|

市場調查報告書

商品編碼

1403921

智慧工廠:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Smart Factory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

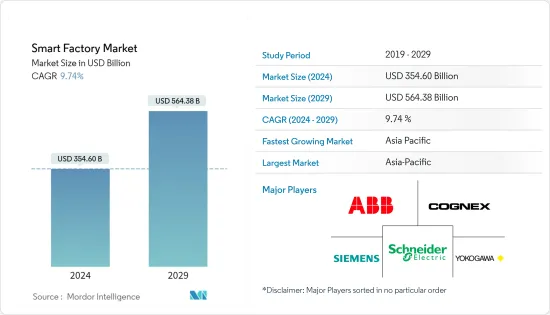

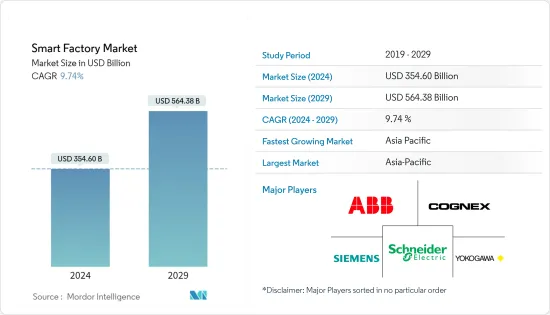

智慧工廠市場規模預計到2024年為3,546億美元,預計到2029年將達到5,643.8億美元,在預測期內(2024-2029年)複合年成長率為9.74%。

主要亮點

- 隨著工業 4.0 和物聯網 (IoT) 的核准,製造業發生了重大轉變,迫使企業變得更加靈活、更具創新性和創造性,以便透過自動化補充和擴展人力的技術來推動生產,並減少因工業事故而造成的事故。處理故障必須採用方法。隨著互聯設備和感測器的採用率不斷提高,促進了 M2M通訊,我們看到製造業中開發的資料點數量呈爆炸式成長。

- 根據 Zebra 的製造願景研究,基於物聯網和 RFID 的智慧資產追蹤解決方案將在 2022 年取代基於電子表格的傳統方法。根據瑪麗維爾大學的計算,到 2025 年,全球每年將產生超過 180 兆千兆位元組的資料。其中大部分是由工業物聯網支援的產業產生的。此外,工業IoT(IIoT) 公司 Microsoft 的一項研究發現,85% 的公司至少擁有一個 IIoT 用例計劃。隨著約 95% 的受訪者將在 2022 年實施 IIoT 策略,這一數字有所增加。

- 技術進步加上製造設施開拓的持續增加預計將影響預測期內的市場成長率。例如,英特爾最近與義大利電信和硬體製造商 Exor International 合作開發使用人工智慧 (AI) 和 5G 網路的智慧製造設施。

- 此外,人工智慧和機器學習(ML)技術的市場滲透加速將提高資料分析的準確性和速度,從而顯著推動市場發展。此外,現場設備市場、機器人和感測器的進步可能會進一步擴大研究市場的範圍。根據思科預測,到 2022 年,支援物聯網應用的機器對機器 (M2M) 連接可能佔全球 285 億連接裝置的 50% 以上。許多政府也鼓勵製造業投資物聯網技術來實施智慧工廠。

- 然而,高昂的安裝成本對市場成長構成了挑戰。此外,需要高技能的勞動力來操作和維護自動化基礎設施,這進一步增加了整體成本,並阻礙了大規模招聘,尤其是在中小型產業。

- 此外,近期經濟不穩定,特別是受疫情和美國貿易爭端、俄羅斯烏克蘭戰爭等地緣政治問題影響,也導致各地區營商環境存在不確定性,也對供應鏈造成影響。以及各地區工業部門對製成品的需求,為研究市場的成長創造了不利的環境。

智慧工廠市場趨勢

半導體產業可望推動市場成長

- 半導體製造商依靠智慧製造流程來產生更高的產量比率和利潤。透過推進半導體創新並鼓勵進一步實施由先進晶片驅動的創新技術,隨著工廠變得更加複雜和互聯,製造商將能夠調整生產以滿足不斷成長的需求。您可以嘗試迎頭趕上。

- 半導體製造工廠 (fabs) 的建設和維護成本達數十億美元。成本在於設備,維護對於持續運作至關重要。透過使用創新的製造技術來監控設備健康狀況並執行預測性維護,工廠可以大幅減少非計劃性維護時間。

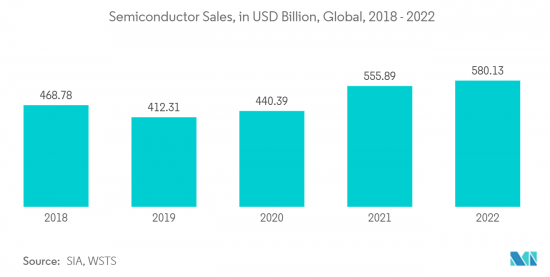

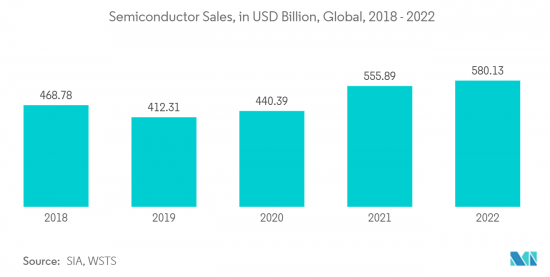

- 全球半導體製造工廠的數量正在增加。半導體行業協會也報告稱,新半導體設備的支出增加。這些因素也可能推動半導體產業智慧工廠的採用。根據半導體產業協會(SIA)預測,2022年全球半導體銷售額將達5,801.3億美元。半導體是電子設備的重要零件,產業競爭激烈。 2022年年與前一年同期比較達4.4%。此外,2022年3月歐洲半導體銷售額為46.3億美元,較上個月的45.1億美元略有成長。

- 此外,該地區各國都致力於透過提供稅收減免、資金、補貼和其他型態援助的政府政策來鼓勵半導體製造。例如,據政府稱,2020 年印度半導體產業價值為 150 億美元,預計到 2026 年將成長至 630 億美元(資料來源:電子和資訊技術部)。隨著政府對半導體製造及相關產業的干涉,印度有望成為全球半導體供應鏈的領先國家之一。

- 此外,2022 年 9 月,礦業集團 Vedanta 和台灣電子製造巨頭富士康進行了有史以來最大的投資之一,投資 18.6 億美元,在古吉拉突邦建立印度第一家半導體工廠。此類投資可能會在所研究的市場中創造更大的需求。

- 此外,半導體產業正在不斷發展,以滿足人工智慧主導的電子設備和自動駕駛汽車和物聯網等項目對半導體材料日益成長的需求。汽車導航、安全和資訊娛樂解決方案中使用的電子元件消費的成長將再次促進半導體產業的成長。

亞太地區市場將實現顯著成長

- 亞太地區是研究市場投資強勁的地區。各國政府持續採取舉措加強智慧製造和技術採用。此外,印度政府的國家製造業政策目標是到2025年將製造業佔GDP的比重提高到25%。此外,印度政府的「印度製造」政策預計將增加當地製造業對機械和工具的需求和消費。

- 此外,2022年1月,Reliance向Adverb Technologies投資1.32億美元,收購54%的股份。這些市場投資預計將加速製造業自動化的採用,並在預測期內推動智慧工廠市場的發展。

- 中國是亞洲智慧型應用轉型的重要參與者。中國政府正在加強智慧製造設計,在標準體系建設方面進行多種規劃和示範。中國的目標是到2025年創造40項製造業創新成果。重點領域包括自動化工具機和機器人、先進資訊技術、航太航空裝備、海洋裝備、現代軌道交通裝備、高技術船舶、新能源汽車及裝備、電力裝備、農業裝備、新材料、生物製藥等。和先進的醫療產品。

- 此外,2022年1月,自動化專家ABB與中國最重要的汽車零件供應商華域汽車宣布成立合資公司,推動中國汽車產業下一代智慧生產。該合資企業建立在兩家公司成功合作夥伴關係的基礎上,代表著華域汽車中國業務在生產彈性且永續的汽車零件方面的重要發展。

- 此外,日本正快速邁向“社會5.0”,這個全新的超級智慧社會將迎來人類發展四大階段的第5章。一切都透過物聯網技術連接起來,所有技術都整合在一起,生活品質正在顯著提高。此外,日本政府還宣布推出連網型工業以響應德國政府的工業 4.0 計劃,新的製造業革命的勢頭正在增強。

- 此外,韓國商業和公共部門已同意增加該地區智慧工廠的數量,並計劃在 2022 年將超過 30,000 家採用最新數位和分析技術的工廠投入運作。韓國產業通商資源部 (MOTIE) 重申政府願意協助中小企業採用和擴展智慧製造技術。中小企業(SME)佔韓國所有企業的99%以上,政府資料顯示中小企業出口正在成長。

智慧工廠產業概況

智慧工廠市場較為分散,主要企業包括ABB有限公司、康耐視公司、西門子公司、Schneider Electric公司及橫河電機。市場參與者正在採取創新、合作、併購和收購等策略來改善其產品供應並獲得永續的競爭優勢。

2023年3月,工業自動化和能源管理數位解決方案供應商Schneider Electric在匈牙利新建的智慧工廠破土動工。投資額為4,000萬歐元(4,300萬美元),用地面積25,000平方公尺,員工人數約500人。

2023年3月,領先的消費電子製造商三星電子宣布計畫擴大投資,在諾伊達的行動電話製造廠安裝智慧製造能力。該公司還宣布計劃擴大國內研發設施,以實現具有競爭力的本地生產。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭強度

- 產業價值鏈分析

- 評估宏觀經濟趨勢對市場的影響

第5章市場動態

- 市場促進因素

- 在整個價值鏈中擴大物聯網 (IoT) 技術的採用

- 對能源效率的需求不斷成長

- 市場抑制因素

- 龐大資金投入轉型

- 容易受到網路攻擊

第6章市場區隔

- 依產品類型

- 機器視覺系統

- 相機

- 處理器

- 軟體

- 外殼

- 影像擷取卡

- 整合服務

- 照明

- 工業機器人

- 關節式機器人

- 笛卡兒機器人

- 圓柱形機器人

- SCARA機器人

- 並聯機器人

- 協作工作機器人

- 控制設備

- 繼電器和交換器

- 伺服馬達及驅動器

- 感應器

- 通訊科技

- 有線

- 無線的

- 其他產品類型

- 機器視覺系統

- 依技術

- 產品生命週期管理 (PLM)

- 人機介面 (HMI)

- 企業資源規劃(ERP)

- 製造執行系統(MES)

- 集散控制系統(DCS)

- 監控和資料採集 (SCADA)

- 可程式邏輯控制器(PLC)

- 其他技術

- 按最終用戶產業

- 車

- 半導體

- 油和氣

- 化工/石化

- 製藥

- 航太/國防

- 食品與飲品

- 礦業

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 北美洲

第7章競爭形勢

- 公司簡介

- ABB Ltd

- Cognex Corporation

- Siemens AG

- Schneider Electric SE

- Yokogawa Electric Corporation

- KUKA AG

- Rockwell Automation Inc.

- Honeywell International Inc.

- Robert Bosch GmbH

- Mitsubishi Electric Corporation

- Fanuc Corporation

- Emerson Electric Co.

- FLIR Systems Inc.(Teledyne Technologies Incorporated)

第8章投資分析

第9章市場的未來

The Smart Factory Market size is estimated at USD 354.60 billion in 2024, and is expected to reach USD 564.38 billion by 2029, growing at a CAGR of 9.74% during the forecast period (2024-2029).

Key Highlights

- Tremendous shifts in manufacturing due to Industry 4.0 and the approval of IoT require enterprises to adopt agile, more innovative, and creative ways to advance production with technologies that complement and augment human labor with automation and reduce industrial accidents caused by process failure. With the increased rate of adoption of connected devices and sensors and the fostering of M2M communication, a surge in the data points that are developed in the manufacturing industry is being observed.

- According to Zebra's Manufacturing Vision Study, smart asset-tracking solutions based on IoT and RFID overtook traditional, spreadsheet-based methods in 2022. Maryville University calculates that by 2025, more than 180 trillion gigabytes of data are anticipated to be created worldwide yearly. IIoT-enabled industries will generate a large portion of this. In addition, an Industrial IoT (IIoT) company Microsoft Corporation survey found that 85 percent of companies have at least one IIoT use case project. This number increased, as approx 95 percent of respondents implemented IIoT strategies in 2022.

- Incremental advancement in technology, coupled with a sustained increase in the development of manufacturing facilities, is expected to impact the market growth rate during the forecast period. For instance, Intel has recently partnered with Telecom Italia and hardware manufacturer Exor International to develop a smart manufacturing facility that uses artificial intelligence (AI) and 5G networking.

- Furthermore, the glowing market penetration of AI and machine learning (ML) technologies may enhance the accuracy and speed of data analysis, thereby significantly driving the market forward. Moreover, the advancement in the field devices market, robots, and sensors may further expand the scope of the studied market. According to Cisco projections, by 2022, machine-to-machine (M2M) connections that support IoT applications may have accounted for more than 50 percent of the world's 28.5 billion connected devices. Many governments also motivate manufacturing companies to invest in IoT technologies for smart factory adoption, which creates a favorable outlook for the growth of the studied market.

- However, a high installation cost is the primary factor challenging the market's growth. Additionally, the requirement of a highly skilled workforce to operate and maintain the automation infrastructure further adds to the overall cost, restraining mass adoption, especially in small and medium-scale industries.

- Additionally, the recent economic instability, especially as an outcome of the pandemic and geo-political issues such as the US-China trade dispute and the Russia-Ukraine war, is also challenging the studied market's growth as it has not only led to an uncertain business environment across various regions but are also impacting the supply chain of industrial sectors and demand for manufactured products across various region, leading to an unfavorable environment for the studied market's growth.

Smart Factory Market Trends

Semiconductor Sector is Expected to Drive the Market Growth

- Semiconductor manufacturers rely on smart manufacturing processes to produce higher yields and margins. By advancing semiconductor innovation and encouraging the further implementation of innovative technologies powered by advanced chips, manufacturers can ensure that production keeps pace with rising demand as factories become more complex and connected.

- Semiconductor fabrication plants, or fabs, cost billions of dollars to build and maintain. The cost goes on equipment, the maintenance of which is vital to ongoing operation. By using innovative manufacturing technologies to observe equipment health and execute predictive maintenance, fabs can decrease unplanned maintenance time significantly.

- The semiconductor fabrication plants globally are on the rise. Also, the Semiconductor Industry Association reported increased spending on new semiconductor equipment. These factors will also drive the adoption of smart factories in the semiconductor industry. According to the Semiconductor Industry Association (SIA), in 2022, semiconductor sales reached USD 580.13 billion worldwide. Semiconductors are crucial components of electronic devices, and the industry is highly competitive. The year-on-year growth rate in 2022 reached 4.4 percent. Additionally, semiconductor sales in Europe in March 2022 were USD 4.63 billion, up slightly from last month's figures, which recorded USD 4.51 billion.

- Moreover, various countries in this region are focused on encouraging semiconductor manufacturing through government policies offering tax breaks, money, subsidies, and other forms of assistance. For instance, according to the government, the Indian semiconductor sector was valued at USD 15 billion in 2020 and is anticipated to grow to USD 63 billion by 2026 (Source: Ministry of Electronics & IT). Through governmental intervention in the manufacturing of semiconductors and the peripheral sector, India is expected to become one of the leading countries in global semiconductor supply chains.

- In addition, in September 2022, mining conglomerate Vedanta and Taiwanese electronics manufacturing giant Foxconn made one of the largest ever investments of USD 1,860 million to set up India's first semiconductor plant in Gujarat. Such investment may further create significant demand in the studied Market.

- Besides, the semiconductor industry is growing to accommodate the rising demand for semiconductor materials in AI-driven electronics and programs such as autonomous vehicles and IoT. The growth in the consumption of electronic components utilized in the navigation of automobiles, safety, and infotainment solutions intention again contribute to the semiconductor industry's growth.

Asia-Pacific to Experience Significant Market Growth

- Asia-Pacific significantly invests in the studied Market. Governments continuously take the initiative to enhance smart manufacturing and technology adoptions in various countries. In addition, the National Manufacturing Policy of the Government of India aims to improve the share of manufacturing in GDP to 25 percent by 2025. Also, the "Make in India" policy of the Government of India is anticipated to increase the demand and consumption of machinery and tools by the local manufacturing industry.

- Moreover, in January 2022, Reliance invested USD 132 million in Addverb Technologies to acquire a 54 percent stake. Such investments in the Market are expected to fuel the adoption of automation in the manufacturing industry, thereby fueling the smart factory market during the forecast period.

- China is an integral part of Asia's rising shift to intelligent applications. The Chinese government has strengthened the design of smart manufacturing by implementing various schemes and demonstrations in developing standard systems. China aims to create 40 manufacturing innovations by 2025. The focus areas include automated machine tools and robotics, new advanced information technology, aerospace and aeronautical equipment, marine equipment, modern rail transport equipment, high-tech shipping, new-energy vehicles and equipment, power equipment, agricultural equipment, new materials, biopharma, and advanced medical products.

- Further, in January 2022, ABB, an automation expert, and HASCO, China's most significant automotive components supplier, announced the construction of a joint venture to push China's automotive industry's next generation of smart production. The joint venture will build on the two businesses' successful partnership, resulting in the vital development of highly flexible and sustainable car parts production within HASCO's China operations.

- Furthermore, Japan is rapidly moving toward "Society 5.0", thus introducing the fifth chapter to the four major stages of human development in this new ultra-smart society. All things are connected through IoT technology, and all technologies are getting integrated, dramatically improving the quality of life. Further, the Japanese government announced connected industries in response to the German government's "Industry 4.0" program, and the momentum for a new manufacturing revolution is rising.

- Further, Korea's commercial and public sectors have agreed to boost the number of local smart factories, intending to have more than 30,000 of them working with the newest digital and analytical technology by 2022. Korea's Ministry of Trade, Industry, and Energy (MOTIE) has reaffirmed the government's ambitions to assist small and medium-sized businesses in adopting and expanding smart manufacturing technology. Small and medium-sized firms (SMEs) account for more than 99 percent of all companies in Korea, and government data suggests that SMEs' exports are growing.

Smart Factory Industry Overview

The smart factory market is fragmented, with significant players like ABB Ltd, Cognex Corporation, Siemens AG, Schneider Electric SE, and Yokogawa Electric Corporation. Players in the market are adopting strategies such as innovations, partnerships, mergers, and acquisitions to improve their product offerings and achieve sustainable competitive advantage.

In March 2023, Schneider Electric, a solution provider for the digital transformation of industrial automation and energy management, broke ground on its new smart factory in Hungary. With an expected investment of EUR 40 million (USD 43 million), the new site will span 25,000 m2 with a headcount of about 500 employees.

In March 2023, Samsung Electronics, a leading consumer electronic device manufacturer, announced its plans to increase investment in setting up smart manufacturing capabilities at its mobile phone manufacturing plant in Noida. The company also announced its plans to expand its research and development facility in the country to make production more competitive and localized.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Internet of Things (IoT) Technologies Across the Value Chain

- 5.1.2 Rising Demand for Energy Efficiency

- 5.2 Market Restraints

- 5.2.1 Huge Capital Investments for Transformations

- 5.2.2 Vulnerable to Cyberattacks

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Machine Vision Systems

- 6.1.1.1 Cameras

- 6.1.1.2 Processors

- 6.1.1.3 Software

- 6.1.1.4 Enclosures

- 6.1.1.5 Frame Grabbers

- 6.1.1.6 Integration Services

- 6.1.1.7 Lighting

- 6.1.2 Industrial Robotics

- 6.1.2.1 Articulated Robots

- 6.1.2.2 Cartesian Robots

- 6.1.2.3 Cylindrical Robots

- 6.1.2.4 SCARA Robots

- 6.1.2.5 Parallel Robots

- 6.1.2.6 Collaborative Industry Robots

- 6.1.3 Control Devices

- 6.1.3.1 Relays and Switches

- 6.1.3.2 Servo Motors and Drives

- 6.1.4 Sensors

- 6.1.5 Communication Technologies

- 6.1.5.1 Wired

- 6.1.5.2 Wireless

- 6.1.6 Other Product Types

- 6.1.1 Machine Vision Systems

- 6.2 By Technology

- 6.2.1 Product Lifecycle Management (PLM)

- 6.2.2 Human Machine Interface (HMI)

- 6.2.3 Enterprise Resource and Planning (ERP)

- 6.2.4 Manufacturing Execution System (MES)

- 6.2.5 Distributed Control System (DCS)

- 6.2.6 Supervisory Controller and Data Acquisition (SCADA)

- 6.2.7 Programmable Logic Controller (PLC)

- 6.2.8 Other Technologies

- 6.3 By End-user Industry

- 6.3.1 Automotive

- 6.3.2 Semiconductors

- 6.3.3 Oil and Gas

- 6.3.4 Chemical and Petrochemical

- 6.3.5 Pharmaceutical

- 6.3.6 Aerospace and Defense

- 6.3.7 Food and Beverage

- 6.3.8 Mining

- 6.3.9 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of the Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle-East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle-East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Cognex Corporation

- 7.1.3 Siemens AG

- 7.1.4 Schneider Electric SE

- 7.1.5 Yokogawa Electric Corporation

- 7.1.6 KUKA AG

- 7.1.7 Rockwell Automation Inc.

- 7.1.8 Honeywell International Inc.

- 7.1.9 Robert Bosch GmbH

- 7.1.10 Mitsubishi Electric Corporation

- 7.1.11 Fanuc Corporation

- 7.1.12 Emerson Electric Co.

- 7.1.13 FLIR Systems Inc. (Teledyne Technologies Incorporated)