|

市場調查報告書

商品編碼

1431297

電阻器:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Resistor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

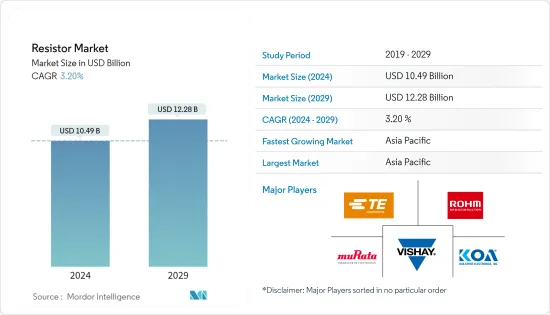

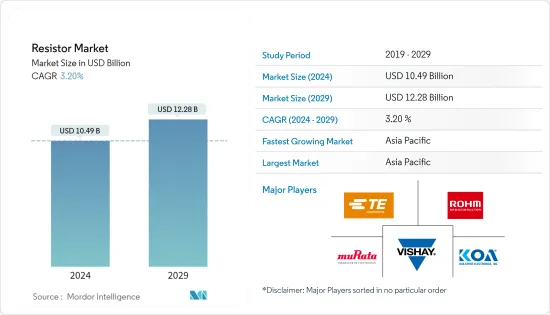

電阻器市場規模預計到2024年為104.9億美元,預計到2029年將達到122.8億美元,在預測期內(2024-2029年)複合年成長率為3.20%。

主要亮點

- 汽車製造商不斷努力提高性能,同時降低成本和重量,從而導致汽車中使用的電氣和電子元件取得重大進展。儘管數位技術已經出現,許多電路仍然依賴類比元件來確保可靠性和準確性。

- 在汽車領域,雖然馬達和ECU的數量由於更高的功能而不斷增加,但應用的安裝面積卻受到限制。因此,高密度封裝不斷進步,刺激了對小功率分路電阻器等元件的需求。此外,高性能匯流排分路電阻器在電動車中的應用正在幫助設計人員以新的創新方式應對市場挑戰。電動車需求的不斷成長補充了市場對電阻器的需求。

- 功率電阻器設計用於在緊湊的設備封裝中承受大量功率並耗散不需要的電能。這對於空間和重量能力是關鍵因素的飛機來說至關重要。功率電阻器有望成為下一代電傳線傳(FBW)飛行控制系統開發的一個組成部分,該系統旨在用全電子等效物取代手動控制。對線傳技術的進一步探索還包括使用功率電阻器,以數位飛行控制電腦驅動的電動致動器取代重型液壓機械飛行控制系統。

- 電阻器幾乎用於所有國防平台,國防工業更喜歡使用薄膜、電線和箔形式的鎳鉻合金,因為它具有防潮性和運行可靠性。

- 此外,近年來,由於厚膜片式晶片電阻器的短缺,釕的價格大幅上漲,從每金衡盎司 40 美元升至 850 美元。價格上漲導致客戶尋求替代設計,包括薄膜鎳基電阻。然而,與厚膜晶片相比,製造薄膜電阻的規模經濟可以忽略不計。厚膜晶片是全球生產量最大的產品之一,數量達數兆。

- 此外,COVID-19 大流行影響了半導體材料的銷售。然而,在後疫情時代,消費性電子產品的需求不斷成長,支撐著半導體產業的擴張。因此,汽車和電子行業對產品的需求預計將增加,從而促進電阻器市場的成長和整體效率的提高。

電阻器市場趨勢

市場區隔:消費性電子領域主導市場

- 電阻器是電子電路中最常用的被動元件之一,因為它們可以抵抗幾乎可以立即損壞電子設備的突然電壓尖峰。各種類型的電阻器廣泛應用於電腦、個人電腦、筆記型電腦等家用電子電器。

- 表面黏著技術晶片電阻器體積較小,通常用於智慧型手機和筆記型電腦內建的印刷電路基板(PCB)中,並且用於大多數矽印刷電路中,以確保訊號始終正確。壓敏電阻通常也稱為動阻器(金屬氧化物壓敏電阻的縮寫),是一種有多種形式的電阻器。它們大量用於突波或瞬態保護的主電源擴展,透過根據施加的電壓改變電阻來保護電腦。

- 智慧型手機中常見的電阻器類型包括表面黏著技術晶片電阻器和網路電阻器。晶片電阻器是行動電話PCB 上最小的電子元件之一。減小電流並讓它向前流動。網路電阻器由兩個或更多晶片電阻器製成。例如,華新科技公司的片式電阻器陣列用於行動電話、數位攝影機和其他消費性電子產品。

- 隨著家用電子電器的進步,功率和脈衝需求也在改變。開發更有效率的電子產品需要更低的功率、電壓和電流需求。因此,以前依賴昂貴的碳成分或線繞電阻的設計現在可以選擇更實惠的金屬氧化物電阻。儘管氧化金屬電阻器可能無法像碳成分或繞線電阻器那樣承受脈衝能量,但與標準金屬膜電阻器相比,它們仍然提供改進的脈衝處理能力。

亞太地區佔主要市場佔有率佔有率

- 不斷發展的電子工業吸引了多家跨國公司在亞洲國家設立製造工廠。其中包括 Tyco Electronics、FCI OEN、Molex、Vishay 和 EPCOS 等全球領導公司。預計這將進一步活性化亞太地區電阻器的本地生產。

- 在中國,對電阻器等被動電子元件的需求主要由家用電子電器的成長所推動。此外,中國工業和資訊化部公佈了2021年至2023年中國電子元件產業發展行動計畫。該行動計畫旨在實現電路、連接器、感測器、光纖通訊等領域的技術突破,提升中國企業在產業供應鏈中的地位,並緩解對國外高階產品的供應依賴。該計劃預計將為該地區的行業相關人員創造新的機會。

- 支持蟄居族經濟的筆記型電腦和遊戲機的強勁需求,以及行動電話和汽車應用需求的逐步復甦,正在對多家公司的生產力提高產生影響。

- 特別是,對電流檢測電阻器的需求正在迅速增加。然而,薄膜電阻器和晶片電阻器目前在印度市場的需求量相對較低。這一趨勢表明,印度沒有專門的電子製造商使用此類電阻器。然而,大多數製造商仍然認知到電阻器製造的未來在於厚膜和晶片電阻器。

- 台灣國巨等亞洲公司從事多種產品創新活動。 YAGEO集團開發出PA0100(01005尺寸,0.4mm x 0.2mm),是最小的金屬電流感測電阻器之一。 PA0100金屬電流檢測電阻主要應用於輕量化、薄型化、多功能、短時間、高密度的行動設備,如智慧型手機、電池模組、穿戴式裝置、高頻收發模組等。

電阻器產業概況

電阻器市場是一個半固定市場。市場競爭非常激烈,各個廠商都在積極嘗試擴大市場佔有率。該供應商還致力於產品開發、合作夥伴關係和地理擴張等各種成長策略,以發展基本客群並滿足全球範圍內的廣泛客戶需求。市場上的知名供應商包括 TE Connectivity Ltd.、Murata Manufacturing、Vishay Intertechnology Inc.、KOA Speer Electronics, Inc. 和 ROHM。

- 2023 年 4 月 ROHM 宣佈開發出業界最薄(0.03 吋高)12W額定功率金屬板分路電阻器(PSR350)。 PSR350 是一款針對汽車和工業設備市場的高功率應用而最佳化的產品。 ROHM計劃透過推出0.2mΩ(PSR100)和業界最小的15W類型(PSR330)來擴大其PSR產品陣容。分路電阻器在工業電源模組中的使用有著悠久的歷史。同樣,在汽車領域,採用薄型雙面冷卻功率模組作為xEV的主逆變器的趨勢日益明顯。

- 2023 年 3 月 Vishay Intertechnology, Inc. 宣布將 Draloric RCS0805 e3 防突波厚膜電阻的額定功率提高至 0.5 瓦。額定功率的額定功率使得此電阻器能夠取代 1210 外殼尺寸中的一個電阻器、較大 1206 外殼尺寸中的兩個並聯裝置或 0805 外殼尺寸中的四個標準並聯電阻器。這使得設計人員能夠節省基板空間,同時減少工業、通訊、汽車和醫療應用中的元件數量和佈局成本。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 汽車產業需求增加

- 對高性能電子產品的需求不斷成長

- 市場限制因素

- 金屬價格上漲影響生產成本

- 價值鏈分析

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 宏觀經濟分析

第5章市場區隔

- 類型

- 表面黏著技術晶片

- 網路

- 繞線

- 薄膜/氧化膜/箔

- 碳

- 最終用戶產業

- 車

- 航太/國防

- 通訊

- 消費性電子與計算

- 其他最終用戶產業(醫療、工業、能源、電力)

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 其他地區(拉丁美洲、中東和非洲)

第6章 競爭形勢

- 公司簡介

- Panasonic Corporation

- Vishay Intertechnology Inc

- Murata Manufacturing Co Ltd.

- Yageo Corporation

- Bourns, Inc.

- TT Electronics

- KOA Speer Electronics, Inc.

- TE Connectivity Ltd.

- Ohmite Manufacturing Company

- Susumu International USA

- Honeywell International Inc.

- ROHM Co., Ltd.

- Viking Tech Corporation

- Walsin Technology Corporation

第7章 市場機會及未來趨勢

The Resistor Market size is estimated at USD 10.49 billion in 2024, and is expected to reach USD 12.28 billion by 2029, growing at a CAGR of 3.20% during the forecast period (2024-2029).

Key Highlights

- Automotive manufacturers are consistently working towards enhancing performance while reducing cost and mass, leading to significant advancements in electrical and electronic components used in automobiles. Despite the emergence of digital technology, the reliability and accuracy of many circuits still rely on their analog components.

- In the automotive sector, rising functionality is resulting in a greater number of motors and ECUs, and at the same time, the mounting area for applications is limited. As a result, high-density mounting increases, spurring the demand for components, including compact power shunt resistors. Further, the applications of high-performance bus bar shunt resistors in electric vehicles are helping designers meet the challenges of the market in new and innovative ways. The increase in demand for EVs has been complementing the demand for resistors in the market.

- Power resistors are designed to withstand large amounts of power and dissipate unwanted electrical energy with a compact device footprint. This is essential in aircraft, where space and weight capacity are crucial factors. They are poised to be essential in developing next-generation fly-by-wire (FBW) flight control systems that seek to replace manual flight controls with fully electronic equivalents. Further research into power-by-wire technology also uses power resistors to replace heavyweight hydro-mechanical flight control systems with electric actuators driven by digital flight control computers.

- Resistors are being used in almost all defense platforms, and the defense industry prefers the use of nickel-chromium in film, wire, and foil formats due to its resistance to moisture and operational reliability.

- Furthermore, ruthenium has experienced a significant price increase in the last few years, from USD 40 per troy ounce to as high as USD 850 per troy ounce, corresponding with shortages of thick film chip resistors. This price increase has resulted in customers seeking alternative resistor designs, including those based on thin-film nickel. However, the economies of scale in manufacturing thin-film resistors are a small fraction compared to thick-film chips. Thick film chips are one of the largest volume products produced globally, measured in trillions of pieces.

- Moreover, The COVID-19 pandemic had an impact on the sales of semiconductor materials. However, in Post-pandemic scenario, there has been a growing demand for consumer electronics products, which has helped the semiconductor industry to expand. As a result, there is projected to be an increase in product demand in the automotive and electronics sectors, which will contribute to the growth of the resistor market and enhance overall efficiency.

Resistor Market Trends

Consumer Electronics Segment to Dominate the Market

- Resistors are one of the most commonly used passive components in electronic circuits because they resist the flow of sudden voltage spikes, which are enough to cause damage to electronic equipment almost instantly. Multiple resistor types find widespread application in consumer electronics such as computers, PCs, and notebooks.

- Surface-mount chip resistors are tiny and used significantly for printed circuit boards (PCBs) incorporated in smartphones and laptops, and most silicon-printed circuits use them for operations that ensure signals are always right. Also, varistors, often described as movistors (a contraction of the words metal oxide varistor), are among the types of resistors available in various forms. They are significantly utilized in the surge or transient-protected mains extension to protect computers by varying the resistance with the applied voltage.

- Common types of resistors found in smartphones include surface-mount chips and network resistors. Chip resistors are one of the smallest electronic components on the PCB of a mobile phone. They decrease the current and pass it forward. Network resistors are made from two or more chip resistors. For instance, Chip Resistors Array's offering from Walsin Technology Corporation is applied to mobile phones, digital camcorders, and other consumers' electrical equipment.

- As consumer electronics continue to advance, there have been changes in the power and pulse requirements. The development of more efficient electronics means that lower power, voltage, and current conditions are now necessary. Consequently, designs that previously relied on costly carbon composition or wire-wound resistors can now opt for the more affordable metal oxide option. Although metal oxide resistors may not be able to withstand as much pulse energy as carbon comps or wire wounds, they still offer improved pulse handling compared to standard metal film resistors.

Asia-Pacific to Hold Significant Market Share

- The growing electronics industry is attracting several MNCs to establish manufacturing plants in Asian countries, either independently or through a joint venture with different regional companies. This includes large global organizations such as Tyco Electronics, FCI OEN, Molex, Vishay, and EPCOS. This is further anticipated to boost the local manufacturing activity of resistors in the Asia-Pacific region.

- In China, the demand for passive electronic components like resistors is primarily driven by the growth of consumer electronics. Moreover, China's Ministry of Industry and Information Technology released an action plan to develop the country's electronic components industry from 2021 to 2023. The action plan aims to achieve technological breakthroughs in areas including circuits, connectors, sensors, and optical communication components to enhance the position of Chinese companies in the industrial supply chain and ease supply reliance on high-end foreign products. This plan will unlock new opportunities for industry players in the region.

- The strong demand for notebooks and gaming machines supporting the stay-at-home economy and the gradual pickup in demand for handsets and automotive applications have influenced several companies to increase their productivity.

- The trading of resistors in countries like India is witnessing an upsurge, especially with surging demand for current sense resistors. However, thin film and chip resistors currently have relatively lower demand in the Indian market. This trend indicates the lack of specialized electronic product manufacturing in the country that uses such resistors. However, most manufacturers still perceive that the future of resistor manufacturing lies in thick film and chip resistors.

- Asian companies, such as Taiwan-based Yageo, are engaging in multiple product innovation activities. YAGEO Group has developed one of the smallest metal current sensing resistors, PA0100 (01005 sizes, 0.4mm x 0.2mm). PA0100 metal current sensing resistors are mainly adopted in light, thin, multi-functional, short, and high-density mobile devices such as smartphones, battery modules, wearable devices, and radiofrequency transceiver modules.

Resistor Industry Overview

The Resistor Market is a Semi-consolidated market. The market is significantly competitive, and the players are actively trying to increase their market share. Besides, the vendors are also engaging in various growth strategies such as product development, partnerships, and geographical expansions, among others, to develop their customer base and cater to a broader range of customers across the globe. Some of the prominent vendors in the market include TE Connectivity Ltd., Murata Manufacturing Co. Ltd., Vishay Intertechnology Inc., KOA Speer Electronics, Inc., and ROHM Co., Ltd., among others.

- April 2023: ROHM Co., Ltd. announced the development of the industry's thinnest (H: 0.03 inch) 12W-rated metal plate shunt resistor (PSR350). It is optimized for high-power applications in the automotive and industrial equipment markets. ROHM plans to enhance the PSR lineup by introducing a 0.2mΩ (PSR100) model and a 15W type in the industry's smallest size (PSR330). Shunt resistors have a long history of being utilized in power modules for industrial equipment. Likewise, in the automotive sector, there is a growing trend of employing thin double-sided cooled power modules in the main inverters of xEVs.

- March 2023: Vishay Intertechnology, Inc. announced the enhancement of the Draloric RCS0805 e3 anti-surge thick film resistor with a higher power rating of 0.5 watts. Therefore, with its increased power rating, the resistor can now be utilized in place of one resistor in the 1210 case size, two parallel devices in the larger 1206 case size, or four standard parallel resistors in the 0805 case size. This allows designers to save board space in industrial, telecommunications, automotive, and medical applications while lowering component counts and placement costs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand from the Automotive Industry

- 4.2.2 Growing Demand for High-performance Electronics

- 4.3 Market Restraints

- 4.3.1 Growth in the Metal Prices to Impact Production Cost

- 4.4 Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Macro-economic Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Surface-mounted Chips

- 5.1.2 Network

- 5.1.3 Wirewound

- 5.1.4 Film/Oxide/Foil

- 5.1.5 Carbon

- 5.2 End-User Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace and Defense

- 5.2.3 Communications

- 5.2.4 Consumer Electronics and Computing

- 5.2.5 Other End-user Industries (Medical, Industrial, Energy and Power)

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World (Latin America, Middle East & Africa)

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Panasonic Corporation

- 6.1.2 Vishay Intertechnology Inc

- 6.1.3 Murata Manufacturing Co Ltd.

- 6.1.4 Yageo Corporation

- 6.1.5 Bourns, Inc.

- 6.1.6 TT Electronics

- 6.1.7 KOA Speer Electronics, Inc.

- 6.1.8 TE Connectivity Ltd.

- 6.1.9 Ohmite Manufacturing Company

- 6.1.10 Susumu International U.S.A

- 6.1.11 Honeywell International Inc.

- 6.1.12 ROHM Co., Ltd.

- 6.1.13 Viking Tech Corporation

- 6.1.14 Walsin Technology Corporation