|

市場調查報告書

商品編碼

1431615

衛星組件:市場佔有率分析、產業趨勢、成長預測(2024-2029)Satellite Component - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

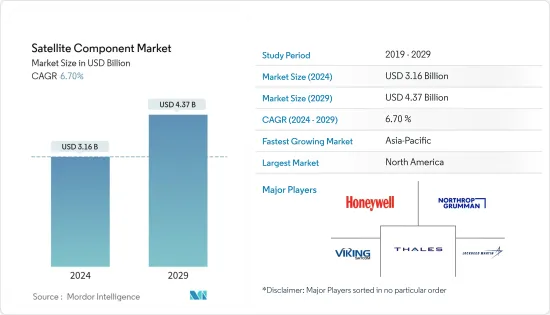

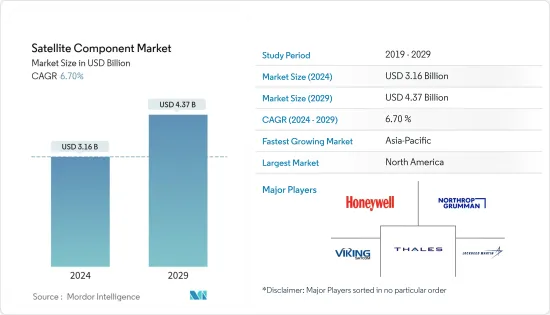

衛星零件市場規模預計到 2024 年為 31.6 億美元,預計到 2029 年將達到 43.7 億美元,在預測期內(2024-2029 年)複合年成長率為 6.70%。

主要亮點

- 由於 COVID-19 大流行,全球衛星零件市場面臨前所未有的挑戰。航太領域面臨原料短缺、衛星發射計畫延遲、政府嚴格監管導致供應鏈中斷等挑戰。疫情過後,市場呈現強勁復甦態勢。航太領域支出的增加和小型衛星發射數量的增加正在推動疫情後的市場成長。

- 衛星部件由通訊系統、電力系統、動力系統等組成。通訊系統包括接收和轉發訊號的天線和中繼器。推進系統由推進衛星的火箭組成,電力系統由提供電力的太陽能板組成。衛星發射數量的增加和航太領域支出的增加正在推動市場成長。根據聯合國外太空事務辦公室(UNOOSA)的指標,2022年將有8,261顆衛星繞地球運行,比2021年4月增加11.84%。

衛星組件市場趨勢

預計天線部分在預測期內將出現顯著成長

- 預計天線部分在預測期內將顯著成長。這一成長是由對先進通訊系統的需求增加、衛星發射數量的增加以及航太領域支出的增加所推動的。衛星天線用於將衛星的發射功率集中到地球上的指定地理區域,並避免來自不必要的訊號的干擾,從而劣化整體訊號品質。用於通訊、廣播、導航和天氣預報等各種最終用途的衛星發射數量的增加正在推動該領域的成長。

- 美國航太局 (UNOOSA) 宣布 2022 年 11 月進行了 155 次軌道和亞軌道發射。此外,2022年6月,衛星產業協會(SIA)發布了第25次衛星產業狀況報告(SSIR)。報告顯示,2021年部署的商業衛星數量為1,713顆,較2020年大幅增加40%以上。對衛星的需求不斷成長將推動對衛星組件的相應需求,並推動預測期內的市場成長。其中一個例子是 2022 年 7 月,MDA Ltd. 與衛星製造商 York Space Systems 簽署了一份契約,為衛星建造Ka波段可操縱天線。

在預測期內,北美將主導市場

- 北美在衛星零件市場上佔據主導地位,並將在預測期內繼續保持這一地位。這是由於美國航太總署(NASA)和SpaceX增加了太空研發支出,以及衛星發射數量的增加。 2022年,美國政府將在太空計畫上花費約620億美元,成為世界上最大的太空支出國。 2022年,全球將成功發射180次火箭,其中76次由美國發射。

- 例如,2021年9月,美國衛星製造公司Terran Orbital宣布將在佛羅裡達州太空海岸開設世界上最大的衛星製造和零件工廠,這是一個耗資3億美元的計畫。此外,2021 年 12 月,Redwire Corporation 與衛星製造公司 Terran Orbital 簽訂了為期三年的供應商協議,提供用於衛星製造和服務的各種先進組件和解決方案。

衛星零件行業概況

衛星零件市場適度整合,少數公司佔較大佔有率。一些著名的市場參與者包括泰雷茲公司、維京衛星通訊公司、洛克希德·馬丁公司、諾斯羅普·格魯曼公司和霍尼韋爾國際公司。由於競爭加劇,主要目標商標產品(OEM) 正在專注於太空應用的先進衛星組件和系統的設計和開發。下一代衛星天線、中繼器、推進系統等研發和設計開發支出的增加可能會在未來幾年創造更好的機會。

例如,2021年10月,歐洲太空總署(ESA)、法國太空總署CNES和衛星製造商泰雷茲阿萊尼亞航太公司宣布,將共同開發冷卻系統,以維持在軌大型衛星的溫度。它將是大型商業通訊上使用的第一個機械泵迴路。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場限制因素

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 成分

- 天線

- 電源系統

- 推進系統

- 應答器

- 其他組件(感測器、熱控制系統等)

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 其他拉丁美洲

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 公司簡介

- Lockheed Martin Corporation

- Viking Satcom

- Sat-lite Technologies

- Honeywell International Inc.

- THALES

- Northrop Grumman Corporation

- IHI Corporation

- BAE Systems plc

- Challenger Communications

- JONSA TECHNOLOGIES CO., LTD.

- Accion Systems

第7章 市場機會及未來趨勢

The Satellite Component Market size is estimated at USD 3.16 billion in 2024, and is expected to reach USD 4.37 billion by 2029, growing at a CAGR of 6.70% during the forecast period (2024-2029).

Key Highlights

- The global satellite component market has faced unprecedented challenges due to the COVID-19 pandemic. The space sector witnessed challenges such as shortages of raw materials, delayed satellite launch programs, and supply chain disruptions due to strict regulations imposed by governments. The market showcased a strong recovery after the pandemic. An increase in expenditure on the space sector and rising small satellite launches drive the market growth post-covid.

- The satellite components consist of the communications system, power systems, power systems, and others. The communication system includes antennas and transponders that receive and retransmit signals. The propulsion system consists of rockets that propel the satellite, and the power system includes solar panels that provide power. An increasing number of satellite launches and growing expenditure on the space sector drive the market growth. According to the United Nations Office for Outer Space Affairs (UNOOSA) index, in 2022, there were 8,261 individual satellites orbiting the Earth, with an increase of 11.84% compared to April 2021.

Satellite Component Market Trends

The Antenna Segment is Expected to Show Remarkable Growth During the Forecast Period

- The antenna segment is projected to show significant growth during the forecast period. The growth is due to increasing demand for advanced communication systems, rising number of satellite launches, and rising spending on the space sector. Satellite antennas are used to concentrate the satellite's transmitting power to the designated geographical region on Earth and avoid interference from undesired signals that will deteriorate the overall quality of the signal. Increasing satellite launches for various end-use applications such as communications, broadcasting, navigation, weather forecasting, and others drive the growth of the segment.

- The United Nations Office for Outer Space Affairs (UNOOSA) stated that 155 orbital and suborbital launches took place in November 2022. Moreover, in June 2022, the Satellite Industry Association (SIA) unveiled the 25th annual State of the Satellite Industry Report (SSIR). The report indicated a remarkable deployment of 1,713 commercial satellites in 2021, reflecting a notable surge of over 40 percent compared to 2020. This escalating demand for satellites is set to trigger a corresponding need for satellite components, thereby propelling market growth in the projected period. As an illustration, a significant development took place in July 2022 when MDA Ltd. entered into a contract with York Space Systems, a satellite manufacturer, to construct Ka-Band steerable antennas for satellites.

North America Held Highest Shares in the Market During the Forecast Period

- North America dominated the satellite components market and continued its domination during the forecast period. An increase in spending on space research and development and a rising number of satellite launches from the National Aeronautics and Space Administration (NASA) and SpaceX. In 2022, the United States government spent approximately USD 62 billion on its space programs and making the country with the highest space expenditure in the world. There were 180 successful rocket launches worldwide in 2022, out of which 76 were launched by the United States.

- For instance, in September 2021, Terran Orbital, a satellite manufacturing company in the United States, announced that it would open the world's largest satellite manufacturing and component facility on Florida's Space Coast at a cost of USD 300 million. Furthermore, in December 2021, Redwire Corporation signed a three-year supplier agreement with Terran Orbital, a satellite manufacturer, to provide a range of advanced components and solutions used in satellite manufacturing and service offerings.

Satellite Component Industry Overview

The satellite component market is moderately consolidated in nature, with a handful of players holding significant shares in the market. Some prominent market players are THALES, Viking Satcom, Lockheed Martin Corporation, Northrop Grumman Corporation, and Honeywell International Inc. With the growing competition, major original equipment manufacturers (OEMs) are focusing on the design and development of advanced satellite components and systems for space applications. Growing expenditure on research and development and design and development of next-generation satellite antennas, transponders, propulsion systems, and others will create better opportunities in the coming years.

For instance, in October 2021, the European Space Agency (ESA), French space agency CNES and Thales Alenia Space, a satellite manufacturer, announced it would jointly develop a cooling system that will maintain the temperature of big satellites in orbit. It will be the first mechanically pumped loop to be used on large commercial telecommunications satellites.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Component

- 5.1.1 Antennas

- 5.1.2 Power Systems

- 5.1.3 Propulsion Systems

- 5.1.4 Transponders

- 5.1.5 Other Components (Sensors, Thermal Control Systems, etc)

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Lockheed Martin Corporation

- 6.1.2 Viking Satcom

- 6.1.3 Sat- lite Technologies

- 6.1.4 Honeywell International Inc.

- 6.1.5 THALES

- 6.1.6 Northrop Grumman Corporation

- 6.1.7 IHI Corporation

- 6.1.8 BAE Systems plc

- 6.1.9 Challenger Communications

- 6.1.10 JONSA TECHNOLOGIES CO., LTD.

- 6.1.11 Accion Systems