|

市場調查報告書

商品編碼

1134393

電動汽車用氫燃料電池專利格局(2022 年)Hydrogen Fuel Cells for Electric Vehicles Patent Landscape 2022 |

||||||

德國汽車製造商不斷增長的專利活動以及中國公司最近開發的令人印象深刻的知識產權使氫基電動汽車 (BEV) 和電池電動汽車 (BEV) 成為解決汽車製造商面臨的問題的解決方案之一. 這標誌著人們對燃料電池電動汽車 (HFCEV) 重新產生了興趣。

分析背景

目前,全球交通運輸部門約佔直接二氧化碳排放量的四分之一。為了解決這個問題,過去幾年,世界各國政府都出台了政策法規和研發項目的財政激勵措施,以支持綠色氫生產、氫基礎設施和燃料電池電動汽車的未來繁榮。此外,汽車製造商、設備供應商 (OEM)、氫能和燃料電池公司之間的許多研發計劃、戰略聯盟和合作夥伴關係也蓬勃發展,為構建和加強這一特定市場提供了深刻的見解。

在過去十年中,汽車行業的技術興趣發生了變化,公司將研發工作和專利工作集中在電池技術上。然而,電動汽車仍然存在未解決的問題(裡程自主性、充電速度、安全性等),導致 2010 年代中期燃料電池技術專利申請重新興起,2015-2021 年的複合年增長率為18%。

專利概覽< br >最活躍的專利申請人(2020年過渡)

隨著新進入者的出現而蓬勃發展的領域

用於公路運輸(汽車、卡車、公共汽車)的氫基燃料電池技術是一個引起全球許多公司關注的領域,在過去 20 年中公佈了 30,000 多個專利家族。與許多創新驅動型行業一樣,日本公司歷來在 2000 年代主導燃料電池技術領域,並對專利活動採取量化方法。

專利分類

專利系列包括燃料電池技術(PEMFC、SOFC、MCFC、PAFC、AFC 等)、電池材料和組件(電極、膜、催化劑、氣體擴散層、雙極板、電解質等)、管理和控制(熱管理、壓力管理等)、燃料電池堆、燃料電池系統、儲氫等。

專利部概要

最大的專利受讓人:按供應鏈細分

大眾/奧迪

專利組合概覽

在本報告中,我們分析了與電動汽車 (EV) 用氫燃料電池相關的專利趨勢,包括近年來專利申請和出版物數量的趨勢、申請專利的主要國家以及主要專利轉讓情況。供應鏈各領域新進入者、IP合作(聯合專利申請)和IP轉讓(專利所有權變更)、細分專利分佈(共20多種)、15家主要公司的IP概況(申請號)專利數量、明細、法律區域、地域範圍等)、主要專利概要(共3萬餘項)等。

本報告提及的公司(部分)

行業:AGC、愛信精機、安德森工業、旭化成、北汽集團(北京汽車)、藍界科技、寶馬、博世、佳能、Cellcentric、奇瑞汽車、戴姆勒、電裝、東風汽車、一汽(中國一汽)、福特、FTXT能源科技、通用汽車、格羅夫氫能汽車、日立集團、本田、海利恩工業、現代/起亞、強生科技、科隆工業、LG集團, 三菱集團, 村田製作所/索尼, 新科力化學, 新日鐵, 日產集團, Nuvoton, Panasonic/Sanyo, Refire Technology, 雷諾, 三星集團, Schaeffler Technologies, S-FuelCell, 上海神力高科技, 中化華通, 總研, 住友集團、日出動力、鈴木集團、凸版印刷、東麗工業、東芝集團、豐田集團、偉易購、大眾/奧迪、濰柴集團、宇通等

研究機構:AIST(國家先進工業科學技術研究院)、北京大學、CEA(替代能源與原子能委員會)、大連化學物理研究所- 中科院、吉林大學、KAIST(韓國高等科學技術研究院)、KIER(韓國能源研究所)、首爾國立大學、上海交通大學、華南理工大學、同濟大學、清華大學、武漢大學科技、浙江大學等

內容

簡介

分析範圍及方法

亮點和關鍵見解

專利格局:概述

- 專利公佈時間表

- 總部的時代演變

- 主要專利申請人

- 最活躍的專利申請人(自 2020 年 1 月起)

- 按公司類型劃分的主要專利申請人

- 專利申請人:已發布專利數量隨時間變化的趨勢

- 新進入者的知識產權

- 專利的當前法律狀態

- 專利權人的知識產權領導力

- 專利受讓人IP塊的可能性

- 有效專利的區域分佈

- 專利權人的組合:地理範圍

- 中國主要公司的知識產權戰略

知識產權合作

知識產權訴訟與挑戰

專利細分

- 專利家族的分佈:按細分市場

- 已公開專利數量隨時間的變化:按細分市場

- 主要專利申請人與細分市場

- 專利申請人排名:按細分市場

專注於 PEMFC

- 一段時間內公佈的專利數量

- 主要專利申請人

- 專利權人的知識產權領導力

- 主要專利

主要公司的知識產權概況

- 主要IP企業:Toyota、Honda、Nissan、Hyundai/Kia、General Motors、Panasonic、Volkswagen/Audi、Bosch、BMW、Grove Hydrogen Automotive、Shen-Li High Tech (Sino Fuel Cell)、FAW、Weichai、Sunrise Power、Cellcentric

- 每家公司概覽: 競爭優勢、增強潛力、公司的知識產權動態、知識產權合作、近期專利活動概覽

關於KnowMade

The growth in patenting activity among German vehicle manufacturers and the impressive IP recent developments of Chinese companies are indicative of renewed interest in hydrogen-based fuel cell electric vehicles (HFCEV) as one solution, along with battery electric vehicles (BEV), to tackle the issues faced by automakers.

Report's Key Features:

- Describing the global patenting trends,including time evolution of patent publications, countries of patent filings, etc.

- Identifying the main patent assignees and the IP newcomers in the different segments of the supply chain.

- Determining the status of their patenting activity (active / inactive) and their IP dynamics (ramping up, slowing down, steady).

- Identifying the IP collaborations (patent co-filings) and IP transfers (changes of patent ownership).

- Patents categorized into more than 20 segments: fuel cell technologies (PEMFC, SOFC, MCFC, PAFC, AFC, etc.), cell materials and components (electrodes, membranes, catalysts, gas diffusion layer, bipolar plates, electrolytes, etc.), stacking of fuel cells, fuel cell system, thermal management, pressure management, etc.

- IP profile of 15 key players: patent portfolio overview (IP dynamics, segmentation, legal status, geographic coverage, etc.), IP collaborations, and recent patenting activity.

- Excel database containing all patents analyzed in the report, including patent segmentations and hyperlinks to an updated online database.

Context of the report:

Nowadays, the global transportation sector represents about one quarter of all direct carbon dioxide emissions. To remedy this, during the past few years, several national and supranational governments around the world have instigated policy regulations and financial incentives regarding research and development programs in order to help green hydrogen production, hydrogen infrastructures and fuel cell-powered electric vehicles thrive in the future. Moreover, numerous R&D programs, strategic alliances and partnerships among vehicle manufacturers, equipment suppliers (OEM) and hydrogen- and fuel cell-related companies have blossomed, giving a strong insight into the structuring and strengthening of this specific market.

The last 10 years we witnessed a shift in technological interest in the automotive sector, with companies concentrating their R&D efforts and patenting activities on battery technologies. But with some as yet unresolved issues for electric vehicles (mileage autonomy, charging speed and safety to name a few), there was a revival in interest in fuel cell technology patent filings in the mid-2010s, with a CAGR of 18% between 2015 and 2021.

In this context, Knowmade is releasing a new report which aims to provide a comprehensive view of the patent landscape related to hydrogen-based fuel cells for terrestrial electric vehicles (cars, trucks and buses), from electrolyte and electrode materials to the fuel cell system and vehicle integration, segmented into fuel cell technologies - such as proton exchange membrane (PEMFC), solid oxide (SOFC) and molten carbonate (MCFC).

Patent landscape analysis is a powerful tool to understand global hydrogen fuel cell electric vehicles competitive and technological environment. Overall, patenting activity (patent filings) reflects the level of R&D investment made by a country or player in a specific technology, while providing clues as to the technology readiness level reached by the main IP players. What's more, the technology coverage along the value chain and the geographical coverage of the patent portfolios are closely related to the business strategy of IP players.

PATENT LANDSCAPE OVERVIEW

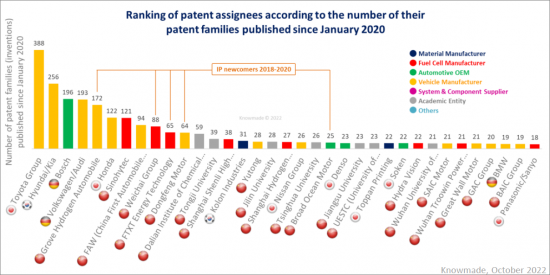

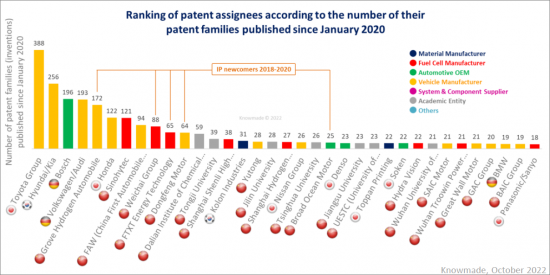

Most active patent applicants since 2020

A sector boosted by the emergence of newcomers

With more than 30,000 patent families published in the past 20 years, hydrogen-based fuel cell technologies for road transportation (cars, trucks, buses) is a sector that has caught the attention of a lot of companies around the world. As in a lot of innovation-led industry sectors, Japanese players historically took over the fuel cell-related technological field in the 2000s, taking a quantitative approach in patenting activity. Players such as car makers (Toyota, Nissan, Honda, Mitsubishi, etc.), equipment suppliers (Aisin Seiki, Denso, Soken, etc.), device manufacturers (Panasonic/Sanyo, Hitachi, Toshiba, Murata/Sony, etc.) or material suppliers (Toppan Printing, Nippon Steel, Toray Industries, Sumitomo, etc.) have been active all along the value chain, from electrode materials and fuel cell stacks to system integration into vehicles. Other players have joined their Japanese counterparts in patent filings in that period, like US General Motors and Ford, German Daimler, Volkswagen/Audi, Bosch and BMW, and South Korean Hyundai/Kia, Samsung and LG. More recently, the patenting activity is led by German vehicle manufacturers and Chinese newcomers, as a way to develop and diversify their businesses, for the former - Volkswagen/Audi, Bosch or BMW - and to take some market shares and develop fuel cell technologies, for the latter - vehicle manufacturers Grove Hydrogen Automotive, FAW China First Automotive Works, Dongfeng Motor, Yutong Bus or SAIC Group, and product devices sellers SinoHytec, Weichai Group, FTXT Energy Technology or Shanghai Shenli High Technology.

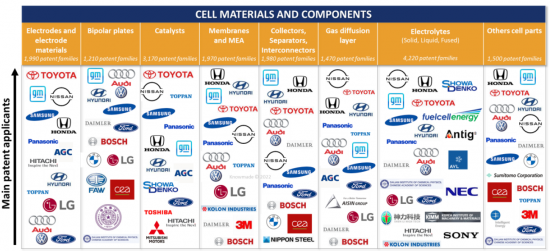

Patent segmentation

The patent families have been categorized according to the fuel cell technologies (PEMFC, SOFC, MCFC, PAFC, AFC, etc.), cell materials and components (electrodes, membranes, catalysts, gas diffusion layer, bipolar plates, electrolytes, etc.), management and control (thermal management, pressure management, etc.), stacking of fuel cells, fuel cell system, hydrogen storage, etc.

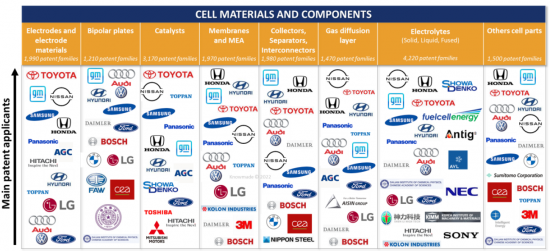

PATENT SEGMENTATION OVERVIEW

Most patent assignees per supply chain segment

IP profiles: focus on the top IP players' patent portfolios

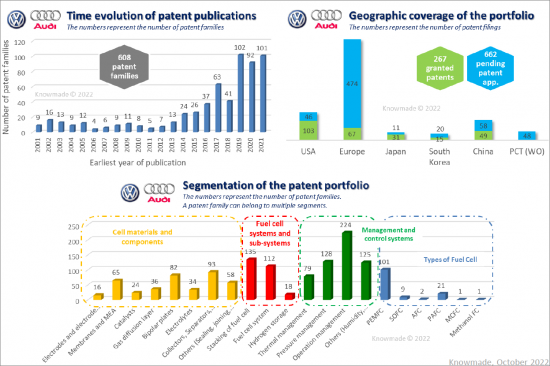

The patent portfolio of 15 companies is analyzed: Toyota, Honda, Nissan, Hyundai/Kia, General Motors, Panasonic, Volkswagen/Audi, Bosch, BMW, Grove Hydrogen Automotive, Shen-Li High Tech (SinoFuelCell), FAW, Weichai, Sunrise Power, Cellcentric. For each player, the hydrogen fuel cell patent portfolio is analyzed to provide an overview of its strengths, its potential for reinforcement, the level of IP activity, IP collaborations and recent patenting activity.

Useful Excel patent database

This report also includes an extensive Excel database with the 30,000+ patent families (inventions) analyzed in this study. This useful patent database allows for multi-criteria searches and includes patent publication numbers, hyperlinks to an updated online database (original documents, legal status, etc.), priority date, title, abstract, patent assignees, patent's current legal status, and 20+ segments (PEMFC, SOFC, MCFC, AFC, electrodes, membranes, catalysts, gas diffusion layer, stacking of fuel cells, fuel cell system, hydrogen storage, thermal management, pressure management, etc.).

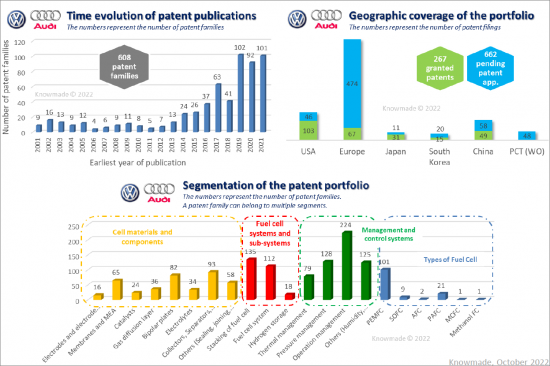

VOLKSWAGEN/AUDI

Patent portfolio overview

Companies mentioned in the report (non-exhaustive)

Industrials: AGC, Aisin Seiki, Anderson Industries, Asahi Kasei, BAIC Group (Beijing Automotive), Blue World Technologies, BMW, Bosch, Canon, Cellcentric, Chery Automobile, Daimler, Denso, Dongfeng Motor, FAW (China First Automobile Works), Ford, FTXT Energy Technology, General Motors, Grove Hydrogen Automotive, Hitachi Group, Honda, Hylium Industries, Hyundai/Kia, J&L Tech, Kolon Industries, LG Group, Mitsubishi Group, Murata Manufacturing/Sony, New Keli Chemical, Nippon Steel, Nissan Group, Nuvoton, Panasonic/Sanyo, Refire Technology, Renault, Samsung Group, Schaeffler Technologies, S-FuelCell, Shanghai Shenli High Technology, Sinohytec, Soken, Sumitomo Group, Sunrise Power, Suzuki Group, Toppan Printing, Toray Industries, Toshiba Group, Toyota Group, Vitesco Technologies, Volkswagen/Audi, Weichai Group, Yutong, etc.

Research organizations: AIST (National Institute of Advanced Industrial Science & Technology), Beijing University, CEA (Alternative Energies and Atomic Energy Commission), Dalian Institute of Chemical Physics - CAS, Jilin University, KAIST (Korea Advanced Institute of Science &Technology), KIER (Korea Institute of Energy Research), Seoul National University, Shanghai Jiao Tong University, South China University of Technology, Tongji University, Tsinghua University, Wuhan University of Technology, Zhejiang University, etc.

TABLE OF CONTENTS

INTRODUCTION

- Context

- Hydrogen fuel cells: advantagea and drawbacks

- Types of fuel cells: PEMFC, SOFC, MCFC, PAFC, etc.

- Fuel cells in transportation

- Incentives & Policies worldwide

- Latest news

SCOPE OF THE REPORT AND METHODOLOGY

- Key features of the report

- Methodology for patent search ,selection and analysis

- Key IP players & Key patents

- Terminology

HIGHLIGHTS AND KEY INSIGHTS

PATENT LANDSCAPE OVERVIEW

- Timeline of patent publications

- Time evolution of company headquarters

- Main patent assignees

- Most active patent applicants since January 2020

- Main patent assignees by company type

- Patent assignees time evolution of patent publications

- IP newcomers

- Current legal status of patents

- IP leadership of patent assignees

- IP blocking potential of patent assignees

- Geographical distribution of alive patents

- Patent assignees geographical coverage of portfolio

- IP strategy of main Chinese players

IP COLLABORATIONS

IP LITIGATIONS AND OPPOSITIONS

PATENT SEGMENTATION

- Distribution of patent families by segment

- Time evolution of patent publications by segment

- Main patent assignees vs. Segments

- Ranking of patent assignees for each segment

FOCUS ON PEMFC

- Time evolution of patent publications

- Main patent assignees

- IP leadership of patent assignees

- Key patents

IP PROFILES OF KEY PLAYERS103

- Selected IP players: Toyota, Honda, Nissan, Hyundai/Kia, General Motors, Panasonic, Volkswagen/Audi, Bosch, BMW, Grove Hydrogen Automotive, Shen-Li High Tech (Sino Fuel Cell), FAW, Weichai, Sunrise Power, Cellcentric

- For each player: Overview of its strength, its potential for reinforcement, the player's IP dynamics, its IP collaborations and its recent patenting activity