|

市場調查報告書

商品編碼

1437968

NAND快閃記憶體:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)NAND Flash Memory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

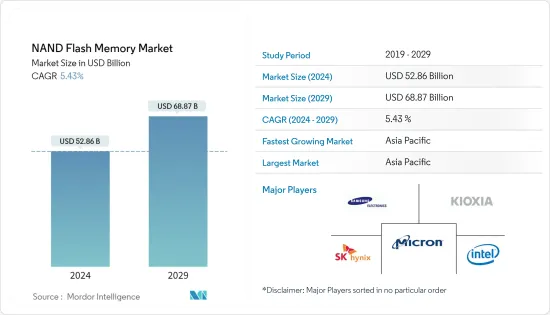

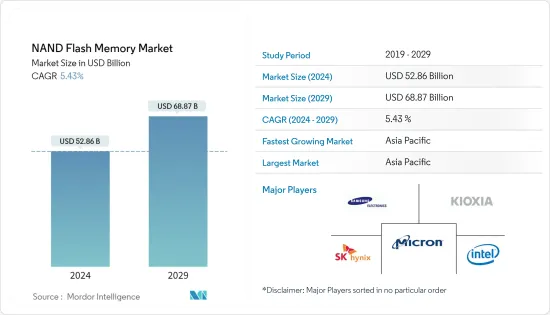

2024年 NAND 快閃記憶體市場規模估計為528.6億美元,預計到2029年將達到688.7億美元,在預測期間(2024-2029年)以5.43%的複合年增長率增長。

主要亮點

- 隨著個人電腦和智慧型手機的興起, NAND快閃記憶體消費量急劇增加,其中很大一部分原因是智慧型手機平均容量的增加。預計這將增加NAND快閃記憶體封裝的需求,並影響記憶體封裝的需求。

- 據美光稱,智慧型手機平均配備 43 GB NAND快閃記憶體閃存,預計未來四年將大幅增加。該公司預計,到 2021 年,普通行動電話將擁有 142 GB 的NAND快閃記憶體閃存,旗艦設備將擁有 1 Terabyte的快閃記憶體。

- 其他消費性產品(例如平板電腦和相機)以及工業設備和感測器、汽車系統和醫療設備都與處理器整合,並依靠快閃記憶體來儲存資料和可執行程式碼。隨著人工智慧和機器學習應用程式對大規模資料處理的需求的增加,基於快閃記憶體的儲存趨勢將繼續發展。

- 中國的NAND快閃記憶體供應商的生產並未受到新的COVID-19感染疾病的嚴重影響。這是因為工廠自動化程度較高,人力需求相對較低,經營者也在農曆新年前囤積原料。由於半導體製造工廠持有特殊的國家許可證,晶圓代工廠產品交貨給中國的客戶。這使得該公司能夠將產品運送到中國各地,甚至是被隔離的城市。

- 由於中國是原料和最終產品的主要供應國之一,預計電子業將受到COVID-19感染疾病的嚴重影響。該行業面臨產量減少、供應鏈中斷和價格波動的問題。在此期間,知名電子公司的銷售受到影響。人員和產品的旅行限制在短期內阻礙了市場成長。

NAND快閃記憶體主要市場趨勢

智慧型手機領域預計將顯著成長

- 快閃記憶體已成為智慧型手機的重要組成部分。 NAND快閃記憶體需求快速成長,主要得益於智慧型手機平均容量的增加。

- 智慧型手機中的 NAND 快閃記憶體可以顯著提高網頁瀏覽、電子郵件閱讀、遊戲甚至 Facebook 等社群網站的效能。隨著智慧型手機變得越來越普及,該公司正在添加額外的功能和應用程式,以將其產品與其他製造商區分開來。

- 例如,製造商正在將手勢控制、指紋掃描器和 GPS 等功能整合到他們的設備中。這增加了對 NAND 快閃記憶體的需求,NAND 快閃存在智慧型手機中用作代碼儲存媒體。

- 隨著5G無線通訊的到來,智慧型手機的使用量將增加許多倍,從而增加了對不斷提高標準的最新型號的需求。例如,根據愛立信移動的一份報告,在北美地區,到年終,5G合約預計將佔行動合約的55%。

亞太地區獲得主要市場佔有率

- 亞太地區是全球最大的 NAND 快閃記憶體市場之一。該地區幾乎所有最終用戶應用程式的需求都非常高,這主要是由該地區多個新興國家(例如中國、印度和印尼)對智慧型手機的需求所推動的。

- 中國、韓國和新加坡等國家的半導體製造設施也都很活躍。多家跨國記憶體製造商正在將巨額資金投入中國市場,特別是在中國政府「中國製造2025」等措施的推動下。中國的宏偉目標是到 2030 年半導體產量達到 3,050 億美元,並於 2025 年實現。它佔國內半導體需求的至少80%,預計在預測期內該國的投資將進一步增加。

- 預計多家中國新興企業將在該地區進行重大投資,包括長江儲存、福建金華、華力和合肥長鑫記憶體。這些公司的資本支出預計也將增加一倍。

- 多個國家的這些發展促使該地區的各個競爭對手加強了擴張。例如,截至2019年2月,全球最大的記憶體晶片製造商之一SK海力士計劃巨額投資1,060億美元,主要用於在韓國建立四座新的半導體製造工廠,並宣布正在這樣做。 2021年4月,該公司在韓國京畿道利川市總部舉行了新製造工廠M16的完工儀式。

NAND快閃競爭形勢

NAND快閃記憶體市場由英特爾、美光科技、三星電子、SanDisk、SK海力士和東芝等主要供應商主導。市場進入障礙較高,新進者舉步維艱。市場上的現有供應商正在大力投資新產品和創新產品的研發。

2021年12月,SK海力士宣布將投資90億美元收購英特爾NAND部門。該公司的目標是在 2025 年之前完成新的整合流程。因此,此類發展正在推動市場。

2021 年 11 月,Mercury Systems Inc. 宣布推出NAND快閃記憶體記憶體非揮發性儲存設備。這款新元件採用塑膠球柵陣列 (BGA) 封裝,符合 NASA 的 EEE-INST-002 航太級應用指南,適用於太空等高輻射環境中的超密集記憶體儲存應用。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

- 市場促進因素

- 對資料中心的需求增加

- 5G 和物聯網設備的普及提高

- 市場限制因素

- 可靠性問題

第5章市場區隔

- 類型

- SLC(每單元 1 位元)

- MLC(每個單元 2 位元)

- TLC(每個單元 3 位元)

- QLC(四級單元)

- 結構

- 2D結構

- 3D結構

- 目的

- 智慧型手機

- SSD

- 記憶卡

- 藥片

- 其他用途

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭形勢

- 公司簡介

- Samsung Electronics Co. Ltd

- KIOXIA Corporation

- Micron Technology Inc.

- SK Hynix Inc.

- Intel Corporation

- Yangtze Memory Technologies

- SanDisk Corp.(Western Digital Technologies Inc.)

- Powerchip Technology Corporation

- Cypress Semiconductor Corporation

第7章 廠商市場定位

第8章投資分析

The NAND Flash Memory Market size is estimated at USD 52.86 billion in 2024, and is expected to reach USD 68.87 billion by 2029, growing at a CAGR of 5.43% during the forecast period (2024-2029).

Key Highlights

- With the rise of PCs and smartphones, NAND flash consumption is dramatically increasing, much of which is attributed to the growth of the average capacity of smartphones. This is expected to drive the demand for NAND flash packaging, thus influencing the demand for memory packaging.

- According to Micron, an average smartphone contains 43 GB of NAND flash storage, and it is expected to grow substantially over the next four years. The company estimated that, by 2021, an average phone would have 142 GB of NAND flash storage, with flagship devices having one terabyte of flash storage.

- Other consumer products such as tablets and cameras, along with industrial equipment and sensors, automotive systems, and medical devices, rely upon flash memory, which is integrated alongside their processors, and stores both data and the code they execute. As demand for massive data processing for artificial intelligence and machine learning applications grows, the trend for flash-based storage will continue to evolve.

- Production of China-based NAND flash vendors was not severely affected by the outbreak of novel COVID-19. This is because the plants are highly automated, have relatively low demands for manpower, and operators are also stocked up with raw materials before the Chinese Lunar New Year. Foundry output was delivered to customers in China because semiconductor fabrication plants hold national special licenses. These allow them to ship their products throughout domestic China, even with cities under quarantine.

- The electronics device sector was anticipated to be impacted significantly by the COVID-19 outbreak, as China is one of the major suppliers of raw materials and finished products. The industry faced a reduction in production, disruption in the supply chain, and price fluctuations. The sales of prominent electronic companies were affected during the period. The travel restriction on both people and products hampered the market's growth in the short run.

NAND Flash Memory Key Market Trends

The Smartphone Segment is Expected to Witness Significant Growth

- Flash memory storage has become an essential component of smartphones. The NAND flash demand has been growing exponentially, primarily driven by the growth of the average capacity of smartphones.

- NAND flash memory in smartphones can significantly enhance the performance of web browsing, email loading, games, and even social network sites such as Facebook. With the increasing adoption of smartphones, companies are adding extra features and applications to differentiate their products from other manufacturers.

- For instance, manufacturers are integrating features such as gesture control, fingerprint scanners, and GPS into the devices. This is boosting the demand for NAND flash memory, which is used as code storage media for smartphones.

- With 5G wireless communication on its way, the use of smartphones would increase multifold, increasing the need for the latest models to raise the bar continuously. For instance, according to the Ericsson Mobility report, in the North American region, 5G subscriptions are expected to account for 55% of mobile subscriptions by the end of 2024.

Asia-Pacific to Hold a Significant Market Share

- Asia-Pacific is one of the biggest markets for NAND flash memories across the world. The region has a very high demand from almost all end-user applications, primarily led by the demand for smartphones in multiple developing countries in the region, such as China, India, and Indonesia.

- Also, there is high activity from the semiconductor fabrication facilities in countries like China, Korea, and Singapore. An immense amount of capital is directed into the Chinese market by several multinational memory manufacturers, especially boosted by the country's government initiatives, such as Made in China 2025. The country's ambitious goal is to reach USD 305 billion in semiconductor output by 2030 and meet at least 80% of the domestic demand for semiconductors, which is expected to draw more investments into the country over the forecast period.

- Multiple new companies in China, such as Yangtze River Storage Technology, Fujian Jin Hua, Hua Li, and Hefei Chang Xin Memory, are expected to invest heavily in the region. These companies are also expected to double their equipment investments.

- Owing to such development in multiple countries, various competitors in the region are intensifying their efforts for expansion. For instance, as of February 2019, SK Hynix, one of the world's largest memory-chip makers, announced that it was planning to invest a huge sum of USD 106 billion, primarily to establish four new semiconductor fabrication plants in South Korea. In April 2021, the company held a completion ceremony for its new fabrication plant M16 at headquarters located in Icheon, Gyeonggi-do, South Korea.

NAND Flash Memory Competitive Landscape

The NAND flash memory market is dominated by major vendors, such as Intel, Micron Technology, Samsung Electronics, SanDisk, SK Hynix, and Toshiba. As the entry barriers in the market are high, the entry of new players is difficult. The existing vendors in the market are investing heavily in the R&D of new and innovative products.

In December 2021, SK Hynix announced the acquisition of Intel's NAND unit for an investment of USD 9 billion. The company aims to focus on completing another integration process by 2025. Thus, such developments are driving the market.

In November 2021, Mercury Systems Inc. announced the launch of the NAND flash non-volatile memory device. The new device features a plastic ball-grid array (BGA) package to meet NASA's EEE-INST-002 space-grade application guidelines for ultra-high-density memory storage applications in high-radiation environments like space.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

- 4.5 Market Drivers

- 4.5.1 Increasing Demand for Data Centers

- 4.5.2 Increasing Proliferation of 5G and IOT Devices

- 4.6 Market Restraints

- 4.6.1 Reliability Issues

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 SLC (One-Bit Per Cell)

- 5.1.2 MLC (Two-Bit Per Cell)

- 5.1.3 TLC (Three-Bit Per Cell)

- 5.1.4 QLC (Quad Level Cell)

- 5.2 Structure

- 5.2.1 2D Structure

- 5.2.2 3D Structure

- 5.3 Application

- 5.3.1 Smartphone

- 5.3.2 SSD

- 5.3.3 Memory Card

- 5.3.4 Tablet

- 5.3.5 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Latin America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Samsung Electronics Co. Ltd

- 6.1.2 KIOXIA Corporation

- 6.1.3 Micron Technology Inc.

- 6.1.4 SK Hynix Inc.

- 6.1.5 Intel Corporation

- 6.1.6 Yangtze Memory Technologies

- 6.1.7 SanDisk Corp. (Western Digital Technologies Inc.)

- 6.1.8 Powerchip Technology Corporation

- 6.1.9 Cypress Semiconductor Corporation