|

市場調查報告書

商品編碼

1438465

電子競技:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)eSports - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

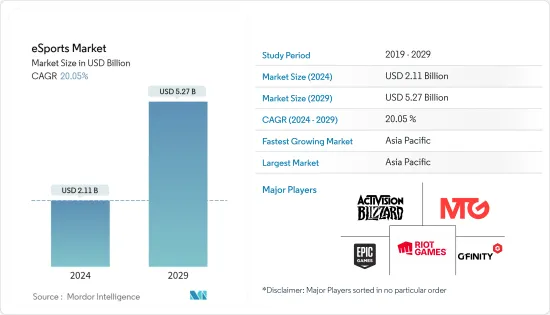

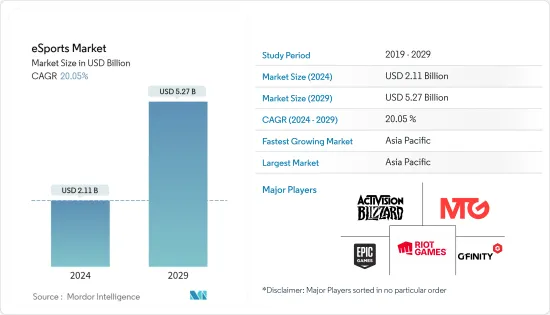

預計2024年電競市場規模為21.1億美元,預計到2029年將達到52.7億美元,在預測期內(2024-2029年)年複合成長率為20.05%。

世界各地數百萬人對獎金數百萬美元的競技電玩遊戲產生了興趣。對於休閒遊戲玩家來說,賺取七位數的工資、獲得串流媒體服務的巨額商業核准以及出現在實況活動中不再罕見。電子競技市場仍處於起步階段,隨著觀眾數量的不斷增加,預計未來市場開拓潛力巨大。

主要亮點

- 市場成長要素包括比賽直播的增加、重大投資、收視率的增加、參與活動和聯賽基礎設施。行業影響者、遊戲玩家、活動策劃者和遊戲開發商日益專業化帶來的盈利豐厚的前景使市場受益。

- 大多數電競觀眾和玩家都是千禧世代。因此,電子競技發行商透過個人化遊戲體驗並在主機、PC 和行動裝置等不同平台上提供遊戲來瞄準這一客戶群。例如,截至 2018 年 4 月,《要塞英雄》遊戲在各個平台上產生了 2.96 億美元的收益,比任何主要主機或 PC 遊戲的年收益都多。因此,隨著時間的推移,新遊戲玩家的加入預計將吸引更多的電競受眾並產生更多收益。

- 此外,負責管治整個運動的組織也不斷湧現。例如,世界電子競技協會(WESA)和電子競技誠信聯盟等組織與電子競技利益相關人員合作,保護比賽的誠信並調查所有形式的詐欺,包括操縱比賽。因此,這對市場前景有利,預計將補充市場成長。

- 然而,另一方面,缺乏支持基礎設施和對這項運動的認知是預測期內阻礙市場成長的一些因素。

- COVID-19感染疾病影響了人類生活的各個方面和許多商業部門。由於 COVID-19,許多聯賽和錦標賽已被重新安排或取消。由於體育場關閉,一些組織者在網上舉辦活動。由於COVID-19,8%的實況活動被推遲,53%轉移到虛擬平台,26%被重新安排,13%如期舉行。在這種情況下,2020年市場略有成長。

電競市場趨勢

廣告將成為電競最大的收益來源

- 廣告包括針對電競觀眾的廣告所產生的收益,例如線上上平台直播期間所展示的廣告、電競比賽的隨選隨選節目或電競電視。

- 目前,全球流行的電子遊戲包括《Dota2》、《要塞英雄》、《英雄聯盟》、《反恐精英:鬥陣特攻》和《全球攻勢》。電玩產業已經從娛樂發展成為一項可行的工作。觀眾對電子競技比賽的巨大興趣導致越來越多的贊助商受到投資者的贊助,其中包括名人和全球品牌。

- 過去幾年,觀眾和粉絲數量穩步成長,開闢了新的成長機會並增加了投資。近年來,由於生態系統提供了跨多個子部門的各種投資機會,該領域的投資取得了重大進展。市場的主要吸引力是傳統創業投資公司、策略投資者和私募股權。

- 電競學位課程由俄亥俄州立大學、麻薩諸塞州貝克爾學院和維吉尼亞謝南多厄大學提供。此外,美國100 多所高中正在舉辦電競比賽和傳統足球等其他比賽。加州大學歐文分校和其他幾所大學一樣,為排名前六名的球員提供獎學金,以鼓勵計畫擴展。

- 因此,預計所有上述因素都將在預測期內為電競市場的廣告收益做出貢獻。

預計亞太地區將主導市場

- 在亞太地區,由於電子競技在年輕人中的普及以及政府對市場成長的支持,預計中國將在電競市場中佔據較大佔有率。

- 例如,杭州(中國城市)計畫在2022年興建14個電競設施,預計投資高達154.5億元(22.2億美元)。透過這項投資,該市有望成為世界電子競技之都。

- 此外,杭州將於2022年舉辦亞運會,電子競技有望成為正式獎牌比賽。由於投資,中國預計將佔據很大的市場佔有率。

- 此外,電競產業的主要參與者騰訊控股有限公司總部位於中國,透過開發大獲成功的《王者榮耀》等遊戲,為中國電競的崛起做出了重要貢獻。騰訊控股有限公司計劃在中國擴大《英雄聯盟》和《王者榮耀》等熱門遊戲的賽事,吸引世界各地的玩家和觀眾。

- 騰訊TiMi電競中心總經理Allan Zhang在騰訊全球電競峰會上宣布,2022年王者榮耀世界冠軍杯(KCC)總獎金池將為1000萬美元(820萬歐元)。張解釋說,從2022年起,來自中國王者職業聯賽(KPL)和其他海外地區的16支隊伍將參加比賽。

- 本次比賽將創下行動電競獎金池最大的新紀錄,對產業來說是一個重大發展。國王隊及其開發商騰訊旗下 TiMi Studio 明確表示,他們希望將電競打造成世界上最盈利的遊戲之一。

- 因此,由於國內電競投資的增加,中國市場預計將擴大。

電子競技產業概述

電子競技市場正處於起步階段。所以它變得有點競爭。看到電競聯賽的受歡迎,公司紛紛進入市場以獲得競爭優勢並擴大其地理影響力。此外,這些公司提高不同地理位置知名度的策略包括組成新的運動聯盟、聯盟、併購和收購。重要參與者包括摩登時代集團、動視暴雪公司和拳頭遊戲公司(騰訊控股有限公司)。最近的一些進展是:

- 2022 年 4 月 - SK Telecom 與韓國電競協會 (KeSPA) 簽署了為期三年的贊助協議。根據這項安排,SK Telecom 將成為 KeSPA 的官方贊助商,並可能指導韓國電競隊參加即將舉行的亞洲錦標賽。預計一些與市場相關的措施和創新將在預測期內推動進一步成長。

- 2022年3月-Rooter Sports Technologies Private Limited購買了Sky Esports所有智慧財產權的媒體權,為期一年。南亞頂級電競賽事主辦單位Sky Esports擁有其智慧財產權。媒體權允許 Rooter Sports 以多種語言在印度轉播比賽,包括英語、印地語、孟加拉語、卡納達語、泰米爾語、馬拉雅拉姆語和泰盧固語。這些併購業務預計將在預測期內推動媒體版權產業的擴張。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果和先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素與阻礙因素簡介

- 市場促進因素

- 電玩遊戲日益流行

- 人們對電競的認知不斷增強

- 市場限制因素

- 對遊戲交易中的盜版、法律規章和詐騙等問題的擔憂

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章 電競市場形勢

- 各國的電競舉措

- 電競愛好者玩的 10 款主要遊戲

- 排名前 10 的聯賽(按觀眾人數和獎金分類)

第6章市場區隔

- 按收益模式

- 媒體權利

- 廣告和贊助

- 商品及門票

- 其他收益模式

- 透過串流媒體平台

- Twitch

- YouTube

- 其他串流媒體平台(鬥魚和哈魚)

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 中國

- 亞太地區(不包括中國)

- 日本

- 印度

- 韓國

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Modern Times Group

- Activision Blizzard Inc

- Electronic Arts Inc

- Riot Games Inc.(Tencent Holdings Ltd)

- Epic Games Inc.

- Gfinity PLC

- Faceit

- Capcom Co. Ltd

- Valve Corporation

第8章市場機會及未來趨勢

第9章投資分析

The eSports Market size is estimated at USD 2.11 billion in 2024, and is expected to reach USD 5.27 billion by 2029, growing at a CAGR of 20.05% during the forecast period (2024-2029).

Millions of people worldwide are increasingly interested in competitive video gaming, which offers millions of dollars in prize money. It is no longer uncommon for casual gamers to command seven-figure wages, receive significant business endorsements from streaming services, and appear at live events. Although the eSports market is still in its initial stage, and with the growing viewership, it is expected that it may offer strong potential to capitalize on the market in the future.

Key Highlights

- The market growth factors are an increase in the live streaming of games, significant investments, growing audience reach, engagement activities, and infrastructure for league competitions. The market benefits from the lucrative prospects made possible by the industry's increasing professionalization for influencers, gamers, event planners, and game developers.

- The majority of the audience and the players of eSports are the Millenials. Thus, the publishers of eSports are targetting this customer base by personalizing the gameplay experience and offering the game on different platforms such as console, PC, and mobile. For instance, as of April 2018, the Fortnite game generated USD 296 million in revenue across platforms, which was more annual than any significant console or PC game. Thus, with the new gamers in the ecosystem, it is expected to attract more eSports audiences, generating more revenue over time.

- Moreover, organizations are emerging for governance to make the entire sports organized. For instance, associations such as the World esports Association (WESA) and Esports Integrity Coalition are working with esports stakeholders to protect the integrity of competition and investigate all forms of cheating, including match manipulation. Hence, this is expected to have a positive outlook on the market and is expected to complement the growth of the market.

- However, on the flip, lack of supportive infrastructure and awareness about sports are a few factors hindering market growth during the forecast period.

- The COVID-19 pandemic impacted many aspects of human life and numerous business sectors. Due to COVID-19, numerous leagues and tournaments were rescheduled or abandoned. As the stadiums were closed, some organizers held the event online. In COVID-19, 8% of live events were postponed, 53% were shifted to virtual platforms, 26% were rescheduled, and 13% were held as planned. Under all of these conditions, the market increased somewhat in 2020.

esports Market Trends

Advertising to be the Largest Sources of eSports Revenue

- The advertising comprises the revenue generated from the advertisements targeting esports viewers, including ads shown during live streams on online platforms, on video-on-demand content of esports matches, or esports TV.

- The top video games globally now include Dota2, Fortnite, League of Legends, Counter-Strike: Overwatch, and Global Offensive. The video game industry has developed from a pastime to a viable job path. Due to the huge amount of interest in esports competitions among spectators, investors, including celebrities and global brands, are becoming sponsors.

- The number of viewers and fans has grown steadily over the past few years, opening up new growth opportunities and increasing investment. Investments in this area have advanced significantly in recent years thanks to the ecosystem, which offers a variety of investment opportunities across several subsectors. The key market draw is traditional venture capital firms, strategic investors, and private equity.

- The esports degree program is offered by Ohio State University, Becker College in Massachusetts, and Shenandoah University in Virginia. Additionally, esports competitions and other games like conventional soccer are being held in more than 100 high schools around the United States. The University of California Irvine offers scholarships to the top 6 players, as are several other institutions, to boost the program's expansion.

- Hence, all the above factors are expected to contribute to the advertising segment for generating revenue for the eSports market in the forecasted period.

Asia-Pacific is expected to dominate the Market

- In the Asian-pacific region, China is anticipated to hold a significant market share in the eSports market owing to the popularity of esports among the youth and supportive government support for the market's growth.

- For instance, Hangzhou ( a city in China) could plan to build 14 esports facilities before 2022, and it is expected to invest up to CNY 15.45 billion (USD 2.22 billion). This investment is expected to make it the esports capital of the world.

- Moreover, Hangzhou will host Asian Games in 2022, where esports is expected to be an official medal event. With its investments, China is expected to hold a significant market share.

- Furthermore, Tencent Holdings Limited, a significant player in the eSports industry, is headquartered in China and played an influential role in the increase of eSports in China by developing games like "Honor of Kings," which was a huge success. Tencent Holdings Limited plans to expand tournaments for hugely popular games like "League of Legends" and "Honor of Kings in China, " which will attract global players and viewers.

- The prize pool for the 2022 Honor of Kings World Champion Cup (KCC) will be USD 10 million (EUR 8.2 million), according to Allan Zhang, general manager of Tencent TiMi Esports Center, who announced during the Tencent Global Esports Summit. Zhang explained that 16 teams from the King Pro League (KPL) in China and other international locations would participate in the competition after 2022.

- The competition will set a new record for the largest prize pool in mobile esports, which is a significant development for the industry. The honor of Kings and its developer Tencent's TiMi Studio have made their intentions for esports clear as one of the most lucrative games globally.

- Hence, the increasing investment in eSports in the country is expected to augment the China market.

esports Industry Overview

The eSports market is at its initial stage; thus, it is a little competitive. Although seeing the popularity of the eSports leagues, companies are entering the market to gain a competitive advantage and expand their geographical presence. Furthermore, these companies' strategies to increase their visibility across different geographic locations include organizing new sports leagues, partnerships, mergers, and acquisitions. Some significant players are Modern Times Group, Activision Blizzard Inc., and Riot Games Inc. (Tencent Holdings Ltd), amongst others. A few recent developments are:

- April 2022 - SK Telecom and the Korean Esports Association (KeSPA) have a three-year sponsorship agreement. As a result of the arrangement, SK Telecom is now KeSPA's official sponsor and may coach the Korean esports team for forthcoming Asian tournaments. During the anticipated term, several market-related efforts and innovations are expected to fuel additional growth.

- March 2022 - Rooter Sports Technologies Private Limited purchased Sky Esports' media rights for all of its intellectual property for a year. The top esports event organizer in South Asia, Sky Esports, owns its intellectual properties. With media rights, Rooter Sports may broadcast matches in India in several languages, including English, Hindi, Bengali, Kannada, Tamil, Malayalam, and Telugu. These M&A operations are anticipated to boost the media rights segment's expansion during the expected term.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Popularity of Video Games

- 4.3.2 Growing Awareness about eSports

- 4.4 Market Restraints

- 4.4.1 Issues Such as Piracy, Laws and Regulations, and Concerns Relating to Fraud During Gaming Transactions

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 ESPORTS MARKET LANDSCAPE

- 5.1 Esports Engagement by Country

- 5.2 Top 10 Games Played by eSports Fans

- 5.3 Top 10 Leagues, By Viewership, By Prize Money

6 MARKET SEGMENTATION

- 6.1 By Revenue Model

- 6.1.1 Media Rights

- 6.1.2 Advertising and Sponsorships

- 6.1.3 Merchandise and Tickets

- 6.1.4 Other Revenue Models

- 6.2 By Streaming Platform

- 6.2.1 Twitch

- 6.2.2 YouTube

- 6.2.3 Other Streaming Platforms ( DouYu and Hayu )

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1.3 Rest of North America

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 China

- 6.3.4 Asia-Pacific ( excluding China)

- 6.3.4.1 Japan

- 6.3.4.2 India

- 6.3.4.3 South Korea

- 6.3.4.4 Rest of Asia-Pacific

- 6.3.5 Latin America

- 6.3.6 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Modern Times Group

- 7.1.2 Activision Blizzard Inc

- 7.1.3 Electronic Arts Inc

- 7.1.4 Riot Games Inc. ( Tencent Holdings Ltd)

- 7.1.5 Epic Games Inc.

- 7.1.6 Gfinity PLC

- 7.1.7 Faceit

- 7.1.8 Capcom Co. Ltd

- 7.1.9 Valve Corporation