|

市場調查報告書

商品編碼

1429246

隔音隔熱材料:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Acoustic Insulation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

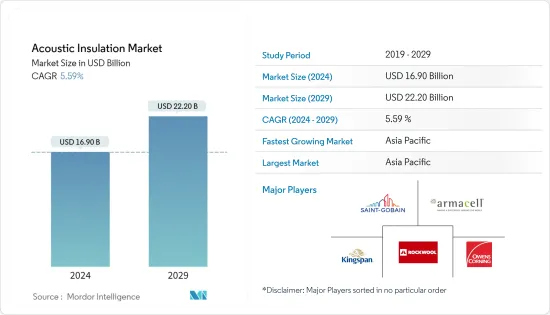

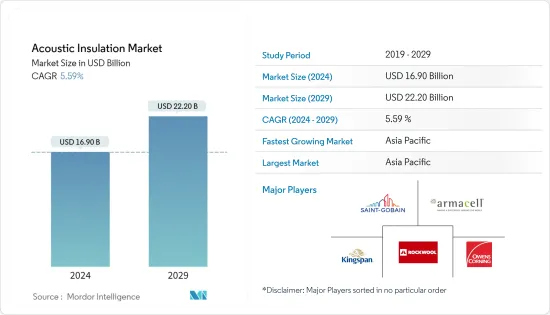

隔音市場規模預計到 2024 年為 169 億美元,預計到 2029 年將達到 222 億美元,在預測期內(2024-2029 年)複合年成長率為 5.59%。

COVID-19的爆發對隔音材料行業造成了打擊。全球封鎖和嚴格的政府法規迫使大多數生產基地關閉,給它們帶來了毀滅性的打擊。儘管如此,業務自 2021 年以來已經復甦,預計未來幾年將大幅成長。

主要亮點

- 短期內,政府對噪音污染控制的法規和住宅應用的快速採用是推動市場的主要因素。新興國家不斷成長的需求也將支持市場成長。

- 相反,原料價格的波動和已開發國家需求的停滯預計將嚴重阻礙所研究市場的成長。

- 對美觀外觀和防火隔音性能的需求可能很快就會成為一個機會。

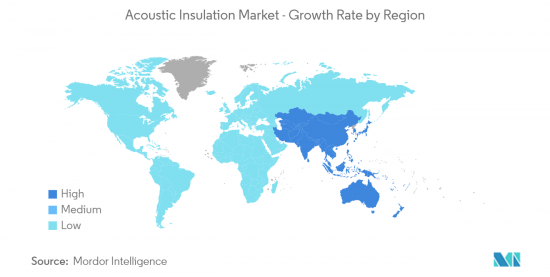

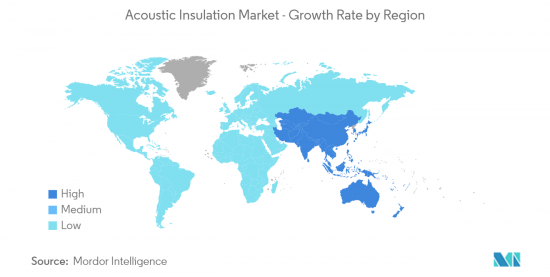

- 亞太地區主導全球隔音材料市場,預計在預測期內將大幅成長。

隔音材料市場趨勢

商業建築需求增加

- 商業建築包括辦公室、零售商店、電影院和其他休閒設施,隔熱材料廣泛應用於牆壁、地板、天花板、污水管、機房等。

- 商業建築有一定的指導方針來避免外部噪音侵入、內部噪音和建築服務噪音。然而,建築物所需的隔熱材料類型取決於其結構和需求。亞太地區、中東和非洲的商業建築正在顯著成長。

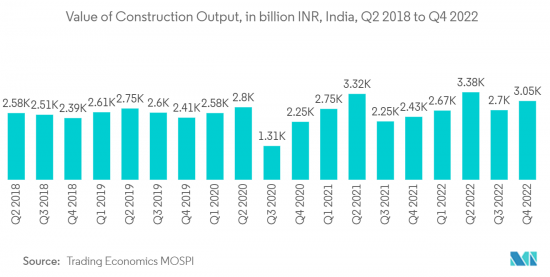

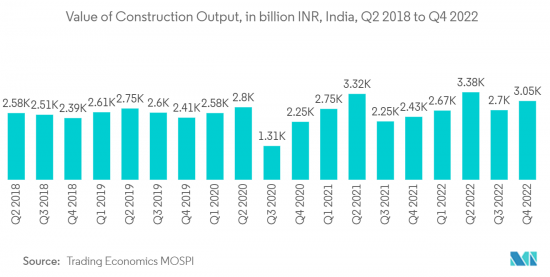

- 亞太、中東和非洲國家正在進行大量的國內和國際投資,用於建立工業單位、醫院、商場、劇院、旅館業和資訊科技部門。例如,印度政府已核准針對 16 家關鍵原料 (KSM)/醫藥中間體和活性藥物成分 (API) 工廠的 PLI 計劃。這16家工廠的建設將需要總合投資34.87億印度盧比(4,701萬美元)。這些工廠的商業開發預計將於 2023 年 4 月開始。因此,印度商業和工業單位不斷增加的投資預計將創造對隔音材料的巨大需求。

- 由於印度、中國和印尼等國家的健康經濟表現,以及中東國家努力發展旅遊業和其他非石油產業,亞太地區已成為對外國公司有吸引力的市場。這些地區正在推動商業建設活動。例如,在沙烏地阿拉伯,根據“2030 年願景”,計劃到 2030 年在沙烏地阿拉伯各地開設 80 家新酒店,擁有 11,000 多間豪華客房。因此,飯店建築投資預計將增加,隔音材料市場需求可期。

- 預計印度仍將是亞太地區二十國集團中成長最快的經濟體。 IBEF預計,未來15年印度將需要在城市基礎設施上投資8,400億美元,以滿足其快速成長的人口的需求。只有注重建築物、橋樑、港口和機場的長期維護和強度,這種投資才是合理且永續的。

- 此外,印度民航國務部長宣布,印度政府還計劃根據區域互聯互通計劃(RCS)-Ude Desh ka Aam Nagrik(UDAN)基礎設施計劃,到2024年建設100個機場。

- 此外,沙烏地阿拉伯正在進行許多商業計劃,這可能會導致商業建築的增加。例如,沙烏地阿拉伯宣布了價值5000億美元的未來特大城市Neom計劃,這是紅海計劃的第一階段。其中包括分佈在五個島嶼和兩個內陸度假村、Qiddiya 娛樂城、超豪華健康旅遊目的地Amaara 以及讓·努維爾(Jean Nouvel) 位於埃爾奧拉(AlUla) 的Shara'an 度假村,擁有3,000間客房,包括14 間豪華和超豪華酒店。

- 因此,所有此類商業建築投資和計劃都在推動這些國家的建設活動並增加對隔音的需求。

中國主導亞太地區需求

- 由於投資和建設活動的增加,中國在亞太地區隔音材料市場佔有率最大。近年來,中國一直是全球基礎設施主要投資國之一,也是最大貢獻國。例如,根據國家統計局(NBS)的數據,2022年中國建築業產值將達到27.63兆元人民幣(41.0858億美元),比2021年增加6.6%。

- 中國是亞太地區GDP第一的經濟大國。該國的成長仍然很高。但隨著人口老化和經濟從投資轉向消費、從製造業轉向服務業、從外需轉向內需的再平衡,成長逐漸下降。

- 汽車隔音材料是汽車的重要組成部分。降低汽車內各種運動部件所產生的噪音。過多的噪音會降低駕駛人和乘客的舒適度,導致疲勞和壓力增加。汽車仍然是該國最大的行業,並在不久的將來顯示出積極的跡象。例如,根據國際汽車製造組織(OICA)的預測,2022年國內汽車產量將達到27,020,615輛,比2021年成長3%。因此,該國汽車生產的這種積極情況預計將導致對隔音材料的需求增加。

- 此外,中國預計在未來三年內超過美國,成為全球最大的航空旅行市場。儘管如此,該國的航空需求仍在呈指數級成長。例如,法國對中國進行國事訪問期間,空中巴士公司與中國航空業合作夥伴簽署了新的合作協議。空中巴士公司表示,未來20年,中國的航空運輸量預計將以每年5.3%的速度成長,顯著高於3.6%的全球平均水準。 2023年至2041年間,客機和貨機的需求將達到8,420架,佔全球總需求的20%以上,未來20年需要約39,500架新飛機。這是因為飛機吞吐量的增加將進一步促進隔音材料市場的開拓和成長。

- 此外,印度和日本等國家也為研究市場的成長做出了貢獻。預計在預測期內,隔音隔熱材料的需求將進一步增加。

隔音行業概況

隔熱材料市場具有綜合性。該市場的主要企業(排名不分先後)包括 Kingspan Group、Owens Corning、Saint-Gobain、Rockwool A/S 和 Armacell。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 控制噪音污染的政府法規和住宅應用的快速採用

- 新興國家的需求增加

- 其他司機

- 抑制因素

- 已開發國家需求停滯

- 原物料價格波動

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 類型

- 礦棉

- 玻璃棉

- 聚合物泡沫

- 天然材質

- 最終用戶產業

- 住宅

- 商業建築

- 運輸

- 工業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率分析(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- Armacell

- BASF SE

- Cabot Corporation

- Cellecta

- CSR Limited

- Dow

- Dynamic composite technologies

- Fletcher Insulation

- Insultech, LLC

- Johns Manville

- Kingspan Group

- Knauf Insulation

- L'ISOLANTE K-FLEX SpA

- Owens Corning

- Recticel Insulation

- ROCKWOOL A/S

- Saint-Gobain

- Siderise

- Trelleborg

- Xella(Etex Group)

第7章 市場機會及未來趨勢

- 隔音材料的美觀與防火要求

- 其他機會

The Acoustic Insulation Market size is estimated at USD 16.90 billion in 2024, and is expected to reach USD 22.20 billion by 2029, growing at a CAGR of 5.59% during the forecast period (2024-2029).

The COVID-19 epidemic harmed the acoustic insulation sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business is recovering since 2021 and is expected to rise significantly in the coming years.

Key Highlights

- Over the short term, government regulations for controlling noise pollution and a surge in the adoption of residential applications are the major factors driving the market studied. Also, a rise in demand from emerging economies boosts market growth.

- Conversely, fluctuating raw material prices and stagnant demand from developed countries are expected to significantly hinder the studied market's growth.

- Demand for aesthetic prospects and fire-resistant acoustic insulation properties will likely be an opportunity shortly.

- Asia-Pacific is dominating the global acoustic insulation market and is expected to grow significantly during the forecast period.

Acoustic Insulation Market Trends

Rising Demand from the Commercial Construction

- The commercial buildings include offices, retail, cinema, and other leisure outlets used for conducting operations of the enterprises where acoustic insulation materials find extensive application in walls, floors, ceilings, waste-water pipes, plant rooms, etc.

- In commercial buildings, there are certain guidelines to avoid external noise intrusion, internal noise, and noise from building services. However, the type of insulation required in the building varies according to its structure and need. Commercial construction is growing noticeably in Asia-Pacific, the Middle East, and Africa.

- Asia-Pacific, Middle East, and African countries are experiencing huge domestic and foreign investments for setting up industrial units, hospitals, malls, theaters, the hospitality industry, and the IT sector. For instance, India's government approved a PLI scheme for 16 plants for key starting materials (KSMs)/drug intermediates and active pharmaceutical ingredients (APIs). Establishing these 16 plants would result in a total investment of INR 348.70 crore (USD 47.01 million). The commercial development of these plants is expected to begin by April 2023. Therefore, increasing investments from commercial and industrial units in India are expected to create significant demand for acoustic insulation materials.

- Asia-Pacific is an attractive market for foreign companies due to the healthy economic performance of the countries like India, China, Indonesia, etc., and efforts made by the Middle Eastern countries to develop tourism and other non-oil sectors. They are driving commercial construction activities in these regions. For instance, in Saudi Arabia, under Vision 2030, 80 new hotels with more than 11,000 luxurious rooms are expected to open across Saudi Arabia by 2030. Therefore, increasing investments in the construction of hotels is expected to create demand for the acoustic insulation market.

- India is anticipated to remain the fastest-growing G20 economy in the Asia-Pacific region. According to IBEF, it is estimated that India needs to invest USD 840 billion over the next 15 years into urban infrastructure to meet the needs of its fast-growing population. This investment will only be rational and sustainable if we additionally focus on the long-term maintenance and strength of our buildings, bridges, ports, and airports.

- Moreover, in India, the Minister of State, Civil Aviation, announced that under the regional connectivity scheme (RCS)-Ude Desh ka Aam Nagrik (UDAN) infrastructure scheme, the Indian government also planned to construct 100 airports by 2024, owing to increasing demand for air commute.

- Furthermore, Saudi Arabia is working on many commercial projects, likely leading to more commercial buildings. For instance, the kingdom announced the USD 500 billion futuristic mega-city "Neom" project, the Red Sea Project - Phase 1, which is expected to be completed by 2025. It includes 14 luxury and hyper-luxury hotels with 3,000 rooms spread across five islands and two inland resorts, Qiddiya Entertainment City, Amaala - the uber-luxury wellness tourism destination, and Jean Nouvel's Sharaan resort in Al-Ula.

- Hence, all such commercial construction investments and projects are driving construction activities in these countries, increasing the demand for acoustic insulation.

China to Dominate the Demand in the Asia-Pacific Region

- China holds the largest Asia-Pacific market share for acoustic insulation due to rising investments and construction activity. China is the biggest contributor, as it is one of the leading investors in infrastructure worldwide over the past few years. For instance, according to the National Bureau of Statistics (NBS) of China, in 2022, the output value of construction works in China amounted to CNY 27.63 trillion (USD 4108.58 billion), an increase of 6.6% compared with 2021.

- China is the largest economy in the Asia-Pacific region in terms of GDP. The growth in the country remains high. However, it is gradually diminishing as the population ages, and the economy is rebalancing from investment to consumption, manufacturing to services, and external to internal demand.

- Automotive acoustic insulation is a vital part of the vehicle. It reduces the noise produced by various moving parts in the vehicle. The excess noise reduces the comfort level of both drivers and passengers, resulting in increased fatigue and stress. Automotive remains the largest sector in the country and reflects positive signs for the near future. For instance, according to Organisation Internationale des Constructeurs d'Automobiles (OICA), in 2022, automobile production in the country amounted to 2,70,20,615 units, which shows an increase of 3% compared with 2021. Therefore, such a positive scenario in the production of automobiles in the country is expected to create an upside demand for acoustic insulation materials.

- Furthermore, China will overtake the United States as the world's biggest air travel market within the next three years. Still, the country's appetite for aviation continues to grow exponentially. For instance, during a French state visit to China, Airbus signed new cooperation agreements with China's Aviation industry partners. According to Airbus, over the next 20 years, China's air traffic is forecast to grow at 5.3% annually, significantly faster than the world average of 3.6%. It will lead to a demand for 8,420 passenger and freighter aircraft between 2023 and 2041, representing more than 20% of the world's total demand for around 39,500 new aircraft in the next 20 years. It is due to the rising aircraft fleet throughput further augmenting the development and growth of the acoustic insulation market.

- Furthermore, countries such as India and Japan contribute to the studied market growth. It is expected to further drive the demand for acoustic insulation over the forecast period.

Acoustic Insulation Industry Overview

The acoustic insulation market is consolidated in nature. The major players in this market (not in any particular order) include Kingspan Group, Owens Corning, Saint-Gobain, Rockwool A/S, and Armacell.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Government Regulations for Controlling Noise Pollution and Surge in Adoption in Residential Application

- 4.1.2 Rise in Demand from Emerging Economies

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stagnant Demand from the Developed Countries

- 4.2.2 Fluctuating Raw Material Prices

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Mineral Wool

- 5.1.2 Glass Wool

- 5.1.3 Polymeric Foams

- 5.1.4 Natural

- 5.2 End-user Industry

- 5.2.1 Residential Construction

- 5.2.2 Commercial Construction

- 5.2.3 Transportation

- 5.2.4 Industrial

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Armacell

- 6.4.3 BASF SE

- 6.4.4 Cabot Corporation

- 6.4.5 Cellecta

- 6.4.6 CSR Limited

- 6.4.7 Dow

- 6.4.8 Dynamic composite technologies

- 6.4.9 Fletcher Insulation

- 6.4.10 Insultech, LLC

- 6.4.11 Johns Manville

- 6.4.12 Kingspan Group

- 6.4.13 Knauf Insulation

- 6.4.14 L'ISOLANTE K-FLEX S.p.A.

- 6.4.15 Owens Corning

- 6.4.16 Recticel Insulation

- 6.4.17 ROCKWOOL A/S

- 6.4.18 Saint-Gobain

- 6.4.19 Siderise

- 6.4.20 Trelleborg

- 6.4.21 Xella (Etex Group)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Demand for Aesthetic Prospects and Fire-resistant Properties of Acoustic Insulation

- 7.2 Other Opportunities