|

市場調查報告書

商品編碼

1441484

日本通訊:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Japan Telecom - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

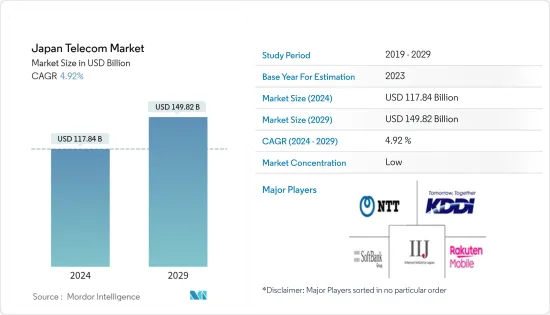

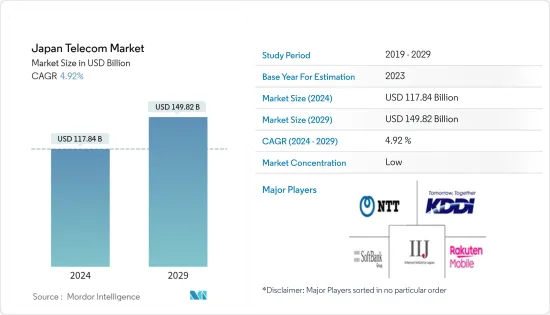

日本通訊市場規模預計 2024 年為 1,178.4 億美元,預計到 2029 年將達到 1,498.2 億美元,在預測期內(2024-2029 年)年複合成長率為 4.92% 成長。

日本擁有高度發達的基礎設施,使人們能夠保持聯繫。除了網路普及高之外,日本還擁有龐大的行動網路用戶群,反映出智慧型手機的日益普及。智慧型手機普及很高,預計未來幾年將有更多人使用智慧型手機。

主要亮點

- 日本於2019年10月修訂了《電訊商業法》,旨在促進行動領域的競爭並保護用戶。此後,關於降價行動電話資費以減輕用戶負擔的討論不斷。內務部宣布了一項行動計劃,旨在透過創建公平和競爭的行動市場來降低行動電話費用。到 2021 年 3 月,所有 MNO 公司都推出了新的低價品牌和收費系統,其中一些包括 20 GB資料。

- 儘管 6G通訊可能需要十年才能充分發揮其潛力,但日本已在建立自己的國內網路和技術基礎設施。日本政府計劃投資數十億美元加速超高速通訊的發展。日本設備製造商 NEC 和富士通以及芬蘭設備製造商諾基亞已宣布計劃試驗新的行動通訊技術,目標是到 2030 年商業推出 6G 服務。

- 儘管網際網路不斷發展系統和通訊協定,但行動網路的發展長期以來一直受到封閉文化和專有技術的限制。要成為各部門的重要基礎設施,行動網路必須能夠動態提供變化和動態設定。透過整合RESTful(表述性狀態傳輸)應用程式介面(API),Softbank Corporation可以調整和修改其網路,以滿足消費者的需求並提供更便捷的服務。

- COVID-19的感染疾病對日本經濟產生了重大影響。採用數位技術對於提高疫情期間和之後的國家復原力至關重要。技術應用程式可以幫助企業及其員工與客戶溝通、數位化營運、重新啟動業務營運以及部署緩解物流瓶頸的技術,從而幫助企業及其員工從 COVID-19的感染疾病中恢復過來,幫助管理影響力。據信,日本 69% 的數位機會(價值 46.8 兆日圓(4,340 億美元))來自幫助企業和員工應對疫情經濟影響的技術。

日本通訊市場的動向

5G部署

- 根據GSMA報告,日本允許通訊業者在交通號誌上方安裝5G基地台,加速全國5G部署。隨著較小蜂窩的部署和網路密度的增加,21 個更高容量的用例可以蓬勃發展。日本的連接普及預計將從2021年的153%上升到2022年的154%。智慧型手機普及預計將從 2021 年的 71% 增加到 2025 年的 81%。日本的用戶普及預計也將從 87 升至 87。 2021 年 % 至 2025 年 88%。

- 考慮到iPhone 12和13的降價和商店供應,該國5G部署的前景看起來更加樂觀。最近,日本政府向該國三大行動電話提供商授予了 5G 頻譜:NTT Docomo、KDDI au、Softbank Corporation以及最近加入的樂天移動。未來幾年,這四家日本通訊業者預計將在基地台、伺服器和光纖等資本計劃上投資超過140億美元。惠譽研究顯示,預計2026年5G將取代4G成為日本主要行動電話技術,到2029年將有約4,500萬4G用戶及超過1.51億5G用戶。

- 根據當地報道,日本通訊業者NTT Docomo 計劃與其競爭對手一樣,加快在全國部署 5G。報導稱,NTT Docomo 計劃在 2024 年 3 月為日本 90% 的人口提供服務,超過原定 80% 的目標。 2022年9月,NTT Docomo聲稱持有世界上第一個商用5G獨立(SA)網路。這使得智慧型手機能夠同時使用中頻(6 GHz 以下)和毫米波頻率,即 5G NR 雙重連線。該公告是與無線技術公司高通聯合發布的,該公司希望強調搭載該公司 Snapdragon 8 Gen 1 平台的智慧型手機可以充分利用新網路的全速。

- 日本客戶可以利用各種毫米波設備,包括三星、索尼、夏普、富士通和谷歌的高階智慧型手機,以及營運商對該技術的巨大推動力。其他OEM(包括較低層級設備製造商)預計也將在未來幾個月內在日本推出毫米波智慧型手機。

- 2022年5月,Softbank Corporation公司開始在日本各地部署MEC伺服器,並宣佈在關東地區啟動5G MEC(多接取邊緣運算)網站。 「軟銀5G MEC」採用5G SA(5G Stand Alone)商用服務,提供低延遲、高品質(低抖動)、高安全的服務體驗。透過推動各種業務的數位轉型(DX)並實現數位雙胞胎*2,Softbank Corporation有望響應社會問題,並將行業發展為Beyond 5G的未來數位平台提供者。

數位轉型舉措

- 數位轉型是 COVID-19 危機最明顯加速的趨勢 (DX) 之一。這種突然的變化可以改善企業和組織的運作方式,並對人們的生活產生廣泛的正面影響。電訊(ITU)的一項研究顯示,2020年,全球大都會圈有76%的人擁有網路接入,而農村地區這一比例為39%。日本設定了創造「新形式資本主義」的崇高目標,強調人與永續性,並將DX定位為實現成長和分配良性循環的重要組成部分。

- 當地私人企業可能會發現很難快速實現盈利,但與地方政府和部會的合作可以將創新想法付諸實行。此外,數位化在日本甚至農村地區並不新鮮。自 2016 年啟動以來,內務部的區域物聯網促進研究所計劃已對日本 105 個地區的研究機構進行了獎勵,獎勵了最佳的新型物聯網解決方案和公司,並鼓勵當地計劃和企業蓬勃發展和騰飛.我們已派出導師來支持您。

- 日本大型公司舉辦開放式創新會議和商業競賽,透過利用其他組織的技術、概念、資產和資源來促進創新。儘管開放式創新在日本尚未像其他國家普及,但開放式創新在日本主要企業中正變得越來越普遍並不斷成長。近年來,各領域舉辦了許多開放創新措施和商業競賽。例如,NTTData在通訊領域開放創新。

- 2020 年 8 月,伊那市為每月支付費用的居民推出了全國首個使用無人機的購物服務「支援購物服務」。該服務透過有線電視提供,是與電信業者KDDI Corporation 合作開發的。客戶可以使用電視遙控器訂購並支付有線電視費用。由於該地區多山,標準電視訊號難以到達該地區,因此該市為戶戶提供有線電視,有線電視普及幾乎達到100%。

- 當地私人企業可能會發現很難快速實現盈利,但與地方政府和部會的合作可以將創新想法付諸實行。此外,數位化在日本並不新鮮,即使在農村地區也是如此。根據經濟產業省(METI)的報告,內務部推進研究所計劃自 2016 年啟動以來,已向日本 105 個地區的研究機構獎勵最佳獎。全新物聯網解決方案和傑出解決方案。已獎勵。我們為企業提供導師,幫助當地計劃和企業蓬勃發展。

日本通訊業概況

日本通訊市場本質上高度分散。該市場的主要企業包括日本電報電話公司、KDDI 公司、Softbank Group、樂天行動公司和 Internet Initiative Inc.。該市場還擁有其他網路服務供應商(ISP)、MVNO 和固定電話業者。一些日本電信業者在國際上具有強大的競爭力,在全球通訊領域擁有強大的地位。

- 2022 年 1 月,NTT Communications Corporation (NTT Com) 宣布即時推出 SDPF Edge,這是一種基於智慧資料平台的整合營運 (SDPF) 邊緣運算解決方案。在主要服務於製造業的新 SDPF Edge 服務的幫助下,公司可以處理大量生產資料以保持品管並更快、更便宜地進行選擇。

- 2022 年 2 月,KDDI 與三星和富士通一起宣布,全球首個由虛擬無線接取網路(vRAN) 提供支援的 5G 獨立開放 RAN 站點將在神奈川縣川崎市上線。借助 Open RAN 和 vRAN,這是 5G SA 的首次商業部署。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業生態系統分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- COVID-19 對產業生態系統的影響

- 國內監理情況

第5章市場動態

- 市場促進因素

- 加速5G設備普及及市場拓展

- 繼續遠距工作

- 市場限制因素

- 對競爭的擔憂

- 基於連接性的市場分析(覆蓋範圍包括詳細的趨勢分析)

- 固定網路

- 寬頻趨勢(纜線數據機、有線光纖、有線DSL、固定Wi-Fi)、ADSL/VDSL、FTTP/B、纜線數據機、FWA、5G FWA

- 窄帶

- 行動網路

- 智慧型手機和行動裝置的普及

- 行動寬頻

- 2G、3G、4G、5G 連接

- 智慧家庭、物聯網、M2M 連接

- 固定網路

- 通訊鐵塔分析(包括格子塔、支線塔、單極塔、隱形塔等不同類型鐵塔的詳細趨勢分析)

第6章市場區隔

- 按服務細分(跨服務細分市場的每個用戶平均收益、2020-2027 年期間每個細分市場的市場規模和估計,以及包括詳細趨勢分析的範圍)

- 語音服務

- 有線

- 無線的

- 資料和通訊服務(網路和行動電話資料套餐,範圍包括套餐折扣)

- OTT 和付費電視服務

- 語音服務

第7章 競爭形勢

- 公司簡介

- Nippon Telegraph and Telephone Corporation

- KDDI Corporation

- SoftBank Group Corp.

- Rakuten Mobile, Inc.

- Internet Initiative Japan, Inc.

- JSAT Corporation

- TOKAI Communications Corporation

- Wowow Inc.

- Internet Initiative Japan, Inc.

- Z Holdings Corporation

第8章投資分析

第9章市場機會與未來趨勢

The Japan Telecom Market size is estimated at USD 117.84 billion in 2024, and is expected to reach USD 149.82 billion by 2029, growing at a CAGR of 4.92% during the forecast period (2024-2029).

Japan has a highly developed infrastructure that allows its people to be constantly connected. Along with having a high internet penetration rate, Japan has a sizable mobile internet user base, which reflects the rising popularity of smartphones. Though the smartphone adoption rate is strong, more individuals are anticipated to utilize smartphones in the years to come.

Key Highlights

- In Japan, the Telecommunications Business Law was changed in October 2019 to encourage competition in the mobile sector and safeguard users. Since then, there have been conversations about reducing mobile phone fees to lessen the load on users. The Ministry of Internal Affairs and Communications unveiled an action plan to lower mobile phone costs by creating a fair and competitive mobile market. By March 2021, all MNO companies introduced new, less-priced brands and pricing schemes, some of which included 20 GB of data.

- It might take a decade for 6G telecommunications to reach its full potential, but Japan is already establishing its own domestic network and technology foundation. The Japanese government plans to invest billions of dollars in promoting the development of ultra-high-speed communication. Japanese equipment manufacturers NEC and Fujitsu, as well as Finnish equipment manufacturer Nokia, announced plans to conduct experimental trials of new mobile communications technologies for the targeted commercial launch of 6G services by 2030.

- Though system and protocol evolution continued due to the Internet, the development of mobile networks was constrained by closed cultures and proprietary technologies for a very long time. Mobile networks must be able to offer modification and dynamic set up on the spot to be essential infrastructure for many different sectors. By integrating RESTful (Representational State Transfer) application programming interfaces (APIs), SoftBank tailors and modifies its network to meet the needs of consumers and offer more convenient services.

- The COVID-19 outbreak significantly impacted the Japanese economy. The adoption of digital technology was essential for the nation to become more resilient during and after the pandemic. Technology applications can help businesses and their employees manage the financial effects of COVID-19 by assisting them in contacting clients and conducting business digitally, restarting business operations, and implementing technologies that reduce logistical bottlenecks. A sizable 69% of Japan's digital opportunity, valued at JPY 46.8 trillion (USD 434 billion), was thought to be sourced from technology that assists companies and employees in managing the effects of the pandemic on the economy.

Japan Telecom Market Trends

5G Rollouts

- According to a GSMA report, Japan allows operators to mount 5G base stations atop traffic signals, accelerating 5G deployments nationwide. 21 higher-capacity use cases can flourish when tiny cells are put into place, and network density is raised. The connection penetration in Japan is expected to rise from 153% in 2021 to 154% in 2022. The projected increase in smartphone adoption rate is from 71% in 2021 to 81% in 2025. Subscriber penetration in Japan is also expected to rise from 87% in 2021 to 88% in 2025.

- Given the price reductions and the availability of the iPhone 12 and 13 in stores, the prospects for 5G adoption in the nation seem more promising. Recently, the Japanese government granted the 5G spectrum to the country's top three mobile providers, NTT Docomo, KDDI au, Softbank, and a recent entrant, Rakuten Mobile. Over the following years, these four Japanese carriers are anticipated to invest more than USD 14 billion in capital projects, including base stations, servers, and fiber optics. According to Fitch Research, by 2026, 5G will overtake 4G as the primary cellular technology in Japan, and by 2029 there will be around 45 million 4G subscribers and more than 151 million 5G subscribers.

- According to the local press, Japanese carrier, NTT Docomo, plans to quicken the speed of its 5G rollout nationwide while competitors do the same. The same article claims that NTT Docomo plans to provide coverage to 90% of the Japanese population, up from its earlier target of 80%, by March 2024. In September 2022 NTT Docomo claimed to have the world's first commercial 5G Standalone (SA) network that enables smartphones to simultaneously use mid-band (sub-6 GHz) and mmWave frequencies, known as 5G NR Dual Connectivity. The announcement was made with wireless technology company Qualcomm, which was keen to showcase that smartphones powered by its Snapdragon 8 Gen 1 platform can exploit the full speed of the new network.

- Japanese customers have access to a wide range of mmWave devices, including high-end smartphones from Samsung, Sony, Sharp, Fujitsu, and Google, and significant carrier momentum for the technology. Other OEMs, including those from lower tiers, are expected to introduce mmWave smartphones in Japan in the coming months.

- In May 2022, SoftBank Corp. declared beginning the statewide deployment of MEC servers in Japan and launching a 5G MEC (Multi-access Edge Computing) site in the Kanto area. Using 5G SA (5G Stand Alone) commercial services, SoftBank 5G MEC offers low-latency, high-quality (low-jitter), and highly secure service experience. By encouraging the digital transformation (DX) of various businesses and achieving Digital Twin*2, SoftBank is expected to address societal concerns and advance the industry as a digital platform provider in the Beyond 5G future.

Digital Transformation Initiatives

- Digital transformation is one of the trends that the COVID-19 crisis has most visibly hastened (DX). This abrupt change can improve business and organization operations and have a wide range of positive effects on people's lives. In metropolitan regions throughout the world, 76% of people had internet access in 2020, compared to 39% in rural areas, according to research by the International Telecommunication Union (ITU). With the lofty objective of creating a "New Form of Capitalism" that would be both people- and sustainability-focused, Japan has positioned DX as a key component of its initiatives for a virtuous cycle of growth and distribution.

- Private businesses in rural locations may find it difficult to reach profitability quickly, but collaboration with regional authorities and ministries may be able to make novel ideas workable. Additionally, digitalization is nothing new in Japan, not even in rural regions. Since its inception in 2016, the Ministry of Internal Affairs and Communication's Local IoT Acceleration Laboratories project has recognized labs in 105 areas around Japan, awarded the finest new IoT solutions and enterprises, and sent mentors to help regional projects and ventures flourish and take off.

- Large Japanese firms host Open Innovation conferences and business competitions to foster innovation by employing other organizations' technology, concepts, assets, and resources. Open innovation is still not as prevalent in Japan as it is in other countries, but it is becoming more common among major Japanese corporations, and it is growing. Over the past several years, numerous open innovation initiatives and business competitions have been held in various sectors. For example, NTTData Open Innovation for the telecom sector.

- Ina City introduced a "Mutual Support Shopping Service" in August 2020, which is Japan's first drone-delivered shopping service for residents who pay a monthly subscription fee. The service is delivered via cable TV and was developed in collaboration with the telecom company KDDI Corp. Customers can use the TV remote control to place orders and pay their cable bill. As a result of the city providing cable TV to households due to poor signal reception for standard television broadcasts due to the area's mountainous terrain, cable TV has almost 100% penetration.

- Private businesses in rural locations may find it difficult to reach profitability quickly, but collaboration with regional authorities and ministries may make novel ideas workable. Additionally, digitalization is nothing new in Japan, not even in rural areas. As per the Ministry of Economy, Trade, and Industry (METI) report, since its inception in 2016, the Ministry of Internal Affairs and Communication's Local IoT Acceleration Laboratories project has recognized labs in 105 regions around Japan, awarded the finest new IoT solutions and enterprises, and sent mentors to help regional projects and ventures flourish and take off.

Japan Telecom Industry Overview

The Japanese telecom market is highly fragmented in nature. Some major players in the market include Nippon Telegraph and Telephone Corporation, KDDI Corporation., SoftBank Group Corp., Rakuten Mobile, Inc, and Internet Initiative Japan, Inc. The market also hosts other Internet service providers (ISPs), MVNOs, and fixed-line service providers. Some Japanese telecommunication companies are very competitive internationally and hold strong ground in the global telecom space.

- In January 2022, on its Smart Data Platform, NTT Communications Corporation (NTT Com) announced the immediate launch of "SDPF Edge," an edge-computing solution with integrated operations (SDPF). With the help of the new SDPF Edge service, which primarily serves the manufacturing sector, companies may process massive volumes of production data to maintain quality control and make choices more quickly and inexpensively.

- In February 2022, KDDI, along with Samsung and Fujitsu, announced the world's first 5G Standalone Open RAN site, powered by a virtualized Radio Access Network (vRAN), will go online in Kawasaki, Kanagawa. With Open RAN and vRAN, this happened to be the first commercial deployment of 5G SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.3 Industry Attractiveness-Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Industry Ecosystem

- 4.5 Regulatory Landscape in the Country

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 5G Device Penetration and Accelerated Expansion of Market

- 5.1.2 Continuation of Remote Work

- 5.2 Market Restrains

- 5.2.1 Concerns on Competition

- 5.3 Analysis of the Market based on Connectivity (Coverage to include In-depth Trend Analysis)

- 5.3.1 Fixed Network

- 5.3.1.1 Broadband (Cable modem, wireline-fiber, wireline DSL, fixed Wi-Fi ), Trends regarding ADSL/VDSL, FTTP/B, cable modem, FWA, and 5G FWA )

- 5.3.1.2 Narrowband

- 5.3.2 Mobile Network

- 5.3.2.1 Smartphone and Mobile Penetration

- 5.3.2.2 Mobile Broadband

- 5.3.2.3 2G, 3G, 4G, and 5G connections

- 5.3.2.4 Smart Home, IoT, and M2M connections

- 5.3.1 Fixed Network

- 5.4 Analysis of Telecom Towers (Coverage to include in-depth trend analysis of various types of towers, like, lattice, guyed, monopole, and stealth towers)

6 MARKET SEGMENTATION

- 6.1 Segmentation by Services (Coverage to include Average Revenue Per User for the overall Services segment, Market size and Estimates for each segment for the period of 2020-2027 and in-depth Trend Analysis)

- 6.1.1 Voice Services

- 6.1.1.1 Wired

- 6.1.1.2 Wireless

- 6.1.2 Data and Messaging Services (Coverage to include Internet & Handset Data packages, Package Discounts)

- 6.1.3 OTT and Pay-tv Services

- 6.1.1 Voice Services

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nippon Telegraph and Telephone Corporation

- 7.1.2 KDDI Corporation

- 7.1.3 SoftBank Group Corp.

- 7.1.4 Rakuten Mobile, Inc.

- 7.1.5 Internet Initiative Japan, Inc.

- 7.1.6 JSAT Corporation

- 7.1.7 TOKAI Communications Corporation

- 7.1.8 Wowow Inc.

- 7.1.9 Internet Initiative Japan, Inc.

- 7.1.10 Z Holdings Corporation