|

市場調查報告書

商品編碼

1334427

尼龍單絲市場規模和份額分析-增長趨勢和預測(2023-2028)Nylon Monofilament Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

尼龍單絲市場規模預計將從 2023 年的 15.9 億美元增長到 2028 年的 20.8 億美元,預測期內(2023-2028 年)複合年增長率為 5.50%。

COVID-19 大流行對尼龍單絲市場產生了負面影響。 尼龍單絲主要用於生產漁網。 COVID-19 大流行對漁業和水產養殖業產生了負面影響。 然而,預計市場在未來幾年將出現積極增長。

主要亮點

- 推動尼龍單絲市場增長的主要因素是漁網用尼龍單絲的需求不斷增加、汽車應用的快速採用以及醫療領域的新應用。

- 但是,與尼龍單絲使用相關的政府法規和原材料價格波動正在阻礙尼龍單絲市場的增長。

- 預計工業紡織品應用需求的大幅增長和生物基尼龍單絲的開發將為預計和預測期內的市場增長提供各種機會。

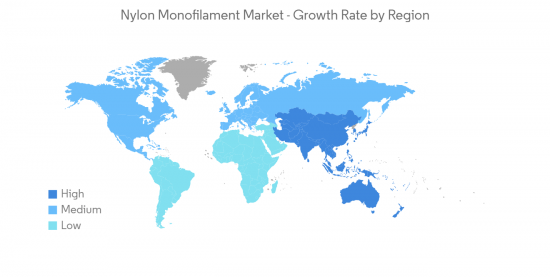

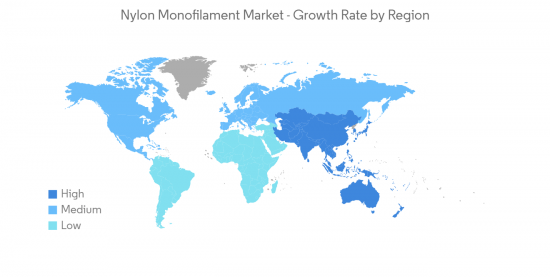

- 亞太地區是全球尼龍單絲市場最大的地區。 由於中國、印度和日本等國家的消費量不斷增加,預計該市場也將成為預測期內增長最快的市場。

尼龍單絲市場趨勢

漁網領域對尼龍單絲的需求不斷增加

- 尼龍單絲是合成纖維的單股連續長絲,最常見的單絲是尼龍釣魚線。 尼龍單絲的熔點比聚丙烯高,通常在 260度C 的溫度範圍內擠出。

- 尼龍單絲用於生產各種漁網,因為它具有成本效益且耐用。 漁業的擴張和對魚類的需求增加可能會在未來幾年增加對漁網應用的尼龍單絲的需求。

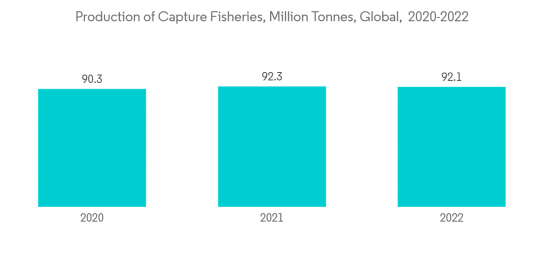

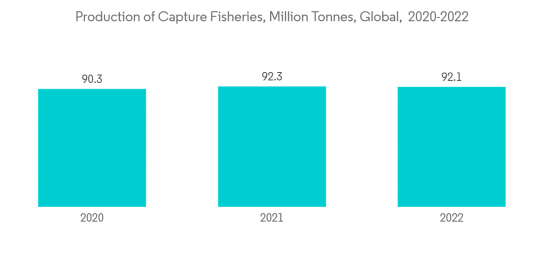

- 根據聯合國糧食及農業組織的數據,到 2030 年,水生動物總產量預計約為 2.02 億噸。 此外,由於廢物和損失的減少以及資源管理的改善,預計從 2020 年到 2030 年,捕撈漁業將增長 6%,達到 9600 萬噸。

- 根據聯合國糧食及農業組織兩年一度的糧食展望,2022年全球水產養殖和漁業產量將增長1.2%,達到1.841億噸,而捕撈漁業將下降0.2%,水產養殖漁業將增長2.6%。 2022 年全球捕撈漁業產量估計為 9210 萬噸。

- 據《水產養殖雜誌》報導,美國糧食及農業組織每半年發布一次的《糧食展望》預測,飲食結構的改變、城市化進程的加快以及收入的迅速增加將導致到2030 年人均海鮮消費量減少。預計人均海鮮消費量將達到21.4 公斤。 海鮮和捕撈漁業生產和消費的增加進一步增加了對漁網的需求。

- 因此,由於上述因素,漁網應用對尼龍單絲的需求不斷增加。

亞太地區主導市場

亞太地區引領全球尼龍單絲市場。 中國、日本和印度等國家對漁網用尼龍單絲的需求不斷增加,以及汽車行業應用的擴大,預計將推動該地區對尼龍單絲的需求。

- 亞太地區是魚類養殖的主要地區之一。 據聯合國糧食及農業組織稱,到2030年,亞太地區漁業和水產養殖產量預計將達到9400萬噸。

- 印度品牌資產基金會表示,印度是世界第三大魚類生產國和第二大水產養殖國。 在2025年計劃中,魚類出口額預計將翻一番,從57.2億美元增至2025年的122.8億美元。

- 尼龍單絲廣泛應用於汽車行業,可保護線束和軟管免遭撕裂,並具有高拉伸強度等有益特性。 彈性好,吸濕性低。

- 根據國際汽車製造商協會 (OICA) 的數據,2022 年中國汽車總產量約為 2700 萬輛,銷量較 2021 年增長近 3%。 因此,汽車產量的增加預計將帶動該國尼龍單絲市場。

- 由於上述因素,亞太地區的尼龍單絲市場預計在預測期內將大幅增長。

錦綸單絲行業概況

尼龍單絲市場部分整合,只有少數大公司主導市場。 主要公司包括 ABC Polymer Industries, LLC、Toray Industries Inc.、Superfil、AstenJohnson 和 Shakespeare Company, LLC。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第一章簡介

- 調查的先決條件

- 調查範圍

第二章研究方法

第 3 章執行摘要

第 4 章市場動態

- 促進因素

- 漁網中尼龍單絲的需求不斷增加

- 在汽車應用中的快速採用

- 醫療領域的新應用

- 抑制因素

- 與尼龍單絲使用相關的政府法規

- 原材料價格波動

- 工業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分(基於價值的市場規模)

- 共聚物類型

- 尼龍6

- 尼龍66

- 其他共聚物類型(尼龍 610、尼龍 612)

- 應用

- 漁網

- 醫療用途

- 汽車面料

- 消費品

- 針織繩

- 其他用途(食品包裝、運動服)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭態勢

- 併購、合資企業、聯盟、協議

- 市場份額 (%)**/排名分析

- 各大公司的戰略

- 公司簡介

- ABC Polymer Industries, LLC

- AstenJohnson

- Atkins & Pearce

- ICF Mercantile LLC

- Nanjing Forever Textile Co.,LTD.

- RUICHANG MONOFILAMENT

- Shakespeare Company, LLC

- Shinkey Monofilament Enterprise Co., LTD.

- Superfil

- Toray Industries Inc.

第7章市場機會和未來趨勢

- 工業紡織品應用需求顯著增加

- 生物基尼龍單絲的開發

The Nylon Monofilament Market size is expected to grow from USD 1.59 billion in 2023 to USD 2.08 billion by 2028, at a CAGR of 5.50% during the forecast period (2023-2028).

The COVID-19 pandemic negatively impacted the nylon monofilament market. Nylon monofilaments are mainly used in the manufacturing of fishing nets. The COVID-19 pandemic negatively impacted the fisheries and aquaculture sectors. However, the market is expected to achieve a positive growth rate over the coming years.

Key Highlights

- The major factors driving the growth of the nylon monofilament market are the growing demand for nylon monofilament in fishing nets, the surge in adoption in automotive applications, and novel applications in the medical sector.

- However, government restrictions related to the use of nylon monofilament and volatility in raw material prices are hindering the growth of the nylon monofilament market.

- Significant increases in demand from industrial textile applications and the development of bio-based nylon monofilament are estimated to offer various opportunities for market growth over the forecast period.

- Asia-Pacific represents the largest region in the global nylon monofilament market. It is also expected to be the fastest-growing market over the forecast period owing to the increasing consumption from countries such as China, India, and Japan.

Nylon Monofilament Market Trends

Growing Demand for Nylon Monofilaments from the Fishing Net Segment

- Nylon monofilament is a single, continuous-strand filament of synthetic fiber, and the most commonly recognized monofilament is a nylon fishing line. Nylon monofilaments have higher melting points than polypropylene and are generally extruded at temperatures in the range of 260 °C.

- Nylon monofilament is used to produce a variety of fishing nets owing to its cost-effective and durable properties. Expansion in the fishing industry and increasing demand for fish are likely to boost the demand for nylon monofilament for fishing net applications over the coming years.

- According to the Food and Agriculture Organization of the United Nations, by 2030, the total production of aquatic animals is projected to account for around 202 million metric tons. Moreover, owing to reduced waste and losses and improved resource management, the capture fisheries are projected to grow by 6% from 2020 to 2030 in order to reach 96 million metric tons.

- According to the Biannual Food Outlook of the Food and Agriculture Organization of the United Nations, in 2022, global aquaculture and fisheries production will have increased by 1.2% to 184.1 million metric tons, with capture fisheries decreasing by 0.2% and aquaculture increasing by 2.6%. The global production of capture fisheries was estimated at 92.1 million metric tons in 2022.

- The Aquaculture Magazine stated that, according to the Biannual Food Outlook of the Food and Agriculture Organization of the United Nations, the average per capita consumption of seafood is projected to reach 21.4 kg by 2030, owing to shifting dietary habits, growing urbanization, and a surge in income. The increase in the production and consumption of seafood and capture fisheries is further boosting the demand for fishing nets.

- Hence, the demand for nylon monofilament is increasing in fishing net applications due to the abovementioned factors.

Asia-Pacific Region to Dominate the Market

The Asia-Pacific region is the leader in the global nylon monofilament market. Nylon monofilament's rising demand for fishing nets and its growing applications in the automotive sector in countries like China, Japan, and India are expected to drive the demand for nylon monofilaments in this region.

- Asia-Pacific is one of the leading regions in fish farming. According to the Food and Agriculture Organization of the United Nations, fisheries and aquaculture production in the Asia Pacific is estimated to reach 94 million metric tons by 2030.

- The Indian Brand Equity Foundation stated that India is the third-largest producer of fish and the second-largest aquaculture nation in the world. As per the plan set for FY 2025, fish export is expected to double from USD 5.72 billion to USD 12.28 billion by 2025.

- Nylon monofilament is extensively used in the automotive industry in order to protect wire harnesses and hoses from tearing and offers beneficial properties such as high tensile strength. Superior elasticity and low moisture absorption.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), the total vehicle production volume in China stood at around 27 million units in 2022, which was an increase of nearly 3% in terms of sales compared to 2021. Thus, an increase in vehicle production volume is likely to drive the market for nylon monofilament in the country.

- Owing to the abovementioned factors, the market for nylon monofilament in the Asia-Pacific region is projected to grow significantly during the forecast period.

Nylon Monofilament Industry Overview

The nylon monofilament market is partially consolidated in nature, with only a few major players dominating the market. Some of the major companies are ABC Polymer Industries, LLC, Toray Industries Inc., Superfil, AstenJohnson, and Shakespeare Company, LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Nylon Monofilament in Fishing Nets

- 4.1.2 Surge in Adoption in Automotive Applications

- 4.1.3 Novel Applications in the Medical Sector

- 4.2 Restraints

- 4.2.1 Government Restrictions Related to the Use of Nylon Monofilament

- 4.2.2 Volatility in Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Co-polymer Type

- 5.1.1 Nylon 6

- 5.1.2 Nylon 66

- 5.1.3 Other Co-polymer Types (Nylon 610, Nylon 612)

- 5.2 Application

- 5.2.1 Fishing Net

- 5.2.2 Medical

- 5.2.3 Automobile Fabrics

- 5.2.4 Consumer Goods

- 5.2.5 Braided Ropes

- 5.2.6 Other Applications (Food Packaging, Sports Wear)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ABC Polymer Industries, LLC

- 6.4.2 AstenJohnson

- 6.4.3 Atkins & Pearce

- 6.4.4 ICF Mercantile LLC

- 6.4.5 Nanjing Forever Textile Co.,LTD.

- 6.4.6 RUICHANG MONOFILAMENT

- 6.4.7 Shakespeare Company, LLC

- 6.4.8 Shinkey Monofilament Enterprise Co., LTD.

- 6.4.9 Superfil

- 6.4.10 Toray Industries Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Significant Increase in Demand from Industrial Textile Applications

- 7.2 Development of Bio-Based Nylon Monofilament