|

市場調查報告書

商品編碼

1405718

聚氨酯合成橡膠:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Polyurethane Elastomers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

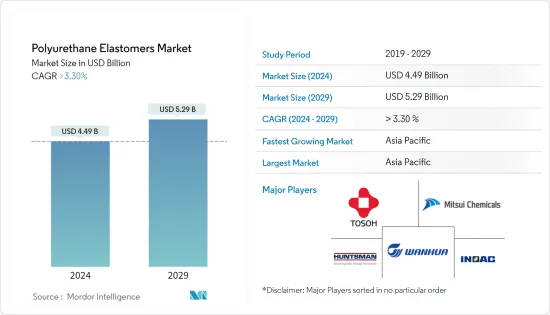

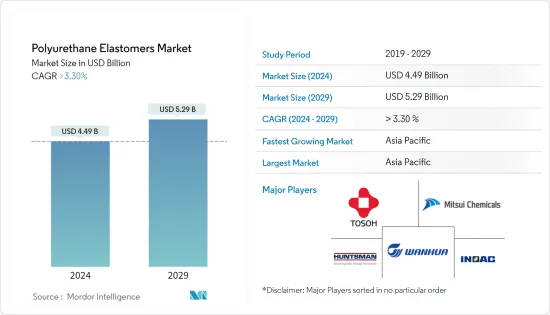

聚氨酯合成橡膠市場規模預計到2024年為44.9億美元,預計到2029年將達到52.9億美元,在預測期內(2024-2029年)複合年成長率將超過3.30%。

在COVID-19期間,由於經濟活動減少,對使用聚氨酯合成橡膠的產品(例如汽車零件、消費品和建築材料)的需求減少。然而,情況已經有所改善,從而恢復了市場的成長軌跡,預計在預測期內也會出現成長。

主要亮點

- 由於人口成長,製造鞋墊、中底和外底的製鞋業的需求不斷增加,聚氨酯合成橡膠(PUE) 正在主導市場。

- PUE 常用於汽車零件、醫療和航太等高性能應用。然而,它們的市場受到耐用性低的限制,由於暴露在熱、紫外線、化學物質和其他環境因素中,隨著時間的推移,它們很容易劣化。

- 對生物基聚氨酯產品不斷成長的需求可能代表著未來幾年該市場的機會。

- 亞太地區主導聚氨酯合成橡膠市場,印度、中國和日本是主要消費國。

聚氨酯(PU)合成橡膠市場趨勢

鞋業是一個快速成長的市場

- 聚氨酯合成橡膠(PU)是具有橡膠特性的聚氨酯族的一員。聚氨酯合成橡膠是由硬質部分(異氰酸酯)和彈性部分(多元醇)組合而成,不同的選擇創造了聚氨酯合成橡膠的卓越品質。

- 聚氨酯彈性體主要用於製鞋行業,使用在“0°C~80°C”溫度範圍內調節柔韌性的配方生產高強度和柔性鞋底,從而生產出品質上乘、經久耐用的產品。

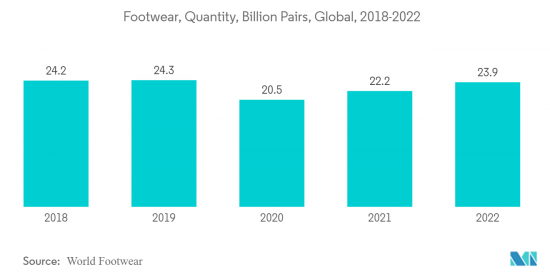

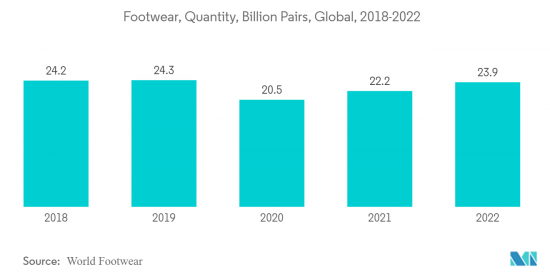

- 根據《2022 年世界鞋類年鑑》,全球鞋類產量成長 7.6%,達到 239 億雙,大致與疫情前的水準持平。

- 2022年鞋類市場收益排名顯示,美國以858.4億美元成長最快,其次是中國,為793.2億美元。因此,它顯示了該行業與上一年相比的成長。

- 根據印度儲備銀行 2022 年報告,印度出口的皮革和皮革製品金額超過 3,260 億印度盧比(約 41.4 億美元)。與上年度超過 2,440 億印度盧比(約 31 億美元)相比,成長了 33%,其中還包括鞋類產品。預計聚氨酯合成橡膠市場在預測期內將成長。

- 人口成長正在推動中國、印度和日本等國家的鞋業市場,形成聚氨酯合成橡膠的主要市場。

亞太地區主導市場

- 預計亞太地區將在預測期內主導聚氨酯合成橡膠市場。在中國和印度等國家,由於鞋類、皮革和汽車等消費品產業的使用不斷增加,聚氨酯合成橡膠市場正在擴大。

- 聚氨酯合成橡膠也用於需要高動態應力的地方。當需要耐腐蝕性以減少濕氣滲透並防止磨損時,這些合成橡膠也可用作被覆劑。

- 根據《2022 年世界鞋類年鑑》,鞋類產業仍高度集中在亞洲,每 10 雙鞋就有近 9 隻是在亞洲生產的。

- 亞太國家中,2022年中國、印度、越南和印尼將佔全球鞋類產量的75%以上。中國是全球最大的鞋類生產國,2022年佔有率小幅成長至54.6%,扭轉了近年來下降的趨勢。

- 此外,越南產量增幅最高,達10.3%,成為PU合成橡膠市場的驅動力。

- PU合成橡膠用於各種汽車零件,包括懸吊襯套、墊圈和密封件、保險桿、車輪和輪胎、軟管和管材以及內裝。聚氨酯合成橡膠的物理性能,如拉伸強度、壓縮強度和撕裂強度,使其在汽車行業備受追捧。

- 根據OICA資料,2022年中國汽車工業將生產約2380萬輛小客車,這也是亞太地區小客車保有量最高的地區,影響預測期內PU合成橡膠市場的帶動。是。

- 上述因素加上政府的支持,促使預測期內對聚氨酯合成橡膠的需求增加。

聚氨酯(PU)合成橡膠產業概況

全球聚氨酯合成橡膠市場分散。主要企業(排名不分先後)包括 Tosoh India Pvt. Ltd.、三井化學、萬華化學、INOAC CORPORATION、Huntsman International LLC 等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 鞋業需求增加

- 擴大在汽車和消費品產業的應用

- 其他司機

- 抑制因素

- 聚氨酯合成橡膠的耐久性下降

- 聚氨酯的環境問題

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 類型

- 熱塑性塑膠

- 熱固性

- 目的

- 鞋類

- 工業機械

- 汽車/運輸設備

- 其他(建築/施工、採礦設備、醫療)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- American Urethane, Inc.

- Argonics

- Covestro AG

- Dow

- Huntsman International LLC.

- INOAC CORPORATION

- LANXESS

- Mitsui Chemicals, Inc.

- Ravelast Polymers

- Tosoh India Pvt. Ltd.

- The Lubrizol Corporation

- Unicast Engineered Urethane Products

- Wanhua

- Weaver Industries, Inc.

第7章 市場機會及未來趨勢

- 對生物基聚氨酯合成橡膠的需求增加

- 其他機會

The Polyurethane Elastomers Market size is estimated at USD 4.49 billion in 2024, and is expected to reach USD 5.29 billion by 2029, growing at a CAGR of greater than 3.30% during the forecast period (2024-2029).

During COVID-19, the reduced economic activity led to decreased demand for products using polyurethane elastomers, such as automotive components, consumer goods, and construction materials. However, the condition has recovered, thereby restoring the growth trajectory of the market, and is expected to grow over the period.

Key Highlights

- Polyurethane elastomers (PUEs), rising in demand from the footwear industry for producing insoles, midsoles, or outsoles, are dominating the market owing to the increasing population.

- PUEs are often used in high-performance applications such as automotive parts, medical, and aerospace. However, they have lower durability as they are susceptible to degradation over time due to exposure to heat, UV radiation, chemicals, and other environmental factors, restricting the market.

- Increasing demand for bio-based polyurethane products could act as an opportunity for this market in the coming years.

- Asia-Pacific region dominated the market for polyurethane elastomers, with India, China, and Japan as major countries in consumption.

Polyurethane (PU) Elastomers Market Trends

Footwear Industry Representing the Fastest Growing Market

- Polyurethane elastomers (PU) are a class of the polyurethane group that have the characteristics of rubber. Polyurethane elastomers are formed by combining hard (isocyanate) and elastic (polyol) parts, and changing these selections creates the superior quality of the polyurethane elastomers.

- Polyurethane elastomers are majorly used in the footwear industry to produce high tensile and flexible soles using formulations that regulate flexibility ranging from temperatures '0 degrees Celsius to 80 degrees Celsius' thereby producing superior quality and durable products, increasing the scope for this market.

- As per the World Footwear Yearbook 2022, global footwear production increased by 7.6% to reach 23.9 billion pairs, roughly standing at pre-pandemic levels.

- In 2022, the revenue ranking in the footwear market is led by the United States with USD 85.84 billion, while China is following with USD 79.32 billion, showing a rapid growth company. Hence showing growth in the sector compared to the previous year.

- According to the Reserve Bank of India report 2022, the value of leather and leather products exported from India amounted to over INR 326 billion (~USD 4.14 billion). This was an increase of 33% compared to the previous year's value of over INR 244 billion (~USD 3.1 billion ), which includes footwear products. It is expected to increase in the PU elastomers market during the forecast period.

- The growing population is aiding the market for the footwear industry in countries like China, India, and Japan creating a major market for polyurethane elastomers.

Asia-Pacific Region to Dominate the Market

- Asia Pacific region is expected to dominate the market for polyurethane elastomers during the forecast period. In countries like China and India, due to the increasing applications in footwear and other consumer goods industries like leather and automotive, the market for polyurethane elastomers has been increasing.

- Elastomers of polyurethane are also used where a high degree of dynamic stress is anticipated. These elastomers are also used as coatings when corrosion resistance is preferred for inhibiting moisture transmission and preventing abrasion damage.

- As per the World Footwear Yearbook 2022, the footwear industry continues to be strongly concentrated in Asia, where almost 9 out of every 10 pairs of shoes are manufactured, resulting in a share of 87.4% of the world's total driving PU elastomers market.

- Among Asia-Pacific countries, China, India, Vietnam, and Indonesia accounted for over 75% of footwear production worldwide as of 2022. China is the world's largest footwear producer, marginally increasing its share in 2022 to 54.6%, reversing the downward trend observed in recent years.

- Moreover, Vietnam experienced the highest production growth of 10.3%, which has a direct impact on driving the PU elastomers market.

- The PU elastomers are used across various automobile components such as suspension bushing, gaskets and seals, bumpers, wheels and tires, hoses and tubing, interior trim, and other components. The physical properties of polyurethane elastomers, such as tensile strength, compression strength, and tear strength, are increasing their demand in the automobile industry.

- According to the OICA data, for 2022, China's automotive industry 2022 produced approximately 23.8 million passenger cars, and it is also the most passenger cars in the Asia-Pacific region, which has an impact on PU elastomers driving the market during the forecast period.

- The factors mentioned above, coupled with government support, are contributing to the increasing demand for polyurethane elastomers during the forecast period.

Polyurethane (PU) Elastomers Industry Overview

The global polyurethane elastomers market is fragmented in nature. The major players (not in any particular order) include Tosoh India Pvt. Ltd., Mitsui Chemicals, Inc., Wanhua, INOAC CORPORATION, and Huntsman International LLC among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Footwear Industry

- 4.1.2 Growing Application in Automotive and Consumer Goods Industries

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Lower Durability of Polyurethane Elastomers

- 4.2.2 Environmental Concerns Caused by Polyurethane

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Thermoplastic

- 5.1.2 Thermoset

- 5.2 Application

- 5.2.1 Footwear

- 5.2.2 Industrial Machinery

- 5.2.3 Automotive & Transportation

- 5.2.4 Others (Building & Construction, Mining Equipment, and Medical)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 American Urethane, Inc.

- 6.4.2 Argonics

- 6.4.3 Covestro AG

- 6.4.4 Dow

- 6.4.5 Huntsman International LLC.

- 6.4.6 INOAC CORPORATION

- 6.4.7 LANXESS

- 6.4.8 Mitsui Chemicals, Inc.

- 6.4.9 Ravelast Polymers

- 6.4.10 Tosoh India Pvt. Ltd.

- 6.4.11 The Lubrizol Corporation

- 6.4.12 Unicast Engineered Urethane Products

- 6.4.13 Wanhua

- 6.4.14 Weaver Industries, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Bio-based Polyurethane Elastomers

- 7.2 Other Opportunities