 月為 16,955 億美元。

- 根據美國人口普查局的數據,2022 年 7 月美國住宅建築業價值為 9,297 億美元,而 2021 年 7 月為 8,155 億美元,成長 14%。老化住宅代表了一個不斷成長的改造市場,因為舊建築通常需要添加新設備或維修/更換舊零件。該國住宅上漲也鼓勵住宅在住宅裝修上投入更多資金。

亞太地區主導市場

- 亞太地區在整體市場佔有率佔據主導地位。中國、印度和日本建設活動的擴大以及對層壓板、木材黏劑、油漆和塗料的需求增加正在增加該地區三聚氰胺的使用。

- 中國佔全球塗料市場四分之一以上。根據中國塗料工業協會統計,近年來該產業成長了7%。

- 中國政府推出了一項大規模建設計畫,包括為未來十年內2.5億人搬入新大都市做準備。此類計劃將增加對使用三聚氰胺製造油漆的油漆的需求。

- 預計2023年至2026年中國整體建設產業實際成長4.6%。中國國家統計局發布的報告顯示,2022年上半年交通運輸投資成長6.7%。

- 印度政府與日本政府合作啟動了德里-孟買工業走廊項目,旨在在德里-孟買工業走廊地區投資2000億美元,開發新型工業城市。類似的計劃可能會在班加羅爾-清奈走廊等地區啟動。

- 根據中國民航局統計,目前全國機場計劃已復工80%以上,全國有65個機場計劃。其中,27個機場是國家重大機場計劃。預計此類計劃將增加對三聚氰胺的需求。

三聚氰胺黏劑產業概況

三聚氰胺市場較為分散,前五家企業約佔總產能的40%。這些公司包括(排名不分先後)OCI NV、Borealis AG、河南新聯新化工集團、Prefere Resins Holding GmbH 和 Grupa Azoty。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 建設產業需求旺盛

- 其他司機

- 抑制因素

- 消費者越來越重視三聚氰胺模塑材料的甲醛排放

- 液化木材、大豆和粉末塗料等替代品的可用性

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

- 原料分析及趨勢

- 生產過程

- 進出口趨勢

- 價格趨勢

- 專利分析

- 監理政策分析

第5章市場區隔(市場規模(數量))

- 目的

- 層壓板

- 木材黏劑

- 成型材料

- 油漆和塗料

- 其他用途(阻燃劑和纖維樹脂)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)分析

- 主要企業採取的策略

- 公司簡介

- BASF SE

- Borealis AG

- Cornerstone Chemical Company

- Grupa Azoty

- Gujarat State Fertilizers &Chemicals Limited(GSFC)

- Prefere Resins Holding GmbH

- Methanol Holdings(Trinidad)Limited(MHTL)

- Mitsui Chemicals Inc.

- Hexion

- Nissan Chemical Corporation

- OCI NV

- Qatar Melamine Company

- Sichuan Chemical Works Group Ltd

- Henan Xinlianxin Chemicals Group Co. Ltd

- Eurochem Group

第7章市場機會與未來趨勢

- 三聚氰胺發泡體的成長趨勢

The Melamine Market size is estimated at 1.87 Million tons in 2024, and is expected to reach 2.30 Million tons by 2029, growing at a CAGR of 4.15% during the forecast period (2024-2029).

The melamine market was negatively impacted during the COVID-19 pandemic in 2020. The market improved in 2021. With construction and automotive manufacturing activities recovering from the lockdown, the demand for construction materials such as laminates, paints, and coatings, and wood adhesives increased. The construction industry is recovering rapidly and is estimated to grow further in the coming years, which may boost the demand for melamine.

Key Highlights

- Over the short term, the rising demand for laminates, coatings, and wood adhesives from the construction industry is expected to drive the market's growth.

- The availability of substitutes like liquefied wood, soy, and powder coatings and increasing consumer concerns about formaldehyde emissions from melamine-based molding compounds are expected to hinder the market's growth.

- However, the increasing trend of melamine-based foams is likely to act as an opportunity in the future.

- Asia-Pacific dominates the market across the world, with the largest consumption from China and India.

Melamine-based Adhesives Market Trends

Laminates Segment to Dominate the Market

- Melamine resins are the polymers of choice used in the outer or decorative layer of laminates and in manufacturing counters and tabletops, kitchen cabinets, flooring, furniture, etc.

- Melamine resins impart a hardness, transparency, stain resistance, freedom from discoloration, and overall durability. For this application, the resin used to saturate the overlay or decorative sheet is prepared by reacting approximately two moles of formaldehyde per mole of melamine.

- These sheets are commonly applied to the surface decoration projects, such as walls, columns, tabletops, furniture, and suspended ceilings.

- According to the Canadian Construction Association, the construction sector is one of Canada's largest employers and a major contributor to the country's economic success. It is the backbone of the country's economy. As per the Canadian Construction Association, the construction sector employs more than 1.4 million people and generates about USD 141 billion for the Canadian economy annually. Also, the industry accounts for 7.5% of the country's Gross Domestic Product (GDP).

- According to the US Census data, the total construction spending in February 2022 was around USD 1,704.4 billion compared to USD 1,695.5 billion in January 2022.

- As per the United States Census Bureau, the residential construction industry in the United States was valued at USD 929.7 billion in July 2022, as compared to USD 815.5 billion in July 2021, registering a growth of 14%. The aging houses signal a growing remodeling market, as old structures normally need to add new amenities or repair/replace old components. Rising home prices in the country have also encouraged homeowners to spend more on home improvements.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominates the overall market share. With growing construction activities and the increasing demand for laminates, wood adhesives, and paints and coatings in China, India, and Japan, the usage of melamine is increasing in the region.

- China accounts for more than one-fourth of the global coatings market. According to the China National Coatings Industry Association, the industry registered a 7% growth in recent years.

- The Chinese government rolled out massive construction plans, including making provisions for the movement of 250 million people to its new megacities over the next 10 years. Such plans will increase the demand for paints where melamine is used to prepare paints.

- The overall Chinese construction industry is expected to increase by 4.6% in real terms in 2023-2026. According to the report published by the National Bureau of Statistics of China, transportation investment increased by 6.7% in the first half of 2022.

- The Indian government launched the Delhi-Mumbai Industrial Corridor program in collaboration with the Japanese government, which aims at developing new industrial cities with an investment of 200 billion USD in the Delhi-Mumbai Industrial Corridor region. Similar programs may be launched in regions such as the Bangalore Chennai Corridor etc.

- According to the Civil Aviation Administration of China, the government has resumed construction work on more than 80% of total airport projects, representing 65 airport projects across the country. Out of these, 27 airports are national major airport projects. Such projects are expected to increase the demand for melamine.

Melamine-based Adhesives Industry Overview

The melamine market is fragmented, and the top five players account for around 40% of the total production capacity. These companies include (not in any particular order) OCI NV, Borealis AG, Henan Xinlianxin Chemicals Group Co. Ltd, Prefere Resins Holding GmbH, and Grupa Azoty.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Strong Demand from the Construction Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Consumer Concerns About Formaldehyde Emission from Melamine-based Molding Compounds

- 4.2.2 Availability of Substitutes, like Liquefied Wood, Soy, and Powder Coatings

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Feedstock Analysis and Trends

- 4.6 Production Process

- 4.7 Import-export Trends

- 4.8 Price Trends

- 4.9 Patent Analysis

- 4.10 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Laminates

- 5.1.2 Wood Adhesives

- 5.1.3 Molding Compounds

- 5.1.4 Paints and Coatings

- 5.1.5 Other Applications (Flame Retardants and Textile Resins)

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Russia

- 5.2.3.6 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Borealis AG

- 6.4.3 Cornerstone Chemical Company

- 6.4.4 Grupa Azoty

- 6.4.5 Gujarat State Fertilizers & Chemicals Limited (GSFC)

- 6.4.6 Prefere Resins Holding GmbH

- 6.4.7 Methanol Holdings (Trinidad) Limited (MHTL)

- 6.4.8 Mitsui Chemicals Inc.

- 6.4.9 Hexion

- 6.4.10 Nissan Chemical Corporation

- 6.4.11 OCI NV

- 6.4.12 Qatar Melamine Company

- 6.4.13 Sichuan Chemical Works Group Ltd

- 6.4.14 Henan Xinlianxin Chemicals Group Co. Ltd

- 6.4.15 Eurochem Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Trend of Melamine-based Foams