|

市場調查報告書

商品編碼

1403061

能源 UCaaS:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029UCaaS In Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

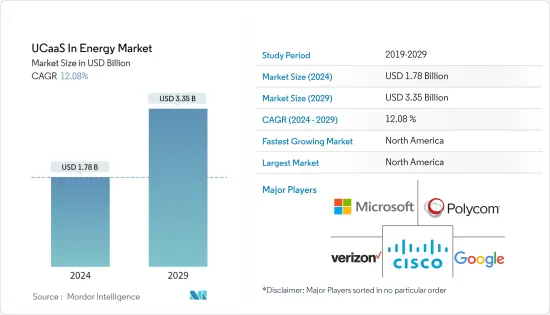

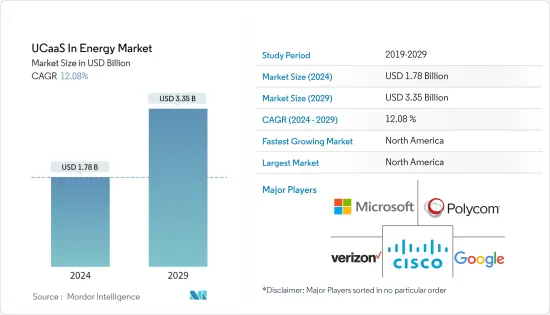

能源 UCaaS 市場規模預計到 2024 年為 17.8 億美元,預計到 2029 年將達到 33.5 億美元,在預測期內(2024-2029 年)複合年成長率為 12.08%。

主要亮點

- 企業正在投資透過第三方供應商提供的雲端基礎的UCaaS 來提高通訊的多功能性,而無需額外的人力資源。在能源產業,越來越多的公司正在轉向 UCaaS(也稱為託管 PBX),而不是投入時間和精力維護本地 PBX。

- UCaaS 技術正在幫助供應商利用傳統 VoIP 和 SIP 服務提供的功能。該技術有助於提高可用性和擴充性,同時增強協作。 UCaaS 解決方案旨在幫助公司專注於發展業務而不是維護業務。

- 推動市場成長的主要因素是行業基礎設施的快速發展、產品商業化的提高以及能源 UCaaS 需求的不斷成長,因為行業相關人員意識到 UCaaS 可以為國際收益做出重大貢獻。

- 推動能源 UCaaS 需求不斷成長的另一個關鍵因素是能源業務的地理分散性。例如,石油和天然氣探勘通常涉及在陸上和海上偏遠地區工作的團隊。 UCaaS 平台透過語音、視訊會議、即時訊息和檔案共用等各種通訊管道提供無縫連接。這使得地理上分散的團隊能夠有效協作,即時做出資訊的決策,並快速回應業務挑戰。

- 此外,能源產業正在經歷旨在最佳化流程和提高效率的數位轉型。 UCaaS 透過與物聯網 (IoT) 設備和資料分析工具等其他技術解決方案整合,很好地應對了這種轉變。這種整合使能源公司能夠在業務中收集、分析和分發資料,從而促進預測性維護、資源最佳化和整體成本降低。

- 此外,COVID-19大流行加速了全球向遠距工作和彈性工作型態的轉變,進一步加速了 UCaaS 在能源產業的採用。對於在不同地點工作的員工,UCaaS 提供了一個連接整個員工隊伍的有凝聚力的平台。這種彈性不僅可以改善工作與生活的平衡,還可以確保在自然災害或全球突發衛生事件等危機期間不間斷的溝通。

能源 UCaaS 市場趨勢

雲端基礎的生態系統的普及推動市場成長

- 企業擴大透過雲端提供對其所需文件和資料的訪問,從而導致了 BYOD 的普及。能源公司也在效仿,鑑於業務全球化,遠端存取資料已成為該行業的關鍵功能。隨著歐佩克繼續降低油價和收益下降,公司正在尋找可能削減成本和創造內部收益的方法。

- 鼓勵員工使用自己的設備是增加IT基礎設施容量的有效方法。 BYOD(自備設備)允許員工從辦公室遠端工作,存取他們需要的資料和文件,並透過網路存取系統。例如,借助 Office 365 附帶的團隊網站,員工可以透過同時編輯文件和參加線上會議來改善協作,即使在不同地點也是如此。

- 根據商業 Wi-Fi 網路服務供應商iPass 的最新報告,70% 的行動員工已採用企業自帶裝置 (BYOD) 政策。有些公司需要 BYOD。隨著辦公室和私人空間之間的界線變得模糊,這一趨勢將擴大反映在能源產業中。

- 此外,近年來,遠距工作和混合工作模式已成為包括能源在內的各個行業的焦點。有效的溝通和遠端協作已變得至關重要。 UCaaS 使能源專業人員能夠在任何地方工作,而不會犧牲通訊品質。視訊會議、虛擬會議室和行動應用程式確保遠端員工無縫整合到公司的通訊生態系統中。

- 此外,能源領域對雲端基礎的UCaaS 的需求正在不斷成長,以彌合地理差距、加強協作、確保安全性、提供可擴展性、支援遠端工作並永續性資料,以及利用由物聯網。隨著能源產業的不斷發展,UCaaS 正在成為一項變革性技術,它不僅可以改善通訊,還有助於提高能源營運的整體效率和永續性。對於尋求在快速變化的環境中保持競爭力的能源公司來說,部署 UCaaS 不再是一種奢侈,而是一種策略必要事項。

北美仍是最大市場

- 由於該地區精通技術的勞動力的出現和基礎設施的改善,預計北美地區將在預測期內引領全球 UCaaS 市場,並且仍然是主要的收益貢獻者。由於該地區公司投資增加,預計未來幾年對 UCaaS 的需求將激增。

- 美國是世界上成長最快的能源市場之一,世界上許多主要企業的總部都總公司在美國。這些公司資金雄厚且技術精湛,這可能會導致他們採用統一通訊領域的所有新技術。

- 根據美國能源資訊署2023年1月發布的資料,美國原油產量達到創紀錄的1,240萬桶/日,預計2024年將達到1,280萬桶/日。此外,預計 2022 年美國原油產量平均為 1,190 萬桶/日。

- 由於業界需要高效的通訊和協作工具,美國石油產量的增加導致對 UCaaS 的需求增加。它還有助於簡化參與石油生產的各個相關人員(包括遠端工人、現場團隊和總公司)之間的溝通,從而提高整體業務效率。

能源 UCaaS 產業概述

能源UCaaS市場的特徵是整合,少數公司佔較大市場佔有率。該領域的主要企業包括 West Corporation、Microsoft Corporation、Cisco Systems, Inc.、Verizon Enterprise Solutions, LLC、Polycom Inc. 和 Google LLC。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場動態介紹

- 市場促進因素

- 雲端基礎的生態系統的普及是一個促進因素

- 改善通訊技術

- 市場抑制因素

- 資料安全問題仍是市場成長的挑戰

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按成分

- 語音通訊

- 合作

- 統一訊息傳遞

- 會議

- 其他

- 按部署模型

- 私人的

- 民眾

- 混合模型

- 按公司規模

- 主要企業

- 中小企業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章競爭形勢

- 公司簡介

- Verizon Enterprise Solutions, LLC

- Google LLC

- West Corporation

- Cisco Systems, Inc.

- Microsoft Corporation

- Avaya Inc.

- Alcatel-Lucent(Nokia Corporation)

- International Business Machines Corporation

- BT Group plc

- Polycom, Inc.

第7章 投資分析

第8章 市場機會及未來趨勢

The UCaaS In Energy Market size is estimated at USD 1.78 billion in 2024, and is expected to reach USD 3.35 billion by 2029, growing at a CAGR of 12.08% during the forecast period (2024-2029).

Key Highlights

- Companies are investing in improved communications versatility using cloud-based Unified Communications as a Service of third-party vendors that don't require extra human resources. A growing number of organizations in the energy sector are migrating to UCaaS, also known as hosted PBX, instead of investing time and energy into maintaining an on-premise PBX.

- The UCaaS technology is helping vendors leverage features that traditional VoIP and SIP services offer. This technology helps increase availability and scalability while enhancing collaboration. UCaaS solutions are designed to allow enterprises to focus on the growth of their business rather than the maintenance of it.

- The factors primarily driving the market growth are quickly developing industry infrastructure, increased product commercialization, and growing demands for Unified Communication-as-a-Service in Energy as industry players realize that it can significantly contribute to international revenue generation.

- Another key driver behind the growing demand for UCaaS in the energy sector is the geographically dispersed nature of energy operations. Oil and gas exploration, for instance, often involves teams working in remote locations, both onshore and offshore. UCaaS platforms offer seamless connectivity through a variety of communication channels, such as voice, video conferencing, instant messaging, and file sharing. This enables geographically separated teams to collaborate effectively, make informed decisions in real-time, and respond promptly to operational challenges.

- Furthermore, the energy industry is embracing digital transformation to optimize processes and increase efficiency. UCaaS aligns well with this transformation by integrating with other technology solutions, such as Internet of Things (IoT) devices and data analytics tools. This convergence allows energy companies to collect, analyze, and distribute data across their operations, thereby facilitating predictive maintenance, resource optimization, and overall cost reduction.

- Also, the global shift towards remote and flexible work arrangements, accelerated by the COVID-19 pandemic, further fueled the adoption of UCaaS in the energy industry. With employees working from diverse locations, UCaaS offers a cohesive platform that keeps the entire workforce connected. This flexibility not only improves work-life balance but also ensures uninterrupted communication during crises, such as natural disasters or global health emergencies.

UCaaS In Energy Market Trends

Proliferation of Cloud Based Ecosystem to Drive the Market Growth

- Companies are increasingly making essential files and data accessible through the cloud, which in turn has led to the proliferation of the BYOD trend. The energy companies are also following suit, and given the globalized nature of their business, remote access to data becomes an important feature for this industry. With the increasing cuts on Oil prices by OPEC and falling revenues, enterprises are searching for ways that cut down on expenses and have the potential to generate internal revenues.

- Encouraging employees to use their own devices is an efficient way of adding capacity to your IT infrastructure. Bring your own device (BYOD) enables employees to work away from the office while still being able to access the system over the Internet by accessing the data and files they need. For example, Team Sites, which comes with Office 365, allows employees to improve collaboration while in different locations, editing documents simultaneously and taking part in online conferences.

- A new report from iPass, a commercial Wi-Fi network service provider, indicates that 70 percent of mobile workers adopt their companies' bring your own device (BYOD) policies. For some, BYOD is a must. This trend will also be increasingly reflected in the energy industry as the lines between office and private spaces get blurred.

- Also, in recent years, remote work and hybrid work models have gained prominence across industries, including energy. The ability to communicate effectively and collaborate remotely has become essential. UCaaS empowers energy professionals to work from anywhere without sacrificing communication quality. Video conferencing, virtual meeting rooms, and mobile applications ensure that remote employees remain seamlessly integrated into the company's communication ecosystem.

- Moreover, the increasing demand for cloud-based UCaaS in the energy sector can be attributed to its ability to bridge geographical gaps, enhance collaboration, ensure security, offer scalability, support remote work, align with sustainability goals, and harness the power of IoT-generated data. As the energy industry continues to evolve, UCaaS emerges as a transformative technology that not only improves communication but also contributes to the overall efficiency and sustainability of energy operations. Embracing UCaaS is no longer a luxury but a strategic imperative for energy companies looking to stay competitive in a rapidly changing landscape.

North America to Remain the Largest Market

- North America region will lead the global UCaaS market during the forecast period and remain the major revenue contributor due to the emergence of huge tech-savvy employees and improved infrastructure in the region. The demand for UCaaS is expected to surge in the coming years owing to growth in investment by enterprises in this region.

- The United States has one of the fastest-growing energy markets in the world, with many of the major companies of the world headquartered there. These companies are cash-rich and tech-savvy and hence will lead to adopting any new technology in the unified communications segment.

- The US Energy Information Administration Data released in January 2023 states that US crude oil production reached a record 12.4 million barrels per day and is expected to reach 12.8 million barrels per day in 2024. Also, in 2022, US crude oil production averaged an estimated 11.9 million barrels per day.

- The growing oil production in the US is leading to an increased demand for unified communications as a service (UCaaS) due to the need for efficient communication and collaboration tools within the industry. It also helps streamline communication among various stakeholders involved in oil production, such as remote workers, field teams, and headquarters, enhancing overall operational efficiency.

UCaaS In Energy Industry Overview

The unified communication-as-a-service (UCaaS) sector in the energy market is characterized by consolidation, with a select few companies holding significant market share. Key players in this space include West Corporation, Microsoft Corporation, Cisco Systems, Inc., Verizon Enterprise Solutions, LLC, Polycom Inc., and Google LLC. While innovation remains a critical driver of market leadership in this industry, several major players have expanded their reach through acquisitions, fortifying their portfolios and addressing any strategic gaps. Recent developments in the sector include:

In April 2023, Vodafone Business Unified Communications (UC) announced a strategic partnership with RingCentral, a provider of cloud-based solutions. This collaboration led to the introduction of a new unified communications solution in Italy. This solution enables customers to seamlessly integrate various communication tools, including video conferencing, messaging, file sharing, meetings, and virtual phone systems. All these features are accessible through a unified user interface, accessible on any internet-enabled device. This partnership represents a significant step in enhancing the UCaaS offerings in the energy sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Dynamics

- 4.3 Market Drivers

- 4.3.1 Proliferation of Cloud Based Ecosystem will Act as a Driver

- 4.3.2 Improvement of Communication Technology

- 4.4 Market Restraints

- 4.4.1 Data Security Concerns will Remain a Challenge to the Growth of the Market

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Telephony

- 5.1.2 Collaboration

- 5.1.3 Unified Messaging

- 5.1.4 Conferencing

- 5.1.5 Other Services

- 5.2 By Deployment Model

- 5.2.1 Private

- 5.2.2 Public

- 5.2.3 Hybrid Model

- 5.3 By Enterprise Size

- 5.3.1 Large Enterprise

- 5.3.2 Small & Medium Enterprise

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Verizon Enterprise Solutions, LLC

- 6.1.2 Google LLC

- 6.1.3 West Corporation

- 6.1.4 Cisco Systems, Inc.

- 6.1.5 Microsoft Corporation

- 6.1.6 Avaya Inc.

- 6.1.7 Alcatel-Lucent(Nokia Corporation)

- 6.1.8 International Business Machines Corporation

- 6.1.9 BT Group plc

- 6.1.10 Polycom, Inc.