|

市場調查報告書

商品編碼

1435917

甲苯二異二異氰酸鹽:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029)Toluene Diisocyanate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

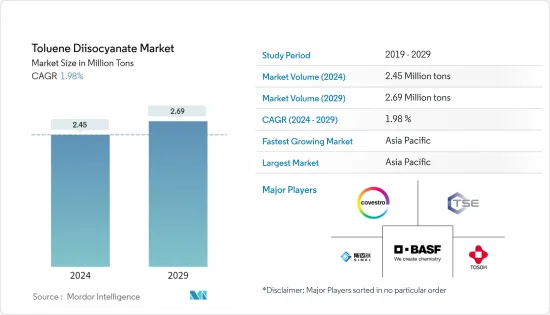

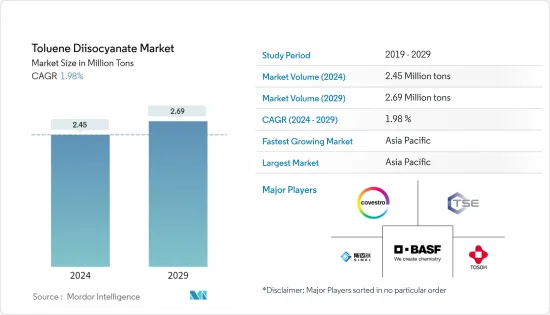

2024年甲苯二異二異氰酸鹽市場規模預計為245萬噸,預計到2029年將達到269萬噸,在預測期內(2024-2029年)複合年成長率為1.98%。

甲苯二異二異氰酸鹽是2,4-和2,6-異構體的合成混合物,是一種揮發性、無色、淡黃色液體,可溶於許多有機溶劑。該公司主要生產聚氨酯產品,如硬質和軟質泡沫、塗料、黏劑、密封劑和合成橡膠。對軟質泡沫的需求不斷成長正在推動市場成長。

主要亮點

- 然而,全球範圍內冠狀病毒的爆發阻礙了所研究市場的成長。

- 甲苯二異二異氰酸鹽在塗料行業的不斷擴大應用預計將在未來五年為甲苯二二異氰酸鹽市場創造機會。

- 亞太地區主導了全球市場,最大的消費來自中國和印度等國家。

甲苯二異二異氰酸鹽(TDI)市場趨勢

征服家具和室內設計

- 甲苯二二異氰酸鹽是用於坐墊、寢具、家具、床墊等軟質聚氨酯泡棉的重要原料。它是家具和室內設計行業使用的主要原料之一。

- 根據宜家2022年連合收益,宜家全球零售額的約75%來自該公司現有的零售店。線上銷售約佔 22%,其餘部分作為消費者服務銷售。

- 此外,經濟分析局估計,2022年第四季美國家具及相關產品產業經季節性已調整的的付加值約為349億美元,比2022年的付加值高出約5.5%。去年同期。 2022 年四個季度的付加值接近 1,366 億美元。

- 由於住宅、辦公室和其他場所對家具的需求,預計中國將佔據全球家具業務的大部分。根據中國國家統計局的數據,2022年12月中國家具零售額約174億元人民幣(約25億美元)。營收較去年同期下降5.8%。儘管如此,與 2022 年 11 月產生的收益相比,銷售額成長了 3%。

- 由於上述因素,TDI在家具產業的應用預計在預測期內將佔據主導地位。

亞太地區主導市場

- 甲苯二異二異氰酸鹽主要用於生產具有優異溫度穩定性的硬質聚氨酯泡棉。同時也用於生產合成橡膠、油漆和塗料、清漆、漆包線漆、黏劑和密封劑以及黏合劑。

- 亞太地區高度發展的油漆、塗料、包裝、家具和汽車工業預計將推動TDI需求的成長,並使該地區相對於其他地區佔據主導地位。

- 根據全球油漆和塗料工業協會預測,2022年亞太地區油漆和塗料產業價值預計將達到630億美元。目前,中國在該地區市場佔據主導地位,複合年成長率為 5.8%。預計2022年中國市場將成長5.7%。依照目前趨勢,2022年中國油漆塗料總銷售額將超過450億美元。在東亞,中國佔最大的市場佔有率,達78%。

- TDI用於汽車修補漆聚氨酯塗料和高性能防腐蝕塗料。根據中國工業協會統計,2022年中國汽車產量與前一年同期比較增加約3.4%。 2021年汽車產量為2,608萬輛,2022年約2,700萬輛。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 泡沫的應用範圍隨著家具、汽車和其他最終用途行業的使用而擴大

- 其他司機

- 抑制因素

- 由於有毒化合物的存在而受到的環境法規

- 其他限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔

- 應用

- 泡棉

- 塗層

- 黏劑和密封劑

- 合成橡膠

- 其他

- 最終用戶產業

- 家具/室內裝飾

- 建築與建造

- 電子產品

- 車

- 包裝

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業採取的策略

- 公司簡介

- Alfa Aesar, Thermo Fisher Scientific

- BASF SE

- Covestro AG

- Dow

- Hanwha Solutions Chemical Division

- KH Chemicals

- Merck KGaA

- Mitsui Chemicals, Inc.

- Simel Chemical Industry Co., Ltd.

- Tokyo Chemical Industry Co., Ltd

- Tosoh Corporation

- TSE Industries, Inc.

- Wanhua

第7章市場機會與未來趨勢

- 擴大甲苯二異氰酸鹽在塗料行業的應用

- 其他機會

The Toluene Diisocyanate Market size is estimated at 2.45 Million tons in 2024, and is expected to reach 2.69 Million tons by 2029, growing at a CAGR of 1.98% during the forecast period (2024-2029).

Toluene Diisocyanate is a synthetic mixture of the 2,4- and 2,6-isomers, a volatile, colorless pale yellow liquid soluble in many organic solvents. They mainly make polyurethane products, such as rigid and flexible foams, coatings, adhesives, sealants, and elastomers. The growing demand for flexible foam is driving the market growth.

Key Highlights

- However, the outbreak of coronavirus across the globe hindered the growth of the studied market.

- The growing application of toluene diisocyanate in the coating industry will likely provide opportunities for the toluene diisocyanate market over the next five years.

- Asia-Pacific dominated the global market, with the largest consumption from countries such as China and India.

Toluene Diisocyanates (TDI) Market Trends

Furniture and Interior to Dominate

- Toluene Diisocyanate is a vital raw material for flexible polyurethane foam for use in cushions, bedding, and furniture, mattresses. It is one of the primary raw materials used in the furniture and interior industry.

- IKEA, a well-known international retailer of home furnishings, reported in its annual report that its yearly revenue climbed by almost 6% between 2021 and 2022, when its sales were EUR 41.9 billion (~USD 45 billion) and EUR 44.6 billion (~USD 61.2 billion), respectively.

- Moreover, as per IKEA's 2022 consolidated revenue, about 75% of IKEA's global retail sales were generated in the company's existing retail stores. Online sales accounted for about 22%, and the rest was sold as services to consumers.

- The Bureau of Economic Analysis also estimated that the value added by the furniture and related products industry in the United States in the fourth quarter of 2022 was approximately USD 34.9 billion at a seasonally adjusted rate, or approximately 5.5% more than the value added in the same period the previous year. Over the four quarters of 2022, the value addition was nearly USD 136.6 billion.

- China is predicted to include a huge fraction of the furniture business of the world, owing to the need for furniture in residential areas, offices, and other locations. According to the National Bureau of Statistics of China, retail sales of furniture in China in December 2022 were roughly CNY 17.4 billion (~USD 2.5 billion). It amounted to a 5.8% decline in revenue compared to the prior year's time. Nonetheless, a 3% rise in sales was noted compared to the revenue generated in November 2022.

- Owing to the factors mentioned above, the application of TDI in the furniture industry is expected to dominate during the forecast period.

Asia-Pacific Region to Dominate the Market

- Toluene diisocyanate is primarily used to make rigid polyurethane foams with great temperature stability. It also produces elastomers, paints and coatings, varnishes, wire enamels, adhesives and sealants, and binders.

- The Asia-Pacific region's highly developed paints and coatings, packaging, furniture, and automotive industries are expected to enhance TDI demand, making the region more dominant than others.

- According to the World Paint & Coating Industry Association, in 2022, the Asia-Pacific paints and coatings industry was expected to be worth USD 63 billion. China now dominates the region's market, which is growing at a CAGR of 5.8%. In 2022, the Chinese market was estimated to grow by 5.7%. According to current trends, China's total paints and coatings sales exceeded USD 45 billion in 2022. In East Asia, the country had the largest market share of 78%.

- TDI is used in polyurethane coatings for automotive refinishing and high-performance anti-corrosion coatings. According to the Chinese Association of Automotive Manufacturers, China's automotive production increased by roughly 3.4% in 2022 compared to the previous year. In 2022, approximately 27 million automobiles were produced, compared to 26.08 million units produced in 2021.

- As of November 2022, the total production value of the Japanese electronics industry was expected to reach over JPY 10.1 trillion (~84.5 USD billion), which is roughly 100.7% of the amount from the previous year, according to the Japan Electronics and Information Technology Industries Association (JEITA).

- Moreover, according to the Statistics Bureau of Japan and a survey conducted by the Ministry of Economy, Trade and Industry of Japan, the furniture and home furnishing sales in Japan's wholesale sector reached around JPY 4.5 trillion (~USD 41.06 billion) in 2021, reaching a decade high.

- Hence, all such market trends are expected to drive the demand for toluene diisocyanate market in the region during the forecast period.

Toluene Diisocyanates (TDI) Industry Overview

The global toluene diisocyanate market is fragmented due to numerous players with no significant market share. Some major companies are Tosoh Corporation, Simel Chemical Industry Co., Ltd., BASF SE, Covestro AG, and TSE Industries, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Foam Application due to Utilization in the Furniture, Automotive and other End Use Industries

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Environmental Regulations due to Presence of Toxic Compounds

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Foams

- 5.1.2 Coatings

- 5.1.3 Adhesives and Sealants

- 5.1.4 Elastomers

- 5.1.5 Others

- 5.2 End-user Industry

- 5.2.1 Furniture and Interiors

- 5.2.2 Building and Construction

- 5.2.3 Electronics

- 5.2.4 Automotive

- 5.2.5 Packaging

- 5.2.6 Others

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alfa Aesar, Thermo Fisher Scientific

- 6.4.2 BASF SE

- 6.4.3 Covestro AG

- 6.4.4 Dow

- 6.4.5 Hanwha Solutions Chemical Division

- 6.4.6 KH Chemicals

- 6.4.7 Merck KGaA

- 6.4.8 Mitsui Chemicals, Inc.

- 6.4.9 Simel Chemical Industry Co., Ltd.

- 6.4.10 Tokyo Chemical Industry Co., Ltd

- 6.4.11 Tosoh Corporation

- 6.4.12 TSE Industries, Inc.

- 6.4.13 Wanhua

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Application of Toluene Diisocyanate in Coating Industry

- 7.2 Other Opportunities