|

市場調查報告書

商品編碼

1407018

NOR 快閃記憶體:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)NOR Flash Memory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

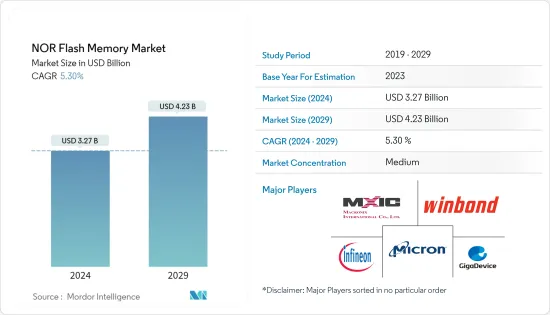

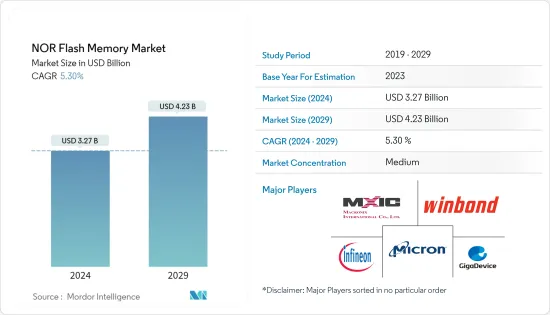

全球NOR快閃記憶體市場規模預計在2024年達到32.7億美元,並在2024-2029年預測期內以5.30%的複合年成長率成長,到2029年將達到42.3億美元。

主要亮點

- NOR 快閃記憶體對於程式碼儲存和低階嵌入式應用仍然有用,但並不是大容量儲存應用的有力競爭者。在汽車領域,NOR 產品用於資訊娛樂系統、ADAS(高級駕駛輔助系統)和儀表板儀表組。一些主要的汽車ADAS 製造商已經在使用 NOR 快閃記憶體。例如,博世使用賽普拉斯半導體公司(目前已被 Infenion 收購)的汽車級串行 NOR 快閃記憶體製造基於視訊的 ADAS(高級駕駛輔助系統)。這種用途預計允許系統啟動程式碼和演算法在高達 +125°C 的溫度下儲存。

- 此外,日益數位化正在增加對資料登錄需求、人工智慧和無線更新的需求,這些需求主要被涵蓋穿戴式裝置中。穿戴式裝置的這種技術需求也為全球 NOR 快閃記憶體市場創造了機會。例如,根據消費者技術協會 (CTA) 的數據,2023 年美國穿戴式裝置銷售額預計將達到 138 億美元。

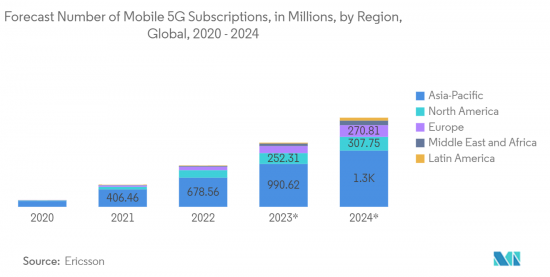

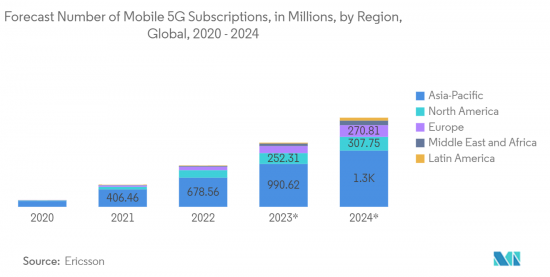

- 通訊業的擴張預計也將促進所研究市場的成長。例如,繼4G之後的5G,是數位蜂巢式網路的下一代無線通訊技術。 5G 技術因其高速度、大頻寬(高達 10Gb/s)和超低延遲而有潛力實現以前難以想像的新應用。 NOR快閃記憶體因其滿足現代社會高可靠性和可用性的需求而被廣泛應用於無線基地台。與NAND快閃記憶體快閃記憶體不同,NOR 快閃記憶體經常用於儲存韌體映像,因為它可以始終從 SoC(系統晶片設備)或 FPGA(現場可編程閘陣列)直接啟動。快速擴張的 5G 基礎設施將如何增加 NOR 快閃記憶體的需求也是顯而易見的。

- 此外,自疫情爆發以來,目前的半導體短缺以及 NAND 和 DRAM 等其他儲存產品的供不應求,增加了 NOR 快閃記憶體產品的需求和平均售價。然而,未來幾年,由於庫存增加,NOR快閃記憶體的平均售價預計將下降,這將影響所研究市場的成長。

- 此外,NOR快閃記憶體市場的研發成本很高,預計隨著最終用戶需求的增加,研發成本也會增加。像美光這樣的供應商最近加大力度建設新的記憶體製造製造和研發設施,以滿足汽車、資料中心、人工智慧和5G記憶體應用等行業不斷成長的需求,並宣布投資10億美元。這表明研發和製造流程的成本高昂,這仍然是所研究市場成長的課題。

NOR快閃記憶體市場趨勢

通訊成為第一大最終用戶應用

- 通訊和電訊是最大的市場領域。世界各地產生的資料量正在迅速增加。大量嵌入式設備推動了資料爆炸,這些設備為每個單獨的事務產生少量資料,這些數據加在一起就變成了巨量資料。組織從各種來源收集資料,包括智慧 (IoT) 設備、商業交易、工業設備和社交媒體。

- 現場可程式閘陣列(FPGA) 和系統晶片系統裝置 (SoC) 廣泛應用於各種無線基礎設施應用,以滿足不斷發展的市場標準並要求更快的上市時間。現已投入使用。 FPGA 和 SoC 需要在每次系統加電時進行配置。這些設備可以配置不同類型的內存,包括閃存。

- 與NAND快閃記憶體不同,NOR 快閃存在初始回應和啟動期間提供低延遲和高可靠性。此外,NOR 快閃記憶體製程技術的進步(例如每個儲存單元存儲兩位數的 MirrorBit 技術)支援比浮閘技術更高的密度縮放。密度的增加使得 5G 無線基礎設施所需的單晶片 1GB 和更高密度 NOR 快閃記憶體產品成為可能。由於這些特性,NOR 快閃記憶體廣泛應用於無線基礎架構應用。

- 隨著5G需求的增加,全球5G基地台的數量不斷增加。 5G基地台通常配備 1 或 2 GB 高密度 NOR 閃存,預計需要大量儲存晶片,從而推動所研究市場的需求。

- 機器對機器 (M2M) 無線解決方案的成長也對 NOR 快閃記憶體產生了巨大的需求。 NOR 快閃記憶體等嵌入式記憶體可實現短距離無線解決方案(Wi-Fi、ZigBee、Z-wave、藍牙、IP500)。

中國佔主要市場佔有率

- 攜帶式電子產品的成長趨勢以及物聯網等先進技術在中國的滲透是推動 NOR 快閃記憶體市場成長的主要因素。中國消費性電子產品銷售的增加推動了 NOR 快閃記憶體市場的成長。

- 例如,根據中華人民共和國國務院的數據,2022年1月至2月兩個月,重點電子製造業付加年增12.7%。中國是全球領先的電視、行動電話、筆記型電腦和個人電腦等消費性電子產品生產國,推動了 NOR 快閃記憶體元件的需求。

- 中國電子製造業的集中是物聯網產品在中國大幅發展的基礎,而龐大的國內消費需求進一步推動了物聯網產品的發展。中國物聯網的發展也受惠於國家主導的大規模基礎設施支出。例如,中國最近公佈了新型物聯網基礎設施三年計畫(2021-2023),目標是到年終首先在主要城市建造新型物聯網基礎設施。此類舉措預計將促進物聯網智慧設備的成長並推動市場成長。

- 隨著5G需求的增加,全球5G基地台的數量不斷增加。據工業和資訊化部 (MIIT) 稱,中國的目標是到 2022 年安裝 200 萬個 5G基地台,以擴展下一代行動網路。根據工信部統計,目前中國當地已安裝5G基地台142.5萬個,支援全國超過5億用戶,是全球最大的網路。據工信部稱,該國5G普及為24.3%。隨著 5G 網路的廣泛使用,使用 NOR 儲存裝置的物聯網和其他智慧型自動化應用正在不斷擴展。

NOR快閃記憶體產業概況

NOR快閃記憶體市場競爭溫和,英飛凌、美光科技、兆易創新、華邦電子等主要廠商佔市場主導地位。新進入者很難,因為進入障礙很高。現有供應商大力投資創新新產品的研發。

2023年5月,領先的快閃記憶體製造商兆易創新推出了業界最小的128Mb SPI NOR快閃物GD25LE128EXH,採用超小型3x3x0.4mm FO-USON8封裝。該公司表示,GD25LE128EXH 的厚度僅為 0.4m,在設計緊湊型應用時提供了無與倫比的彈性,非常適合需要低功耗和高功能的穿戴式設備、物聯網、醫療保健和網路產品,這是一個代碼儲存單元。

2023年3月,兆易創新將在其1.2V快閃記憶體產品策略藍圖中引入GD25UF系列SPI NOR快閃記憶體,以支援基於先進功能節點的系統晶片(SoC)和應用處理器。 GD25UF SPI NOR 快閃記憶體產品針對需要超低功耗和小基板空間的應用進行了最佳化。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 數位化的進步和資料為中心的應用程式的出現

- 物聯網應用的成長

- 市場抑制因素

- 研發和製造成本高

- 替代品的存在

第6章市場區隔

- 依類型

- 串行NOR快閃記憶體

- 並行NOR快閃記憶體

- 依最終用戶應用程式

- 通訊

- 消費性電子產品

- 車

- 產業

- 其他最終用戶應用程式

- 依地區

- 美洲

- 歐洲

- 日本

- 中國

- 其他地區

- 依密度

- 2 兆位元或更少 NOR

- 4 兆位元或更少(超過 2MB)NOR

- 8 兆位元或更少(超過 4MB)NOR

- 16 兆位元或更少(超過 8MB)NOR

- 32 兆位元或更少(超過 16MB)NOR

- 64 兆位元或更少(超過 32MB)NOR

- 其他密度

第7章 競爭形勢

- 公司簡介

- Infineon Technologies AG

- Micron Technology Inc.

- GigaDevice Semiconductor Inc.

- Macronix International Co. Ltd

- Winbond Electronics Corporation

- Integrated Silicon Solution Inc.

- Microchip Technology Inc.

- Renesas Electronics Corporation

- Elite Semiconductor Microelectronics Technology Inc.

- Wuhan Xinxin Semiconductor Manufacturing Co. Ltd(XMC)

第8章供應商市場佔有率

第9章投資分析

第10章市場機會與未來趨勢

第11章價格分析價格分析

The NOR Flash Memory Market size is estimated at USD 3.27 billion in 2024, and is expected to reach USD 4.23 billion by 2029, growing at a CAGR of 5.30% during the forecast period (2024-2029).

Key Highlights

- NOR flash memory remains useful for code storage and low-end embedded applications but is not a serious contender for high-capacity storage applications. In the automotive space, NOR products are used in infotainment systems, advanced driver assistance systems (ADAS), and dashboard instrument clusters. Some leading automotive ADAS manufacturers have already been using NOR flash. For Example, Bosch uses the automotive-grade Serial NOR Flash memories from Cypress Semiconductor Corporation, which Infenion now acquires to manufacture its video-based Advanced Driver Assistance Systems (ADAS). The usage is expected to boost the storage of system boot code and algorithms at temperatures up to +125 degree C.

- Additionally, the growing digitalization is driving demand for data logging requirements, artificial intelligence, and over-the-air updates, which are mainly incorporated by wearables. This demand for technology in wearables is also creating opportunities in the global NOR flash memory market. For instance, according to the Consumer Technology Association (CTA), the sales revenue of wearables in the United States is anticipated to reach USD 13.8 billion in 2023.

- The expanding telecommunication sector is also anticipated to support the studied market's growth. For instance, following 4G, 5G is the next generation of wireless communication technology for digital cellular networks. 5G technology, with its fast speed, huge bandwidth (up to 10Gb/s), and ultra-low latency, could enable new applications that were previously unimaginable. NOR Flash is widely employed in wireless base stations because it meets the modern world's high reliability and availability demand. NOR Flash, unlike NAND Flash, allows SoCs (system-on-chip devices) and FPGAs (field-programmable gate arrays) to boot from it directly and consistently; hence, it is frequently used to store firmware images. It is also clear how the rapidly expanding 5G infrastructure would increase demand for NOR Flash.

- Furthermore, the current semiconductor shortages and undersupply of other memory products, such as NAND and DRAM, have increased demand and the average selling price of NOR Flash products since the pandemic. However, over the coming years, the ASP of NOR Flash is expected to decline due to growing stockpiles, which will impact the growth of the studied market.

- Research and development costs are also a costly affair in the NOR flash memory market, which is expected to increase with the growing end-user requirements. Vendors like Micron have recently announced investments worth billions to construct new fabrication & R&D facilities for memory manufacturing to cater to the growing demand across industries like automotive, data centers, and memory applications in artificial intelligence and 5G. This indicates the costly setup for research and development and the fabrication process, which continues to remain among the challenging factors for the growth of the studied market.

NOR Flash Memory Market Trends

Communication to be the Largest End-user Application

- Communications and Telecom represent the largest segment of the market. The amount of data generated worldwide is increasing at a rapid pace. The explosion of data is fueled by a plethora of embedded devices that produce a small amount of data for each discrete transaction and add up to big data when clubbed together. Organizations collect data from a range of sources, including smart (IoT) devices, business transactions, industrial equipment, social media, etc.

- The need to respond to evolving market standards in a compressed time-to-market window has resulted in the widespread use of field-programmable gate arrays (FPGAs) and complementary system-on-chip devices (SoCs) in a wide range of wireless infrastructure applications. FPGAs and SoCs require configuration each time the system is powered up. These devices can be configured by diverse types of memories, including Flash.

- Unlike NAND flash, NOR flash memories provide high reliability with low latency in initial response and boot. In addition, advances in NOR Flash process technology, such as MirrorBit technology, which stores two bits per memory cell, support greater density scaling than floating-gate technology. The increased density enables monolithic 1-GB and higher density NOR flash products required for 5G wireless infrastructure. Due to such characteristics, NOR flash memories are widely used in wireless infrastructure applications.

- With the growing demand for 5G, the number of 5G base stations is increasing globally. 5G base stations are expected to need a significant amount of memory chips, as they are usually equipped with high-density NOR flash with 1 or 2 gigabytes of memory, fueling the demand for the market studied.

- Also, a growth in machine-to-machine (M2M) wireless solutions is creating a significant demand for NOR Flash memory. Embedded memory, like NOR Flash, can enable short-range radio solutions (Wi-Fi, ZigBee, Z-wave, Bluetooth, and IP500).

China to Hold Major Market Share

- The rise in the trend of portable electronic devices combined with the growing penetration of advanced technologies, like IoT, among the population across china acts as one of the major factors driving the growth of the NOR flash memory market. The increase in the sales of consumer electronics in China is escalating the growth of the NOR flash market.

- For instance, according to the State Council of the People's Republic of China, significant electronics manufacturers' added value increased 12.7% year over year in the two months between January and February 2022, as opposed to the 7.5% growth experienced by the nation's entire industrial sector. The demand for NOR flash memory devices is driven by China, the world's top producer of consumer electronics such as TVs, cellphones, laptops, and PCs.

- The concentration of electronics manufacturing in China has provided a foundation for the significant development of IoT products in the country, further stimulated by massive domestic consumer demand. IoT development in China also benefits from massive state-led spending on enabling infrastructure. For instance, China recently announced a three?year plan for new IoT infrastructure development (2021?2023), targeting the initial completion of new IoT infrastructure in major cities by the end of 2023. Such initiatives will fuel the growth of IoT-enabled smart devices, facilitating market growth.

- With the growing demand for 5G, the number of 5G base stations is increasing globally. According to the Ministry of Industry and Information Technology (MIIT), China aims to have 2 million installed 5G base stations in 2022 to expand the country's next-generation mobile network. According to MIIT, the Chinese mainland currently has 1.425 million installed 5G base stations that support more than 500 million 5G users nationwide, making it the biggest network in the world. According to the ministry, the country has a 24.3% 5G penetration rate. IoT and other intelligent automation applications that use NOR memory devices are expanding as a result of 5G networks being more widely used.

NOR Flash Memory Industry Overview

The NOR Flash Memory market is moderately competitive, with major vendors such as Infineon, Micron Technology, GigaDevice Semiconductor (Beijing) Inc., and Winbond Electronics Corporation dominating the market. High entry barriers make it difficult for new players to enter the market. Existing vendors are investing heavily in researching and developing new and innovative products.

In May 2023, GigaDevice, a leading flash memory manufacturer, launched GD25LE128EXH, the industry's smallest 128Mb SPI NOR Flash in the ultra-compact 3x3x0.4mm FO-USON8 package. According to the company, with only 0.4m thickness, the GD25LE128EXH offers unparalleled flexibility in designing compact applications, making it the ideal code storage unit for wearables, IoT, healthcare, and networking products that demand low power consumption and high functionality.

In March 2023, GigaDevice introduced the GD25UF series of SPI NOR Flash in its strategic roadmap of 1.2V Flash products, which support systems-on-chip (SoCs) and applications processors built on advanced function nodes. The GD25UF SPI NOR Flash products are optimized for applications that require ultra-low power consumption or a small board footprint.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Digitalization and Emergence of Data-Centric Applications

- 5.1.2 Growing Applications of IoT

- 5.2 Market Restraints

- 5.2.1 High Cost of R&D and Fabrication

- 5.2.2 Availability of Substitutes

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Serial NOR Flash

- 6.1.2 Parallel NOR Flash

- 6.2 By End-user Application

- 6.2.1 Communication

- 6.2.2 Consumer Electronics

- 6.2.3 Automotive

- 6.2.4 Industrial

- 6.2.5 Other End-user Applications

- 6.3 By Geography

- 6.3.1 Americas

- 6.3.2 Europe

- 6.3.3 Japan

- 6.3.4 China

- 6.3.5 Rest of the World

- 6.4 By Density

- 6.4.1 2 MEGABIT and LESS NOR

- 6.4.2 4 MEGABIT and LESS (>2MB) NOR

- 6.4.3 8 MEGABIT and LESS (>4MB) NOR

- 6.4.4 16 MEGABIT and LESS (>8MB) NOR

- 6.4.5 32 MEGABIT and LESS (>16MB) NOR

- 6.4.6 64 MEGABIT and LESS (>32MB) NOR

- 6.4.7 Other Densities

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Infineon Technologies AG

- 7.1.2 Micron Technology Inc.

- 7.1.3 GigaDevice Semiconductor Inc.

- 7.1.4 Macronix International Co. Ltd

- 7.1.5 Winbond Electronics Corporation

- 7.1.6 Integrated Silicon Solution Inc.

- 7.1.7 Microchip Technology Inc.

- 7.1.8 Renesas Electronics Corporation

- 7.1.9 Elite Semiconductor Microelectronics Technology Inc.

- 7.1.10 Wuhan Xinxin Semiconductor Manufacturing Co. Ltd (XMC)