|

市場調查報告書

商品編碼

1408022

五氧化二鈮 -市場佔有率分析、產業趨勢/統計、2024-2029 年成長預測Niobium Pentoxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計年終五氧化二鈮市場規模為6,374.07噸。

預計未來五年將達到10,306.82噸,預測期內複合年成長率超過10.09%。

COVID-19 對五氧化二鈮產業產生了負面影響。全球封鎖和政府實施的嚴格規定摧毀了大多數生產基地。儘管如此,業務自 2021 年以來已經復甦,預計未來幾年將大幅成長。

主要亮點

- 短期來看,電動車產業需求的增加和製造業優質鋼材的需求是推動市場需求的因素。

- 由於嚴重接觸五氧化二鈮而導致的健康問題的擔憂正在阻礙市場的成長。

- 在預測期內,生物醫學領域需求的增加可能成為五氧化二鈮市場的成長機會。

- 預計亞太地區將主導市場,並在預測期內呈現最高的複合年成長率。

五氧化二鈮市場趨勢

增加鈮金屬生產的使用

- 五氧化二鈮,尤其工業級,主要用於生產金屬鈮。此外,五氧化二鈮(99.9%)也用於生產金屬鈮,對品質要求較高。技術品質五氧化二鈮(98-99%)適用於鈮金屬電加熱和金屬加熱生產。

- 鈮金屬具有耐高溫、耐腐蝕、抗氧化、增強抗蠕變性、減少高溫侵蝕的特性。

- 即使在高溫下,鈮金屬也具有出色的耐腐蝕性化學物質。因此,金屬鈮被用來製造化學設備。具體來說,鈮金屬片材、板材、線材、棒材和管材用於濺鍍物體、大型鋼結構的陰極保護系統和化學加工設備。此外,它也用於醫療植入。

- 根據世界鋼鐵協會最新短期展望,預計2022年全球鋼鐵需求與前一年同期比較%。不過,預計 2023 年將恢復 1%。該產業受到通貨膨脹、美國貨幣緊縮、中國經濟放緩和俄羅斯入侵烏克蘭的打擊,而能源價格急劇上升、利率上升和信心減弱壓低了需求預測,導致鋼鐵製造業放緩。

- 此外,根據世界鋼鐵協會的數據,2023年1月至7月全球鋼鐵產量為11.032億噸,與前一年同期比較下降0.1%。這一下降主要是由於歐洲產量下降10.3%。然而,亞太地區、非洲和中東地區分別成長1.7%、7.0%和2.3%,2023年1-7月產能分別為828.4噸、9噸和26.2噸。

- 根據國際汽車製造商組織(OICA)預測,2022年全球汽車產量約8,501萬輛,較2021年的8,020.5萬輛成長5.99%。 2022年,全球小客車產量約6,000萬輛,較2021年成長近7.35%。

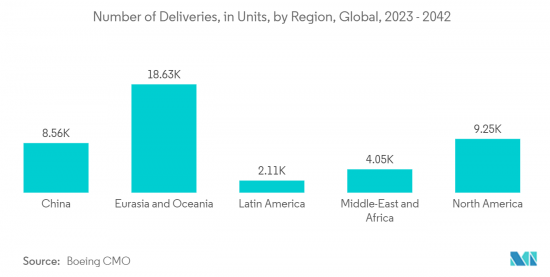

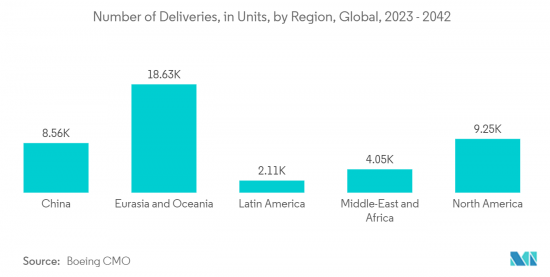

- 最近,飛機製造商一直在尋找加快生產的方法,以填補訂單訂單。例如,根據波音《2023-2042 年商業展望》,到 2042 年,全球新飛機交付總量預計將達到 42,595 架。由於預計交付如此之大,全球對用於生產航太應用鈮金屬和合金的五氧化二鈮的需求可能會增加。

- 所有上述因素預計將顯著促進市場成長。

預計亞太地區將主導市場

- 中國是亞太地區GDP最大的經濟體。即使在與美國的貿易戰造成貿易障礙之後,該國 2022 年的 GDP 仍成長了約 3%。

- 五氧化二鈮及其衍生物在鋼鐵生產上有重要用途。添加鈮可提高鋼的強度。此外,鈮還能提高鋼的高溫抗氧化性和耐腐蝕,降低韌脆轉變溫度,使鋼具有良好的焊接性能和成形性能。具體來說,鈮用於生產高級結構鋼、高強度低合金 (HSLA) 鋼和不銹鋼。

- HSLA鋼以鈮為主要成分,主要應用於汽車和建築領域。具體來說,大約 80% 的汽車鋼板牌號碼都會定期添加鈮微合金化。 HSLA 鋼用於製造省油、安全且持久的車輛。

- 根據OICA(國際汽車結構組織)預計,2022年中國汽車產量將達到2,702.1萬輛,汽車銷售量將達到2,686.4萬輛,分別與前一年同期比較成長3.4%和2.1%。

- 中國政府致力於增加全國建築業的投資,以促進整體經濟成長。例如,近期增加基礎建設融資的措施包括提高政策性銀行貸款比例1,200億美元。政府也考慮透過地方政府特別債券安排向地方政府提供最多約2,200億美元的資金,用於基礎建設。

- 此外,印度的目標是到2025年成為5兆美元的經濟強國。因此,基礎設施建設將發揮重要作用。政府推出了國家基礎設施管道(NIP)以及印度製造和生產相關激勵措施(PLI)計劃等其他舉措,以促進基礎設施行業的成長。從歷史上看,該國80%以上的基礎設施支出都用於交通、電力、水和灌溉領域。

- 此外,在建築領域,鈮合金也用於生產結構和承載能力部件。據國土交通省稱,2022年日本將開工約8.595億住宅開發項目,與前一年同期比較增加0.4%。

- 根據波音《2023-2042 年商業展望》,預計到 2042 年,中國將交付約 8,560 架新飛機。預計到 2042 年,中國將新增交付約 8,560 架,增加飛機零件(尤其是引擎葉片)製造對五氧化二鈮的需求。

- 此外,隨著民航領域活動的增加,印度航太業正在顯著成長。由於對大型飛機的需求不斷成長,並且香辛料和 Indigo 等印度航空公司專注於依小時供電的合約 (PBH),印度的大部分航太製造業務預計將出現。事實確實如此。

- 據斯德哥爾摩國際和平研究所(SIPRI)稱,日本2022年將撥款460億美元用於軍事費用,比2021年增加5.9%。此外,中國在南海和東海地區日益增強的自信已成為日本等國家軍費開支的主要動力。

- 由於上述因素,該地區預計五氧化二鈮市場在預測期內將穩定成長。

五氧化二鈮產業概況

五氧化二鈮市場是一個綜合市場,前五名公司控制著全球供應的大部分佔有率。主要參與企業(排名不分先後)包括 CBMM、西美資源控股有限公司、Solikamsk Magnesium Plant OJSC 和 AMG。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 電動車領域需求不斷成長

- 製造業對優質鋼材的需求不斷擴大

- 抑制因素

- 對急性接觸造成的健康問題的擔憂

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 依年級

- 工業級(純度99.0%~99.8)

- 3N

- 4N

- 依用途

- 鈮金屬

- 光學玻璃

- 超級電容

- 超合金

- 陶瓷

- 其他用途

- 依地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 合併、收購、合資、合夥和協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- AMG

- CBMM

- F&X Electro-Materials Limited

- JX Nippon Mining & Metals Corporation

- King-Tan Tantalum Industry Ltd

- Mitsui Mining & Smelting Co. Ltd

- MPIL

- Solikamsk Magnesium Plant OJSC

- Taki Chemical Co., Ltd.

- XIMEI Resources Holding Limited

第7章 市場機會及未來趨勢

- 生醫領域需求不斷擴大

The niobium pentoxide market is estimated to be at 6,374.07 tons by the end of this year. It is projected to reach 10,306.82 tons in the next five years, registering a CAGR of over 10.09% during the forecast period.

COVID-19 had a negative impact on the niobium pentoxide sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business has been recovering since 2021 and is expected to rise significantly in the coming years.

Key Highlights

- Over the short term, the growing demands from the electric vehicles segment and high-quality steel from the manufacturing sector are some factors driving market demand.

- Concerns about health issues on acute exposure to niobium pentoxide are hindering the growth of the market studied.

- The increasing demand from the biomedical sector is likely to act as a growth opportunity for the niobium pentoxide market during the forecast period.

- The Asia-Pacific region is expected to dominate the market and witness the highest CAGR during the forecast period.

Niobium Pentoxide Market Trends

Increasing Usage in the Production of Niobium Metal

- Niobium pentoxide, especially industrial grade, is used mainly in producing niobium metal. In addition, niobium pentoxide (99.9%) is also used to produce niobium metal for higher quality requirements. Technical quality niobium pentoxide (98-99%) is suitable for the electrothermic and metallothermic manufacture of niobium metal.

- Niobium metal offers high-temperature resistance, corrosion resistance, oxidation resistance, improved creep resistance, and reduced erosion at high temperatures.

- Niobium metal has good resistance to corrosive chemicals, even at high temperatures. It is, therefore, used to construct chemical equipment. Specifically, niobium metal plates, sheets, wires, rods, and tubings are used in sputtering targets, cathode protection systems for large steel structures, and chemical processing equipment. Moreover, it is also used for medical implants.

- According to the World Steel Association's latest short-term outlook, the global steel demand is estimated to drop by 2.3% year-on-year in 2022. However, it is expected to recover by 1% in 2023. The industry was hit by inflation, US monetary tightening, China's slowdown, and Russia's invasion of Ukraine, while high energy prices, rising interest rates, and declining confidence pushed demand forecasts down, leading to a slowdown in the steel manufacturing sector.

- Furthermore, according to the World Steel Association, the global steel production for January to July 2023 stood at 1,103.2 million tons, a decline of 0.1% compared to the previous year. This decline is majorly due to the 10.3% decline in European production. However, Asia-Pacific, Africa, and the Middle East registered a growth of 1.7%, 7.0%, and 2.3%, respectively, with a production capacity of 828.4 MT, 9 MT, and 26.2 MT in the first seven months of 2023.

- According to the Organisation Internationale des Constructeurs d'Automobiles(OICA), in 2022, around 85.01 million vehicles were produced across the world, witnessing a growth rate of 5.99% compared to 80.205 million vehicles in 2021, thereby indicating an increased demand for metal hoses from the automotive industry. In 2022, around 60 million passenger cars were manufactured worldwide, up nearly 7.35% compared to 2021.

- Recently, aircraft manufacturers have been looking for ways to accelerate production to fill order backlogs. For instance, according to the Boeing Commercial Outlook 2023-2042, the total global deliveries of new airplanes are estimated to be 42,595 by 2042. Owing to such huge expected deliveries, the demand for niobium pentoxide to produce niobium metal and alloys for aerospace is likely to rise globally.

- All factors mentioned above are likely to enhance the market's growth significantly.

The Asia Pacific Region is Expected to Dominate the Market

- China is the largest economy in terms of GDP in the Asia Pacific region. The country witnessed about 3% growth in its GDP in 2022, even after the trade disturbance caused due to its trade war with the United States.

- Niobium pentoxide and its derivatives find their key applications in iron and steel production. The strength of steel increases upon adding niobium to it. Moreover, niobium also improves the high-temperature oxidation resistance and corrosion resistance of steel, reduces its ductile-brittle transition temperature, and offers good welding properties and formability to steel. Specifically, niobium is used in the production of high-grade structural steel or high-strength low alloy (HSLA) steels and stainless steel.

- Niobium-based HSLA steels are mainly used in automotive and construction activities. Specifically, about 80% of all automotive sheet steel grades are regularly micro-alloyed with niobium. HSLA steels are used to manufacture fuel-efficient, safe, and long-lasting vehicles.

- According to the OICA (Organisation Internationale des Constructeurs d'Automobiles), automobile production and sales in China reached 27.021 million units and 26.864 million units in 2022, up by 3.4% and 2.1% from the previous year, respectively.

- The Chinese government is focusing on boosting investments across the construction sector in the country to boost overall economic growth. For instance, recent moves to increase financing for infrastructure construction include a USD 120 billion increase in the lending ratio of policy banks. The government is also considering allowing local governments to spend up to about USD 220 billion of the special bond quota, through which local governments fund infrastructure construction.

- Furthermore, India aims to become a USD 5 trillion economy by 2025. As a result, infrastructure development will play a critical role. The government has launched the National Infrastructure Pipeline (NIP) along with other initiatives, such as the Make in India and Production-Linked Incentives (PLI) schemes, to boost the growth of the infrastructure sector. Historically, more than 80% of the nation's infrastructure spending has been spent in the areas of transportation, power, water, and irrigation.

- Additionally, in construction, niobium alloys are used for producing structural and load-bearing parts. According to the Ministry of Land, Infrastructure, Transport, and Tourism (MLIT), Japan, in 2022, approximately 859.5 thousand housing developments were initiated in Japan, which represented an increase of 0.4% compared to the previous year.

- According to the Boeing Commercial Outlook 2023-2042, in China, around 8,560 new deliveries are projected to be made by 2042. Owing to such new deliveries in the country, the demand for niobium pentoxide from manufacturing aircraft components, especially engine blades, is likely to rise.

- Moreover, the aerospace industry in India is increasing significantly with the rising activities from the civil aviation sector. Many of India's aerospace manufacturing operations are anticipated to be carried out as a result of the rising demand for big aircraft from Indian carriers like SpiceJet and Indigo and the focus on Powered by Hour Contracts (PBH).

- According to the Stockholm International Peace Research Institute (SIPRI), Japan allocated USD 46.0 billion to its military in 2022, up 5.9% from 2021. Moreover, China's growing assertiveness in and around the South and the East China Seas has become a major driver of military spending in countries such as Japan.

- Due to the above-mentioned factors, the market for niobium pentoxide in the region is expected to have steady growth during the forecast period.

Niobium Pentoxide Industry Overview

The niobium pentoxide market is consolidated in nature, with the top five players controlling the majority of the share of the global supply. Some of the major players (not in any particular order) include CBMM, Ximei Resources Holding Limited, Solikamsk Magnesium Plant OJSC, and AMG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Electric Vehicles Segment

- 4.1.2 Growing Demand for High-Quality Steel from the Manufacturing Sector

- 4.2 Restraints

- 4.2.1 Concerns About Health Issues on Acute Exposure

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Grade

- 5.1.1 Industrial Grade (purity: 99.0% to 99.8%)

- 5.1.2 3N

- 5.1.3 4N

- 5.2 By Application

- 5.2.1 Niobium Metal

- 5.2.2 Optical Glass

- 5.2.3 Supercapacitors

- 5.2.4 Superalloys

- 5.2.5 Ceramics

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMG

- 6.4.2 CBMM

- 6.4.3 F&X Electro-Materials Limited

- 6.4.4 JX Nippon Mining & Metals Corporation

- 6.4.5 King-Tan Tantalum Industry Ltd

- 6.4.6 Mitsui Mining & Smelting Co. Ltd

- 6.4.7 MPIL

- 6.4.8 Solikamsk Magnesium Plant OJSC

- 6.4.9 Taki Chemical Co., Ltd.

- 6.4.10 XIMEI Resources Holding Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand from the Biomedical Sector