|

市場調查報告書

商品編碼

1443961

汽車架 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Car Rack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

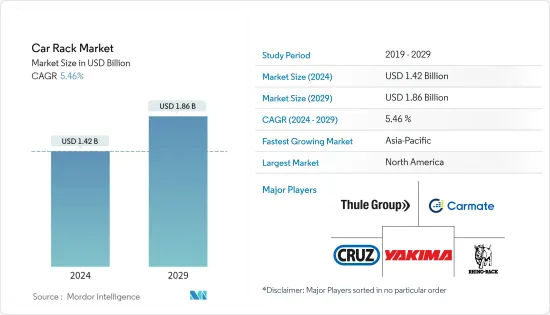

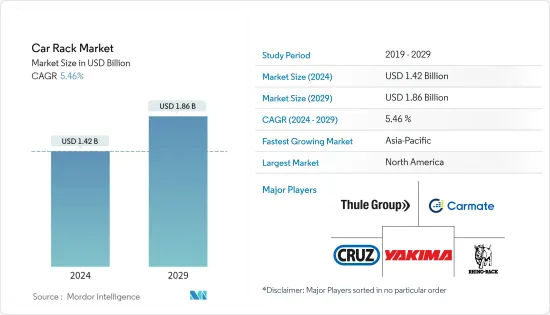

2024年汽車架市場規模估計為14.2億美元,預計到2029年將達到18.6億美元,在預測期內(2024-2029年)CAGR為5.46%。

COVID-19 大流行的爆發導致製造業停工、封鎖和貿易限制,對汽車電液動力轉向產業產生了負面影響。此外,旅行限制和戶外探險活動數量的下降極大地削弱了對汽車架的需求。因此,汽車車頂行李架業務的小型或大型公司都受到了嚴重影響。在 COVID-19之後,隨著對定期娛樂活動和健康益處的需求不斷增加,山地自行車和滑雪旅行的需求可能會增加,這可能會增加對更多可靠的汽車架和屋頂安裝架的需求,從而增加市場價值。此外,製造商正在實施應急計劃,以減輕未來業務的不確定性,以保持與汽車行業關鍵領域客戶的連續性。

未來五年,千禧世代對額外行李空間的需求以及休閒活動和旅遊日益成長的吸引力是推動市場成長的主要原因。品質(低品質行李架的生鏽和腐蝕)和定價困難(影響價格的因素,例如建築材料/原料、車頂行李架類型和品牌等產品費用)可能會限制市場的成長。

實用性更強的緊湊型SUV的推出、車輛性能的提高以及越野能力增強的汽車數量的增加正在推動汽車行李架市場的發展,因為這些因素將大大改善車頂行李架的應用。

主要市場參與者正在參與合資企業、新產品發布和產能擴張,以滿足快速成長的汽車架市場的需求。例如

主要亮點

- 2022 年 10 月:Yakima Products Inc. 宣布與向零售商提供特殊汽車產品的主要經銷商 Meyer Distributing 合作,透過 Meyer Distributing 的網路向汽車零售商分銷 Yakima 的產品。

- 2022 年 4 月:Polaris Inc. 與 Rhino-Rack 合作,為 Polaris 的越野車和探險車提供儲存產品。

從地理來看,由於人們對戶外探險活動的強烈偏好、房車和休閒皮卡車等休閒車的深入滲透以及規模較大的汽車存儲原始設備製造商的存在,北美已被確定為汽車行李架市場最大的地區。由於戶外活動和旅遊業的成長趨勢以及SUV等生活方式車輛的日益普及,歐洲和亞太地區成為第二大市場。

車架市場趨勢

車頂架區隔市場預計在預測期內將以更快的速度成長

由於露營車和越野車的使用不斷增加,預計汽車架市場的車頂架部分在預測期內將變得更加重要。隨著越野車用戶和 SUV 銷售的增加,車頂行李架的需求預計將會增加。

2021年,SUV約佔全球乘用車總銷量的45.9%,較上年成長4%,顯示越野應用的巨大潛力以及車頂行李架在全球長途旅行中的使用增加。此外,預計 2021 年將有 2 億輛 SUV 投入營運,這表明這些車輛和車頂行李架的出行潛力巨大。

根據房車行業協會統計,2021年露營車銷量將突破60萬輛。露營車通常配備行李架以增加存儲容量,因為露營者更喜歡在戶外長途度假時攜帶露營車,通常去偏遠地區,並裝滿生活必需品。露營車銷量的成長也促使汽車架銷量的成長。

一些原始設備製造商還在其車型中採用了各種技術來提高乘客舒適度和車頂行李架實用性。例如,

- 2022 年 10 月:德國露營車專家 Ququq 推出了世界上第一款露營車套件,其中包括專為大眾 ID Buzz 設計的行李架。該設備的價格低於 3000 美元,具有競爭力。

因此,預計上述所有因素的綜合作用將推動未來五年車頂行李架週期的成長。

北美將在汽車架市場發展中發揮關鍵作用

預計北美的汽車架市場在預測期內將主導整個市場。推動美國市場成長的一些主要因素是旅遊部門對車輛的需求不斷成長(汽車租賃和計程車服務)、休閒車需求的增加(消費者休閒旅遊需求的增加)以及大量年輕人搬到美國不同的城市學習和工作。

2021年,美國休閒旅遊佔旅遊業總量的比重超過86%,顯示安裝在車輛上的優質車頂行李架潛力巨大。騎自行車和徒步旅行被選為加拿大公民最喜歡的第三和第五大戶外活動,這些活動通常需要標準的汽車車頂架來安裝各種設備和自行車。這一因素進一步增加了該國對汽車貨架設備的需求。

儘管受疫情影響用戶數量有所下降,但加拿大旅遊業的套餐度假和度假租賃領域的用戶數量在 2021 年急劇增加,這表明對配備車架的多功能車輛的需求預計將增加以滿足旅行的需要。

由於該地區存在 Yakima、Allen Group 和 Saris Group 等知名車頂架製造商,預計預測期內車頂架的使用量將達到最高水準。因此,這些因素預計將在預測期內提振北美汽車架市場。

預計該市場也將受到汽車架原始設備製造商推出新產品的推動。例如

- 2022 年 10 月:Lucid Motors 為 Lucid Air 豪華電動車推出了全新 Lucid Air Crossbars 配件。配件包括能夠支撐 165 磅的新型鋁製屋頂儲存系統。已滿載,現已可供訂購,將於 2022 年第四季開始出貨。

因此,由於上述因素,未來五年北美地區很可能仍將是全球最大的汽車貨架市場。

汽車貨架產業概況

車架市場由幾家主要和本地參與者適度整合。一些主要的市場參與者包括 Thule Group AB、Yakima Products Inc.、Rhino-Rack USA LLC、Car Mate Mfg. 和 Cruzber。製造商正在尋求安裝在車輛上的不同的創新設計,這些設計佔用的空間更少,並且在設計方面更實用。他們專注於各種成長策略,例如產品開發、合作夥伴關係和零售擴張,以加強他們在市場中的地位。例如,

- 2022 年 9 月,現代摩比斯為印度現代 Tucson、Creta、Venue 和 Kona 電動 SUV 客戶推出了新的旅行配件車頂箱、車頂籃和自行車架。這些配件是與 Thule Group AB 共同開發的。

- 2022 年 10 月,Carmate 推出了一款名為 Inno 的新型儲物車頂箱,它可以作為手提箱安裝在車輛頂部或從車頂拆卸。車頂包廂容量為 160 公升,可容納長度達 900 毫米的桌椅。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

第 5 章:市場區隔(市場規模(十億美元))

- 依應用類型

- 車頂行李架

- 車頂箱

- 自行車車架

- 滑雪架

- 水上活動載體

- 依地理

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 亞太

- 中國

- 印度

- 日本

- 亞太其他地區

- 世界其他地區

- 巴西

- 南非

- 其他國家

- 北美洲

第 6 章:競爭格局

- 供應商市佔率

- 公司簡介

- Thule Group

- Yakima Products Inc.

- Allen Sports

- Rhino-Rack USA LLC

- Cruzber SA

- ACPS Automotive GmbH

- Malone Auto Racks

- Kuat Car Racks

- Car Mate Mfg Co. Ltd

- Saris

第 7 章:市場機會與未來趨勢

The Car Rack Market size is estimated at USD 1.42 billion in 2024, and is expected to reach USD 1.86 billion by 2029, growing at a CAGR of 5.46% during the forecast period (2024-2029).

The outbreak of the COVID-19 pandemic led to manufacturing shutdowns, lockdowns, and trade restrictions which negatively affected the automotive electro-hydraulic power steering industry. Furthermore, the traveling restrictions and the fall in the number of outdoor adventure activities massively dented the demand for car racks. Consequently, the small or large companies in the car roof rack business suffered significantly. Post-COVID-19, with the increasing demand for regular recreational activities and health benefits, the need for mountain biking and ski trips may increase, which may increase the demand for more car racks and rooftop mounts that are dependable, thus increasing the market value. Furthermore, the manufacturers are implementing contingency plans to mitigate future business uncertainties to retain continuity with clients in the critical sectors of the automobile industry.

Over the next five years, the demand for additional baggage space and the growing attraction for leisure activities and tourism amongst the millennial generation are the primary reasons driving the market's growth. Quality (rust and corrosion in low-quality racks) and pricing difficulties (factors impacting the price, such as product expenses like building material/raw material, roof rack type, and brand) may limit the market's growth.

The introduction of more compact SUVs with greater practicality increased vehicular capabilities, and an increased number of competent automobiles for off-roading are driving the car rack market, as these factors will substantially improve the application of roof racks.

Key market players are engaging in joint ventures, new product launches, and capacity expansions to address the rapidly growing car rack market. for instance

Key Highlights

- October, 2022: Yakima Products Inc. announced a tie-up with Meyer Distributing, a major distributor of specialty automotive products to retailers, to distribute Yakima's products through Meyer Distributing's network to automotive retailers.

- April, 2022: Polaris Inc. partnered with Rhino-Rack to offer storage products for Polaris' off-roaders and adventure vehicles.

Geographically, North America has been identified as the largest region for the car rack market due to a strong preference for outdoor adventure activities, deep penetration of leisure vehicles like motorhomes and lifestyle pickup trucks, and the presence of sizeable automotive storage OEMs. Europe and Asia-Pacific are the following biggest markets due to the growing trend of outdoor activities and tourism and the rising adoption of lifestyle vehicles like SUVs.

Car Rack Market Trends

Roof Rack Segment is Expected to Grow at a Faster rate During the Forecast Period

The roof rack segment of the car rack market is expected to gain significance over the forecast period, owing to the increasing use of campers and off-road vehicles. With rising off-road vehicle users and SUV sales, the need for roof racks is expected to increase.

In 2021, SUVs accounted for about 45.9% of the total passenger car sales worldwide, growing by 4% from the previous year, indicating the high potential for off-road applications and increased use of roof racks for long-distance traveling across the world. Also, an estimated 200 million SUVs were in operation in 2021, indicating the high potential for these vehicles and roof racks for traveling.

According to RV Industry Association, sales of camper vehicles crossed 600000 units in 2021. Camper vans are generally outfitted with racks to increase their storage capacity since campers prefer to take their camper vehicles on long outdoor vacations, often to remote locations, stuffed with daily necessities. This increase in the sales of camper vehicles is also leading to a rise in the sales of car racks.

Several OEMs also implement various techniques for passenger comfort and roof rack utility in their models. For instance,

- October, 2022 : German camper specialist Ququq launched the world's first camper kit consisting of a luggage rack specially designed for VW I.D. Buzz. The equipment is priced competitively under USD 3000.

Thus the confluence of all the above factors is predicted to drive the growth of the roof rack period in the next five years.

North America to Play Key Role in Development of Car Rack Market

The car rack market in North America is expected to dominate the overall market during the forecast period. Some of the major factors driving the growth of the US market are the growing demand for vehicles from the tourism sector (car rental and taxi services), increasing demand for recreational vehicles (rising demand for recreational travels among consumers), and a large number of young people moving out to different cities in the United States for studies and work.

The share of leisure trips in the United States was valued at more than 86% of the total tourism in 2021, indicating the huge potential for quality roof racks to be mounted on vehicles. Bicycling and hiking have been voted as the third and fifth most popular outdoor activities preferred by Canadian citizens, which usually require standard car roof racks to mount various equipment and bicycles. This factor further increases the need for car rack equipment in the country.

Although there was a decline in the number of users due to the pandemic, the packaged holidays and vacation rentals segment of Canadian tourism observed a steep rise in the users in 2021, pointing toward an expected increase in the need for multipurpose vehicles equipped with car racks for traveling needs.

With the presence of renowned roof rack manufacturers like Yakima, Allen Group, and Saris Group in the geography, the use of roof racks is expected to be the highest during the forecast period. Therefore, such factors are expected to boost the North American car rack market during the forecast period.

The market is also expected to be driven by the launching of new products by car rack OEMs. For instance

- October, 2022: Lucid Motors launched new Lucid Air Crossbars accessories for Lucid Air Luxury EVs. The accessories include a new aluminum roof storage system capable of support 165 Ib. of load and are available for order now, with shipping beginning in Q4 2022.

Thus, North America is likely to remain the world's largest market for car racks over the next five years due to the above factors.

Car Rack Industry Overview

The car rack market is moderately consolidated with several major and local players. Some of the major market players are Thule Group AB, Yakima Products Inc., Rhino-Rack USA LLC, Car Mate Mfg. Co. Ltd, and Cruzber. Manufacturers are looking at different and innovative designs to be installed onto vehicles that consume less space and are more practical in design aspects. They are focusing on various growth strategies, such as product developments, partnerships, and retail expansion to strengthen their position in the market. For instance,

- September, 2022, Hyundai Mobis introduced new touring accessories Roof Box, Roof Basket, and Bike Carrier for Hyundai Tucson, Creta, Venue, and Kona electric SUV customers in India. These accessories have been developed in association with Thule Group AB.

- October, 2022, Carmate introduced a new storage roof box called Inno which can be attached and removed as a suitcase to the roof of the vehicle. The rooftop box has a capacity of 160 liters and can accommodate chairs and tables of up to 900mm in length.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD Billion)

- 5.1 By Application Type

- 5.1.1 Roof Rack

- 5.1.2 Roof Box

- 5.1.3 Bike Car Rack

- 5.1.4 Ski Rack

- 5.1.5 Watersport Carrier

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.4.1 Brazil

- 5.2.4.2 South Africa

- 5.2.4.3 Other Countries

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Thule Group

- 6.2.2 Yakima Products Inc.

- 6.2.3 Allen Sports

- 6.2.4 Rhino-Rack USA LLC

- 6.2.5 Cruzber SA

- 6.2.6 ACPS Automotive GmbH

- 6.2.7 Malone Auto Racks

- 6.2.8 Kuat Car Racks

- 6.2.9 Car Mate Mfg Co. Ltd

- 6.2.10 Saris