|

市場調查報告書

商品編碼

1439727

智慧鎖:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Smart Lock - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

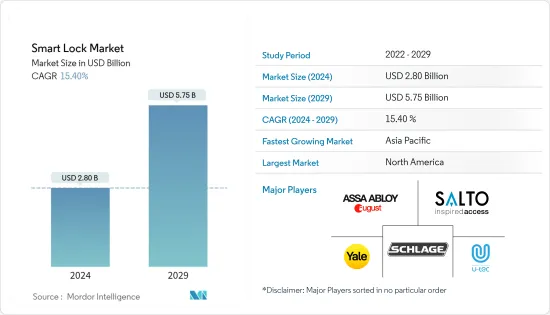

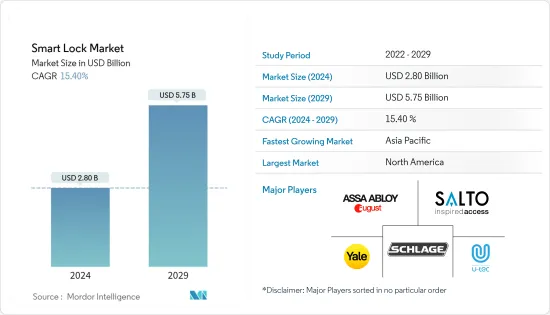

預計2024年智慧鎖市場規模為28億美元,預計2029年將達57.5億美元,在預測期間(2024-2029年)年複合成長率為15.40%。

世界各地擴大採用智慧家庭架構,包括遠端存取、語音控制和無縫連接等功能,進一步推動了住宅智慧鎖的採用。此外,住宅也對無需攜帶機械鑰匙感興趣。

主要亮點

- 全球智慧家庭的日益普及以及提供家庭自動化技術的公司的崛起進一步推動了智慧鎖需求的成長。產業參與者專注於開發尖端技術和商業性可行的產品,例如遠端鎖定和打開門窗。

- 此外,配備語音助理的家庭數量正在穩步增加,因此製造商正在將其產品與此類設備相結合,從而實現對門鎖的語音控制。客戶對複雜且簡單的鎖定/解鎖解決方案的要求越來越高,這些進步預計將進一步提高其受歡迎程度。越來越多的房地產需要進行識別和認證,包括私人住宅、飯店、超級市場、銀行、金融機構、企業建築和商業建築。

- 智慧型手機的日益普及也刺激了連網型設備的成長,這些裝置允許用戶使用各種相關的行動應用程式遠端存取和解鎖門。根據電商公司Obero統計,目前全球有35億智慧型手機用戶,普及約全球77億人口的45.4%。簡而言之,現在世界上十分之四的人擁有智慧型手機。

- 在各種促進因素中,由於駭客漏洞的普遍存在和網路犯罪威脅的增加,智慧鎖市場的成長可能面臨挑戰,特別是智慧鎖是網路犯罪分子的熱門目標。例如,今年7月,NCC集團的安全研究人員報告稱,Nuki智慧鎖系統存在11個安全問題,其中一個可能允許入侵者解鎖門的問題也包含在內。諸如此類的案例,讓一般使用者產生了一種焦慮感。

- COVID-19感染疾病導致ICT產業投資大幅下降,特別是物聯網、5G技術和其他新興技術。智慧鎖市場的參與者被迫限制營運費用。就業和資本預算也被削減。此外,這種情況下的個人可自由支配支出也減少了智慧鎖的銷售。市場前景黯淡,預計經濟放緩將持續到去年第二季。

智慧鎖市場趨勢

商業用途預計將大幅增加

- 透過遠端存取對各種入口點進行安全、輕鬆的管理以及追蹤場所安全的能力等因素正在推動智慧鎖在這些空間中的採用,各個相關人員都進行了大量投資。我開始這樣做。諸如此類的統計數據凸顯了這些場所(主要是學校和教堂)的組織在公共場所大規模槍擊事件發生的時代需要追求盡可能高的安全等級。

- 然而,客戶服務和體驗在餐旅服務業中發揮著重要作用。飯店管理人員將協助您讓您的住宿盡可能舒適。在此過程中,各酒店正計劃在其酒店中引入支援藍牙或支援 Wi-Fi 的鎖,而不是可透過晶片卡存取的 RFID 鎖,以提高飯店場所的安全性。

- 飯店業迅速採用智慧鎖來解決顧客在店內日益成長的安全問題。隨著酒店尋求加強室內安全,免鑰出入控管系統預計將在未來幾年變得更加普及。市場領先的公司為酒店業提供創造性解決方案。基於應用程式的租賃物業門禁服務 Hoomvip 安裝了 Assa Abloy 商標之一 TESA 的 ENTR 智慧門鎖,以增強安全性並確保無障礙進入租賃住宅。

- 此外,針對企業和辦公空間的新型智慧鎖的推出具有很高的成長潛力,因為大量的人需要進入同一場所。由於需要提高安全性,管理員需要簡化授權使用者的門解鎖流程。例如,U-tec 計劃推出一款主要針對辦公室門應用設計的新型生物識別智慧鎖。

美國預計將出現顯著成長

- 在美國,與其他智慧家居設備的採用相比,智慧鎖的採用仍需要普及。根據消費者科技協會 (CTA) 最近的一項研究,大約 69% 的美國家庭(代表 8,300 萬個家庭)目前擁有至少一台智慧家庭設備。其中,日本智慧音箱的採用率高達28%,而智慧鎖的採用率僅10%。這些統計數據凸顯了市場相關人員遵循適當行銷策略的機會。

- 美國市場主要企業向其他地區,特別是歐洲國家的擴張,預計也將有力推動市場成長。例如,August Inc. 和 Yale Locks(美國智慧鎖製造商)宣佈在產品系列中推出新的智慧鎖,並向 EMEA 地區的 Yale Smart Locks 新所有者和現有所有者提供其產品。 “濃啤酒訪問模組”

- August 的新 Wi-Fi 智慧鎖需要雙因素認證和兩層加密,並且可以透過應用程式和雲端進行遠端管理。同樣,濃啤酒大學的新型 Linus 智慧鎖配備了 DoorSense 技術,可以監控並通知您門的鎖定/解鎖位置。它還支援使用智慧型手機解鎖門。智慧型手機的日益普及也加速了連網裝置的成長,用戶可以使用各種連網行動應用程式遠端存取和解鎖門鎖。它會是這樣的。

- 客戶的高購買力和日益增加的安全擔憂,特別是在關鍵基礎設施和家庭應用中,正在為智慧鎖的實施創造有利的法規環境。例如,在美國,由於快速成長,超過1,200萬戶住宅安裝了智慧鎖。今天,Parks Associates 發布了一份白皮書,概述了智慧鎖在美國的採用情況以及擁有智慧鎖的好處。

智慧鎖產業概況

智慧鎖市場正在整合,因為它仍處於早期階段,全球採用率較低。然而,隨著對住宅和建築安全的需求不斷增加,市場為智慧鎖提供者提供了各種成長機會。因此,August Inc.、Yale Locks & Hardware、Allegion PLC、Salto Systems、SL、U-TEC Group Inc.等市場相關人員正在為市場提供創新產品,以獲得最大的市場吸引力。我們不斷創新以實現這一目標。預測期。

- 2022 年 2 月 - Dormakaba 完全收購 AtiQx Holding BV,擴大在荷蘭的核心和服務業務。 AtiQx 是相關市場中電子門禁和勞動力管理的領先供應商之一。

- 2022 年 4 月 - Wyze Rock Bolt 在 Wyze 網站 (wyze.com) 上正式發布。 Lockin最新的安全技術被用來創造新產品。兩家公司之間的第三個聯合品牌合資企業是 Wyze Lock Bolt。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

- 產業價值鏈分析

- 市場促進因素

- 日益成長的安全和安保問題

- 智慧家庭架構的採用率不斷提高

- 市場挑戰

- 網路安全和駭客威脅不斷上升

第 5 章 評估 COVID-19 的影響

- 市場概覽 - 趨勢、發展、市場預測

- 市場促進因素

- 市場挑戰

第6章市場區隔

- 通訊科技

- Wi-Fi

- Bluetooth

- Zigbee

- Z-Wave

- 身份驗證方法

- 生物識別

- PIN碼

- RFID卡

- 最終用戶使用情況

- 商業的

- 教育機構和政府

- 產業

- 地區

- 歐洲

- 亞太地區

- 北美洲

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- August Inc.

- Yale Locks &Hardware

- Allegion PLC(Schlage)

- Salto Systems SL

- Hanman International Pte Ltd

- Dormakaba Group

- U-TEC Group Inc.

- Kwikset(Spectrum Brands Inc.)

- Lockly

- Master Lock Company LLC

- Nuki Home Solutions

- Netatmo(Legrand)

第8章投資分析

第9章市場的未來

The Smart Lock Market size is estimated at USD 2.80 billion in 2024, and is expected to reach USD 5.75 billion by 2029, growing at a CAGR of 15.40% during the forecast period (2024-2029).

The increasing adoption of smart home architecture worldwide, including features like remote access, voice control, and seamless connectivity, is further propelling the adoption of smart locks for residential premises. Additionally, the eliminated need to carry the mechanical keys around has attracted the likes of residential owners.

Key Highlights

- The expansion of smart home adoption on a global scale and the rise of businesses that offer home automation technology are further factors in the rising demand for smart locks. The industry's participants concentrate on developing cutting-edge techniques and commercially viable goods, such as remote locking and opening windows, doors, and doors.

- Additionally, manufacturers pair their products with such devices as the number of households with voice assistants increases steadily, enabling voice control of locks. Customers are anticipated to become more popular due to these advancements as they increasingly look for sophisticated and straightforward locking/unlocking solutions. A growing number of properties must be identified and certified, including individual homes, hotels, supermarkets, banks, financial institutions, corporate buildings, and commercial buildings.

- The increasing penetration of smartphones is also stimulating the growth of connected devices, which enable users to remotely access their door locks and unlock the doors using various related mobile apps. According to Oberlo, an e-commerce company, there are currently 3.5 billion smartphone users worldwide, and the penetration rate is approximately 45.4% of the global population of 7.7 billion people. Simply put, four out of every ten people in the world are currently equipped with a smartphone.

- Amid various driving factors, the growth of the smart locks market could face challenges, owing to the prevailing vulnerability to hacking and increasing threats of cybercrimes, as smart locks, in particular, is a popular target for cybercriminals. For instance, in July this year, According to security researchers with NCC Group, there were 11 security problems affecting Nuki intelligent lock systems, including ones that could let intruders unlock doors. Such instances instill a sense of insecurity among casual users.

- The COVID-19 pandemic has led to a nosedive in investments in the ICT industry, particularly in the Internet of Things, 5G technologies, and other emerging technologies. Players in the smart lock market are forced to restrict their operational expenses. They have witnessed a reduction in hiring and capital budgets as well. Moreover, discretionary consumer spending in this scenario has also lowered the sales of smart locks. The scenario for this market looks bleak, and it is expected to witness a slowdown, which is projected to continue until the second quarter of the last year.

Smart Lock Market Trends

Commercial Adoption is Expected to Grow Significantly

- Factors such as secure and easy management of various entry points through remote access and the ability to track the security of the premises have enabled the growth of smart lock adoption in these spaces, thus, propelling various stakeholders to invest significant amounts. Such statistics highlight the need for organizations in these spaces (mainly schools and churches) to seek the highest security level possible in the age of mass shootings in public places.

- However, customer service and experience play a vital role in the hospitality industry. Hotel management ensures that customers' stay at their place is pleasant. In the process, various hotels are planning to adopt Bluetooth-enabled or Wi-Fi-enabled locks in place of RFID locks accessible by IC cards for their hotels to improve the security of their premises.

- The hospitality industry has quickly adopted smart locks to address the growing security concerns of customers while they are in the store. In the upcoming years, keyless entry systems are projected to become more popular as hotels are required to increase in-room security. Leading market companies are providing creative solutions for the hotel sector. Hoomvip, an app-based rental property access service, installed an ENTR smart door lock by TESA, one of Assa Abloy's trademarks, to increase security and ensure hassle-free access to rental homes.

- Further, the new smart lock launches aimed at businesses and office spaces have high growth potential as numerous people require access to the same facility. The need for enhanced safety has forced the management to simplify the door-unlocking process for authorized users. For instance, U-tec is expected to launch a new biometric smart lock designed primarily for their application in office doors.

United States is Expected to Grow Significantly

- The adoption of smart locks still needs to be prevalent in the United States compared to the adoption of other smart home devices. According to a recent Consumer Technology Association (CTA) study, about 69% (translates to 83 million households) of U.S. households now own at least one smart home device. Of which, the adoption of smart speakers in the country is high, with a rate of 28%, whereas the adoption of smart locks is only 10%-statistics such as this highlight the opportunity for market players to follow proper marketing strategies.

- Expanding the key players in the U.S. market to other regions, especially in European nations, is also expected to provide a strong impetus for market growth. For instance, August Inc. and Yale Locks (smart lock manufacturers based out of the United States) announced new smart locks in their product portfolios and the availability of their products for new and existing owners of Yale Smart Lock in the EMEA region under the name 'Yale Access module.'

- The new product 'Wi-Fi Smart Lock' from August Inc. mandates two-factor authentication and two-layer encryption and can be remotely managed through their App and cloud. Similarly, a new Linus Smart Lock from Yale is equipped with DoorSense technology that can monitor the lock/unlock position of the door and notifies. It also supports unlocking doors via smartphones. Also, the increasing penetration of smartphones is augmenting the growth of connected devices, which enable users to remotely access their door locks and unlock the doors using various connected mobile apps.

- A favorable regulatory climate for smart lock adoption has been created due to customers' high purchasing power and growing safety concerns, particularly in essential infrastructure and household applications. For instance, over 12 million homes in the U.S. have smart locks installed due to their rapid growth. Today, Parks Associates published a whitepaper outlining the adoption of smart locks in the U.S. and the benefits of having a smart lock.

Smart Lock Industry Overview

The Smart Lock Market is consolidated as it is still in its nascent stage with fewer adoptions across the globe. However, the market poses various growth opportunities to smart lock providers due to the increasing need for home and building security. Hence, the market players, such as August Inc., Yale Locks & Hardware, Allegion PLC, Salto Systems, S.L., and U-TEC Group Inc., are consistently innovating to provide innovative products in the market to gain maximum market traction in the forecast period.

- February 2022 - AtiQx Holding B.V. has been fully acquired by Dormakaba, expanding its core business and services operations in the Netherlands. AtiQx is one of the leading suppliers of electronic access control and labor management in the relevant market.

- April 2022 - On Wyze's website, Wyze Lock Bolt was officially released (wyze.com). The latest security technology from Lockin is used to create the new product. The third co-branding venture between the two businesses is Wyze Lock Bolt.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Increasing Safety and Security Concerns

- 4.4.2 Increasing Adoption of Smart Home Architecture

- 4.5 Market Challenges

- 4.5.1 Increasing Cyber Security and Hacking Threats

5 ASSESSMENT OF COVID-19 IMPACT

- 5.1 Market Overview - Trends, Developments, and Market Projections

- 5.2 Market Drivers

- 5.3 Market Challenges

6 MARKET SEGMENTATION

- 6.1 Communication Technology

- 6.1.1 Wi-Fi

- 6.1.2 Bluetooth

- 6.1.3 Zigbee

- 6.1.4 Z-Wave

- 6.2 Authentication Method

- 6.2.1 Biometric

- 6.2.2 Pin Code

- 6.2.3 RFID Cards

- 6.3 End-user Application

- 6.3.1 Commercial

- 6.3.2 Educational Institutions & Government

- 6.3.3 Industrial

- 6.4 Geography

- 6.4.1 Europe

- 6.4.2 Asia Pacific

- 6.4.3 North America

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 August Inc.

- 7.1.2 Yale Locks & Hardware

- 7.1.3 Allegion PLC (Schlage)

- 7.1.4 Salto Systems SL

- 7.1.5 Hanman International Pte Ltd

- 7.1.6 Dormakaba Group

- 7.1.7 U-TEC Group Inc.

- 7.1.8 Kwikset (Spectrum Brands Inc.)

- 7.1.9 Lockly

- 7.1.10 Master Lock Company LLC

- 7.1.11 Nuki Home Solutions

- 7.1.12 Netatmo (Legrand)