|

市場調查報告書

商品編碼

1429479

生物分解性聚合物:市場佔有率分析、產業趨勢、成長預測(2024-2029)Bio-degradable Polymers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

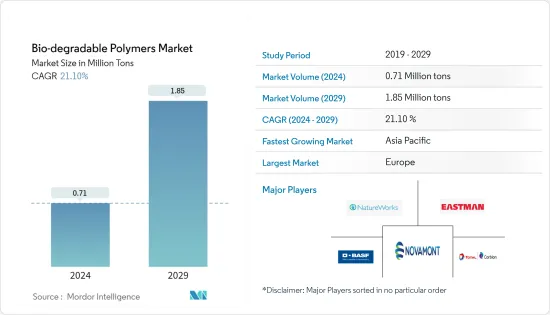

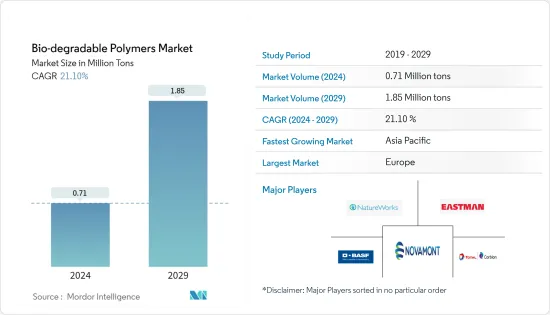

生物分解性聚合物市場規模預估2024年為71萬噸,預估2029年將達185萬噸,預測期內(2024-2029年)複合年成長率為21.10%。

生物分解性聚合物相對於非生物分解分解聚合物的優點在於毒性較低、副作用較少、提高病患依從性、並能維持藥物穩定性。因此,全球工業和消費品生產的暫時停止不僅影響了需求,也影響了生物分解性聚合物的生產。這樣的市場情境將在2020年出現,預計當年全球經濟成長將下降3%至6%。

主要亮點

- 推動市場的主要因素是政府推廣生質塑膠的政策。此外,其在軟包裝中的大量使用可能有利於市場成長。

- 另一方面,與石油基聚合物相比,生物分解性聚合物的價格較高,預計將阻礙市場成長。

- 生物分解性塑膠擴大用於利基應用,例如頁岩氣工業(在水力壓裂過程中使用)、衛生產品和漁具,這可能代表著未來的市場機會。

生物分解性聚合物市場趨勢

包裝產業需求增加

- 可生物分解性聚合物用於軟包裝和硬包裝應用。可生物分解性聚合物用於有機食品包裝以及具有特殊要求的奢侈品和品牌產品。

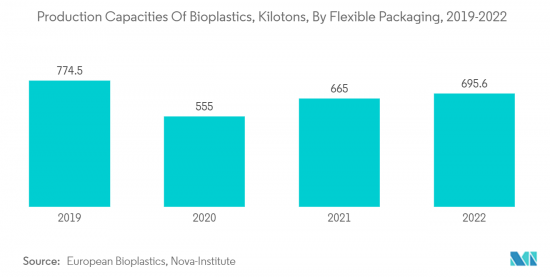

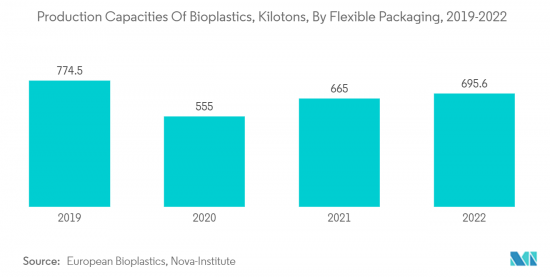

- 根據歐洲生物塑膠協會的數據,全球生質塑膠(其中生物分解性聚合物約佔市場的40%)產能預計將從2022年的220萬噸增加到2027年的630萬噸。其中約 50% 用於包裝市場,使其成為生質塑膠行業中最大的細分市場。

- 在硬包裝應用中,可生物分解性聚合物用於包裝乳霜和口紅等化妝品以及飲料瓶。 PLA 廣泛用於硬質包裝應用。

- 生物分解性是易腐食品包裝的關鍵要素。薄膜和托盤等軟包裝解決方案特別適合水果和蔬菜等生鮮食品,因為它們可以延長保存期限。

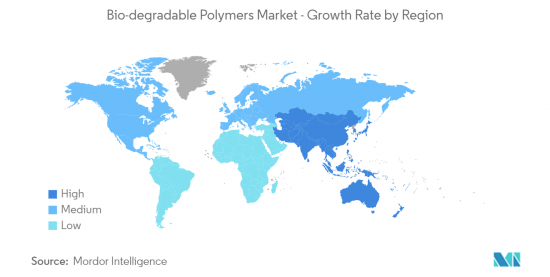

- 由於嚴格的政府法規禁止使用石油基塑膠以及這些地區瓶子硬包裝中生物分解性生物分解性的使用增加,歐洲和北美的生物可分解聚合物的消費量正在增加。

- 由於亞太地區、南美洲和中東等發展中地區各食品和安全機構食品包裝標準的提高,預計在預測期內這些地區的包裝產業成長將會增加。反過來,預計在預測期內也將推動生物分解性聚合物市場的成長。

- 由於上述因素,在預測期內,生物分解性聚合物市場預計將隨著包裝產業需求的增加而成長。

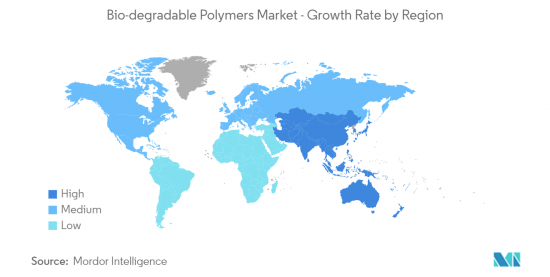

中國是亞太地區成長最快的國家

- 在亞太地區,中國是GDP最大的經濟體。佔全球塑膠產量近29%的中國塑膠製造商表示,對環境污染的擔憂促使北京發出指令,減少刀叉餐具、塑膠袋和包裝等傳統一次性、非生物分解塑膠的使用。部分原因是由於禁令的前景,我們正在重點擴大玉米、砂糖和其他作物的使用,以開發生物分解性塑膠。

- 根據Interpak 2023的數據,中國在全球軟包裝市場中佔有很大佔有率。至2022年,該國軟包裝市場的複合年成長率約為8%,而全球複合年成長率約為4.3%。包裝產業的成長主要是由經濟的強勁發展、都市化的加速以及人們生活品質的提高所推動的。消費者正在轉向更安全、更方便、獨特和環保的包裝。

- 消費者越來越關注包裝中使用的材料及其對健康和環境的影響。這就是為什麼公司專注於改造生物分解性塑膠包裝。

- 食品和飲料包裝是推動生物分解性聚合物需求的主要因素。根據Interpak 2023統計,2023年中國食品包裝零售貿易總量達4,470.66億件。

- 中國也生產大量塑膠,透過貿易出口為企業帶來收益,從而為各種包裝公司創造了巨大的產能。根據國際貿易中心(ITC)統計,2021年,中國塑膠及模壓製品出口額約1,310.7億美元,較上年(約963.8億美元)成長36%。

- 地膜覆蓋在中國農業中發揮重要作用,因為它能有效保持土壤溫暖、保濕和控制雜草。塑膠薄膜的使用標準不斷完善,相應的技術也得到了發展,如塑膠薄膜的多功能化、廢渣回收技術的機械化以及用生物分解性的聚合物薄膜取代聚乙烯等。這種生物分解性塑膠覆蓋技術已幫助糧食產量20-50%,為保障國家農產品供應發揮了重要作用。

- 因此,由於終端用戶產業的上述趨勢,中國生物分解性聚合物市場預計將在預測期內成長。

生物分解性聚合物產業概況

全球可生物分解性聚合物市場已部分一體化,各個產品領域的市場領導公司佔據了大部分市場。擁有重要市場佔有率的主要企業(排名不分先後)包括 NatureWorks LLC、Novamont SpA、 BASF SE、Total Corbion PLA 和 Eastman Chemical Company。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 政府利多政策促進生質塑膠發展

- 增加軟包裝的使用

- 其他司機

- 抑制因素

- 價格高於石油基聚合物

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(基於數量的市場規模)

- 種類

- 澱粉基塑膠

- 聚乳酸(PLA)

- 聚羥基烷酯(PHA)

- 聚酯(PBS、PBAT、PCL)

- 纖維素衍生物

- 最終用戶產業

- 農業

- 纖維

- 消費品(家用電器)

- 包裝

- 衛生保健

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- BASF SE

- Biome Technologies plc

- BIOTEC Biologische Naturverpackungen GmbH & Co. KG

- Cardia Bioplastics

- Danimer Scientific

- DuPont

- Eastman Chemical Company

- FKuR

- Merck KGaA

- Mitsubishi Chemical Group Corporation

- NatureWorks LLC

- Novamont SpA

- TEIJIN LIMITED

- Total Corbion PLA

第7章 市場機會及未來趨勢

- 擴大在電子產業的應用

- 擴大在醫療產業的應用

The Bio-degradable Polymers Market size is estimated at 0.71 Million tons in 2024, and is expected to reach 1.85 Million tons by 2029, growing at a CAGR of 21.10% during the forecast period (2024-2029).

Bio-degradable polymers are advantageous over non-bio-degradable polymers as they are less toxic, have lesser side effects, help to improve patient compliance, and maintains the stabilization of the drug. Therefore, temporary halt in the global production of industrial and consumer goods had repercussion not only on the demand, but also production of bio-degradable polymers. Such market scenario being witnessed in 2020 is indicated to trim the global economic growth by 3% to 6% during the year.

Key Highlights

- A major factor driving the market studied is the favorable government policies which promote bio-plastics. Additionally, tremendous usage in flexible packaging is likely to favor the market growth.

- On the flipside, the higher price of bio-degradable polymers compared to petroleum-based polymers is expected to hinder the market growth.

- Bio-degradable plastics are increasingly finding usage in niche applications, such as in shale gas industry (where they are used during hydro-fracking), hygiene products, and in fishing gears, among other applications, these are projected to act as an opportunity for the market in future.

Bio-degradable Polymers Market Trends

Increasing Demand from the Packaging Industry

- Bio-degradable polymers are used in both flexible and rigid packaging applications. Bio-degradable polymers are used for wrapping organic food, as well as for premium and branded products with particular requirements.

- According to European Bioplastics, global production capacities of bioplastics (of which bio-degradable polymers accounted for around 40% of the market) are expected to increase from 2.2 million tons in 2022 to 6.3 million tons in 2027. Around 50% of the volume is used for the packaging market, which is the biggest market segment within the bioplastics industry.

- In rigid packaging applications, bio-degradable polymers are used in cosmetics packaging, such as creams and lipsticks, as well as beverage bottles and many more. PLA is widely used in rigid packaging applications.

- Biodegradability is an important component of food packaging for perishables. Flexible packaging solutions, such as films and trays, are particularly suitable for fresh produce, such as fruit and vegetables, as they enable longer shelf life.

- In Europe and North America, the consumption of bio-degradable polymers is increasing, owing to stringent regulations by the government to ban the usage of petroleum-based plastics, coupled with the increasing usage of bio-degradable polymers in rigid packaging for bottles in these regions.

- The growth in the packaging industry in developing regions, such as Asia-Pacific, South America, and the Middle East, is expected to increase over the forecast period due to the improving food packaging standards of various food and safety organizations in these regions. In turn, it is expected to propel the growth of the bio-degradable polymers market during the forecast period.

- Owing to the aforementioned factors, the bio-degradable polymers market is expected to grow with the increasing demand from the packaging industry during the forecast period.

China to Grow at a Fastest Rate in Asia Pacific Region

- In Asia-Pacific, China is the largest economy in terms of GDP. Chinese plastics manufacturers that account for almost 29% of the global plastic production are focusing on the increased use of corn, sugar, and other crops to develop biodegradable plastics as concerns about environmental pollution have encouraged directives from Beijing and the prospects of a ban on conventional plastics single-use non-biodegradable plastics, such as cutlery, plastic bags, and packaging.

- According to Interpak 2023, China holds a significant share of the global flexible packaging market. The average annual growth of the flexible packaging market in the country until 2022 was around 8%, whereas the global annual average growth rate was around 4.3%. This growth in the packaging industry is mainly driven by dynamic economic development, accelerating urbanization, as well as improvement in people's quality of life. Consumers are shifting toward more safe, convenient, unique, and eco-friendly packaging.

- Consumers take more interest in the materials used for packaging and the impact on their health and environment. Therefore, companies are focusing on transforming biodegradable plastic packaging.

- Food and beverage packaging is the major driver boosting the demand for bio-degradable polymers. As per Interpak 2023, the Chinese total retail trade of foodstuff packaging in 2023 reached 447,066 million units.

- Also, China has a significant presence in producing considerable quantities of plastics, generating revenues from trade exports, thereby creating significant production capacities for various packaging companies. According to International Trade Center (ITC), in 2021, China exported plastics and articles valued at about USD 131.07 billion, a 36% rise in exports from the previous year, valued at around USD 96.38 billion.

- Plastic film mulching in the Chinese agriculture industry has played a vital role, owing to its effects on soil warming, moisture conservation, and weed control. Standards for using plastic films have been improved, and appropriate techniques are being developed for multipurpose plastic film, mechanization of residue recycling technology, and the replacement of polythene with biodegradable polymer films. This biodegradable plastic film mulching technology has helped in increasing 20-50% of grain crop yields and plays a key role in ensuring the supply of agricultural goods in the country.

- Thus, the market for biodegradable polymers in China is expected to experience growth during the forecast period owing to such trends in the end-user industries.

Bio-degradable Polymers Industry Overview

The global market for biodegradable polymers is partly consolidated, with a chunk of the market in the hands of the market leader in each product segment. Major companies holding a significant market share (not in any particular order) are NatureWorks LLC, Novamont S.p.A, BASF SE, Total Corbion PLA, and Eastman Chemical Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Favorable Government Policies Promoting Bio-plastics

- 4.1.2 Increasing Usage in Flexible Packaging

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Higher Price Compared to Petroleum-based polymers

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Starch-based Plastics

- 5.1.2 Polylactic Acid (PLA)

- 5.1.3 Polyhydroxy Alkanoates (PHA)

- 5.1.4 Polyesters (PBS, PBAT, and PCL)

- 5.1.5 Cellulose Derivatives

- 5.2 End-User Industry

- 5.2.1 Agriculture

- 5.2.2 Textile

- 5.2.3 Consumer Goods (Consumer Electronics)

- 5.2.4 Packaging

- 5.2.5 Healthcare

- 5.2.6 Other End-User Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Biome Technologies plc

- 6.4.3 BIOTEC Biologische Naturverpackungen GmbH & Co. KG

- 6.4.4 Cardia Bioplastics

- 6.4.5 Danimer Scientific

- 6.4.6 DuPont

- 6.4.7 Eastman Chemical Company

- 6.4.8 FKuR

- 6.4.9 Merck KGaA

- 6.4.10 Mitsubishi Chemical Group Corporation

- 6.4.11 NatureWorks LLC

- 6.4.12 Novamont S.p.A.

- 6.4.13 TEIJIN LIMITED

- 6.4.14 Total Corbion PLA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Use in the Electronics Industry

- 7.2 Increasing Applications in the Medical Industry