|

市場調查報告書

商品編碼

1441701

綠色建材:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Green Building Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

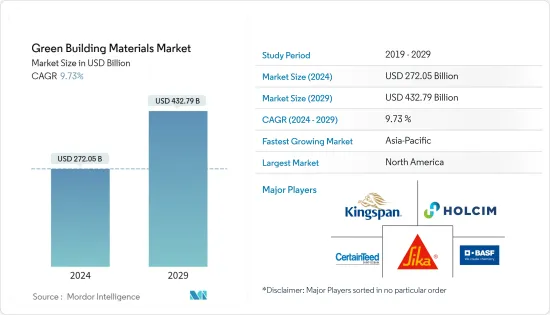

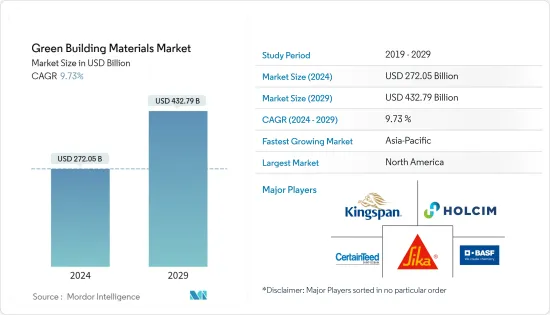

預計2024年綠色建材市場規模為2,720.5億美元,預估至2029年將達4,327.9億美元,在預測期內(2024-2029年)將以複合年成長率9.73%成長。

2020年和2021年上半年的COVID-19爆發,由於各國政府的禁令和限制,對全球建築業產生了重大影響,限制了綠色建材市場的成長。住宅住宅受到的打擊最為嚴重,因為優質住宅的嚴格封鎖措施導致住宅登記停止並推遲了房屋抵押貸款支付。然而,自從這些限制取消以來,該行業已經恢復良好。過去兩年,住宅銷售的增加、新計劃的推出以及對新辦公室和商業空間的需求增加推動了市場復甦。

主要亮點

- 從中期來看,綠色建築材料在節能建築中的潛在應用是推動研究市場成長的關鍵驅動力。此外,政府也制定了有利的政策來支持綠建築的建設,並確保所有建築業的標準做法。這些政策正在推動建築材料製造商將更環保的材料成分/系統融入他們的產品中。

- 相反,與傳統建築相比,綠色建築的初始資本投資較高,是預期在預測期內抑制調查市場成長的關鍵因素。

- 儘管如此,各個經濟體對實現碳中和的興趣日益濃厚,綠色建築營運成本隨著時間的推移而下降,以及回收建築的成長趨勢可能會在不久的將來為全球市場創造利潤豐厚的成長機會。

- 預計北美將在預測期內主導市場。這一優勢是由於住宅、商業、工業和基礎設施領域對框架、屋頂、隔熱材料和各種其他應用的高需求。

綠色建材市場趨勢

住宅終端產業綠色建材消費不斷增加

- 住宅產業是綠色建材的主要終端用戶產業。各種類型的綠色建築材料在住宅建築中越來越受歡迎,因為這種趨勢有利於節能、防潮、耐用和易於維護的材料。由於人身安全、人們對綠色建築材料的認知和親和力不斷增強以及政府法規等因素,綠色建築材料在住宅應用中的使用不斷增加。

- 纖維水泥牆板、熱改質木材、竹子、飛灰或灰混凝土、大麻混凝土和再生塑膠是綠色建築材料,擴大被住宅建設產業採用。其他天然材料如纖維素、大麻和軟木也用於絕緣目的。

- 棉花、黃麻和羊毛等天然纖維,水磨石、再生混凝土、石灰外牆、石材和橡膠基材料等再生材料也是用於住宅領域各種應用的綠色建築材料。

- 各國政府紛紛推出綠色住宅獎勵措施,鼓勵綠色住宅計劃興建。例如,美國和西班牙的稅額扣抵、新加坡的綠色標誌激勵計劃和紐西蘭的補貼正在鼓勵該國建造綠色住宅建築,並可能有利於所研究的市場。

- 過去一年,日本在綠色建築領導力方面取得了長足進步,並繼續擴大其能源與環境設計卓越領導力 (LEED) 產品組合。日本有超過 268 個計劃參與 LEED,面積約 2,950 萬平方英尺。

- 此外,德國的 KfW 計劃為超出標準性能並符合認證評級的建築和維修計劃提供低利率貸款和津貼。

- 中國是全球最大的建築市場。中國政府已將綠建築舉措列為國家「十三五」規劃的優先事項。該國的氣候污染計劃要求到 2020 年所有新建建築中 50% 獲得綠色認證。

- 印度約有 6,548 個註冊的綠建築計劃。 2021年6月,IIA與CII-IGBC簽署協議,在建築設計與規劃領域推廣綠建築方法。

- 由於上述所有因素,住宅建築應用中綠色建築材料的使用和需求預計在預測期內將會成長。

北美市場佔據主導地位

- 在北美,各類建設活動中綠色建材的高消費水準是推動綠色建材市場成長的主要因素。

- LEED 評級系統是美國使用最廣泛的綠建築評級系統。它為健康、高效、減碳、降低成本的綠色建築提供了框架。 LEED 認證的建築可節省成本、提高效率並減少碳排放。

- 根據USGBC統計,截至2022年10月,美國約有20,125個LEED認證計劃、21,068個銀級計劃、21,206個金級計劃和7,027個白金級計劃。

- 根據美國能源資訊署的數據,2021年住宅和商業部門的能源消費量四捨五入為21,000兆BTU,佔該國終端能源消費量的28%。建築物的高能源需求引起了美國政府的關注,美國政府正斥資31億美元,對低收入地區約45萬套住宅進行節能建築改造,降低國家水電費,並宣布計劃投資6000萬美元。

- 加拿大政府承諾到2030年將國內溫室氣體排放總量從2005年的水準減少40~45%,到2050年實現凈零排放,以保護環境並減輕氣候變化的影響。 為了實現這些目標,該國 2022 財年預算撥款 1.5 億加元用於制定加拿大綠色建築戰略。 該戰略動員各國採取行動,改變市場並降低成本,以實現這一目標。

- 據 WGBC 稱,加拿大表現最好的綠色建築領域是新設施建設。目前,該國所有新計畫中有超過三分之一是綠色計劃,而這一數字在未來幾年可能會大幅增加。環境法規和能源消費量的減少是推動加拿大綠色建築產業成長的因素。

- 根據 USGBC 的數據,2021 年,墨西哥在 LEED 認證平方英尺(平方英尺)方面排名全球第十,總合47 個計劃,面積為 10,285,729.57 平方英尺。

- 此外,截至 2021 年 12 月,兩家墨西哥房地產投資信託基金 Fibra Macquarie 和 Fibra Shops 正在透過維修投資和更高品質的准入標準相結合,對其整個投資組合進行綠色認證。墨西哥的私人公司也宣布了他們對 LEED 和綠色建築的承諾。

- 所有上述因素都可能在預測期內推動北美綠色建材市場的成長。

綠色建材產業概況

全球綠色建材市場較為分散,眾多參與者佔了較小的市場佔有率。主要企業包括(排名不分先後)Sika AG、Kingspan Group、Holcim、Saint-Gobain (CertainTeed) 和BASF SE。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 對隔熱和節能建築的需求不斷增加

- 政府對綠建築的利多政策

- 抑制因素

- 與傳統建築相比,初始資本投資較高

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 目的

- 框架

- 隔熱材料

- 屋頂

- 外牆牆板

- 室內裝修

- 其他

- 最終用途產業

- 住宅

- 商業的

- 工業/機構

- 基礎設施

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)/排名分析

- 主要企業採取的策略

- 公司簡介

- BASF SE

- Binderholz GmbH

- Dupont

- Holcim

- Interface Inc.

- Kingspan Group

- Owens Corning

- PPG Industries Inc.

- Saint-Gobain(Certainteed)

- Sika AG

- Soben International(Asia-Pacific)Ltd

第7章市場機會與未來趨勢

The Green Building Materials Market size is estimated at USD 272.05 billion in 2024, and is expected to reach USD 432.79 billion by 2029, growing at a CAGR of 9.73% during the forecast period (2024-2029).

The outbreak of COVID-19 in 2020 and the first half of 2021 significantly affected the global construction sector due to government-imposed bans and restrictions, thereby limiting the growth of the green building materials market. Residential real estate was the worst hit as strict lockdown measures across major cities resulted in the suspension of home registrations and slow disbursements of home loans. However, the sector has been recovering well since these restrictions were lifted. An increase in house sales, new project launches, and an increasing demand for new offices and commercial spaces have been leading the market recovery over the last two years.

Key Highlights

- Over the medium term, the potential application of green building materials in energy-efficient buildings is the major driving factor driving the growth of the market studied. Furthermore, there are favorable government policies that support green building construction and ensure standard practices across all construction sectors. These policies are prompting the manufacturers of construction materials to include more green material compositions/systems in their products.

- On the flip side, the high first capital investments for green building construction when compared to conventional buildings is the key factor anticipated to restrain the growth of the market studied over the forecast period.

- Nevertheless, the increasing focus of various economies on achieving carbon neutrality, the declining operation costs of green buildings over time, and the growing trends in recycled construction are likely to create lucrative growth opportunities for the global market soon.

- North America is expected to dominate the market during the forecast period. This dominance is attributed to the high demand for framing, roofing, insulation, and various other applications in the residential, commercial, industrial, and infrastructure sectors.

Green Building Materials Market Trends

Increasing Consumption of Green Building Materials in the Residential End-use Industry

- The residential industry is the major end-user industry for green building materials. Various types of green building materials are gaining popularity in residential buildings owing to the increasing preference for materials that are energy-efficient, moisture-resistant, durable, and easy to maintain. Factors like personal safety, increasing awareness and affinity toward green building materials, and government regulations favor the continuous increase in the use of green building materials for residential applications.

- Fiber cement siding, thermally modified wood, bamboo, fly ash or ashcrete, hempcrete, and recycled plastic are some green construction materials that are witnessing increased adoption in the residential construction industry. Other natural materials, like cellulose, hemp, and cork, are used for insulation applications.

- Natural fibers such as cotton, jute, and wool, recycled materials such as terrazzo, and recycled concrete, stucco, stone, and rubber-based materials are also among the green building materials employed in various applications in the residential sector.

- The governments of various countries are providing green housing incentives to promote the construction of green residential projects. For instance, tax credits in the United States and Spain, the Green Mark incentive program in Singapore, and subsidies in New Zealand are promoting the construction of green residential buildings in the country, which is likely to favor the market studied.

- Over the last year, Japan made significant strides in green building leadership and continues to expand its impressive Leadership in Energy and Environmental Design (LEED) portfolio. Japan has more than 268 projects participating in LEED, comprising approximately 29.5 million sq. ft.

- Also, the Kreditanstalt fur Wiederaufbau (KfW) program in Germany provides low-interest loans and grants for construction and renovation projects that meet certification ratings beyond code performance.

- China is the world's largest construction market. The Chinese government prioritized the country's 13th Five Year Plan, which has schemes for green building initiatives. The country's national climate commitment calls for 50% of all new buildings constructed by 2020 to be certified green.

- India has around 6,548 registered green building projects. In June 2021, the IIA and the CII-IGBC signed an agreement to boost green building methods in the areas of architectural design and planning.

- Owing to all the above factors, the usage and demand of green building materials for residential construction applications are expected to grow during the forecast period.

North America to Dominate the Market

- In North America, the high level of consumption of green building materials across all types of construction activities is the primary factor driving the growth of the green building materials market.

- The LEED rating system is the most widely used green building rating system in the United States. It provides a framework for healthy, efficient, carbon-saving, and cost-saving green buildings. LEED-certified buildings save money, improve efficiency, and lower carbon emissions.

- According to the USGBC, as of October 2022, the United States had around 20,125 Certified LEED projects, 21,068 Silver projects, 21,206 Gold projects, and 7,027 Platinum projects.

- According to the US Energy Information Administration, the energy consumption by the residential and commercial sectors in 2021 was rounded to 21 quadrillion Btu, which made up 28% of the country's end-use energy consumption. The high energy demand from buildings has drawn the attention of the US government, which has announced its plans to invest USD 3.16 billion to transform around 450,000 homes in low-income areas into energy-efficient structures and cut down on the country's utility bills.

- The Government of Canada has committed to reducing the country's total GHG emissions to 40-45% below 2005 levels by 2030 and to reach net zero by 2050 in order to protect the environment and reduce the impacts of climate change. To achieve such goals, the country's budget for 2022 committed CAD 150 million to develop the Canada Green Buildings Strategy. This strategy will mobilize national action to transform markets and reduce costs to meet this goal.

- According to the WGBC, the best-performing sector for green buildings in Canada is new institutional construction. Currently, over one-third of all new projects in the country are green, and this number is likely to grow significantly in the coming years. Environmental regulations and reduction in energy consumption are the factors driving the growth of the green building industry in Canada.

- According to the USGBC, in 2021, Mexico held the 10th position globally in terms of square feet (sq. ft) of LEED certification, with a value of 10,285,729.57 sq. ft in a total of 47 projects.

- Also, as of December 2021, two Mexican REITs, Fibra Macquarie and Fibra Shop, were in the process of certifying their entire portfolios green through a combination of retrofit investments and higher quality-on-entry standards. Privately-owned Mexican firms are also displaying their commitment to LEED and green building.

- All the above-mentioned factors are likely to fuel the growth of the North American green building materials market over the forecast period.

Green Building Materials Industry Overview

The global green building materials market is fragmented, with many players having small shares of the market. Some of the major companies (in no particular order) are Sika AG, Kingspan Group, Holcim, Saint-Gobain (CertainTeed), and BASF SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Insulation and Energy-efficient Buildings

- 4.1.2 Favorable Government Policies for Green Buildings

- 4.2 Restraints

- 4.2.1 High Initial Capital Investment Compared to Conventional Buildings

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Framing

- 5.1.2 Insulation

- 5.1.3 Roofing

- 5.1.4 Exterior Siding

- 5.1.5 Interior Finishing

- 5.1.6 Other Applications

- 5.2 End-use Industry

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial and Institutional

- 5.2.4 Infrastructure

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Binderholz GmbH

- 6.4.3 Dupont

- 6.4.4 Holcim

- 6.4.5 Interface Inc.

- 6.4.6 Kingspan Group

- 6.4.7 Owens Corning

- 6.4.8 PPG Industries Inc.

- 6.4.9 Saint- Gobain (Certainteed)

- 6.4.10 Sika AG

- 6.4.11 Soben International (Asia-Pacific) Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Focus on Achieving Carbon Neutrality by Several Economies

- 7.2 Other Opportunities