|

市場調查報告書

商品編碼

1440260

鋁零件重力鑄造:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Aluminum Parts Gravity Die Casting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

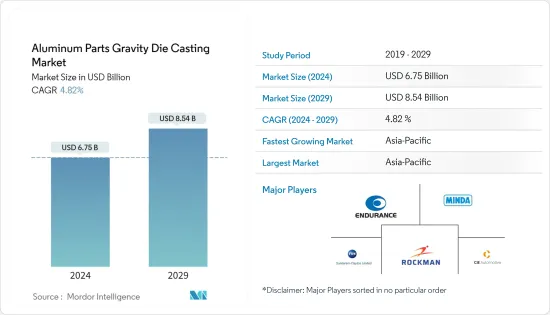

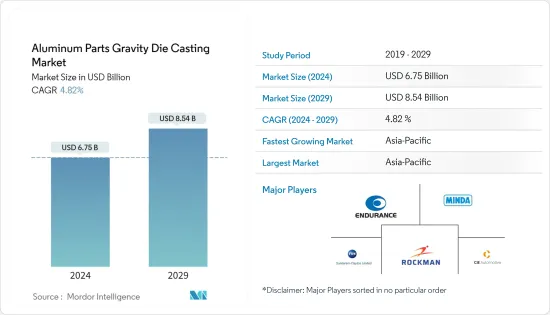

鋁零件重力鑄造市場規模預計到 2024 年為 67.5 億美元,預計到 2029 年將達到 85.4 億美元,在預測期內(2024-2029 年)成長 4.82%,年複合成長率為

2020年COVID-19爆發時,整個汽車產業供應鏈受到了顯著影響。OEM正在努力維持業務。然而,隨著封鎖和限制的放鬆,汽車產業和鋁零件重力鑄造市場恢復了勢頭。

該市場主要由壓鑄行業供應鏈的複雜性、汽車市場的擴張、壓鑄件在工業機械中的普及不斷提高、建築行業的成長以及鋁鑄件在汽車工業中的採用所推動。電氣和電子領域。馬蘇。

重力壓鑄是最古老的壓鑄方法之一。這種壓鑄工藝用於生產尺寸精確、輪廓清晰、表面光滑或有紋理的金屬零件。重力鑄造的主要優點是生產速度快。

CAFE 標準和 EPA 旨在減少車輛排放氣體和提高燃油效率的政策正在推動汽車製造商透過採用輕質金屬來減輕車輛重量。此後,採用壓鑄件作為減重策略,對汽車領域的前市場起到了重要的推動作用。

鋁件重力鑄造市場趨勢

嚴格的 EPA 法規和咖啡館標準可能會推動市場需求

歐洲和北美汽車法律規範為創建汽車行業的永續環境做出了貢獻。最新的法規結構Euro 6 於 2011 年推出並於 2014 年 9 月生效,它改變了對於確定該地區汽車市場方向非常重要的監管標準。自2013年以來,EC(歐盟委員會)與EEA/EMEP合作,保存了在歐洲註冊的每輛新車的排放性能標準記錄。

排放法規將汽車製造商團結在一起。貨運公司和車隊所有者正在迅速採取行動,實施更多有望降低平均排放率的技術。因此,減輕車輛重量以降低排放氣體水準的需求極大地促進了壓鑄件在車輛中的採用。

汽車製造商不斷尋找提高車輛零件效率的方法,以提高車輛燃油效率並減少碳排放。使用高效且成本最佳化的鋁壓鑄件的輕量化結構在實現這一目標方面發揮關鍵作用。 Nemak 等公司正在關注「輕量化」趨勢,並將電動車產品(採用 HPDC 製程製造)引入汽車產業。上述環境政策預計將增加市場需求。

亞太地區預計將佔據主要市場佔有率

由於印度、中國等主要經濟體的存在、主要企業的積極參與以及多項政府舉措,亞太地區是全球最大的汽車市場,預計將進一步促進鋁重力的發展。壓鑄市場。中國是世界主要鋁及鋁製品出口國之一。 2022年,中國鋁出口量與前一年同期比較%,達到100萬噸,從2021年12月的僅39.69億噸,達到2022年12月的57,349萬噸。

由於全球對中國產品的高需求,亞太地區也正在感染疾病(COVID-19) 大流行的影響中迅速恢復。隨著製造能力的增加,鋁零件重力鑄造市場的需求預計在預測期內將成長。

2022年,Vedanta(1,696,960噸)、Hindalco(969,180噸)和Nalco(343,460噸)是三大鋁生產公司。印度是世界第二大鑄造業,生產鑄造金屬。印度的鑄造廠可以生產符合國際標準的重力鑄造產品,用途廣泛。

政府對「印度製造」的關注、汽車工業的發展和嚴格的排放標準正在推動市場的成長。 2022-23 年小客車(PV)出口總量為 662,891 輛,而 2021-22 年為 577,875 輛。現代、起亞、馬魯蒂鈴木和大眾等公司正在向非洲銷售印度製造的汽車,而不是在該地區設立工廠,因為印度的製造成本較低且零件供應商較多。我們正在向該地區出口。所有這些因素都有助於預測期內亞太鋁零件重力鑄造市場的整體發展。

鋁件重力鑄造產業概況

鋁零件重力鑄造市場本質上是分散的,有大量大型/國際參與者以及跨越多個國家的中小型參與者。

主要企業也透過各種合併、擴張、聯盟、合資和收購進行全球擴張。這些主要企業將收益集中在研發上,以設計更好的生產流程和合金。這項策略可以幫助為全球汽車和工業領域生產高品質的壓鑄零件。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 重視汽車和航太的輕量材料

- 市場限制因素

- 設計彈性有限

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔(市場規模、金額)

- 目的

- 車

- 零件

- 傳動部件

- 引擎零件

- 煞車零件

- 其他零件

- 車輛類型

- 小客車

- 商用車

- 其他車輛

- 電氣和電子

- 工業用途

- 其他用途

- 車

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 土耳其

- 中東和非洲其他地區

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Rockman Industries

- Endurance Technologies Limited

- Minda Corporation Limited

- Hitachi Metals Ltd

- MAN Group Co.

- MRT Castings Ltd

- Harrison Castings Limited

- Vostermans Companies

- CIE Automotive

- Sundaram Clayton Ltd

- GWP Manufacturing Services AG

第7章市場機會與未來趨勢

- 電動車的採用率增加

- 改良的模具設計、電腦輔助模擬和製程控制系統

The Aluminum Parts Gravity Die Casting Market size is estimated at USD 6.75 billion in 2024, and is expected to reach USD 8.54 billion by 2029, growing at a CAGR of 4.82% during the forecast period (2024-2029).

During the COVID-19 outbreak in 2020, the entire supply chain of the automotive industry was significantly impacted. The OEMs struggled to keep their operations going. However, as the lockdowns and restrictions were relaxed, the automotive industry and the aluminum parts gravity die-casting market regained their momentum.

The market is largely driven by supply chain complexities in the die-casting industry, the expanding automotive market, increasing penetration of die-casting parts in industrial machinery, the growing constructional sector, and employing aluminum castings in the electrical and electronics sector.

Gravity die casting is one of the oldest methods of die casting. This die-casting process is used for producing accurately dimensioned, sharply defined, and smooth or textured-surface metal parts. The main advantage of gravity die casting is its high speed of production.

The CAFE standards and EPA policies to cut down automobile emissions and increase fuel efficiency are driving the automakers to reduce the weight of automobiles by employing lightweight metals. Subsequently, employing die-cast parts as a weight reduction strategy is acting as a major driver for the former market in the automotive segment.

Aluminum Parts Gravity Die Casting Market Trends

Stringent EPA Regulations and Cafe Standards are Likely to Drive Demand in the Market

The automobile regulatory frameworks in Europe and North America have been instrumental in creating a sustainable environment in the automobile industry. The latest regulatory framework, Euro 6, which was introduced in 2011 and came into effect from September 2014 onward, changed the regulatory standards that have been crucial in determining the dynamics of the automotive market in the region. Since 2013, the EC (European Commission), along with EEA/EMEP, has been maintaining the record of emission performance standards for each new vehicle registered in Europe.

The emission regulations bind the automotive manufacturers together. Freight companies and fleet owners are rapidly moving toward incorporating more technologies that are expected to reduce the average emission rate. Thereby, a need to reduce vehicle weight to lowering emission levels has greatly encouraged the employment of die-cast parts in vehicles.

Automobile manufacturers are always looking for ways to make vehicle components more efficient to improve the fuel efficiency of vehicles and reduce carbon emissions. Lightweight construction, using efficient and cost-optimized aluminum die-casted parts, plays a key role in achieving this goal. Companies like Nemak are focusing on the 'lightweight' trend and introducing electric vehicle products (manufactured by using the HPDC process) into the automotive industry. Such aforementioned environmental policies are expected to drive the demand in the market.

The Asia-Pacific Region is Expected to Hold a Significant Share in the Market

Asia-Pacific is the largest automotive market in the world due to the presence of key economies like India, China, etc., and active engagements of key players and several government initiatives, which are expected to further contribute to the development of the aluminum gravity die-casting market. China is the world's leading exporter of aluminum and aluminum products. In 2022, China's exports of aluminum increased by 741.4% year on year to 1 million mt and reached 57,349 mt in December 2022 compared to only 3,969 mt in December 2021.

The Asia-Pacific region has also recovered quickly from the impact of the COVID-19 pandemic due to the high demand for Chinese products across the world. With growing manufacturing capabilities, the demand in the aluminum parts gravity die-casting market is expected to grow during the forecast period.

In 2022, Vedanta (1,696,960 mt), Hindalco (969,180 mt), and Nalco (343,460 mt) were the three prominent companies in aluminum production. India stands as the second-largest foundry industry that produces castings in the world. Foundries in India are capable of producing gravity die-casting products that serve a wide range of applications conforming to international standards.

The government's focus on 'Make in India', developing the automotive industry, and the stringent emission norms is driving the market growth. In FY 2022-23, total passenger vehicle (PV) exports stood at 6,62,891 units in compare to 5,77,875 units in 2021-22. Companies such as Hyundai, Kia, Maruti Suzuki, and Volkswagen are exporting Indian-made cars to the African region instead of setting up their factories there because of low-cost manufacturing and availability of parts suppliers in India. All these factors contribute to the overall development of the Asia-Pacific aluminum parts gravity die casting market during the forecast period.

Aluminum Parts Gravity Die Casting Industry Overview

The market for aluminum parts gravity die casting is fragmented in nature, with the presence of many regional small-medium scale players across several countries, as well as large-scale/international players.

Key players have also expanded their operations globally through various mergers, expansions, partnerships, joint ventures, and acquisitions. These key players are focusing their revenues on R&D to come up with better production processes and alloys. This strategy may assist in the production of premium-quality die-cast parts for the global automotive and industrial sectors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Emphasis on Lightweight Materials in Automobile and Aerospace sector

- 4.2 Market Restraints

- 4.2.1 Limited Design Flexibility

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 Application

- 5.1.1 Automotive

- 5.1.1.1 Parts and Components

- 5.1.1.1.1 Transmission Parts

- 5.1.1.1.2 Engine Parts

- 5.1.1.1.3 Brake Parts

- 5.1.1.1.4 Other Parts and Components

- 5.1.1.2 Vehicle Type

- 5.1.1.2.1 Passenger Cars

- 5.1.1.2.2 Commercial Vehicles

- 5.1.1.2.3 Other Vehicles

- 5.1.2 Electrical and Electronics

- 5.1.3 Industrial Applications

- 5.1.4 Other Applications

- 5.1.1 Automotive

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Turkey

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Rockman Industries

- 6.2.2 Endurance Technologies Limited

- 6.2.3 Minda Corporation Limited

- 6.2.4 Hitachi Metals Ltd

- 6.2.5 MAN Group Co.

- 6.2.6 MRT Castings Ltd

- 6.2.7 Harrison Castings Limited

- 6.2.8 Vostermans Companies

- 6.2.9 CIE Automotive

- 6.2.10 Sundaram Clayton Ltd

- 6.2.11 GWP Manufacturing Services AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Adoption of Electric Vehicles

- 7.2 Improved Tooling Design, Computer-aided Simulation, and Process Control Systems