|

市場調查報告書

商品編碼

1431451

HVAC 感測器:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029 年)HVAC Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

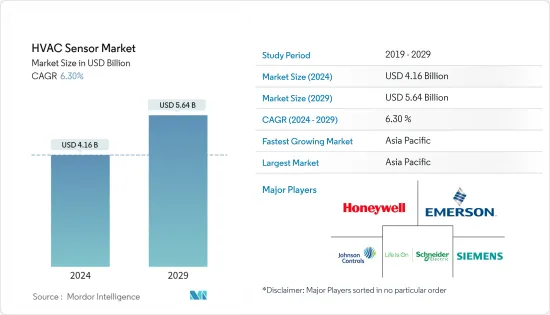

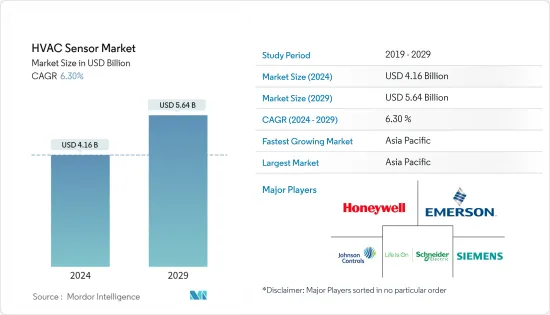

HVAC感測器市場規模預計到2024年將達到41.6億美元,預計到2029年將達到56.4億美元,在市場估計和預測期間(2024-2029年)複合年成長率為6.30%。曾經。

HVAC 感測器可調節和監控商業建築和住宅等最終用戶建築中的各種活動,例如空氣溫度、壓力和品質。因此,由於降低能耗和提高能源效率的需求不斷增加,HVAC 感測器得到普遍使用。

主要亮點

- 全球工業化和都市化的快速發展是推動市場成長的主要因素之一。由於世界各地各種商業建築和住宅的建設大幅增加,作為空間供暖和製冷系統、通風控制、濕度控制和空氣過濾,對 HVAC 感測器的需求大幅增加。例如,根據IEA的數據,全球建築施工產業金額超過6.3兆美元,與前一年同期比較成長5%。

- 提高感測器與物聯網 (IoT) 平台的兼容性正在成為促進遠端監控和控制的先決條件。物聯網連接設備為感測器在工業、醫療、消費性電子和汽車等各種應用中提供了巨大的可能性。根據思科年度網際網路報告,到2023年,連網設備數量預計將從2018年的184億增加到約300億。到 2023 年,物聯網設備預計將佔所有連網裝置的 50%(147 億),高於 2018 年的 33%(61 億)。物聯網設備的增加可能會推動所研究市場的成長。

- 商業建築中的暖氣、通風和空調通常比建築內的任何其他活動消耗更多的能源。根據美國能源局研究,暖通空調設備通常佔建築物能源使用的 40% 以上。由於能源量龐大,HVAC系統可以利用感測器來提高設備效率,從而顯著降低建築營運成本。

- 例如,暖通空調監控系統包括物聯網感測器,用於監控溫度、運轉率、新鮮空氣攝入量和其他室內氣候條件。控制器和致動器將從這些感測器收集的資料轉化為行動。有些操作是立即執行的,並且已預先編程到系統中。具有機器學習功能的智慧建築管理平台可以提供詳細的見解並不斷完善調整,以執行更複雜的分析。

- 此外,能源規範和建築規範在過去十年也大大支持了節能建築的設計。例如,主導美國綠建築委員會(USGBC)主導的能源與環境設計(LEED)綠建築評級體系提高了人們對建築設計有效利用能源的必要性的認知。因此,該國多個州要求政府建築使用 LEED 評級系統。

- 諸如此類的措施顯示了建築節能的重要性。因此,降低能耗的需求日益成長,HVAC 感測器越來越普遍用於提高能源效率。因此,政府和監管機構正在關注暖通空調控制如何減少建築能耗。

- 這種流行病對暖通空調產業產生了重大影響,由於封鎖限制和公司避免投資新設備,感測器需求在前幾個月大幅下降。疫情導致世界各地許多建設計劃暫停。商業、住宅和工業領域建設活動的減少暫時減少了對 HVAC 感測器(包括空氣調節機)的需求。

- 此外,2020年2月至3月,由於中國等國家停產,多個產業出現供不應求。供應鏈中斷導致原物料價格上漲,影響感測器的整體定價。

HVAC感測器市場趨勢

建築和維修活動的增加推動了市場成長

- 根據JRAIA統計,近年來全球室內空調需求量已增加至9,516萬台。此外,根據聯合國的數據,預計到 2022 年 11 月 15 日,世界人口將達到 80 億。該組織的最新預測表明,2030年世界人口將達到約85億,2050年約97億,2100年約104億。死亡率下降也影響著人口成長。

- 此外,在亞太地區,特別是中國和印度等新興市場,大量人口從農村遷移到都市區,增加了政府和私人在住宅、商業建築和基礎設施方面的支出。新建築的建設對安裝暖氣、通風和空調系統新設備產生了巨大的需求。因此,建設產業的成長可能會推動所研究的市場。

- 例如,2021年11月,印度政府核准在Pradhan Mantri Awas Yojana(都市區)下建造361萬套住宅。新住宅單位的核准使該計劃批准的住宅總數達到 11.4 億套。這些趨勢將對新安裝的暖通空調系統中對暖通空調感測器的需求產生正面影響。

- 此外,政府為提高能源效率而進行的建築維修計劃數量不斷增加,正在顯著擴大全球暖通空調感測器市場。這是因為節能建築有益於公眾健康,因為它們可以減少溫室氣體排放,降低住宅和企業的能源費用,並改善室內空氣品質。

- 此外,歐洲等國家也宣布了《歐洲綠色交易》,這是一項雄心勃勃的一攬子政策,旨在使歐洲在 2050 年之前成為第一個氣候中和的大陸。歐洲綠色新政的目標是到 2050 年將建築維修率提高一倍或三倍,加速建築數位化,並使歐盟建築存量實現脫碳。Masu。

- 因此,隨著建築和維修的增加,降低能耗的需求顯著增加了對節能 HVAC 感測器的需求,以維持建築物內舒適的室內溫度和良好的空氣質量,從而提高能源和效率。

亞太地區預計將錄得最快成長

- 由於印度和中國的商業和住宅建設活動以及奢侈品消費者支出的增加,預計亞太地區暖通空調感測器市場將出現強勁成長。由於擁有率低和可支配收入增加,亞洲市場預計將成長。由於印度和中國的需求不斷成長,住宅領域佔據了亞太地區暖通空調感測器市場的很大一部分。

- 根據中國建設業協會的數據,2021年,住宅建築在中國竣工建築中佔比最大。住宅建築面積佔竣工占地面積的67%以上。隨著國家經濟的成長,人們從農村地區遷移到大城市,增加了這些地區的住宅需求。此外,用作投資物業的公寓正在推動需求。如此大規模的住宅預計將推動受調查的市場。

- 而且,商業建築的增加估計會對人們的能源消耗產生直接影響,因此中國政府正在認真考慮能源管理。兩項法律為建築能源系統以及 HVAC 和 R 行業提供了主要指導方針:《節能法案》和《可再生能源法案》。

- 該地區的公司正在開發新產品以贏得市場佔有率。例如,2022年3月,Voltas推出了印度首款採用HEPA過濾技術的空調。 Voltas的PureAir 6級可調變頻空調內建PM1.0空氣品質感測器和AQI指示器(業界首創)可協助淨化室內空氣,並具有6級可調音調模式,您可以在多種音調之間切換取決於環境溫度和房間內的人數。提供純淨、乾淨的空氣,節省成本並最佳化能源。

- 此外,根據 RAP(監管援助計劃)的數據,到 2021 年,在日本安裝熱泵將減少 8,100 萬噸二氧化碳排放。 RAP 計算得出,中國建築中熱泵的部署每增加 1%,每年可減少 7.1 噸二氧化碳排放。目前,我國只有3.4%的建築面積採用熱泵供暖。

- 這些估計支持該地區採用高效的 HVAC 感測器。物聯網 HVAC 監控系統使用感測器資料評估設備效能、識別低效率並根據各種變數提高效率,幫助建築物更有效率地供熱和冷卻。制定您的自動化策略。

- 物聯網設備還可以監控暖通空調系統內的元件,包括可變風量系統和風機盤管,以提高能源效率。例如,即使家中無人,運動啟動空調系統也可以根據家中的運動情況打開和關閉感應器,從而節省金錢。

HVAC 感測器產業概述

HVAC 感測器市場中知名製造商的數量不斷增加,而競爭公司之間的敵意預計在預測期內將會加劇。西門子股份公司、艾默生電氣公司、霍尼韋爾國際公司和 TE Connectivity Ltd. 等市場老牌企業對整個市場有重大影響。市場上的公司正在採取聯盟和收購等策略來加強其產品陣容並獲得永續的競爭優勢。

2023年3月,Sensirion宣布推出SHT40I-類比濕度感測器。此感測器適用於噪音水平高且數位解決方案無效的惡劣工業應用和惡劣環境。這種新穎的感測器由於其簡單的設計和客戶特定的輸出特性,可以大量生產。

2022 年4 月,特靈科技(Trane Technologies PLC) 宣布將繼續建立戰略合作夥伴關係,利用三菱電機的Air-Fi 無線感測器進行City Multi-VRF 和Intellipak 1 HVAC 屋頂機組改進,以實現更高的能源效率。此次升級提供技術、資料和控制,幫助建築業主滿足效率標準,實現脫碳目標,並使維修變得更容易、更具成本效益。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 科技趨勢

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 建築業的成長

- 汽車領域對暖通空調感測器的需求不斷成長

- 市場限制因素

- 與運動啟動空調相關的挑戰

第6章市場區隔

- 按類型

- 溫度感應器

- 濕度感測器

- 壓力/流量感測器

- 動作感測器

- 煙霧/氣體感測器

- 其他類型

- 按最終用戶

- 住宅

- 商業/工業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Siemens AG

- Emerson Electric Co.

- Honeywell International Inc.

- Schneider Electric

- TE Connectivity Ltd.

- Sensirion AG

- Senmatic A/S

- Sensata Technologies, Inc.

- Belimo Aircontrols(USA), Inc.

- Johnsons Controls Inc.

第8章投資分析

第9章市場的未來

The HVAC Sensor Market size is estimated at USD 4.16 billion in 2024, and is expected to reach USD 5.64 billion by 2029, growing at a CAGR of 6.30% during the forecast period (2024-2029).

The HVAC sensors regulate and monitor various activities like air temperature, pressure, and quality in end-user buildings like commercial and residential buildings. Hence, HVAC sensors are being commonly used owing to the increasing need to reduce energy consumption and enhance energy efficiency.

Key Highlights

- The rapid rise in industrialization and urbanization worldwide is one of the primary factors driving the market's growth. The significant increase in the construction of different commercial and residential buildings worldwide is creating considerable demand for HVAC sensors as a space heating and cooling system, ventilation control, humidity control, and air filtration. For instance, according to the IEA, the global building construction sector's value increased by 5% compared to the previous year, reaching over USD 6.3 trillion.

- Increasing sensor compatibility with the Internet of Things (IoT) platform is gradually becoming a prerequisite for facilitating remote monitoring and control. IoT-connected devices have opened massive opportunities for sensors in several applications like industrial, medical, consumer electronics, automotive, etc. According to Cisco's Annual Internet Report, by 2023, there is expected to be nearly 30 billion network-connected device connections, up from 18.4 billion in 2018. By 2023, IoT devices were expected to make up 50% (14.7 billion) of all networked devices, up from 33% (6.1 billion) in 2018. Such an increase in IoT devices would drive the growth of the studied market.

- Heating, ventilating, and air-conditioning in a commercial building usually consume more energy than any other activity in the building. According to U.S. Department of Energy studies of commercial buildings, HVAC equipment usually accounts for over 40% of a building's energy usage. Owing to the huge amount of energy, HVAC systems use sensors to improve equipment efficiency, which results in significant reductions in building operating costs.

- For instance, HVAC monitoring systems include IoT sensors for monitoring temperature, occupancy, fresh air intake, and other indoor climate conditions. Controllers and actuators turn the data collected from these sensors into action. Some actions are immediate and preprogrammed into the system. Smart building management platforms with machine learning capabilities that provide in-depth insights and continuously refine adjustments carry out more complex analyses.

- Furthermore, energy standards and building codes have also significantly driven the design of energy efficient buildings over the past decade. For instance, the US Green Building Council's (USGBC) leadership in the Energy and Environmental Design (LEED) Green Building Rating System has raised awareness of the need for building designs that use energy efficiently. As such, several states in the country have mandated the use of the LEED rating system for government buildings.

- Such initiatives indicate the importance of energy conservation in buildings. Hence, HVAC sensors are being commonly used because the need to reduce energy consumption is increasing, enhancing energy efficiency. As a result, the government and regulatory organizations are primarily focusing on how HVAC controls can reduce energy consumption in buildings.

- The pandemic significantly influenced the HVAC industry, as demand for the sensors observed a significant drop during the initial months, owing to lockdown restrictions and businesses refraining from investing in new equipment. Due to the pandemic, many construction projects were halted across the world. The reduction in construction activities across the commercial, residential, and industrial sectors temporarily dampened the demand for HVAC sensors, including those for air handling units.

- Moreover, due to the production shutdown in countries such as China, multiple industries observed a shortage of supply of various products during February and March 2020. Due to supply chain disruption, the price of raw materials increased, impacting the overall pricing of the sensors.

HVAC Sensor Market Trends

Increased Construction and Retrofit Activity to Aid the Market's Growth

- According to JRAIA, the global demand for room air conditioners has increased to 95.16 million in recent years. Furthermore, according to the United Nations, the world's population was projected to reach 8 billion on November 15, 2022. The latest projections by the organization suggested that the global population could reach around 8.5 billion in 2030, 9.7 billion in 2050, and 10.4 billion in 2100. Declining levels of mortality partly influence population growth.

- Furthermore, in emerging markets like the Asia Pacific region, especially China and India, many people have been migrating from rural areas to cities, raising government and private spending on housing, commercial construction, and infrastructure. New building construction is creating significant demand for new equipment installations for heating, ventilation, and air conditioning systems. Hence, the growing construction industry would likely drive the studied market.

- For instance, in November 2021, the Indian government approved the construction of 3.61 lakh houses under the Pradhan Mantri Awas Yojana (Urban). The approval of the new housing units takes the total number of sanctioned houses under the scheme to 1.14 crore. Such trends positively contribute to the demand for HVAC sensors, in newly installed HVAC systems.

- Moreover, increasing building renovation projects by the government to make them more energy-efficient are significantly increasing the global HVAC sensor market. This is because energy-efficient buildings can help reduce greenhouse gas emissions, lower energy bills for homeowners and businesses, and improve indoor air quality, thus making them suitable for public health.

- Moreover, a country like Europe has presented the European Green Deal, an ambitious package of policy measures to make Europe the first climate-neutral continent by 2050. The European Green Deal aims to double or even triple building renovation rates and speed up building digitization to ensure the EU's building stock is on track to decarbonize by 2050.

- Therefore, with the growing construction and retrofit activities, there will be a significant rise in the demand for energy-efficient HVAC sensors for maintaining comfortable indoor temperatures and good air quality in buildings, owing to the need to reduce energy consumed, increasing and leading to the enhancement of energy and its efficiency.

Asia-Pacific Expected to Register Fastest Growth

- The Asia-Pacific HVAC sensor market is predicted to rise steadily due to commercial and residential construction activity in India and China and rising consumer expenditure on luxury products. Low ownership rates and increased disposable income in Asia will likely boost the market's growth. Due to rising demand from India and China, the residential sector accounted for a significant portion of the Asia-Pacific HVAC sensor market.

- According to the China Construction Industry Association, in 2021, residential structures accounted for the largest share of finished construction in China. Buildings intended for housing accounted for over 67 percent of the completed floor space. As the country's economy grows, people migrate from rural areas to major cities, increasing demand for residential accommodation in these locations. Furthermore, apartments utilized as investment properties drive up demand. Such huge residential construction is expected to drive the studied market.

- Besides, the increase in commercial buildings is estimated to affect national energy consumption directly, so the Chinese government has seriously considered energy management. Two laws, the Energy Saving Law and the Renewable Energy Law, provide the main guidelines for building energy systems and the HVAC and R industries.

- The players in the region are developing new products to capture market share. For instance, in March 2022, Voltas unveiled India's first AC with HEPA filter technology. Voltas' PureAir 6 Stage Adjustable Inverter AC is embedded with a PM 1.0 air quality sensor and AQI indicator (an industry first) that helps to purify the indoor air and is also loaded with 6 Stage Adjustable Tonnage Mode, which allows the user to switch between multiple tonnages depending on the ambient heat or number of people in the room. It provides pure and clean air, cost savings, and energy optimization.

- Further, according to RAP (Regulatory Assistance Project), heat pump installations in the country reduced CO2 emissions by 81 million metric tons in 2021. RAP calculated that with every 1% increase in heat pump uptake in China's buildings, an additional 7.1 Mt of CO2 may be avoided each year. Presently, just 3.4% of building area in China uses heat pumps for space heating, indicating a considerable possibility to grow deployment and reduce CO2 emissions countrywide.

- Such estimates encourage the adoption of efficient HVAC sensors in the region. Since IoT HVAC monitoring systems help buildings heat and cool spaces more efficiently, Sensor data can be used to evaluate equipment performance, identify inefficiencies, and create efficiency-focused automation strategies based on a range of variables.

- IoT devices can also monitor elements within an HVAC system, including variable air volume systems and fan coils, to promote energy efficiency. For instance, motion-activated air conditioning systems use sensors that turn themselves off and on based on movement in the home, saving money in the absence of anyone in the home.

HVAC Sensor Industry Overview

The increasing presence of prominent manufacturers in the HVAC sensors market is expected to intensify competitive rivalry during the forecast period. Market incumbents like Siemens AG, Emerson Electric Co., Honeywell International Inc., and TE Connectivity Ltd. considerably influence the overall market. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain a sustainable competitive advantage.

In March 2023, Sensirion announced the release of the SHT40I-Analog humidity sensor, which is intended for demanding industrial applications and severe settings where high noise levels may make digital solutions ineffective. The novel sensor allows for simple design and customer-specific output characteristics for high-volume applications.

In April 2022, Trane Technologies PLC announced a strategic continuing collaboration to achieve higher energy efficiency using Air-Fi wireless sensors for Trane and Mitsubishi Electric City multi VRF and improvements to the IntelliPak 1 HVAC Rooftop Unit. The upgrades give building owners technology, data, and controls to help them satisfy efficiency standards, achieve decarbonization targets, and make retrofits easier and more cost-effective.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technology Trends

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Value Chain Analysis

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Construction Sector

- 5.1.2 Growing Demand for HVAC Sensors in the Automotive Sector

- 5.2 Market Restraints

- 5.2.1 Issues Related to Motion-Activated Air Conditioners

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Temperature Sensors

- 6.1.2 Humidity Sensors

- 6.1.3 Pressure & Flow Sensors

- 6.1.4 Motion Sensors

- 6.1.5 Smoke & Gas Sensors

- 6.1.6 Other Types

- 6.2 By End-user

- 6.2.1 Residential

- 6.2.2 Commercial & Industrial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 Emerson Electric Co.

- 7.1.3 Honeywell International Inc.

- 7.1.4 Schneider Electric

- 7.1.5 TE Connectivity Ltd.

- 7.1.6 Sensirion AG

- 7.1.7 Senmatic A/S

- 7.1.8 Sensata Technologies, Inc.

- 7.1.9 Belimo Aircontrols (USA), Inc.

- 7.1.10 Johnsons Controls Inc.