|

市場調查報告書

商品編碼

1284311

智能建築初創公司(2023):protech領域初創公司的併購、融資和戰略投資StartUps in Smart Buildings 2023: M&A, Funding & Strategic Investments in Startup Companies in the Proptech Space |

||||||

在本報告中,我們對智能建築和proptech 領域的初創公司進行了調查,並通過初創公司的融資、收購、合作和聯盟總結了業務發展趨勢以及未來前景。

列出的公司包括(但不限於)::

|

|

內容

執行摘要

第 1 章:全球智能建築市場的初創公司

第二章風險投資與私募股權投資

- 為初創公司開發 VC 和 PE 基金

- 前 20 家初創公司:按籌集的公共資金總額

- 吸引投資者的科技行業和初創企業

- 智能建築物聯網平台

- 數字孿生解決方案

- 網絡安全解決方案

- 自治建築

- 可持續性和碳管理

- 能源管理硬件

- 入住率分析

- 移動訪問控制和訪客管理

- 視頻監控和視頻分析

第三章初創公司併購

- 收購和發展智能建築領域的初創公司

- 2021 年和 2022 年收購的初創公司

- 主要公司正在擴展構建物聯網產品組合

- 可持續性和碳管理

- 可再生能源管理

- 數字工作場所併購

- 工作場所體驗應用市場整合

- 通過收購訪客管理軟件加強數字化工作場所

- 一家企業安全公司擴展視頻分析和訪問控制產品

第 4 章特殊目的收購公司 (SPAC) 和首次公開募股 (IPO)

- SPAC 與初創公司之間的交易

- 上市

第 5 章公司風險投資/併購/與現有公司的合作

- 樓宇自動化公司

- ABB

- Honeywell

- Johnson Controls

- Schneider Electric

- Siemens

- 房地產服務公司

- CBRE

- Cushman & Wakefield

- JLL

- HVAC 設備公司

- Carrier

- Daikin

第 6 章創業投資展望:2023 年

附錄

This Report is a New 2023 Definitive Resource for Evaluating Startup Companies in the Smart Building & PropTech Space.

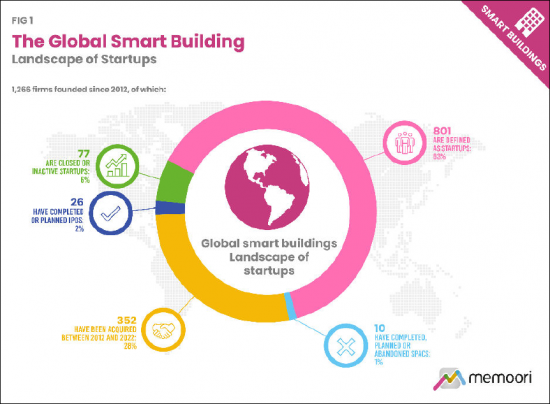

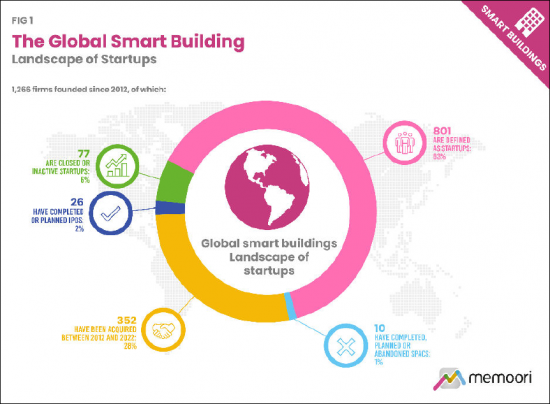

Around 1,266 startups are active in the management and operations phase of the global smart commercial buildings space. This has increased by 20% in the 2 years since we published our last startup research. 352 startups have been acquired between 2012 - 2022, 28% of the total. 77 are closed or inactive, 6% of the total.

Our definition of a Startup is "a private company formed no earlier than 2012 that is focused on the commercial and industrial buildings market, is not a subsidiary or an acquisition of a larger company and is often financed by venture capital or private equity funding."

The report INCLUDES at no extra cost, a spreadsheet which lists all Startup acquisitions and investments in 2021 & 2022 AND a presentation file with high-resolution charts from the report.

What does this Report tell You?

- Funding from venture capital, private equity and corporate backers has reached unprecedented levels since 2015, with $5.9B invested in 2022.

- Total capital invested in startups in the global smart building space since 2015 amounts to over $31 billion. Corporate strategic investors across the built environment are playing an increasingly significant role in supporting startups.

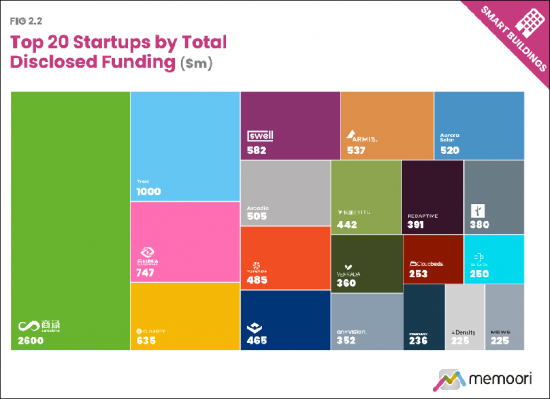

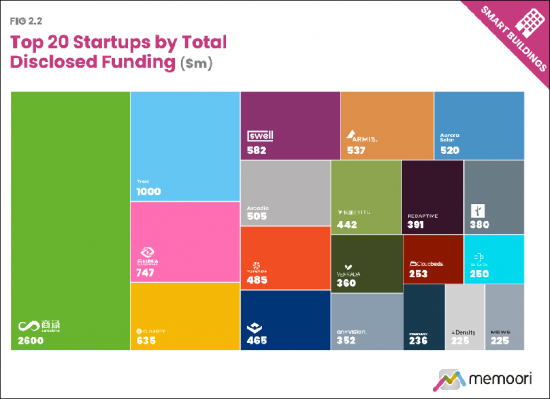

- The highest-funded startups in the smart buildings space in the last two years are shown below. These top 20 firms have each attracted between $225 million and $2.6 billion in total disclosed funding.

The information and analysis in this report is based on research and interviews with emerging players in the Smart Building Space. It benefits from Memoori's previous reports over the last 2 years on subjects such as the Building Internet of Things (BIoT) , Cyber Security, Physical Security and the Digital Workplace.

It demonstrates the critical contribution that Startups are making to the introduction of innovation in the Smart Buildings & PropTech spaces.

Within its 117 Pages and 56 Presentation Slides, The Report Sieves out all the Key Facts and Draws Conclusions, so you can understand how StartUp Companies are Shaping the Future of PropTech.

The report identifies recent partnerships with established players including building systems vendors, IoT and IT vendors, lighting suppliers, facilities management service firms and security systems vendors. There is also a detailed assessment of the ecosystems of 10 incumbent players, ABB, Honeywell, Johnson Controls, Schneider Electric, Siemens, CBRE, Cushman & Wakefield, JLL, Carrier, Daikin.

This report provides valuable information into how StartUp companies are developing their businesses through Acquisitions, Partnerships and Alliances.

Companies Mentioned Include (BUT NOT LIMITED TO):

|

|

Table of Contents

Executive Summary

1. The Global Smart Buildings Landscape of Startups

2. Venture Capital and Private Equity Funding

- 2.1. Development of VC & PE Funding for Startups 2015-2022

- 2.2. Top 20 Startups by Total Disclosed Funding

- 2.3. Which Technology Segments and Startups Have Attracted Investors?

- 2.3.1. IoT Platforms for Smart Buildings

- 2.3.2. Digital Twin Solutions

- 2.3.3. Cybersecurity Solutions

- 2.3.4. Towards Autonomous Buildings

- 2.3.5. Sustainability and Carbon Management

- 2.3.6. Energy Management Hardware

- 2.3.7. Occupancy Analytics

- 2.3.8. Mobile Access Control and Visitor Management

- 2.3.9. Video Surveillance and Video Analytics

3. Mergers and Acquisitions of Emerging Players

- 3.1. Development of Startup Acquisitions in the Smart Buildings Space 2015-2022

- 3.2. Which Startups Have Been Acquired in 2021 and 2022?

- 3.2.1. Leading Players Expand Building IoT Portfolios

- 3.2.2. Sustainability and Carbon Management

- 3.2.3. Renewable Energy Management

- 3.2.4. Digital Workplace M&A

- 3.2.5. Consolidation in the Workplace Experience Apps Market

- 3.2.6. Visitor Management Software Acquisitions Augment the Digital Workplace

- 3.2.7. Enterprise Security Players Expand Video Analytics & Access Control Offerings

4. SPACs and IPOs

- 4.1. Special Purpose Acquisition Companies (SPAC) Transactions with Startups

- 4.2. Initial Public Offerings (IPOs)

5. Corporate VC, M&A and Partnerships with Established Players

- 5.1. Building Automation Firms

- 5.1.1. ABB

- 5.1.2. Honeywell

- 5.1.3. Johnson Controls

- 5.1.4. Schneider Electric

- 5.1.5. Siemens

- 5.2. Real Estate Service Firms

- 5.2.1. CBRE

- 5.2.2. Cushman & Wakefield

- 5.2.3. JLL

- 5.3. HVAC Equipment Companies

- 5.3.1. Carrier

- 5.3.2. Daikin

6. Investment Outlook for Startups in 2023

Appendix

- A1. VC and PE Funding for Smart Building Startups 2021-2022

- A2. Smart Building Startups M&A 2021-2022

List of Charts and Figures

- Fig 1. The Global Smart Building Landscape of Startups

- Fig 2.1. Development of Startups VC and PE Funding 2015 - 2022

- Fig 2.2. Top 20 Startups by Total Disclosed Funding ($m)

- Fig 2.3.1. Notable Funding for BIoT Startups in 2022

- Fig 2.3.2. Notable Funding for Digital Twin Startups in 2022

- Fig 2.3.3. Notable Funding for Cybersecurity Startups in 2021 and 2022

- Fig 2.3.4. Notable Funding for AI-powered HVAC Optimization Startups in 2022

- Fig 2.3.5. Notable Sustainability & Carbon Management Funding in 2022

- Fig 2.3.6. Notable Energy Management Hardware Funding in 2022

- Fig 2.3.7. Notable Occupancy Analytics Funding in 2021 and 2022

- Fig 2.3.8. Notable Mobile Access Control & Visitor Management Funding in 2021 and 2022

- Fig 2.3.9. Notable Video Surveillance & Video Analytics Funding in 2022

- Fig 3.1. Startup Acquisitions in the Smart Buildings Space 2015 - 2022

- Fig 3.2.1. Notable Building IoT Startup Acquisitions in 2021 & 2022

- Fig 3.2.2. Notable Sustainability and Carbon Management Startup Acquisitions in 2022

- Fig 3.2.3. Notable Renewable Energy Management Startup Acquisitions in 2022

- Fig 3.2.4. Notable Digital Workplace Startup Acquisitions in 2021 and 2022

- Fig 3.2.5. Notable Workplace Experience Apps Startup Acquisitions in 2021 and 2022

- Fig 3.2.6. Notable Visitor Management Startup Acquisitions in 2021

- Fig 3.2.7. Notable Video Surveillance and Access Control Startup Acquisitions in 2021 and 2022

- Fig 4.1. Special Purpose Acquisition Company (SPAC) Transactions with Startups

- Fig 4.2. Completed Initial Public Offerings (IPOs) by Startups

- Fig 5.1.1. ABB Business Relationships with Startups

- Fig 5.1.2. Honeywell Business Relationships with Startups

- Fig 5.1.3. Johnson Controls Business Relationships with Startups

- Fig 5.1.4. Scheider Electric Business Relationships with Startups

- Fig 5.1.5. Siemens Business Relationships with Startups

- Fig 5.2.1. CBRE Business Relationships with Startups

- Fig 5.2.2. Cushman & Wakefield Business Relationships with Startups

- Fig 5.2.3. JLL Business Relationships with Startups

- Fig 5.3.1. Carrier Business Relationships with Startups

- Fig 5.3.2. Daikin Business Relationships with Startups