|

市場調查報告書

商品編碼

1432671

工廠自動化/工業控制:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Factory Automation and Industrial Controls - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

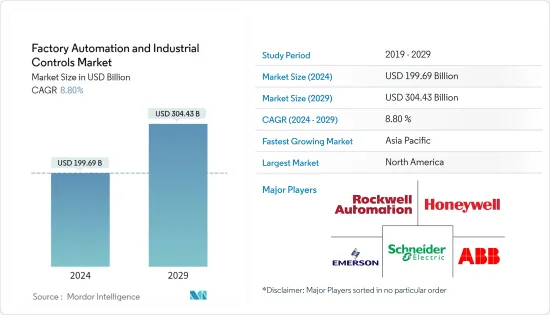

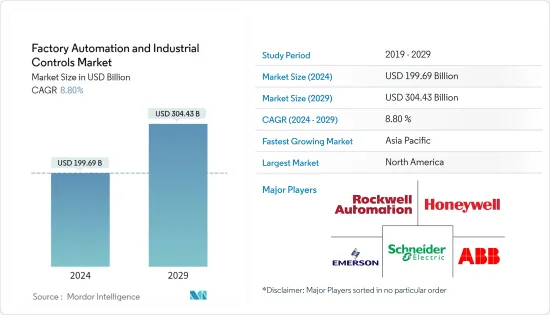

工廠自動化和工業控制市場規模預計到2024年為1996.9億美元,預計到2029年將達到3044.3億美元,在預測期內(2024-2029年)複合年成長率為8.80%,預計將成長。

自動化和控制系統減少製造錯誤,節省時間和成本,並提高客戶滿意度。建造用於規劃、產品開發和供應鏈物流的智慧工廠是擴大採用智慧系統、組件、機械和設備透過自動化和自我最佳化來改進流程的結果。這是影響市場的一個重要方面。

主要亮點

- 自動化產業正在透過製造的數位和實體方面的結合進行徹底變革,旨在提供最佳效能。此外,對實現零廢棄物生產和縮短時間的關注正在加速市場成長。

- 工業物聯網 (IIoT) 和工業 4.0 是整個物流鏈開發、生產和管理的新技術方法的核心,稱為智慧工廠自動化,其中機器和設備透過網際網路和 IT 連接起來。主導工業領域的趨勢。

- 此外,由於工業4.0 和物聯網(IoT) 的普及,製造業發生了巨大轉變,正在推動企業變得敏捷,並透過自動化補充和增強人力的技術來推進生產,並減少因流程故障而導致的工業事故。我們需要採取明智的創新方法。

- 此外,世界各地的汽車製造商都認知到,下一代機器人和自動化技術具有革命性的潛力,可以在生產力、品質、安全性和成本參數方面改變汽車產業。機器人自動化系統需求也預計將受益於機器人自動化支出逐年增加。

- 各領域的人事費用都在快速上漲。此外,品質標準也變得越來越嚴格。考慮到這一點,工廠自動化可以降低生產、營運和人事費用。

- COVID-19 的爆發迫使世界各地的企業和製造設施關閉,擾亂了市場。製造業對工業自動化系統的需求下降導致了重大損失,特別是在今年前兩個季度。幸運的是,隨著工廠重新開業和工業營運恢復,2021 年前幾個月出現了積極的復甦跡象。工業 4.0 技術的進步正在增加各個工業領域對機器人等自動化解決方案的需求。

工廠自動化和工業控制市場趨勢

汽車產業預計將錄得顯著成長

- 汽車工業是重要產業之一,在全球自動化製造設備中佔有很大佔有率。已經證實,各汽車製造商的生產設施都實現了自動化,以保持準確性和效率。此外,以電動車取代傳統汽車的趨勢預計將增加汽車產業的需求。

- 在許多工業領域,工業4.0技術的發展增加了對機器人等自動化解決方案的需求。由於技術,工廠可以全年 365 天、每天 24 小時運轉,無需人工監管。例如,組裝機器人比專用設備更容易使用,並且比人類移動得更快、更準確。機械臂可以執行諸如在汽車製造設施中驅動螺絲、安裝擋風玻璃和安裝輪圈等任務。機械臂因提高生產力和效率、同時降低人類工人的成本和風險而享有盛譽。

- 此外,人工智慧正在整個汽車價值鏈中使用,從設計和生產等製造業務到保險和預測性維護等支援活動。然而,當今人工智慧最令人興奮的應用之一是交通運輸,它正在幫助創建無人駕駛車輛和駕駛員輔助系統。

- 此外,現代汽車等品牌正在大力投資智慧移動解決方案,以保持領先於競爭對手的優勢。隨著汽車變得更加智慧和連網型,擁有一家專門從事機器人和人工智慧的公司從長遠來看將是一筆巨大的資產。 2021年6月,現代汽車宣布從Softbank Corporation收購波士頓動力公司的管理權。該交易對這家美國機器人開發商的估值為11億美元,其中現代汽車持有80%的股份,Softbank Corporation仍持有20%。

- 由於採用智慧工廠,汽車產業有機會增加產量、減少製造停機時間、提高供應鏈效率並更快地回應市場需求。計劃工期是汽車產業面臨的最重要挑戰之一。快速的計劃投資回報,加上經濟實惠的自動化和成本創新,有助於製造商透過提高生產力來提高競爭力。

北美佔據主要市場佔有率

- 主要汽車製造商都位於北美,並受益於強大的基礎設施和政府對電動車的支持。此外,年輕人對豪華和高檔汽車的日益偏好預計將提供有利可圖的機會。

- 由於越來越注重減少汽車排放氣體,汽車產業的重點正在轉向電動車。各國政府和環境機構正在製定更嚴格的排放法規和法律,以解決日益嚴重的環境問題,這可能會增加電力傳動系統和節能柴油引擎的生產成本。因此,過去五年來,北美對電池式電動車的需求達到了歷史最高水準。

- 此外,由於數位化、自動化程度的提高和新的經營模式,汽車產業也將經歷類似的變化。由於以下因素,汽車產業正在出現四種顛覆性技術主導的趨勢:行動多樣化、自主性、電動和連結性。然而,隨著租賃汽車和二手車市場的日益普及,參與企業市場可能會面臨困難。物流和配送服務的成長,以及亞馬遜等主要電子商務公司持有的擴張,將對商用車的需求產生重大影響。

- 採用工廠自動化解決方案可以幫助這些製造商降低成本、提高生產力並提高品質。近日,加拿大皇家銀行(RBC)與微軟合作推出Go Digital計劃,協助加拿大企業投資智慧自動化技術和雲端解決方案。該計劃針對加拿大食品製造商,並計劃在未來擴展到其他行業。

- 此外,在北美,2022年第一季來自汽車製造商和零件製造商的機器人訂單佔總量的47%。多家汽車製造商已宣布增加工廠的資本支出,以支持未來的電動車車型或提高電池產能。有了這些重要舉措,未來幾年對工業機器人的需求可能會增加。

工廠自動化與工業控制產業概況

全球工廠自動化和工業控制市場競爭激烈,由多家大公司組成。市場似乎適度分散。在這個市場上擁有壓倒性佔有率的主要公司正在專注於擴大海外基本客群。這些公司利用策略合作計劃來增加市場佔有率和盈利。此外,我們也致力於透過收購從事工廠自動化和工業控制的新興企業來增強我們的產品能力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 日益關注能源效率和降低成本

- 自動化趨勢日益成長

- 市場挑戰

- 貿易摩擦與實施挑戰

第6章市場區隔

- 依產品

- 透過工業控制系統

- 集散控制系統(DCS)

- 可程式邏輯控制器(PLC)

- 監控/資料採集 (SCADA)

- 產品生命週期管理 (PLM)

- 人機介面 (HMI)

- 製造執行系統(MES)

- 企業資源規劃(ERP)

- 其他工業控制系統

- 現場設備

- 機器視覺系統

- 機器人(工業)

- 感測器和發射器

- 馬達與驅動器

- 其他現場設備

- 透過工業控制系統

- 按最終用戶產業

- 車

- 化工/石化

- 公用事業

- 製藥

- 食品和飲料

- 油和氣

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Schneider Electric SE

- Rockwell Automation Inc.

- Honeywell International Inc.

- Emerson Electric Company

- ABB Limited

- Mitsubishi Electric Corporation

- Siemens AG

- Omron Corporation

- Yokogawa Electric Corporation

- General Electric Co.

- Texas Instruments Inc.

- Robert Bosch GmbH

第8章投資分析

第9章 未來展望

The Factory Automation and Industrial Controls Market size is estimated at USD 199.69 billion in 2024, and is expected to reach USD 304.43 billion by 2029, growing at a CAGR of 8.80% during the forecast period (2024-2029).

Automation and control systems decrease manufacturing errors, which saves time and money and increases customer satisfaction. The creation of smart factories for planning, product development, and supply chain logistics is a result of the increased adoption of smart systems, components, machinery, and equipment for the improvement of processes through automation and self-optimization. This is a key aspect influencing the market.

Key Highlights

- The automation industry has been revolutionized by the combination of digital and physical aspects of manufacturing aimed at delivering optimum performance. Further, the focus on achieving zero waste production and a shorter time to reach the market has augmented the growth of the market.

- The Industrial Internet of Things (IIoT) and the Industrial 4.0 are at the center of the new technological approaches for the development, production, and management of the entire logistics chain, otherwise known as smart factory automation, and are dominating the trends in the industrial sector, with machinery and devices being connected via internet.

- Moreover, massive shifts in manufacturing due to Industry 4.0 and the acceptance of IoT require enterprises to adopt agile, smarter, and innovative ways to advance production with technologies that complement and augment human labor with automation and reduce industrial accidents caused by process failure.

- Additionally, automakers worldwide are aware of the revolutionary potential of the next generation of robots and automation technologies to transform the automotive industry in terms of productivity, quality, safety, and cost parameters. The need for robot automation systems is also anticipated to benefit from rising robotic automation spending year over year.

- The cost of labor has risen exponentially in many different areas. Additionally, the standards for quality are becoming stricter. In light of this, factory automation may result in lower production, operating, and labor expenses.

- The market was disrupted when the COVID-19 epidemic forced the closure of enterprises and manufacturing facilities worldwide. Significant losses were incurred, particularly in the first two quarters of the year, as a result of the drop in demand for industrial automation systems in the manufacturing sectors. Fortunately, there have been encouraging signs of a resurgence in the first few months of 2021, owing to the reopening of the plants and the restart of industrial operations. Industry 4.0 technology advancements have increased demand for automated solutions like robots across a wide range of industrial industries.

Factory Automation and Industrial Controls Market Trends

Automotive is Expected to Register a Significant Growth

- The automotive industry is one of the prominent sectors that hold a significant share in worldwide automated manufacturing facilities. It is observed that the production facilities of various automakers are automated to maintain accuracy and efficiency. Further, the growing trend of replacing conventional vehicles with EVs is expected to augment the automotive industry's demand.

- In many industrial areas, the demand for automated solutions like robots has increased due to developments in Industry 4.0 technology. Because of technology, factories can operate without human supervision for 24 hours daily, 365 days per year. For instance, assembly robots are simpler to use than specialized equipment and can move more quickly and precisely than people. Robotic arms can do activities like screw driving, windshield installation, and wheel mounting in auto manufacturing facilities. They have a reputation for boosting productivity and efficiency while lowering expenses and dangers for human workers.

- Additionally, AI is used in the automotive value chain, from manufacturing duties like design and production to supporting activities like insurance and predictive maintenance. However, one of AI's fascinating uses today is transportation, where it powers the creation of driverless vehicles and driver assistance systems.

- Further, brands such as Hyundai have invested heavily in smart mobility solutions to stay ahead of their competitors. With cars becoming smarter and more connected, having a company specializing in robotics and AI can be a great asset in the long run. In June 2021, Hyundai Motor Company recently confirmed that they had bought a controlling interest in Boston Dynamics from SoftBank. According to the deal, the American robotics developer has been valued at USD 1.1 billion, and Hyundai has 80% shares while SoftBank still owns 20%.

- The automotive industry has chances to increase production, decrease manufacturing downtime, improve supply chain efficiency, and respond more quickly to market demands thanks to smart factories. The length of a project is one of the top issues facing the automotive sector. Rapidly paying off projects, together with affordable automation and cost innovation, aid manufacturers in becoming more competitive by enhancing productivity.

North America to Hold a Significant Market Share

- Major automotive OEMs are based in the nation, benefiting from a substantial infrastructure and the government's support for electric vehicles. In addition, the increasing inclination of young people for luxury and premium vehicles is predicted to present lucrative opportunities.

- The automotive industry's attention has switched to electric vehicles due to the growing emphasis on decreasing vehicle emissions. Governments and environmental agencies are rolling out stringent emission rules and laws to address growing environmental concerns, which could increase the cost of producing electric drive trains and fuel-efficient diesel engines. As a result, over the past five years, battery electric car demand in North America has reached an all-time high.

- Additionally, the automotive industry will similarly undergo a change fueled by digitization, rising automation, and new business models. Four disruptive technology-driven trends are emerging in the automobile industry as a result of these factors: diversified mobility, autonomous driving, electrification, and connection. However, market participants may face difficulties due to the growing popularity of rental and used car markets. Growing logistics and delivery services, along with the expansion of vehicle fleets by major e-commerce players like Amazon, etc., significantly impact the demand for commercial cars.

- The adoption of factory automation solutions can help these manufacturers in cost savings, enhance productivity, and improve quality. Recently, the Royal Bank of Canada (RBC) collaborated with Microsoft and launched the Go Digital program to help Canadian businesses invest in smart automation technologies and cloud solutions. The program is available to Canadian food manufacturers and will continue expanding to other industries.

- In addition, in North America, orders for robots from automakers and component manufacturers accounted for 47% of all orders in the first quarter of 2022. Several automakers have announced investments better to outfit their plants for future electric drive car models or to boost battery production capacity. These significant initiatives will increase the demand for industrial robots in the coming years.

Factory Automation and Industrial Controls Industry Overview

The Global Factory Automation and Industrial Controls Market is highly competitive and consists of several major players. The market appears to be moderately fragmented. The major players with prominent shares in the market are focusing on expanding their customer base across foreign countries. These companies are leveraging on strategic collaborative initiatives to increase their market shares and profitability. The companies operating in the market are also acquiring start-ups working on factory automation and industrial control systems to strengthen their product capabilities.

- July 2022 - Rockwell Automation, Inc., the world's largest company dedicated to industrial automation and digital transformation, announced the launch of the PowerFlex AC variable frequency drive portfolio in the Asia Pacific to support an array of motor control applications. This will provide customers more flexibility, performance, and intelligence in their next generation drive through TotalFORCE Technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 An Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Emphasis on Energy Efficiency and Cost Reduction

- 5.1.2 Growing Trend Towards Automation

- 5.2 Market Challenges

- 5.2.1 Trade Tensions and Implementation Challenges

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 By Industrial Control Systems

- 6.1.1.1 Distributed Control System (DCS)

- 6.1.1.2 Programmable Logic Controller (PLC)

- 6.1.1.3 Supervisory Control and Data Acquisition (SCADA)

- 6.1.1.4 Product Lifecycle Management (PLM)

- 6.1.1.5 Human Machine Interface (HMI)

- 6.1.1.6 Manufacturing Execution System (MES)

- 6.1.1.7 Enterprise Resource Planning (ERP)

- 6.1.1.8 Other Industrial Control Systems

- 6.1.2 Field Devices

- 6.1.2.1 Machine Vision Systems

- 6.1.2.2 Robotics (Industrial)

- 6.1.2.3 Sensors and Transmitters

- 6.1.2.4 Motors and Drives

- 6.1.2.5 Other Field Devices

- 6.1.1 By Industrial Control Systems

- 6.2 By End-User Industry

- 6.2.1 Automotive

- 6.2.2 Chemical and Petrochemical

- 6.2.3 Utility

- 6.2.4 Pharmaceutical

- 6.2.5 Food and Beverage

- 6.2.6 Oil and Gas

- 6.2.7 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 Honeywell International Inc.

- 7.1.4 Emerson Electric Company

- 7.1.5 ABB Limited

- 7.1.6 Mitsubishi Electric Corporation

- 7.1.7 Siemens AG

- 7.1.8 Omron Corporation

- 7.1.9 Yokogawa Electric Corporation

- 7.1.10 General Electric Co.

- 7.1.11 Texas Instruments Inc.

- 7.1.12 Robert Bosch GmbH