|

市場調查報告書

商品編碼

1439843

Diethylene Glycol (DEG) - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Diethylene Glycol (DEG) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

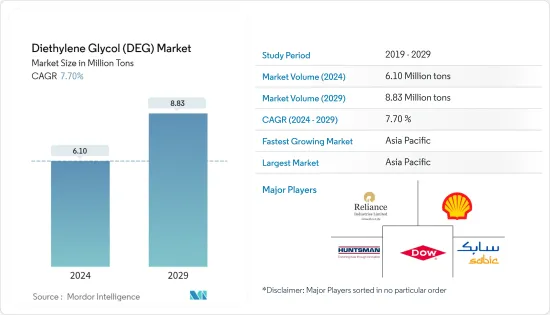

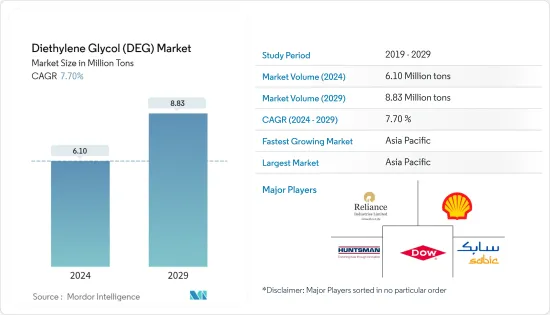

預計2024年Diethylene Glycol市場規模為610萬噸,預計2029年將達到883萬噸,在預測期間(2024-2029年)CAGR為7.70%。

COVID-19 大流行對市場產生了負面影響。這是因為封鎖和限制導致製造設施和工廠關閉。供應鏈和運輸中斷進一步對市場造成了障礙。然而,2021年該產業出現復甦,使研究市場的需求反彈。

主要亮點

- 短期內,印度和中國等新興經濟體建築、油漆和塗料行業需求的增加是推動市場成長的因素。

- 另一方面,由於DEG的毒性和原料價格波動而限制其使用的法規是限制所研究市場成長的一些因素。

- 然而,由於PET樹脂和紡織業下游用途的增加,DEG作為化學工業的化學中間體的需求不斷增加,是未來推動市場的主要機會。

- 由於基礎設施建設的加強和工業化的快速發展,亞太地區在全球佔據主導地位,並將成為成長最快的市場。

Diethylene Glycol(DEG)市場趨勢

塑膠產業需求不斷成長

- DEG是環氧乙烷部分水解產生的有機化合物。它是一種無色、無臭、低揮發性、低黏度、有甜味的液體。

- 隨著DEG作為生產紙張、軟木和合成海綿塑化劑原料的使用不斷增加,塑膠產業對DEG的需求不斷增加。預計它將在預測期內推動其市場。

- DEG也用於生產聚氨酯等塑膠材料。用於冰箱和冰櫃的隔熱以及汽車工業中的塗層和密封材料。例如,根據OICA的資料,2022年美國汽車產量為1,00,60,339輛,較2021年成長10%。因此,汽車產量的增加預計將創造需求用於Diethylene Glycol(DEG)。

- 中國是全球市場上最大的聚氨酯原料及產品生產國。例如,根據中國國家統計局的資料,2021年,中國塑膠製品總產量為8,000萬噸,比上年(2020年)增加5.27%。因此,該國塑膠產品產量的增加預計將為該國Diethylene Glycol(DEG)市場創造需求。

- 由於上述所有因素,Diethylene Glycol市場預計將在預測期內快速成長。

亞太地區主導市場

- 在中國和印度等國家,由於政府在基礎設施發展和快速工業化方面的支出增加,該地區對DEG的需求日益增加。

- 建築、塑膠和汽車等各種最終用戶產業對聚酯樹脂和聚氨酯等產品的需求不斷成長,預計將推動該地區對DEG的需求。它充當其生產的化學中間體。此外,亞太國家各種化學品產量的增加影響了市場的成長。

- 據印度工商聯合會表示,印度政府將農化行業視為實現全球領先地位的 12 大行業之一,到2025年將成長 8-10%。因此,印度農化產業預計將在預測期內成長。

- 據中國塗料工業協會表示,在中國,在建築業和汽車製造業的支持下,國內塗料需求可能增加8%。例如,根據OICA的資料,2022年中國汽車產量為2,70,20,615輛,較2021年成長3.3%。因此,中國汽車產量的增加預計將消耗更多的塗料和塗料,為Diethylene Glycol(DEG)市場創造了上行空間。

- 中國和印度是人口最多的兩個國家,但仍處於發展中。因此,農業化學品、油漆和塗料以及個人護理行業預計將出現巨大成長。例如,2022年,印度住宅市場推出了超過 32.8 萬套房屋。儘管該國對住房的需求很高,但過去幾年住宅的推出量仍處於相對較高的水準。因此,建築塗料需求的增加預計將提振DEG市場。

- 由於上述因素,預計Diethylene Glycol(DEG)市場在研究期間將顯著成長。

Diethylene Glycol(DEG)產業概況

DEG市場高度分散。市場上的一些主要參與者包括(排名不分先後)Reliance Industries Limited、SABIC、Dow、Huntsman International LLC和Shell等。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場動態

- 促進要素

- 各行業對塑膠的需求不斷成長

- 油漆和塗料的需求不斷增加

- 其他促進要素

- 限制

- DEG的毒性

- 其他限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章 市場區隔(市場規模(量))

- 應用

- 塑化劑

- 個人護理

- 化學中間體

- 潤滑劑

- 其他應用(溶劑等)

- 最終用戶產業

- 塑膠

- 農業化學品

- 化妝品和個人護理

- 油漆和塗料

- 其他最終用戶產業(紡織、石油和天然氣等)

- 地理

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太

第6章 競爭格局

- 併購、合資、合作與協議

- 市佔率(%)**/排名分析

- 領先企業採取的策略

- 公司簡介

- Crystal India

- Dow

- PTT Global Chemical Public Company Limited(GC Glycol Company Limited)

- Huntsman International LLC

- India Glycols Limited

- Indorama Ventures Public Company Limited

- Mitsubishi Chemical Corporation

- NIPPON SHOKUBAI CO., LTD

- Petroliam Nasional Berhad(PETRONAS)

- Reliance Industries Limited

- SABIC

- Shell

- Tokyo Chemical Industry Co., Ltd.

第7章 市場機會與未來趨勢

- 作為化學中間體的DEG的需求不斷成長

- 其他機會

The Diethylene Glycol Market size is estimated at 6.10 Million tons in 2024, and is expected to reach 8.83 Million tons by 2029, growing at a CAGR of 7.70% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market. It was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, increasing demand from the construction and paints and coatings industries in emerging economies such as India and China are factors driving the market's growth.

- On the flip side, regulations restricting DEG use due to its toxic nature and volatile prices of raw materials are some of the factors restraining the growth of the market studied.

- However, increasing demand for diethylene glycol as a chemical intermediate in the chemical industry due to increased downstream uses in PET resins and the textile industry are the major opportunities to drive the market in the future.

- The Asia-Pacific region dominates the world and will be the fastest-growing market due to increased infrastructure development and rapid industrialization.

Diethylene Glycol (DEG) Market Trends

Increasing Demand in the Plastics Industry

- Diethylene glycol is an organic compound produced by partial hydrolysis of ethylene oxide. It is a colorless, odorless, low volatility, and low viscosity liquid with a sweet taste.

- Increasing the use of diethylene glycol as raw material in producing plasticizers for paper, cork, and synthetic sponges, the demand for diethylene glycol is rising in the plastic industry. It is expected to drive its market during the forecast period.

- Diethylene glycol is also used for producing plastic materials like polyurethane. It is used for the insulation of refrigerators and freezers and as a coating and sealant material in the automobile industry. For instance, according to OICA, in 2022, automobile production in the United States amounted to 1,00,60,339 units, which showed an increase of 10% compared to 2021. As a result, an increase in automobile production is expected to create demand for Diethylene glycol (DEG).

- China is the largest polyurethane raw materials and product producer in the global market. For instance, according to the National Bureau of Statistics of China, in 2021, China's total production of plastic products amounted to 80 million metric tons, which showed an increase of 5.27% compared to the previous year (2020). Therefore, an increase in the production of plastic products in the country is expected to create demand for the Diethylene glycol (DEG) market in the country.

- Owing to all the factors mentioned above diethylene glycol market is expected to grow rapidly over the forecast period.

The Asia-Pacific Region to Dominate the Market

- In countries like China and India, the demand for diethylene glycol is increasing in the region due to increasing government spending on infrastructure development and rapid industrialization.

- The increasing need for products, such as polyester resins and polyurethanes, in various end-user industries, like construction and building, plastic, and automotive, is projected to boost the demand for diethylene glycol in the region. It acts as a chemical intermediate for their production. Moreover, the rising production of various chemicals in Asia-Pacific countries impacted the market growth.

- According to the Federation of Indian Chambers of Commerce and Industry, the Indian government recognizes the agrochemical industry as one of its top 12 industries to achieve global leadership, growing 8-10% through 2025. Thus, India's agrochemical sector is projected to grow during the forecast period.

- According to the China National Coatings Industry Association, in China, the demand for coatings in the country is likely to grow by 8% with the support of building and construction and automotive manufacturing. For instance, according to OICA, in 2022, automobile production in China amounted to 2,70,20,615 units, which showed an increase of 3.3% compared to 2021. Therefore, increasing the production of automobiles in the country is expected to consume more paints and coatings, creating an upside for the diethylene glycol (DEG) market.

- China and India are the top two largest populated countries, which are still developing. So, huge growth is expected in the agrochemicals, paints and coatings, and personal care industries. For instance, in 2022, over 328 thousand housing units were launched across India's residential market. Even though there is high demand for housing in the country, residential launches are on a comparatively high level over the past few years. Therefore, increasing demand for architectural coatings is expected to boost the diethylene glycol market.

- Owing to the abovementioned factors, the Diethylene glycol (DEG) market is projected to grow significantly during the study period.

Diethylene Glycol (DEG) Industry Overview

The diethylene glycol market is highly fragmented. Some of the major players in the market include (not in any particular order) Reliance Industries Limited, SABIC, Dow, Huntsman International LLC, and Shell, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Plastic Demand from Various Industries

- 4.1.2 Increasing Demand in Paints and Coatings

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Toxic Nature of Diethylene Glycol

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Plasticizers

- 5.1.2 Personal Care

- 5.1.3 Chemical Intermediates

- 5.1.4 Lubricant

- 5.1.5 Other Applications (Solvent, etc.)

- 5.2 End-user Industry

- 5.2.1 Plastics

- 5.2.2 Agrochemicals

- 5.2.3 Cosmetic and Personal Care

- 5.2.4 Paints and Coatings

- 5.2.5 Other End-user Industries (Textiles, Oil and Gas, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Crystal India

- 6.4.2 Dow

- 6.4.3 PTT Global Chemical Public Company Limited (GC Glycol Company Limited)

- 6.4.4 Huntsman International LLC

- 6.4.5 India Glycols Limited

- 6.4.6 Indorama Ventures Public Company Limited

- 6.4.7 Mitsubishi Chemical Corporation

- 6.4.8 NIPPON SHOKUBAI CO., LTD

- 6.4.9 Petroliam Nasional Berhad (PETRONAS)

- 6.4.10 Reliance Industries Limited

- 6.4.11 SABIC

- 6.4.12 Shell

- 6.4.13 Tokyo Chemical Industry Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for Diethylene Glycol as a Chemical Intermediate

- 7.2 Other Opportunities