|

市場調查報告書

商品編碼

1437883

奈米纖維素:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global Nanocellulose - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

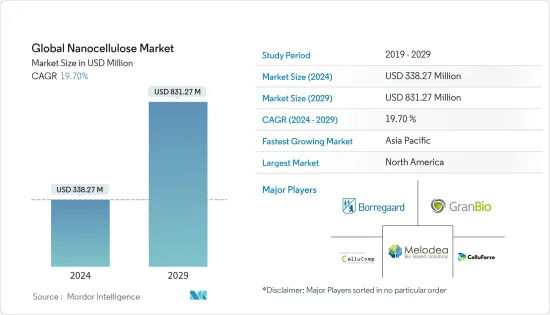

2024 年全球納米纖維素市場規模估計為 3.3827 億美元,預計到 2029 年將達到 8.3127 億美元,在預測期間(2024-2029 年)以 19.70% 的複合年增長率增長。

市場受到 COVID-19 的負面影響。由於供應鏈中斷和勞動力短缺,製造活動已停止。然而,隨著石油和天然氣需求的增加,各種產品在紡織領域的使用量增加,促使各個應用領域的需求增加。

主要亮點

- 短期內,軟包裝輔助材料的日益採用將是推動所研究市場成長的關鍵因素。

- 另一方面,消費者意識的缺乏和經濟障礙預計將阻礙市場成長。

- 增加創新活動和研發投資,以及製造商擴大產能以利用廣泛的適用性,預計將在所研究的市場中創造新的機會。

- 北美消費量最大,並主導全球市場。

奈米纖維素市場趨勢

複合材料領域佔據市場主導地位

- 2021年,複合材料領域是奈米纖維素的最大應用領域。這是由於對包裝材料和生物分解性塑膠的需求增加,促使政府加強了對此類材料開發的支持和投資。

- 奈米纖維素複合材料因其生物分解性和無毒的特性而在很大程度上取代了塑膠。由於分散相尺寸較小,在聚合物基體中的分散性較好,與純聚合物或傳統複合材料相比,這些材料表現出顯著改善的性能。

- 此外,由於政府計劃推動擺脫石化燃料,電動車的發展預計將繼續獲得動力,特別是在北美、歐洲和亞洲。

- 從電動車銷售來看,2022年上半年全球電動車銷量總合4,300萬輛新純電動車和插電式混合動力車,較2021年上半年成長62%。 2021年銷售的675萬輛電動車中,中國當地銷售了340萬輛電動車,歐洲銷售了230萬輛電動車,美國銷售了70萬輛。

- 隨著世界各地,特別是印度、日本和越南等主要新興經濟體對聚合物的需求不斷增加,預計未來幾年複合材料應用對奈米纖維素的需求將大幅增加。

- 印度有 30 多個醫院計劃處於規劃或建設階段,包括計劃和新建設計劃。例如,價值140萬美元的健康城市醫院計劃正在建設中,該項目由安得拉邦維沙卡帕特南區護理醫院承建。

- 因此,考慮到上述因素,預計研究領域對奈米纖維素的需求在預測期內將大幅增加。

北美市場佔據主導地位

- 北美在奈米纖維素市場中佔據主導地位,預計在預測期內將繼續保持主導地位。

- 北美不斷增加的基礎設施計劃和商業建築維修預計將推動混合用途區域奈米纖維素市場的成長。這主要是由於政府在升級公共基礎設施方面投入巨額資金。

- 到2027年,該地區的食品和飲料、石油和天然氣、油漆和塗料、建築等行業的成長將進一步補充奈米纖維素業務的成長。

- 根據貝克休斯的數據,2022 年 1 月最後一周,美國運作的石油和天然氣鑽井平台數量總合610 個。此外,2021年12月美國原油產量降至1,160萬桶/日以下,較2021年11月減少20萬桶/日。 EIA進一步預測,2022年產量將增加至平均1,200萬桶/日。此後,到2023年,產量預計將達到年均1,300萬桶。

- 美國人口普查局報告稱,2021 年建築業價值為 15,890 億美元,比 2020 年的 14,692 億美元成長 8.2%(±0.8%)。 2021 年 12 月住宅額為 8,191.3 億美元。同期非住宅領域的價值為 8,200 億美元。

- 加拿大商業發展銀行 (BDC) 的一份報告也估計食品和飲料和食品和飲料的成長價值為 1,190 億美元。未來五年該產業將成長15.6%以上。

- 墨西哥是世界上最大的石油生產國之一。然而,另一方面,2021年墨西哥石油產量仍持平於166萬桶/日,因為墨西哥國家石油公司的產量從去年同期的161萬桶/日降至160萬桶/日。私人石油產量從每天 53,919 桶增加到每天 64,191 桶。由於國內生產停滯,墨西哥對美國天然氣進口的依賴日益增加。根據CNH稱,截至2021年10月,墨西哥消耗的90%天然氣(不包括Pemex消耗的天然氣)都是進口的。

- 由於各個最終用戶產業的成長,北美奈米纖維素市場預計在預測期內將快速成長,主要由美國推動。

奈米纖維素產業概述

奈米纖維素市場本質上是整合的。主要參與者包括 CelluForce、GranBio、Melodea Ltd、CelluComp Ltd、Borregaard 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 奈米纖維素的優異性能

- 更多採用軟包裝輔助工具

- 抑制因素

- 阻礙市場成長的經濟障礙

- 缺乏消費者意識

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔

- 最終用戶產業

- 紙張加工

- 油漆和塗料

- 油和氣

- 食品和飲料

- 複合材料

- 藥品/化妝品

- 其他最終用戶產業

- 產品類別

- 奈米原纖化纖維素 (NFC)

- 結晶纖維素(NCC)

- 細菌纖維素

- 微纖化纖維素(MFC)

- 其他產品類型

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 北歐國家

- 法國

- 其他歐洲國家

- 世界其他地區

- 南非

- 沙烏地阿拉伯

- 巴西

- 其他國家

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業採取的策略

- 公司簡介

- GranBio Technologies

- Axcelon Biopolymers Corporation

- Borregaard

- CelluComp

- CelluForce

- Chuetsu Pulp and Paper Co. Ltd

- Daicel Finechem Ltd

- Fiberlean Technologies

- Melodea Ltd

- Nippon Paper Industries Co. Ltd

- Norske Skog ASA

- Oji Holdings Corporation

- Sappi Ltd

- University of Maine

第7章市場機會與未來趨勢

- 增加創新活動和研發投資

- 製造商擴大產能以利用廣泛的適用性

The Global Nanocellulose Market size is estimated at USD 338.27 million in 2024, and is expected to reach USD 831.27 million by 2029, growing at a CAGR of 19.70% during the forecast period (2024-2029).

The market was negatively affected due to COVID-19. Manufacturing activities were halted due to supply chain disruptions and labor shortages. However, with the increasing demand observed in oil and gas, the textile segment owing to the growing utilization of various products has increased the demand from various application segments.

Key Highlights

- Over the short term, the increasing adoption of flexible packaging aids is a major factor driving the growth of the market studied.

- On the flip side, a dearth of consumer awareness and economic barriers are expected to hinder the market's growth.

- Increasing innovation activities and R and D investments, and capacity expansion by manufacturers to capitalize on the wide applicability are expected to unveil new opportunities for the market studied.

- North America dominated the market across the world with the most substantial consumption.

Nanocellulose Market Trends

Composites Segment to Dominate the Market

- The composites segment accounted for the largest application of nanocellulose in 2021. This is owing to the increased demand for packaging materials and biodegradable plastics, which has resulted in increased government support and investment in the development of such materials.

- Nanocellulose composites have heavily replaced plastics due to their bio-degradable and non-toxic nature. Due to the reduced size of the dispersed phase and its good dispersion in the polymer matrix, these materials exhibit markedly improved properties when compared to pure polymers or their traditional composites.

- Furthermore, the development of electric vehicles is expected to continue to gain momentum in the future, especially in North America, Europe, and Asia, owing to government programs promoting the move away from fossil fuels.

- According to EV Volumes, global EV sales of a total of 4,3 million new BEVs and PHEVs were delivered during the first half of 2022, an increase of 62 % compared to 2021 H1. Of the 6.75 million EVs sold in 2021, 3.4 million EVs were sold in 2021 in mainland China, 2.3 million EVs were sold in Europe, and 0.7 million were in the United States.

- With the increasing demand for polymers worldwide, and majorly developing economies, such as India, Japan, and Vietnam, among others, the demand for nanocellulose is expected to witness a massive increase in the coming years from composite applications.

- In India, more than 30 hospital projects are under the planning or construction phase which includes both expansions as well as new construction projects. For instance, the Health City hospital project worth USD 1.4 million is under construction, which is being built by Care Hospitals in the Visakhapatnam district of Andhra Pradesh.

- Therefore, considering the aforementioned factors, the demand for nanocellulose in the segment studied is expected to grow substantially during the forecast period.

North America to Dominate the Market

- North America dominated the nanocellulose market and it is expected to continue its dominance during the forecast period.

- Increased infrastructure projects, as well as the renovation of commercial buildings in North America, will drive regional nanocellulose market growth for composite applications. This is mainly owing to huge government spending on public infrastructure upgrades.

- Growing industries like food & beverage, oil & gas, paints & coatings, construction, and other industries, in the region, will further complement nano cellulose business growth by 2027.

- The number of operational United States oil and gas rigs totaled 610 in the last week of January 2022, according to Baker Hughes. Additionally, the United States crude oil production fell below 11.6 million b/d in December 2021, a decline of 0.2 million b/d from November 2021, EIA further forecasted that production would rise to an average of 12.0 million b/d in 2022 and then to recording production on an annual-average basis of 13.0 million b/d in 2023.

- As per the reports by the US Census Bureau, the value of construction in 2021 was USD 1,589.0 billion, 8.2% (±0.8%) above the USD 1,469.2 billion spent in 2020. The residential construction value stood at USD 819.13 billion in December 2021 whereas the value for the non-residential segment was USD 820 billion in the same period.

- According to the reports by the Business Development Bank of Canada (BDC), USD 119 billion worth of the food & beverage industry recovered in 2021 after a downfall of 5.2% in 2020. Moreover, the report also estimated the growth of the food & beverage sectors for more than 15.6% in the next five years.

- Mexico is one of the world's largest oil producers. However, Mexico's oil production, meanwhile, was flat at 1.66 million b/d in 2021, as Pemex output dipped to 1.6 million b/d from 1.61 million b/d a year earlier. Private sector oil production rose to 64,191 b/d from 53,919 b/d. Mexico has become increasingly dependent on U.S. natural gas imports as domestic production has stagnated. Imports account for 90% of gas consumed in Mexico when excluding gas consumed by Pemex as of October 2021, according to CNH.

- With such growth from various end-user industries, the North American nanocellulose market is expected to grow rapidly during the forecast period, majorly spurred by the United States.

Nanocellulose Industry Overview

The nanocellulose market is consolidated in nature. The major players include CelluForce, GranBio, Melodea Ltd, CelluComp Ltd, and Borregaard, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Superior Properties of Nanocellulose

- 4.1.2 Increasing Adoption of Flexible Packaging Aids

- 4.2 Restraints

- 4.2.1 Economic Barriers Hindering the Market Growth

- 4.2.2 Dearth of Consumer Awareness

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 End-user Industry

- 5.1.1 Paper Processing

- 5.1.2 Paints and Coatings

- 5.1.3 Oil and Gas

- 5.1.4 Food and Beverage

- 5.1.5 Composites

- 5.1.6 Pharmaceuticals and Cosmetics

- 5.1.7 Other End User Industries

- 5.2 Product Type

- 5.2.1 Nanofibrillated Cellulose (NFC)

- 5.2.2 Nanocrystalline Cellulose (NCC)

- 5.2.3 Bacterial Cellulose

- 5.2.4 Microfibrillated Cellulose (MFC)

- 5.2.5 Other Product Types

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Nordic Countries

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of World

- 5.3.4.1 South Africa

- 5.3.4.2 Saudi Arabia

- 5.3.4.3 Brazil

- 5.3.4.4 Other Countries

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 GranBio Technologies

- 6.4.2 Axcelon Biopolymers Corporation

- 6.4.3 Borregaard

- 6.4.4 CelluComp

- 6.4.5 CelluForce

- 6.4.6 Chuetsu Pulp and Paper Co. Ltd

- 6.4.7 Daicel Finechem Ltd

- 6.4.8 Fiberlean Technologies

- 6.4.9 Melodea Ltd

- 6.4.10 Nippon Paper Industries Co. Ltd

- 6.4.11 Norske Skog ASA

- 6.4.12 Oji Holdings Corporation

- 6.4.13 Sappi Ltd

- 6.4.14 University of Maine

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Innovation Activities and R and D Investments

- 7.2 Capacity expansion by Manufacturers to Capitalize the Wide Applicability

![奈米纖維素技術市場(產品:纖維素奈米原纖維[CNF]、纖維素奈米晶體[CNC] 和細菌奈米纖維素[BNC])- 2023-2031 年全球產業分析、規模、佔有率、成長、趨勢和預測](/sample/img/cover/42/1402841.png)