|

市場調查報告書

商品編碼

1258777

類器官市場 - 增長、趨勢、COVID-19 影響和預測 (2023-2028)Organoids Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,類器官市場預計將以 17.1% 的複合年增長率增長。

COVID-19 大流行對類器官市場產生了重大影響。 在有限的時間內推出 COVID-19 疫苗的研發活動增加,導致在大流行期間更多地採用類器官。 與真實器官的相似性、細胞嗜性和細胞活力是導致大流行期間類器官在藥物開發中被高度採用的主要因素。 例如,在美國國家生物技術信息中心 (NCBI) 於 2022 年 2 月發表的一篇論文中,類器官可以通過提供適當的細胞異質性、病毒易感性和適當的宿主細胞反應來幫助研究 COVID-19。據報導,它們提供了極快的速度。 此外,據報導某些類器官可有效識別 COVID-19 的治療方法。 例如,Springer Nature Limited 於 2021 年 5 月發表的一篇論文報告說,肺類器官在大流行期間檢測 SARS-COV-2 病毒的治療方案時顯示出可喜的結果。

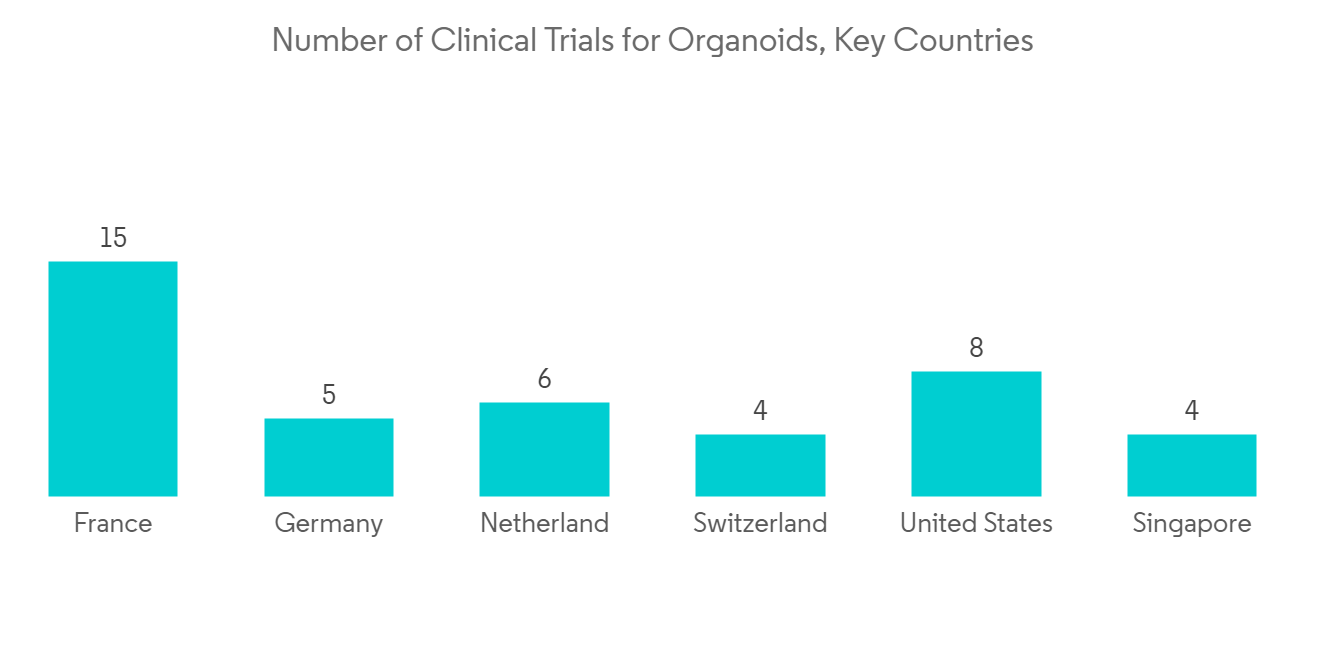

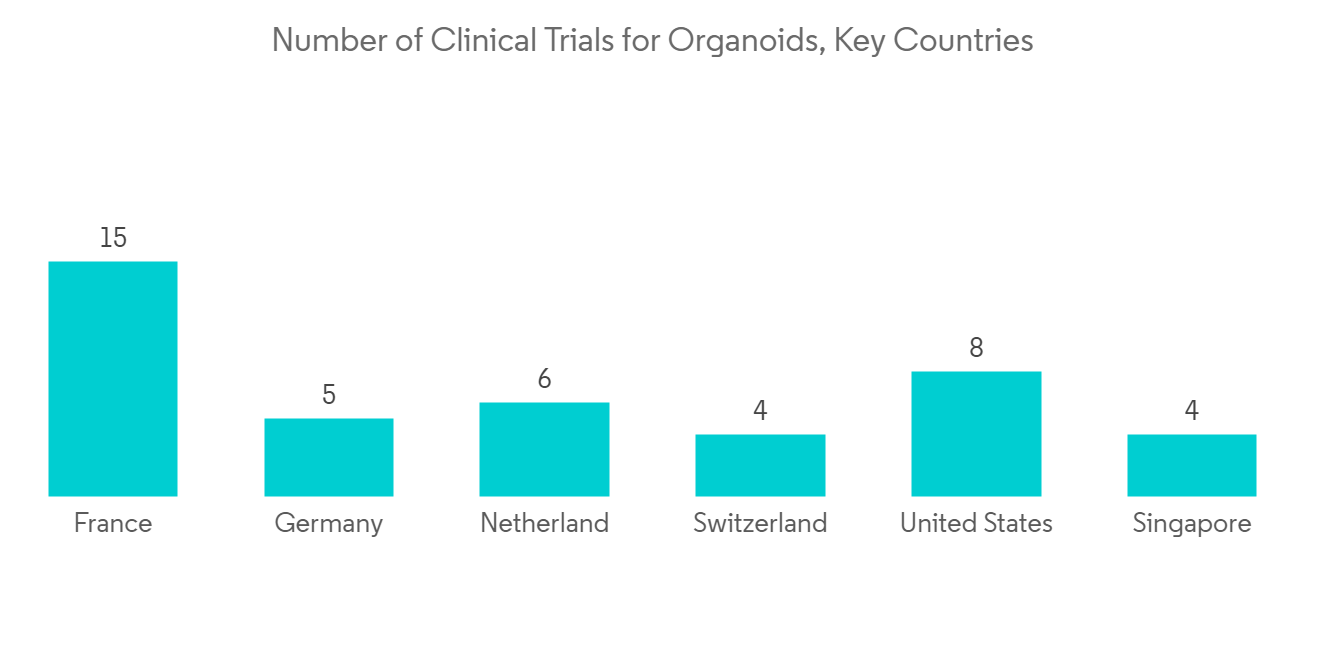

此外,在 Springer Nature Limited 於 2022 年 4 月出版的一份研究期刊中,人類多能幹細胞衍生的氣道類器官證明了 SARS-COV-2 病毒的特異性和病毒的傳播能力。報告了評估選項的有效性減少 因此,在大流行期間,類器官在研究領域的使用增加,推動了市場增長。 然而,在大流行後的情況下,使用類器官的調查和臨床試驗顯著增加。 例如,根據 ClinicalTrials.gov 的數據,從 2021 年 3 月 1 日到 2023 年 1 月 3 日,總共報告了 47 項涉及類器官的研究。 此外,MDPI 在 2022 年 6 月發表的一篇題為“3D Human Organoids: The Next"Viral"Model for the Molecular Basis of Infectious Diseases”的論文中指出,類器官可用於治療 COVID-19、HIV、It已在乙型肝炎和丙型肝炎等多種疾病的調查中被證明有效,並在大流行後情況下的傳染病研究中獲得支持。 預計上述因素將有助於預測期內市場的進一步增長。 推動市場增長的因素包括慢性病患病率上升、基於類器官藥物開發的研究數量增加以及類器官開發技術進步。

慢性病(包括心血管疾病、慢性腎病和癌症)的患病率在世界範圍內呈上升趨勢。 例如,2021 年 5 月國民健康服務 (NHS) 的一篇文章報導稱,估計 2021 年英國將有 140 萬人患有心房顫動。 此外,2021 年發表在 Annals of Cancer Epidemiology 上的一篇研究文章報告稱,2021 年美國估計有 235,760 名新確診肺癌患者。 患有許多慢性病的患者人數不斷增加,這增加了醫療保健的負擔,反過來又刺激了研發工作,以引入用於治療這些慢性病的新藥。我來了。 此外,越來越多地採用類器官模型進行研究和開發,以更好地了解疾病狀態和藥物對真實器官的影響。 據 ClinicalTrial.gov 稱,這項名為“腸道類器官 (BIOIDES)”的研究於 2022 年 9 月在法國開始,將在使用潛在的胃腸道疾病治療分子進行測試之前,以具有相關健康數據的消化器官為目標。我們的目標是開發一個生物集合來自活組織檢查的類器官。

此外,在開發類器官及其在各種適應症(例如肺癌、基因改變、慢性腎病、心血管疾病和結腸癌)中的應用方面,藥物研發方面的舉措越來越多。主要觀察者公司。 這些努力也推動了研究中對類器官的需求。 例如,根據 ClinicalTrials.gov 的數據,到 2022 年 12 月 31 日,共有 79 項針對類器官的臨床研究。 除此之外,類器官模型開發的最新技術進步正在進一步提高類器官在藥物研究中的性能。 例如,2022 年 10 月,AIM Biotech Pte. Ltd. 宣布了 organiX 系統。 該系統可以賦予類器官血管生成和免疫能力,並可以在研究過程中提高類器官的保質期。

由於藥物研究領域對類器官的需求和採用不斷增加,上述因素促進了市場的增長。 然而,類器官與真實器官之間的功能差異等臨床缺點限制了類器官在調查期間的採用率。

類器官市場趨勢

市場細分 按產品類型劃分,藥物發現和個性化醫療領域預計在研究期間將佔據很大的市場份額。

慢性病患病率的增加以及大公司越來越多地向市場推出重磅藥物的舉措是在藥物發現中越來越多地採用類器官等先進技術的主要原因。我來了。 例如,2022 年 8 月,Bayer AG推出了 finerenone 用於治療慢性腎病。 此外,美國國家生物技術信息中心 (NCBI) 於 2022 年 5 月發表的一項研究報告稱,患者來源的胰腺癌類器官在胰腺癌的藥物發現中被證明是有效的。 與此同時,個性化醫療的興起也推動了類器官在研究行業的採用率。

例如,個性化醫療聯盟預測,到 2022 年,美國市場上將共有 300 種個性化醫療。 個性化醫療聯盟的另一份報告稱,到 2021 年,美國食品和藥物管理局 (FDA) 批准的所有藥物中約有 35% 將用於個性化醫療。 此外,根據 2021 年 Alix Ventures 的一份報告,由於某些因素(例如可追溯性和捕獲患者和腫瘤類型多樣性的潛力),類器官越來越多地用於個性化醫學研究。支持類器官在生物醫學發展中的需求和採用。 此外,某些臨床優勢,例如捕捉患者和腫瘤類型多樣性的潛力以及細胞組成的保存,正在推動類器官在個性化醫學研究中的採用。 例如,到 2022 年 12 月 31 日,ClinicalTrial.gov 報告了 31 項基於患者來源的類器官的臨床試驗。

因此,由於上述因素,藥物發現和個性化醫療領域有望在研究期間獲得顯著的市場份額。

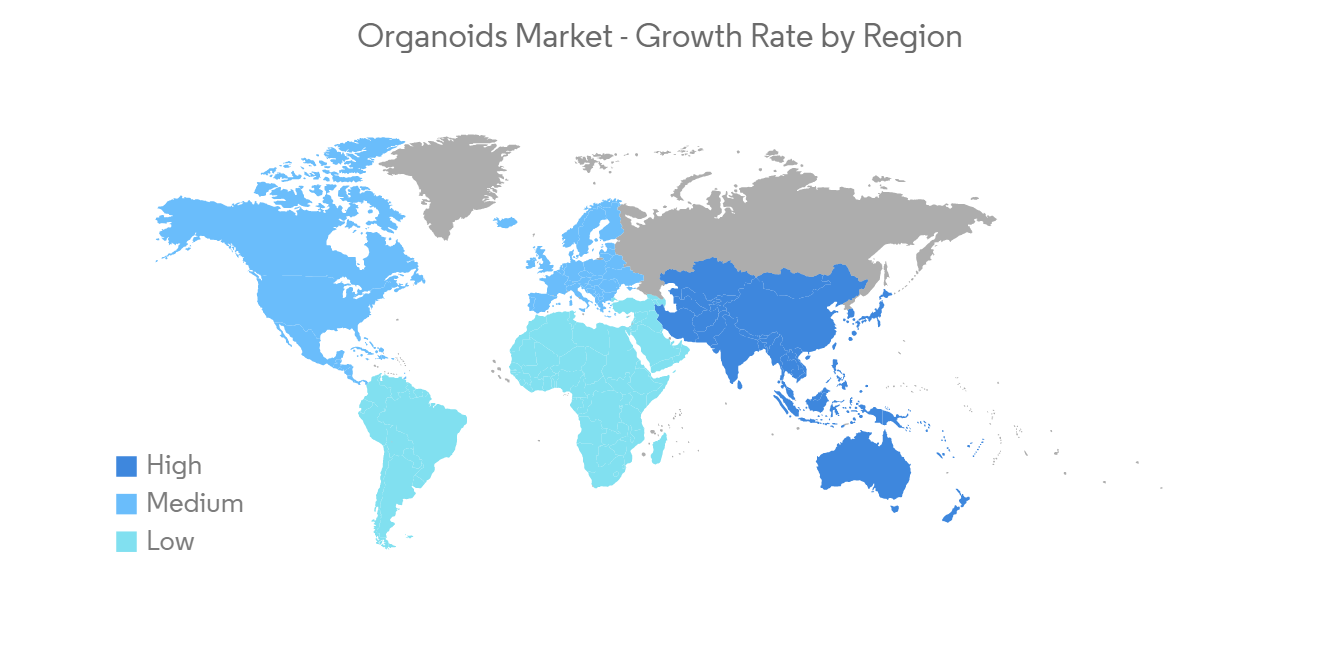

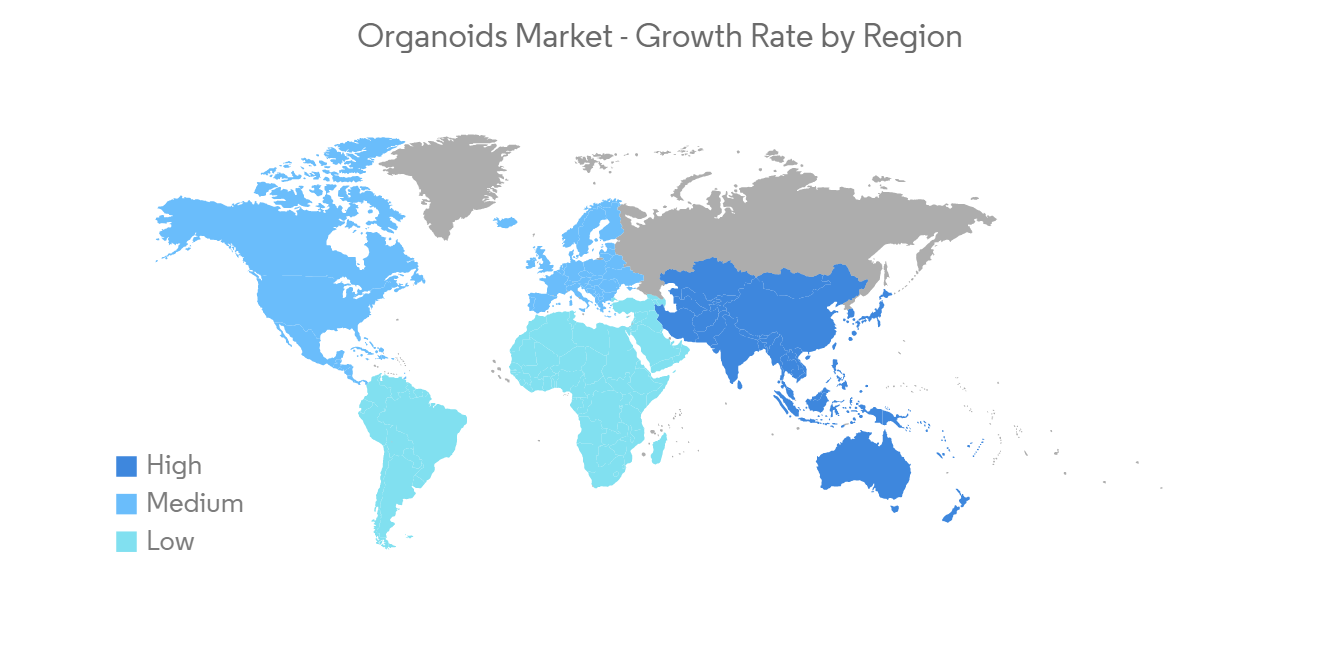

北美在預測期內貢獻了最大的市場份額

在研究期間,預計北美地區將在全球類器官市場佔據主導地位。 大量患有慢性病的患者、先進的醫療設施、主要參與者的存在以及聯邦政府在該地區增加的研發支出是該地區市場增長的驅動因素。 根據美國疾病控制與預防中心(CDC)的數據,2022年美國共有2010萬20歲及以上的成年人患有冠心病。 據美國肝臟基金會估計,2021 年美國將有 42,230 例肝癌新發病例。 此外,國家生物技術信息中心 2022 年 5 月發布的估計表明,2022 年加拿大將報告約 233,900 例新癌症病例。 此外,該地區還報導了一些涉及類器官的慢性疾病的臨床試驗。 根據 ClinicalTrial.gov 的數據,該試驗於 2018 年 8 月在德克薩斯州開始,名為“用於肺癌治療反應的患者衍生類器官模型和循環腫瘤細胞”,預計將於 2024 年 12 月完成。 本研究旨在建立一個用於肺癌治療的患者來源類器官生物庫,並研究潛在類器官對多種化療藥物的體外反應。 此外,北美不斷增加的醫療保健研究支出正在推動先進技術在研究中的採用。 根據 2022 年 12 月美國政府問責辦公室 (GAO) 的一份研究報告,美國聯邦政府已將衛生與公共服務部的研發資金從 2020 年的 600 億美元增加到 2021 年的 688 億美元。

此外,美國政府的持續監管和現代化法律正在限制在藥物臨床試驗中使用動物試驗。 這導致在臨床試驗和其他藥物開發程序中採用替代方法來測試藥物。 出於這個原因,類器官在研究過程中的採用正在增加。

2022 年 FDA 現代化法案將消除在開發任何人類藥物時進行動物試驗的需要。 因此,由於上述因素,預計在預測期內,北美的類器官□□市場將持續增長。

類器官行業概覽

類器官市場是整合的,由幾個主要參與者組成。 就市場份額而言,目前少數大公司佔據市場主導地位。 其中包括 Cellsce Ltd、Merck KGaA、3Dnamics Inc.、R&D Systems, Inc.、Hubrecht Organoid Technology、Definigen、Known Medicine 和 Dynomics Inc。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 研究假設和市場定義

- 調查範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動力

- 啟動研發活動

- 最新的類器官情況

- 市場製約因素

- 區別於實際器官的特徵

- 波特的五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第 5 章市場細分(按價值劃分的市場規模)

- 按產品類型

- 腸道

- 肝臟

- 胃

- 胰腺

- 其他

- 通過申請

- 藥物發現和個性化醫療

- 藥物的毒性和功效測試

- 再生醫學

- 發育生物學

- 其他

- 最終用戶

- 製藥和生物技術公司

- 委託研究機構

- 關於研究機構

- 地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章競爭格局

- 公司簡介

- Merck KGaA

- Cellesce Ltd

- 3Dnamics Inc.

- R&D Systems, Inc.

- Hubrecht Organoid Technology

- Definigen

- Known Medicine

- Dynomics Inc.

第七章市場機會與未來趨勢

The Organoids Market is projected to register a CAGR of 17.1% during the forecast period.

The COVID-19 pandemic had a significant impact on the organoids market. The increasing number of research and development activities for the introduction of the COVID-19 vaccine within a very limited time resulted in the higher adoption of organoids during the pandemic. The resemblance with actual organs, cell tropism, cell viability, and others are some of the key factors for the significant adoption of organoids during drug development at the time of the pandemic. For instance, an article published by the National Center for Biotechnology Information (NCBI) in February 2022, reported that organoids offered a significant pace in the research of COVID-19 by offering proper cellular heterogeneity, viral susceptibility, and appropriate host cell responses. Additionally, specific organoids were reported to be effective while identifying the treatment option for COVID-19. For instance, an article published by Springer Nature Limited in May 2021, reported that lung organoids had shown promising results while detecting the treatment options for the SARS-COV-2 virus during the pandemic.

Moreover, a research journal published by Springer Nature Limited in April 2022, reported that human pluripotent stem cell-derived airway organoids have shown certain specific characteristics of the SARS-COV-2 virus as well showed effectiveness while evaluating the options to limit the spread of the virus. This results in the increased use of organoids in the research field during the pandemic and fosters the market's growth. However, in the post-pandemic situation, the research studies and clinical trials increased significantly involving organoids. For instance, according to ClinicalTrials.gov, a total of 47 studies were reported involving organoids from 1st March 2021 till 3rd January 2023. Also, an article published by MDPI in June 2022, titled "3D Human Organoids: The Next "Viral" Model for the Molecular Basis of Infectious Diseases," reported that organoids were proven to be efficacious in the research of a number of disorders, including COVID-19, HIV, Hepatitis B, Hepatitis C among others and gained its traction in the research of infectious disease in the post-pandemic situation. The above-mentioned factors are anticipated to contribute to the further growth of the market during the forecast period.

There are certain factors that are driving the market growth, including the rising prevalence of chronic diseases, the rising number of research on drug development involving organoids, and technological advancements in the development of organoids. The prevalence of chronic diseases, including cardiovascular disease, chronic kidney disease, and cancer, among others, is increasing globally. For instance, according to an article by the National Health Service (NHS) in May 2021, it was reported that an estimated 1.4 million people in the United Kingdom were suffering from atrial fibrillation in 2021. Additionally, according to a research article published by the Annals of Cancer Epidemiology in 2021, an estimated 235,760 new lung cancer cases were diagnosed in the United States in 2021. This rising number of patients suffering from a number of chronic diseases is increasing the healthcare burden and, alternatively, increasing the research and development initiatives for the introduction of novel drugs to be used in these chronic diseases. Additionally, owing to a better understanding of the disease condition and the effect of drugs on the actual organs, the adoption of organoid models is increasing for R&D purposes. According to ClinicalTrial.gov, a study titled "Intestinal Organoids (BIOIDES)" started in September 2022 in France was aimed to develop a bio-collection of organoids from digestive biopsies with associated health data prior to testing them with potential therapeutic molecules for gastrointestinal disorders.

Furthermore, a number of rising initiatives in pharmaceutical research and development were observed by the major players for the development of organoids and the application of organoids to different indications, such as lung cancer, genetic abnormalities, chronic kidney disease, cardiovascular disorders, and colon cancer, among others. These initiatives are also fueling the demand for organoids in the research field. For instance, according to ClinicalTrials.gov, a total of 79 clinical studies are there for organoids till 31st December 2022. Apart from that, the latest technological advancements in the development of organoids models were further improving the outcomes of organoids in pharmaceutical research. For instance, in October 2022, AIM Biotech Pte. Ltd. introduced organiX System. This system is capable of adding vascularization and immune competence to organoids which can improve the shelf life of organoids during the research procedure.

Thus, the above-mentioned factors are attributed to the growing demand and adoption of organoids in the pharmaceutical research field and have been instrumental in the market's growth. However, certain clinical disadvantages, including functional disparities between the organoids and actual organs, are limiting the adoption rate of organoids during the study period.

Organoids Market Trends

Drug Discovery & Personalized Medicine Segment Expected to Contribute a Significant Proportion in the Market

Based on product type, the drug discovery & personalized medicine segment is anticipated to hold a significant market share during the study period. The increasing prevalence of chronic disease, along with rising initiatives by the major players to introduce blockbuster drugs in the market, is the primary reason attributed to the higher adoption of advanced technology, such as organoids, for drug discovery. For instance, in August 2022, Bayer AG introduced finerenone for the treatment of chronic kidney disease. Further, in a research study published by the National Center for Biotechnology Information (NCBI) in May 2022, it was reported that patient-derived pancreatic cancer organoids proved to be efficient in drug discovery for pancreatic cancer.

Along with that, the rising trend for personalized medicine is also fueling the adoption rate of organoids in the research industry. For instance, according to an estimation by Personalized Medicine Coalition, a total of 300 personalized medicine were there in the market in the United States till 2022. Also, according to another report by Personalized Medicine Coalition, it was reported that approximately 35% of the total drug approval by the Food and Drug Administration (FDA) is for personalized medicine in 2021. Additionally, according to a report by Alix Venture in 2021, owing to certain factors, including traceability and potential to capture patient and tumor type diversity, organoids are increasingly used to study personalized medicines, thus supporting the demand and adoption of organoids in the development of personalized medicine. Additionally, certain clinical benefits, including the potential for capturing patient and tumor type diversity and conservation of cellular composition, among others, are fostering the adoption rate of organoids in the research for personalized medicine. For instance, according to ClinicalTrial.gov, 31 clinical trials based on patient-derived organoids were reported till 31st December 2022.

Thus, owing to the above-mentioned factors, the drug discovery & personalized medicine segment is anticipated to capture a significant market share during the study period.

North America Contributed to the Largest Market Share During the Forecast Period

North America region is anticipated to hold a dominant position in the global organoids market during the study period. The large patient population suffering from chronic diseases, advanced healthcare facilities, the presence of key players in the region, and rising R&D expenditure by the Federal Government in the region are the driving factors for the growth of the market in this region. According to data from the Centers for Disease Control and Prevention (CDC), it was reported that a total of 20.1 million adults of age 20 years and older in the United States have Coronary Artery Disease in 2022. Also, according to American Liver Foundation, the estimated number of new cases of liver cancer was 42,230 in the United States in 2021. Furthermore, according to an estimation published by National Center for Biotechnology Information in May 2022, it was reported that there were around 233,900 new cancer cases reported in Canada in 2022. Moreover, several clinical trials have been reported for a number of chronic diseases involving organoids in this region. According to ClinicalTrial.gov, a study titled "Patient-derived Organoid Model and Circulating Tumor Cells for Treatment Response of Lung Cancer" was started on August 2018 in Texas, United States and is anticipated to complete in December 2024. This study aims to establish a biobank of patient-derived organoids for the treatment of lung cancer and examine the ex-vivo responses of the potential organoids to a number of chemotherapeutic agents. These above-mentioned factors collectively foster the demand and adoption of organoids in healthcare research in North America.

Moreover, rising healthcare R&D funding in North America is bolstering the introduction of advanced technology in the research field. According to a research report by the U.S. Government Accountability Office (GAO) in December 2022, the federal government of the United States increased funding for research and development for the Department of Health and Human Services from USD 60.0 billion in 2020 to USD 68.8 billion in 2021. Thus, the upgradation of research methodologies in the medical field fosters new and advanced equipment, such as organoids, for precise research results and results in the market's growth.

Additionally, ongoing regulations and the modernization act by the government of the United States is limiting the use of animal testing in the clinical trials of drugs. This results in adopting an alternative way of testing drugs during clinical trials and other drug development procedures. Thus the adoption rate of organoids in the research procedure is increasing. For instance, the FDA Modernization Act of 2022 would eliminate the necessity of animal testing for the development of any human drugs.

Thus, due to the above-mentioned factors, the organoids market is expected to witness consistent growth in North America over the forecast period.

Organoids Industry Overview

The Organoids Market is consolidated and consists of a few major players. In terms of market share, a few of the major players are currently dominating the market. Some of the companies among them are Cellesce Ltd, Merck KGaA, 3Dnamics Inc., R&D Systems, Inc., Hubrecht Organoid Technology, Definigen, Known Medicine, and Dynomics Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Number of Research and Development Activity

- 4.2.2 Latest Advancement in Organoids

- 4.3 Market Restraints

- 4.3.1 Certain Charecteristics Differentiation with the Actual Organs

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product Type

- 5.1.1 Intestine

- 5.1.2 Liver

- 5.1.3 Stomach

- 5.1.4 Pancrease

- 5.1.5 Others

- 5.2 By Application

- 5.2.1 Drug Discovery and Personalized Medicine

- 5.2.2 Drug Toxicity and Efficacy Testing

- 5.2.3 Regenerative Medicine

- 5.2.4 Developmental Biology

- 5.2.5 Others

- 5.3 By End User

- 5.3.1 Pharmaceutical and Biotechnology Companies

- 5.3.2 Contract Research Organisations

- 5.3.3 Research Institutes

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Merck KGaA

- 6.1.2 Cellesce Ltd

- 6.1.3 3Dnamics Inc.

- 6.1.4 R&D Systems, Inc.

- 6.1.5 Hubrecht Organoid Technology

- 6.1.6 Definigen

- 6.1.7 Known Medicine

- 6.1.8 Dynomics Inc.