|

市場調查報告書

商品編碼

1439862

交聯劑 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029 年)Crosslinking Agents - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

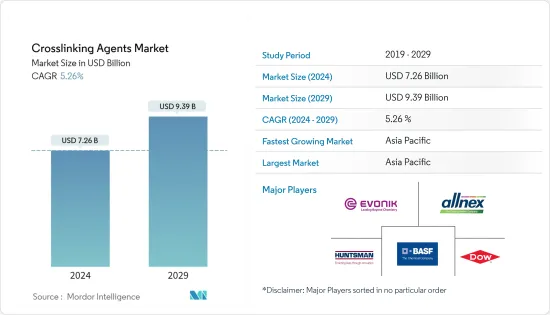

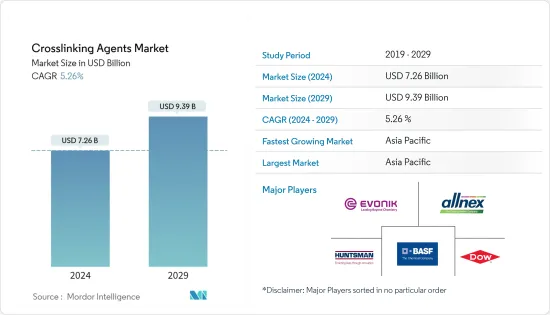

交聯劑市場規模預計到2024年為72.6億美元,預計到2029年將達到93.9億美元,在預測期內(2024-2029年)CAGR為5.26%。

COVID-19 大流行對市場產生了負面影響,但由於全球建築和汽車行業的強勁成長,預計在預測期內將穩步成長。

主要亮點

- 推動市場的主要因素是對各種塗料的需求不斷成長以及對高性能交聯劑的日益重視。

- 另一方面,自交聯劑的存在可能會阻礙市場成長。

- 在預測期內,對創新塗料的需求不斷成長是全球交聯劑市場的重大機會。

- 亞太地區佔據了市場主導地位,預計在預測期內將以最高的CAGR成長。

交聯劑市場趨勢

對裝飾塗料的需求不斷增加

- 裝飾塗料適用於住宅、商業、機構和工業建築的內部和外部表面。全球建築業的成長又增加了裝飾塗料中各種交聯劑的需求。

- 亞太地區的建築業是世界上最大的。由於人口成長、中產階級收入增加和城市化,這一數字以健康的速度成長。

- 中國是購物中心建設領先的國家之一。中國是購物中心建設的領先國家之一。中國擁有近 4,000 家購物中心,預計到2025年還將開幕 7,000 家購物中心。

- 此外,據國家發展和改革委員會表示,2019年中國政府批准了26個基礎設施計畫,預計投資約1,420億美元,將於2023年完工並進行中。不斷成長的住房需求可能會推動該國公共和私營部門的住宅建設。

- 美國擁有世界上最大的建築業之一。根據美國人口普查局的資料,2021年美國新建工程年價值為 16,264.44 億美元,而2020年為 14,995.70 億美元。

- 在加拿大,各種政府項目,包括經濟適用住房計劃(AHI)、加拿大新建築計劃(NBCP)和加拿大製造,一直在支持該行業的擴張。

- 根據 AIA(美國建築師協會)建築共識預測小組的資料,非住宅建築支出預計在2022年成長 5.4%,並在2023年成長至 6.1%。到2023年,所有主要商業、工業和機構預計類別將至少出現相當健康的成長。

- 預計所有這些因素都將在預測期內推動裝飾塗料的需求。

亞太地區將主導市場

- 由於中國高度發展的汽車產業,加上多年來該地區為推動建築和各種工業領域的持續投資,預計亞太地區將主導全球市場。

- 中國政府預計,到2025年,電動車的滲透率將達到20%。中國擁有全球最大、成長最快的電動車市場,2022年上半年,中國大陸向客戶交付了超過240 萬輛電動車,相當於全球電動車銷量的26%。中國的所有汽車銷售。隨著國內汽車產量的增加,對汽車塗料的需求可能會上升,預計這將影響交聯劑市場。

- 中國汽車製造業對全球汽車產量做出了重要貢獻。根據OICA統計,中國擁有全球最大的汽車生產基地,2021年汽車總產量為2,608萬輛,比去年的2,523萬輛成長3%。根據中國汽車工業協會統計,2022年前7個月,全國汽車產量1,457萬輛,較去年同期成長31.5%。

- 在印度,根據「印度製造」改革,該國政府為跨國公司在印度設立基地提供了有利的法規。此外,製造業中外國直接投資佔有率的增加也可能進一步吸引外國企業的投資。因此,預計將在未來幾年支持工業生產。

- 根據經濟產業省(METI)的報告,2021年日本工業生產成長超過3%。該國擁有大型電子和其他零件生產基地,其中大部分出口到經濟體在北美、歐洲和亞太地區。日本電子資訊科技協會(JEITA)公佈的資料顯示,預計到2022年底,日本電子和IT企業的全球產量將實現年比2%的正成長。

- 各種應用的油漆和塗料行業的持續成長預計將在未來幾年推動交聯劑市場的發展。

交聯劑產業概況

就收入而言,交聯劑市場本質上是部分分散的,許多參與者在市場上競爭。市場上一些主要的參與者包括(排名不分先後)Evonik Industries AG、BASF、Dow、Huntsman International LLC和Allnex GMBH等。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場動態

- 促進要素

- 對多種塗料的需求不斷增加

- 越來越關注高性能交聯劑

- 限制

- 自交聯劑的存在

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭程度

第5章 市場區隔(市場價值規模)

- 類型

- 醯胺

- 胺

- 氨基

- 碳二亞胺

- 異氰酸酯

- 其他類型

- 應用

- 汽車塗料

- 裝飾塗料

- 工業塗料

- 包裝塗料

- 其他應用

- 地理

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太

第6章 競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 領先企業採取的策略

- 公司簡介

- BASF SE

- Aditya Birla Chemicals

- Allnex GMBH

- Covestro AG

- Evonik Industries AG

- Hexion

- Huntsman International LLC

- Dow

- Wanhua Chemical Group Co. Ltd

- Nisshinbo Chemical Inc.

- NIPPON SHOKUBAI CO. LTD

- Mitsubishi Chemical Corporation

- KUMHO P&B CHEMICALS INC.

第7章 市場機會與未來趨勢

- 對創新塗料的需求

The Crosslinking Agents Market size is estimated at USD 7.26 billion in 2024, and is expected to reach USD 9.39 billion by 2029, growing at a CAGR of 5.26% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market but is projected to grow steadily in the forecast period owing to strong global growth in the construction and automotive sectors.

Key Highlights

- The major factors driving the market are rising demand for various coatings and an increased emphasis on high-performance crosslinking agents.

- On the other hand, the presence of self-crosslinking agents might hamper the market growth.

- During the forecast period, the increasing demand for innovative coatings is a major opportunity in the global crosslinking agent market.

- Asia-Pacific has dominated the market and is expected to grow with the highest CAGR during the forecast period.

Crosslinking Agents Market Trends

Increasing Demand for Decorative Coatings

- Decorative coatings are applied to the interior and exterior surfaces of residential, commercial, institutional, and industrial buildings. The increase in the construction sector worldwide is, in turn, boosting the demand for various crosslinking agents in decorative coatings.

- The construction sector in the Asia-Pacific region is the largest in the world. It is increasing at a healthy rate, owing to the rising population, increase in middle-class income, and urbanization.

- China is one of the leading countries concerning the construction of shopping centers. China is one of the leading countries in shopping-center construction. China has almost 4,000 shopping centers, while 7,000 more are estimated to be open by 2025.

- Moreover, according to National Development and Reform Commission, the Chinese government approved 26 infrastructure projects at an estimated investment of about USD 142 billion in 2019, which are estimated to be completed by 2023 and are ongoing. The growing demand for housing is likely to drive residential construction in the country, both in the public and private sectors.

- The United States has one of the world's largest construction industries. According to the United States Census Bureau, the annual value for new construction put in place in the United States accounted for USD 1,626,444 million in 2021, compared to USD 1,499,570 million in 2020.

- In Canada, various government projects, including the Affordable Housing Initiative (AHI), New Building Canada Plan (NBCP), and Made in Canada, have been supporting the expansion of the sector.

- According to the AIA (American Institute of Architects) Construction Consensus Forecast Panel, nonresidential building construction spending is expected to expand by 5.4% in 2022 and strengthen to a 6.1% expansion in 2023. By 2023, all the major commercial, industrial, and institutional categories are projected to witness at least reasonably healthy gains.

- All such factors are anticipated to drive the demand for decorative coating during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate the global market, owing to the highly developed automotive sector in China, coupled with the continuous investments done in the region to advance the architectural and various industrial sectors through the years.

- The government of China estimates a 20% penetration rate of electric vehicles by 2025. China has the largest and fastest-growing EV market in the world, In H1 2022, over 2.4 million EVs were delivered to customers in mainland China equating to 26% of all car sales in China. With the increasing production of vehicles in the country, the demand for automotive coating is likely to ascend, which is anticipated to influence the market for crosslinking agents.

- Automobile manufacturing in China is a significant contributor to global automobile production. According to OICA, China has the largest automotive production base in the world, with a total vehicle production of 26.08 million units in 2021, registering an increase of 3% compared to 25.23 million units produced last year. Further, according to the China Association of Automobile Manufacturers (CAAM), in the first 7 months of 2022, the country has produced 14.57 million units of cars, registering a growth rate of 31.5% Year on Year.

- In India, under the Make in India reform, the government of the country has offered favorable regulations for multinationals to set up their bases in India. Moreover, an increase in FDI share in the manufacturing industry is further likely to attract investments by foreign players. Thereby, it is expected to support industrial production in the upcoming years.

- As per the reports by the Ministry of Economy Trade and Industry (METI), industrial production in Japan increased by over 3% in 2021. The country has a large production base for electronics and other components, the majority of which is exported to the economies in North America, Europe, and Asia-Pacific. According to the data published by the Japan Electronics and Information Technology (JEITA), Global production by Japanese electronics and IT companies is expected to record positive growth of 2% year on year by the end of 2022.

- Continuous growth in the paint and coatings industry for various applications is expected to drive the market for crosslinking agents through the years to come.

Crosslinking Agents Industry Overview

The crosslinking agents market is partially fragmented in nature in terms of revenue with many players competing in the market. Some of the major players in the market include (not in any particular order) Evonik Industries AG, BASF SE, Dow, Huntsman International LLC, and Allnex GMBH, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demad for Numerous Coatings

- 4.1.2 Increasing Focus on High-Performance Crosslinking Agents

- 4.2 Restraints

- 4.2.1 Presence of Self-Crosslinking Agents

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Amide

- 5.1.2 Amine

- 5.1.3 Amino

- 5.1.4 Carbodiimide

- 5.1.5 Isocyanate

- 5.1.6 Other Types

- 5.2 Application

- 5.2.1 Automotive Coatings

- 5.2.2 Decorative Coatings

- 5.2.3 Industrial Coatings

- 5.2.4 Packaging Coatings

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Aditya Birla Chemicals

- 6.4.3 Allnex GMBH

- 6.4.4 Covestro AG

- 6.4.5 Evonik Industries AG

- 6.4.6 Hexion

- 6.4.7 Huntsman International LLC

- 6.4.8 Dow

- 6.4.9 Wanhua Chemical Group Co. Ltd

- 6.4.10 Nisshinbo Chemical Inc.

- 6.4.11 NIPPON SHOKUBAI CO. LTD

- 6.4.12 Mitsubishi Chemical Corporation

- 6.4.13 KUMHO P&B CHEMICALS INC.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Demand for Innovative Coatings