|

市場調查報告書

商品編碼

1440346

牲畜監測:全球市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global Livestock Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

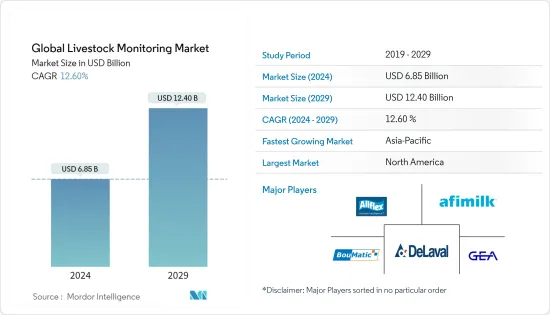

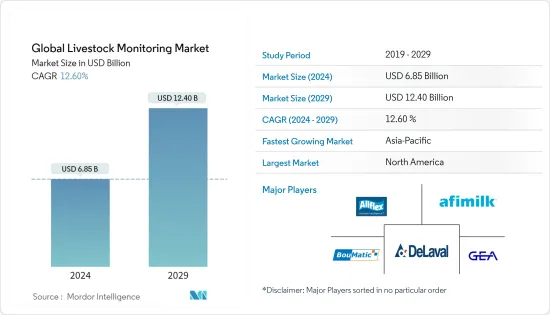

2024年全球牲畜監測市場規模估計為68.5億美元,預計到2029年將達到124億美元,在預測期間(2024-2029年)以12.60%的複合年增長率增長。

COVID-19 不僅對生產業產生了重大影響,而且對畜牧業也產生了重大影響。 政府為遏制COVID-19感染在全國範圍內的傳播而實施的限制措施對畜牧業產生了重大影響,擾亂了動物飼料的供應鏈,降低了牲畜服務,並限制了動物衛生服務,包括疾病檢測的延遲。 和治療。 例如,根據國家生物技術中心 2020 年的數據,COVID-19 感染的爆發對印度乳製品行業造成了沉重打擊,至少因為 COVID-19 大流行的影響使該國的總需求減少了約 25~30%。 自封鎖的第一個月,即 2020 年 3 月 25 日。 此外,為了遏制冠狀病毒的傳播,政府關閉了邊境以限制車輛的通行,這進一步阻礙了向邊境地區客戶運送牛奶。

市場的擴大可歸因於由於牛數量的增加、通用感染疾病發病率的增加以及與牲畜監測管理相關的成本的顯著降低而擴大採用牲畜監測技術。在過去的幾十年裡,世界各地的牲畜數量有所增加。例如,2021年,印度、巴西和中國佔全球牛存欄量的65%以上。此外,動物監測設備在已開發國家已變得司空見慣,可以對牲畜進行即時監測。推動市場擴張的關鍵因素包括日益關注疾病的即時監測和早期診斷、物聯網和人工智慧在牲畜監測中的使用增加以及全球肉類需求的增加。例如,Allflex Livestock Intelligence於2021年10月推出了其智慧型SenseHub監控耳標的增強版。它配備了多功能 LED,有助於檢測群體環境中的個體動物。追蹤所有年齡層的乳牛和肉牛的微妙生育力和反芻模式,以確定它們是否處於發情狀態或需要額外的護理或治療。

此外,市場參與企業之間以產品線和創新為重點的激烈競爭正在影響牲畜管理的未來。例如,2020 年 3 月,美國CattleEye 推出了人工智慧牲畜管理平台。使用該平台,使用者可以了解牛的生活條件、健康狀況、飼料和環境,以提高生產力。

主要亮點

- 然而,牲畜監測解決方案的成本高昂以及農民缺乏技術技能和知識可能會阻礙市場擴張。

畜牧監測市場趨勢

家禽業預計將推動市場成長

家禽產品日常消費量的增加是推動該產業成長的關鍵因素。根據Statista統計,2021年全球肉類消費量加倍,2020年達到3.24億噸。經濟合作暨發展組織公佈的資料顯示,2021年禽肉仍將是肉類產量成長的主要動力。 ,儘管速度比過去十年還要慢。此外,預計到 2030 年,全球肉類消費量將達到 371,675,000 噸。

- 由於對家禽產品的強勁需求以及客戶對高品質產品的認知不斷提高,對動物健康和監測的需求不斷成長。據美國人口普查局稱,美國人口預計將從2014年的3.19億增加到2060年的4.17億。隨著人口成長,對家禽產品的需求可能會進一步增加。

北美預計將擁有較大市場佔有率

預計在預測期內,北美將佔據市場的主要佔有率。這是由於先進的技術發展和家禽產品消費量的增加。經濟合作暨發展組織2021年發布的資料預計,到2030年,北美地區肉類消費量將達到486.02億立方英尺,其中美國將佔449.49億立方英尺,加拿大將佔36.53億立方英尺。美國是世界上最大的雞肉生產國,根據聯合國糧食及農業組織 (UNFAO) 的數據,預計 2021 年肉雞產量將達到 2,040 萬噸。此外,由於通用感染疾病的流行,預計這將增加對監測患病動物的技術的需求,從而推動北美市場的發展。

- 此外,企業和政府為牛管理人員提供牛護理培訓的支持正在推動該地區的市場成長。例如,默克動物保健公司的 Cattle Care365 為希望確保牲畜安全、高效和健康的肉牛管理者提供培訓。

畜牧監測產業概況

全球牲畜監測市場與許多參與者保持適度競爭。因此,參與者將專注於開發先進的監控系統和感測器、降低成本和創新,以確保永續性。主要參與者包括 Allflex Livestock Intelligence、Afimilk Ltd.、DeLaval、GEA Farm Technologies 和 BouMatic。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 主要動物疾病的傳播

- 更加重視即時監測和早期疾病檢測

- 市場限制因素

- 牲畜監測解決方案高成本

- 農民對技術缺乏了解

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 依牲畜類型

- 牛

- 家禽

- 豬

- 其他

- 依成分

- 裝置

- 服務和軟體

- 依用途

- 牛奶收穫

- 飼養管理

- 飼養管理

- 其他

- 依地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東和非洲

- GCC

- 南非

- 中東和非洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭形勢

- 公司簡介

- Allflex Livestock Intelligence

- Lely International NV

- GEA Farm Technologies

- Afimilk Ltd.

- DeLaval

- Dairymaster Ltd.

- Communications Group Lethbridge Ltd.

- Antelliq Corporation

- HID Global Corporation

- Hokofarm-Group BV

第7章市場機會與未來趨勢

The Global Livestock Monitoring Market size is estimated at USD 6.85 billion in 2024, and is expected to reach USD 12.40 billion by 2029, growing at a CAGR of 12.60% during the forecast period (2024-2029).

COVID-19 has majorly impacted the livestock industry as well as the production industries. The restrictions imposed by the government to control the spread of COVID-19 among the nation have had a significant impact on the livestock industry, interrupting the supply chain for animal feed, lowering animal husbandry services, and limiting animal health services including delays in illness detection and treatment. For instance, According to the National Center for Biotechnology Center, 2020, with the incidence of COVID-19, the dairy industry in India has suffered significantly due to the reduced overall demand of about 25-30% in the country, at least during the first one month after the lockdown, that is, since March 25, 2020. In addition, to control the spread of coronavirus, the government has sealed the borders to restrict vehicle mobility which further hampered the transfer of milk to customers in the border regions.

The market's expansion can be ascribed to an increase in the cow population, increased incidences of zoonotic diseases, as well as the increasing adoption of livestock monitoring technologies, as there is substantial cost-saving associated with livestock monitoring management. The livestock population has been increasing over the past few decades globally. For instance, India, Brazil, and China accounted for over 65% of the global cattle inventory in 2021. In addition, animal monitoring devices have become more common in industrialized nations, allowing for real-time monitoring of livestock. Some of the primary drivers driving market expansion include a growing focus on real-time monitoring and early illness diagnosis, expanding usage of IoT and AI for livestock monitoring, and rising worldwide demand for meat. For instance, In October 2021, Allflex Livestock Intelligence launched an enhanced version of its intelligent SenseHub monitoring ear tag, which will have a multi-function LED to aid in the detection of individual animals in a group environment. It keeps track of delicate fertility and rumination behavioral patterns in dairy and beef cattle of all ages to determine whether they are in heat or require additional care or treatment.

Furthermore, fierce competition among market participants, with a strong focus on product lines and innovations, is influencing the future of livestock management. For instance, in March 2020, the United States-based CattleEye introduced an AI-backed livestock management platform. Users with this platform would be able to identify cows and living conditions of their health, feed, and environment to improve productivity.

Key Highlights

- However, the high cost of livestock monitoring solutions, as well as a lack of skills and knowledge of technology among farmers, are likely to stifle market expansion.

Livestock Monitoring Market Trends

Poultry Segment Expects to Drive the Market Growth

The increased daily consumption of poultry products is a crucial factor driving this segment's growth. According to Statista, 2021, The global consumption of meat has doubled, reaching 324 million metric tons in 2020. According to the data published by the Organization for Economic Cooperation and Development, in 2021, poultry meat will remain the key driver of meat production growth, albeit at a slower rate than in the previous decade. In addition, it is estimated that 371,675 kt of meat consumed by 2030, worldwide.

- The increased demand for animal health and monitoring is due to the strong demand for poultry products and growing customer awareness of quality products. According to the United States Census Bureau, the population of the United States is expected to grow from 319 million in 2014 to 417 million in 2060. The demand for poultry products is likely to rise even more as the population grows.

North America is Expected to Have the Significant Market Share

North America is expected to have a significant share of the market in the forecast period. This is due to the high technological developments and increased consumption of poultry products. According to the data published by Organization for Economic Cooperation and Development, in 2021, it has been estimated that 48,602 kt cwe meat will be consumed by 2030 in North America, accounting for 44,949 kt cwe in the United States and 3,653 cwe in Canada. According to the Food and Agriculture Organization of the United Nations (UNFAO), the United States is the largest producer of chicken meat in the world, estimated to produce 20.4 million metric tons of broiler meat in 2021. In addition, the prevalence of zoonotic diseases has fueled the demand for technology to monitor sick animals, which is anticipated to drive the North American market.

- Moreover, the companies providing cattle care training to the caretakers and government support are boosting the growth of the market in this region. For instance, Merck Animal Health's Cattle Care365 provides training for beef cattle caretakers who want to keep their livestock safe, productive, and healthy.

Livestock Monitoring Industry Overview

The global livestock monitoring market is moderately competitive with the presence of many players. As a result, players focus on developing advanced monitoring systems and sensors, cost reduction, and innovation to ensure sustainability. Some of the major players are Allflex Livestock Intelligence, Afimilk Ltd., DeLaval, GEA Farm Technologies, and BouMatic.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Major Animal Diseases

- 4.2.2 Increasing Focus on Real-time Monitoring and Early Disease Detection

- 4.3 Market Restraints

- 4.3.1 High Cost of Livestock Monitoring Solutions

- 4.3.2 Lack of Understanding of Technology Among Farmers

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Livestock Type

- 5.1.1 Cattle

- 5.1.2 Poultry

- 5.1.3 Swine

- 5.1.4 Others

- 5.2 By Component

- 5.2.1 Devices

- 5.2.2 Services and Software

- 5.3 By Application

- 5.3.1 Milk Harvesting

- 5.3.2 Breeding Management

- 5.3.3 Feeding Managemnet

- 5.3.4 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Allflex Livestock Intelligence

- 6.1.2 Lely International NV

- 6.1.3 GEA Farm Technologies

- 6.1.4 Afimilk Ltd.

- 6.1.5 DeLaval

- 6.1.6 Dairymaster Ltd.

- 6.1.7 Communications Group Lethbridge Ltd.

- 6.1.8 Antelliq Corporation

- 6.1.9 HID Global Corporation

- 6.1.10 Hokofarm-Group BV