|

市場調查報告書

商品編碼

1431453

鉭電容器:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Tantalum Capacitors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

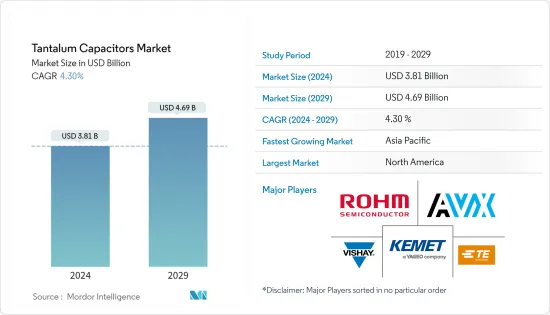

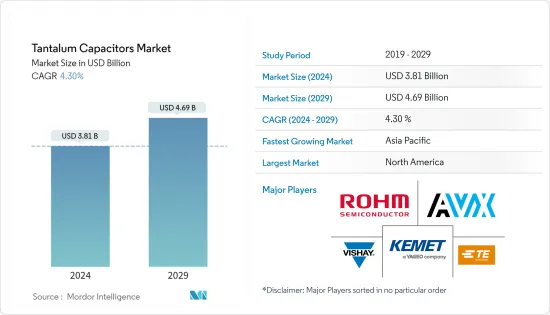

預計2024年全球鉭電容器市場規模將達38.1億美元,2024-2029年預測期間複合年成長率為4.30%,2029年將達46.9億美元。

主要亮點

- 鉭電容器包含充當電介質的導電陰極,並圍繞著充當鉭金屬陽極的氧化層。透過使用鉭,介電層可以做得非常薄。與其他幾種類型的電容器相比,單位體積的電容值較高,頻率響應優異,並且隨時間的推移具有穩定性。

- 然而,使用此類鉭電容器的缺點是不良故障模式,可能導致熱失控、火災和小爆炸。然而,外部故障安全設備(例如熱熔斷器和限流器)可以防止這種情況發生。科技的進步使得這些鉭電容器被用於筆記型電腦、汽車、行動電話等的各種電路中,最常見的是表面黏著型元件的形式。這些表面黏著技術鉭電容器也需要印刷基板的空間更小,並允許更高的封裝密度。

- 這些鉭電容器現在還提供軍用規格版本,可提供更嚴格的公差和更全面的動作溫度範圍。鉭電容器在軍事應用中被廣泛用作電解電容器的替代品,因為它們不易乾燥,並且即使長期使用後其電容量也不易變化。由於鋁電解質的高穩定性,醫療電子產品也依賴鋁電解質。此外,音訊放大器有時會使用這些鉭電容器,其中穩定性是一個重要因素。

- 同樣,在惡劣環境下對鉭電容器的需求預計將增加供應商公司的議價能力,因為將會有更多的產品創新。例如,2022年5月,Exxelia宣布推出可靠度等級為R的MIL-PRF-39006/25和MIL-PRF-39006/22鉭電容器。該電容器符合美國國防部製定的標準,設計用於在 -55 至 +125 C 的惡劣環境條件下運作。

- 此外,Vishay 還於 2022 年 5 月推出了適用於軍事和航空電子應用的單位電壓額定功率電容最高的濕鉭電容器。電容器作為 B 和 C 外殼代碼的選項提供,基於 SuperTan 技術,C 外殼代碼的電容為 3,600F 至 72,000F,B 外殼代碼的電容為 2,700F 至 48,000F。因此,此類創新正在推動鉭電容器在軍事領域的日益普及。

- 此外,隨著5G的快速發展,對鉭電容器的需求也增加。以濕鉭電容器取代固體電容器可能會在短期內帶來機會。在軍事應用中,它是鋁電解質的流行替代品,因為它不易乾燥,其電容不會隨時間變化。

- 另一方面,鉭電容器的缺點是成本比電解電容器高成本,由於其固有的極化而容易受到反向電壓的影響,並且由於暫態電壓、突波、峰值和脈衝電流而可能發生故障。存在以下幾個問題作為:電流突波和漏電流也會對固體鉭電解電容器產生不利影響。但鉭電解電容器的介電層極薄,介電常數高,因此具有單位體積電容高、重量輕等優點。

- 正如各種報告中所提到的,鉭電容器有多種與 COVID-19 相關的應用。例如,《Medical Design Briefs》中的一份報告提到了鉭電容器在醫療設備中的使用,這對 COVID-19 患者的生命維持監測至關重要。 TTI 的另一份報告表明,鉭電容器可在許多應用中取代積層陶瓷電容(MLCC),後者因 COVID-19 大流行而面臨供應鏈中斷和沉降物。在大流行後的情況下,隨著情況恢復正常,鉭電容器的使用量增加。

鉭電容器市場趨勢

家電領域可望帶動市場成長

- 鉭電容器是許多電子設備的重要組件,包括智慧型手機、筆記型電腦和平板設備等家用電子電器產品。這些電容器的單位體積電容較高,可實現更小、更有效率的設備。然而,鉭電容器比同類電解電容器更可靠,必須小心處理,因為它們本質上是極化的。

- 鉭電容器通常用於各種家用電子電器,包括智慧型手機。這些電容器通常用作連接到智慧型手機的 GSM放大器(PA) 電源線的電容器。鉭電容器的小尺寸使其適合用於智慧型手機等小尺寸應用。愛立信預計,2022年全球智慧型手機用戶數預計將超過66億,2028年將達78億。智慧型手機行動網路訂閱數量最多的國家是中國、印度和美國。智慧型手機的顯著成長可能會推動市場發展。

- 鉭電容器也用於筆記型電腦和其他電子設備。例如,研究表明筆記型電腦中的電源濾波器,尤其是主機板中的每個電源濾波器含有約 1 克鉭。這是因為鉭電容器比 MLCC 電容器提供更高的電容值,並且不會表現出顫噪效應,這使得它們成為扁平或緊湊設計設備的有吸引力的選擇。

- 根據中國國家統計局的數據,2022年4月中國完成電腦約3,266萬台。此外,根據電子和資訊技術部的數據,2021 會計年度印度電腦硬體產值為 2,200 億印度盧比(26.4 億美元)。國產電腦配件的價值正在穩定成長。電腦生產方面的巨額支出可能會為鉭電容器製造商擴大產品系列創造機會。

- 此外,電視使用電容器有多種用途。用作電路之間的耦合器、定時元件和電子濾波器。大多數電視都有一個電源,可以將家用插座的 110 伏特交流電轉換為低壓直流電。電源電路使用大型鉭電容器作為電子消音器,以消除電雜訊。由於鉭電容器具有電荷,因此它們起到阻尼器的作用,大大減慢了雜訊電流的快速移動。

預計北美將佔據主要市場佔有率

- 北美地區是全球最大的電容器消費國之一。汽車和電子產業預計將成為美國等國家電器的重要消費者。美國是世界上最大的汽車市場之一,擁有超過13家主要汽車製造商。

- 最近,美國最大的兩個汽車產業組織——全球汽車製造商和汽車製造商聯盟——合併成立了一個新的聯盟,稱為汽車創新聯盟。隨著汽車產業動態的變化,汽車製造商正在轉向電動車,以滿足下一代消費者的需求。加州在電動車銷售方面主導美國市場。該州的零排放汽車(ZEV)計劃要求該州的汽車製造商銷售一定比例的電動車,從而促進了對電動車的需求。

- 根據美國能源資訊署 (EIA) 的數據,到 2023 年第二季度,混合動力汽車、插電式混合動力汽車和純電動車將總合占美國輕型車銷量的 16%。此外,根據加拿大統計局的數據,ZEV 約佔加拿大註冊新車的 10%。 2023 年第二季度,ZEV市場佔有率創下 10.5% 的歷史新高,較 9.2% 大幅成長。此外,加拿大輕型工業車輛(車輛重量8,500磅以下)總量大幅增加34.3%。電動車銷量的成長可能為研究市場創造利潤豐厚的機會。

- 鉭電容器因其即使在惡劣環境下也具有可靠性和性能而經常用於軍用電子產品。鉭電容器可以承受高溫和振動,使其成為軍事和航太應用的理想選擇。國防聯邦採購法規補充(DFARS)要求國防系統中使用的鉭電容器不包含來自某些國家的材料,以確保供應鏈安全。

- 國防預算的增加可能會推動所研究市場的需求。據美國預算辦公室稱,美國國防支出預計將逐年增加,直至 2033 年。 2023年美國國防開支預計將達7,460億美元。根據同一預測,到 2033 年,國防支出預計將增加至 1.1 兆美元。如此巨額的國防支出很可能使參與者能夠開發出滿足廣泛客戶需求的新產品。

鉭電容器產業概況

全球市場的領導供應商正在將鉭電容器市場變成半固體。主要企業參與收購和合作等各種策略,以提高市場佔有率並提高市場盈利。該市場的主要企業包括 Vishay Intertechnology, Inc.、KEMET Corporation、TE Connectivity、AVX Corporation 和 ROHM。

- 2023 年 10 月 Vishay Intertechnology, Inc. 宣布推出採用氣密玻璃金屬密封的新型濕式鉭電容器系列。這些 STH電解電容器專為航空電子和航太應用而設計,具有 Vishay SuperTan 擴展系列裝置的所有優點。它還具有更高的可靠性設計,具有增強的軍用 H 級衝擊 (500g) 和振動能力,以及增強的熱衝擊高達 300 次循環。

- 2023 年 10 月 KYOCERA AVX 宣佈為印度太空研究組織 (ISRO) 歷史性的月球探勘任務「Chandrayaan-3」做出貢獻。該公司為 Pragyaan 月球探勘提供各種重要零件,包括專門設計的多層 TCH 系列表面黏著技術鉭聚合物電容器,符合 ISRO 規範。此外,Kyocera AVX也設計了微型CWR15 MIL-PRF-55365/12鉭片電容器和高電容、低ESR TES系列ESCC QPL鉭片電容器,用於小型化軍用和航太電路。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 設備小型化日益受到關注

- 汽車電子設備的興起

- 市場限制

- 鉭礦石價格波動

第6章市場區隔

- 按用途

- 醫療設備

- 家用電器

- 車

- 工業的

- 其他用途

- 按地區

- 美洲

- 歐洲、中東/非洲

- 亞太地區(不包括日本和韓國)

- 日本韓國

第7章 競爭形勢

- 公司簡介

- Vishay Intertechnology, Inc.

- KEMET Corporation

- TE Connectivity

- AVX Corporation

- ROHM Co., Ltd.

- Samsung Electro-Mechanics

- Vicor Corporation

- Abracon

- Panasonic Corporation

- NTE Electronics Inc.

第8章投資分析

第9章 市場未來展望

The Tantalum Capacitors Market size is estimated at USD 3.81 billion in 2024, and is expected to reach USD 4.69 billion by 2029, growing at a CAGR of 4.30% during the forecast period (2024-2029).

Key Highlights

- Tantalum capacitors include a conductive cathode surrounding a layer of oxide that serves as a dielectric and acts as an anode for the tantalum metal. The use of tantalum enables a very thin dielectric layer. This results in a higher capacitance value per volume, superior frequency characteristics compared to multiple other types of capacitors, and excellent stability over time.

- However, the downside of using these tantalum capacitors is their unfavorable failure mode, which may lead to thermal runaway, fires, and small explosions. However, external failsafe devices like thermal fuses or current limiters can prevent this from happening. Technological advancements have enabled these tantalum capacitors to be used in various circuits found in laptops, automobiles, and cell phones, among others, most often in the form of surface-mounted devices. These surface-mount tantalum capacitors also require less space on the PCBs and allow for greater packing densities.

- These tantalum capacitors have also been made available in military-specified versions that offer tighter tolerances and a more comprehensive operating temperature range. These have become a popular replacement for aluminum electrolytics in military applications as they do not tend to dry out and change capacitance over a period of time. Medical electronic technologies also rely on these owing to their higher stability. Also, audio amplifiers sometimes use these tantalum capacitors where stability is a critical factor.

- Similarly, the demand for tantalum capacitors in harsh environments is expected to increase the bargaining power of the suppliers as there are more product innovations. For instance, in May 2022, Exxelia announced the launch of MIL-PRF-39006/25 and MIL-PRF-39006/22 tantalum capacitors with support for reliability level R. The capacitors meet standards set by the US Department of Defense and are designed to operate in the harshest environmental conditions, with temperatures ranging from -55°C to +125°C.

- Additionally, in May 2022, Vishay also introduced wet tantalum capacitors with the highest capacitance per voltage rating for military and avionics applications. The capacitors are made available as an option in the B and C case codes and are built on SuperTan technology to feature a capacitance from 3,600 F to 72,000 F in the C case code and 2,700 F to 48,000 F in the B case code. Therefore, such innovations are driving adoption growth for tantalum capacitors in military sectors.

- Moreover, as 5G is rapidly growing, the need for tantalum capacitor increases. The replacement of solid capacitors with wet tantalum capacitors is likely to present an opportunity soon. In military applications, they are a popular replacement for aluminum electrolytes as they do not tend to dry out and change capacitance over time.

- On the other side, tantalum capacitors have several challenges, including their high cost compared to aluminum electrolytic capacitors, being inherently polarized and vulnerable to reverse voltage, and the potential for failure due to transient voltage, surge, peak, or pulse currents. Current surges or leakage current can also harm solid tantalum electrolytic capacitors. However, tantalum capacitors also offer advantages such as high capacitance per volume and lower weight due to their very thin and high permittivity dielectric layer.

- There were several COVID-19-related applications of tantalum capacitors, as mentioned in various reports. For example, a report by Medical Design Briefs mentioned using tantalum capacitors in medical devices that were essential for the life support monitoring of COVID-19 patients. Another report by TTI, Inc. suggested that in many applications, tantalum capacitors could be used instead of multilayer ceramic capacitors (MLCCs), which faced supply chain disruptions and fallout due to the COVID-19 pandemic. In the post-pandemic scenario, there was an increase in the use of tantalum capacitors as the situation became more normalized.

Tantalum Capacitors Market Trends

Consumer Electronics Segment is Expected to Drive the Market's Growth

- Tantalum capacitors are essential components in many electronic devices, including consumer electronics such as smartphones, laptops, and tablets. These capacitors offer high capacitance per volume, allowing for smaller, more efficient devices. However, tantalum capacitors are considerably more reliable than comparable aluminum electrolytic capacitors and must be carefully handled as they are inherently polarized.

- Tantalum capacitors are commonly used in various consumer electronic devices, including smartphones. These capacitors are often used as the capacitor connected to the power line of the Power Amplifier (PA) for GSM on smartphones. Tantalum capacitors are small in size, making them suitable for use in small-footprint applications like smartphones. According to Ericsson, the global number of smartphone subscriptions reached over 6.6 billion in 2022 and is expected to hit 7.8 billion by 2028. The countries with the most smartphone mobile network subscriptions are China, India, and the United States. Such a huge rise in smartphones would drive the market.

- Tantalum capacitors are also used in laptops and other electronic devices. For example, researchers demonstrated that about 1 gram of tantalum is used per unit in laptops, specifically in motherboard power supply filters. This is because tantalum capacitors offer higher capacitance values than MLCC capacitors and display no microphonic effect, making them an attractive option for devices with flat or compact designs.

- According to the National Bureau of Statistics of China, China produced around 32.66 million units completed computers in April 2022. Further, according to the Ministry of Electronics and Information Technology, the value of computer hardware output in India was INR 220 billion (USD 2.64 billion), in the fiscal year 2021. The value of computer accessories produced in the country has been steadily increasing. Such huge spending on computer production would create an opportunity for the tantalum capacitors manufacturers to expand their product portfolio.

- Furthermore, a television uses capacitors for multiple purposes. They are used as couplers between circuits, timing components, and electronic filters. Most televisions have a power supply converting the 110-volt alternating current from a household outlet to a low-voltage direct current. Power supply circuits utilize large tantalum capacitors as a form of electronic muffler that removes electrical noise. As tantalum capacitors hold electric charge, they act as dampers, which significantly slows down sudden movements of current, including noise.

North America is Expected to Hold a Major Market Share

- The North American region is one of the largest consumers of capacitors in the world. The automotive and electronics sectors are anticipated to be significant consumers of capacitors in countries such as the United States. The U.S. is one of the largest automotive markets in the world and is home to more than 13 major automakers.

- Recently, the two largest automotive industry trade associations in the United States, Global Automakers and the Alliance of Automobile Manufacturers, merged to form a new alliance known as the Alliance for Automotive Innovation, which is expected to help introduce innovations in the automotive industry. With changing dynamics in the sector, automotive manufacturers are moving towards electric vehicles to meet the needs of next-generation consumers. California dominates the United States market in terms of sales of EVs. Its Zero Emission Vehicle (ZEV) program is driving demand for EVs by requiring automakers in the state to sell a certain percentage of electric cars.

- According to the US Energy Information Administration (EIA), hybrid, plug-in hybrid, and battery EVs collectively represented 16% of US light-duty vehicle sales in the second quarter of 2023. Additionally, According to Statistics Canada, ZEVs make up approximately 10% of the new vehicles registered in Canada. The market share of ZEVs reached a new high of 10.5% in Q2 2023, showing a significant increase from 9.2%. Furthermore, the total volume of light industry vehicles (with a gross vehicle weight of 8500 lbs or less) in Canada saw a notable growth of 34.3%. Such a rise in EV sales would create lucrative opportunities for the studied market.

- Tantalum capacitors are commonly used in defense electronics due to their high reliability and performance in harsh environments. Tantalum capacitors can withstand high temperatures and vibrations, making them ideal for use in military and aerospace applications. The Defense Federal Acquisition Regulation Supplement (DFARS) requires that tantalum capacitors used in defense systems not contain materials sourced from certain countries to ensure supply chain security.

- The rise in the defense budget would drive demand for the studied market. According to the US Congressional Budget Office, defense spending in the United States is expected to rise annually until 2033. Defense spending in the United States is expected to reach USD 746 billion in 2023. Defense spending is expected to rise to USD 1.1 trillion by 2033, according to the prediction. Such huge spending in defense would allow the players to develop new products to cater to a wide range of customer needs.

Tantalum Capacitors Industry Overview

The tantalum capacitors market is semi-consolidated due to large vendors in the global market. The key players are involved in various strategies, such as acquisitions and partnerships, to improve their market share and enhance their profitability in the market. The key players in the market include Vishay Intertechnology, Inc., KEMET Corporation, TE Connectivity, AVX Corporation, ROHM Co., Ltd., and many others.

- October 2023: Vishay Intertechnology, Inc. announced the release of a new series of wet tantalum capacitors with hermetic glass-to-metal seals. These STH electrolytic capacitors are specifically designed for avionics and aerospace applications and offer all the benefits of Vishay's SuperTan extended series devices. They also feature a higher reliability design, enhancing military H-level shock (500 g) and vibration capabilities and increased thermal shock up to 300 cycles.

- October 2023: KYOCERA AVX announced its contribution to the Indian Space Research Organization's (ISRO's) historic Chandrayaan-3 lunar mission. The company provided various essential components for the Pragyaan lunar rover, including specially designed stacked TCH Series surface-mount tantalum polymer capacitors that meet ISRO specifications. Additionally, KYOCERA AVX engineered miniature CWR15 MIL-PRF-55365/12 tantalum chip capacitors to downsize military and aerospace circuits, along with high-capacitance and low-ESR TES Series ESCC QPL tantalum chip capacitors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Focus on Miniaturization of Devices

- 5.1.2 Rising in-vehicle Electronics

- 5.2 Market Restrains

- 5.2.1 Fluctuations in the Price of Tantalum ore

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Medical Devices

- 6.1.2 Consumer Electronics

- 6.1.3 Automotive

- 6.1.4 Industrial

- 6.1.5 Other Applications

- 6.2 By Geography

- 6.2.1 Americas

- 6.2.2 Europe, Middle East & Africa

- 6.2.3 Asia-Pacific (Excl. Japan and Korea)

- 6.2.4 Japan and Korea

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Vishay Intertechnology, Inc.

- 7.1.2 KEMET Corporation

- 7.1.3 TE Connectivity

- 7.1.4 AVX Corporation

- 7.1.5 ROHM Co., Ltd.

- 7.1.6 Samsung Electro-Mechanics

- 7.1.7 Vicor Corporation

- 7.1.8 Abracon

- 7.1.9 Panasonic Corporation

- 7.1.10 NTE Electronics Inc.