|

市場調查報告書

商品編碼

1448840

AI 和 RAN:它們的移動速度有多快?AI and RAN - How Fast Will They Run? |

||||||

本報告探討了人工智慧 (AI) 和無線存取網路 (RAN) 的融合,強調了它們不斷發展的關係並預測了它們未來的發展軌跡。

近年來,人工智慧已成為推動各產業創新的關鍵力量。 特別是在電信領域,我們正在見證人工智慧整合到 RAN 架構中所產生的變革性影響。 本報告探討了這種協同作用,並揭示了它們融合背後的動態及其對電信業的影響。

分析概述

- 從 2023 年到 2028 年,RAN 人工智慧的潛在市場將以每年 45% 的驚人速度成長。

- 5G RAN 中人工智慧的潛在市場將比前幾代電話技術成長得更快。

- 亞太地區將成為 RAN 快取應用人工智慧的最大市場。

目錄

第 1 章執行摘要

第 2 章 AI/ML/DL:關鍵概念解釋

- 人工智慧 (AI)

- 機器學習 (ML)

- 監督式機器學習

- 無監督機器學習

- 增強的機器學習

- k-最近鄰法

- 深度學習神經網路 (DLNN)

- 著名的機器學習/深度學習演算法

- 異常檢測

- 人工神經網路 (ANN)

- 有缺陷的決策樹

- CART/SVM演算法

- 聚類

- 條件變分自動編碼器

- 卷積神經網絡

- 關聯/聚類

- 演化演算法與分散式學習

- 前饋神經網路 (FNN)

- 圖神經網路 (GNN)

- 混合認知引擎 (HCE)

- 卡爾曼濾波器

- 馬可夫決策過程

- 多層感知器 (MLP)

- 樸素貝葉斯

- 徑向基底函數

- 隨機森林

- 循環神經網絡

- 強化神經網絡

- SOM演算法

- 稀疏貝葉斯學習

第 3 章 RAN 虛擬化

- RAN 及其演變

- E-UTRAN 詳細信息

- 5G-NR、NSA、SA

- MEC

- 剛性 CPRI

- 從 RAN 到 vRAN 的演進

- 如何比較基於虛擬機器的 vRAN 和基於容器的 vRAN?

- NFV 架構

- 需要容器

- 微服務

- 容器形式

- 如何安裝容器

- 有狀態和無狀態容器

- 優勢容器

- 容器面臨的挑戰

- RAN 虛擬化:聯盟故事

- O-RAN 架構概述

- O-RAN 的歷史

- O-RAN 工作組

- 開放 vRAN (O-vRAN)

- TIP(通訊基礎設施項目)OpenRAN

第 4 章 AI 在 RAN 的最終使用

- O-RAN 和人工智慧

- 簡介

- RIC、xApp、rApp

- WG2 和 ML

- 人工智慧用例:流量優化

- 背景

- 方法論與問題

- 基於人工智慧的方法

- 人工智慧用例:快取

- 人工智慧用例:能源管理

- 人工智慧用例:編碼

第 5 章 RAN 中的人工智慧:供應商的努力

- 簡介

- 主要分析結果

- 公司/組織概覽

- Aira Channel Prediction xApp

- Aira Dynamic Radio Network Management rApp

- AirHop Auptim

- Aspire Anomaly Detection rApp

- Cisco Ultra Traffic Optimization

- Capgemini RIC

- Cohere MU-MIMO Scheduler

- DeepSig OmniSig

- Deepsig OmniPHY

- Ericsson Radio System

- Ericsson RIC

- Fujitsu Open RAN Compliant RUs

- HCL iDES rApp

- Huawei PowerStar

- Juniper RIC/Rakuten Symphony Symworld

- Mavenir mMIMO 64TRX

- Mavenir RIC

- Net AI xUPscaler Traffic Predictor xApp

- Nokia RAN Intelligent Controller

- Nokia AVA

- Nokia ReefShark Soc

- Nvidia AI-on-5G platform

- Opanga Networks

- P.I. Works Intelligent PCI Collision and Confusion Detection rApp

- Qualcomm RIC

- Qualcomm Cellwize CHIME

- Qualcomm Traffic Management Solutions

- Rimedo Policy-controlled Traffic Steering xApp

- Samsung Network Slice Manager

- ZTE PowerPilot

- VMware RIC

第 6 章 RAN 中的人工智慧:電信公司的努力

- 簡介

- 主要分析結果

- 公司/組織概覽

- AT&T Inc

- Axiata Group Berhad

- Bharti Airtel

- China Mobile

- China Telecom

- China Unicom

- CK Hutchison Holdings

- Deutsche Telekom

- Etisalat

- Globe Telecom Inc

- NTT DoCoMo

- MTN Group

- Ooredoo

- Orange

- PLDT Inc

- Rakuten Mobile

- Reliance Jio

- Saudi Telecom Company

- Singtel

- SK Telecom

- Softbank

- Telefonica

- Telenor

- Telkomsel

- T-Mobile US

- Verizon

- Viettel Group

- Vodafone

第7章定量分析與預測

- 分析法

- 預測的分類方法

- 全球市場

- 整個市場

- 手機世代

- 按地區

- 流量優化

- 整個市場

- 手機世代

- 按地區

- 快取

- 整個市場

- 手機世代

- 按地區

- 能源管理

- 整個市場

- 手機世代

- 按地區

- 編碼

- 整個市場

- 手機世代

- 按地區

This report delves into the intersection of Artificial Intelligence (AI) and Radio Access Network (RAN), shedding light on their evolving relationship and forecasting their future trajectories.

SAMPLE VIEW

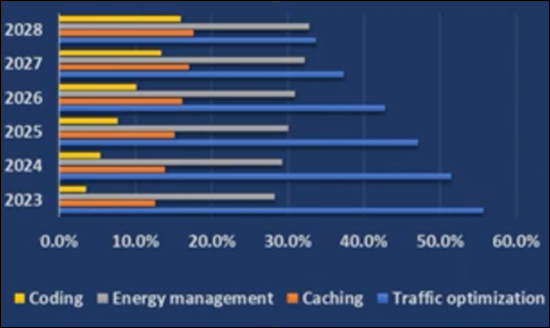

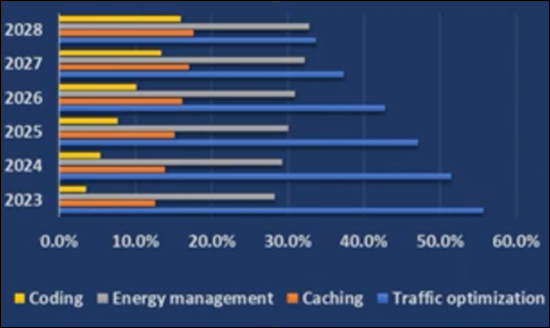

Figure 1-1: Progression of revenue shares of AI end-applications in the RAN

Source: Insight Research

In recent years, AI has emerged as a pivotal force driving innovation across industries. The telecom sector, in particular, has witnessed a transformative impact with the integration of AI into RAN architecture. The report explores this synergy, uncovering the dynamics behind their convergence and the implications for the telecommunication landscape.

"At Insight Research, we recognize the seismic shifts occurring within the telecommunications industry, and our latest report elucidates the symbiotic relationship between AI and RAN," remarked Kaustubha Parkhi, Principal Analyst at Insight Research. "We're witnessing a paradigm shift in RAN architecture, with AI playing a pivotal role in driving efficiency, agility, and performance."

Key Highlights from the Report:

- The addressable market for AI in RAN will grow by an impressive 45% annually during 2023-2028

- The addressable market for AI in 5G RAN will grow faster than earlier telephony generations

- The APAC region will be the largest market for AI in RAN caching applications

With a meticulous breakdown of the market by application, region, and telephony generations, the report offers unparalleled quantitative insights, empowering stakeholders to make informed decisions in a rapidly evolving landscape.

Insight Research's "AI and RAN - How Fast Will They Run?" report is essential reading for telecom operators, technology providers, policymakers, and investors seeking to navigate the evolving landscape of AI-driven telecommunications infrastructure.

Table of Contents

1. Executive Summary

- 1.1. Key observations

- 1.2. Quantitative Forecast Taxonomy

- 1.3. Report Organization

2. AI/ML/DL - Key Concepts Explainer

- 2.1. Artificial Intelligence

- 2.2. Machine Learning (ML)

- 2.2.1. Supervised Machine Learning

- 2.2.2. Unsupervised Machine Learning

- 2.2.3. Reinforced Machine Learning

- 2.2.4. K-Nearest Neighbor

- 2.3. Deep Learning Neural Network (DLNN)

- 2.4. Noteworthy ML and DL Algorithms

- 2.4.1. Anomaly Detection

- 2.4.2. Artificial Neural Networks (ANN)

- 2.4.3. Bagged Trees

- 2.4.4. CART and SVM Algorithms

- 2.4.5. Clustering

- 2.4.6. Conditional Variational Autoencoder

- 2.4.7. Convolutional Neural Network

- 2.4.8. Correlation and Clustering

- 2.4.9. Evolutionary Algorithms and Distributed Learning

- 2.4.10. Feed Forward Neural Network

- 2.4.11. Graph Neural Networks

- 2.4.12. Hybrid Cognitive Engine (HCE)

- 2.4.13. Kalman Filter

- 2.4.14. Markov Decision Processes

- 2.4.15. Multilayer Perceptron

- 2.4.16. Naïve Bayes

- 2.4.17. Radial Basis Function

- 2.4.18. Random Forest

- 2.4.19. Recurrent Neural Network

- 2.4.20. Reinforced Neural Network

- 2.4.21. SOM Algorithm

- 2.4.22. Sparse Bayesian Learning

3. Virtualization of the RAN

- 3.1. The RAN and its Evolution

- 3.1.1. Closer Look at E-UTRAN

- 3.1.2. 5G- NR, NSA and SA

- 3.1.3. MEC

- 3.1.4. The Rigid CPRI

- 3.2. The Progression of the RAN to the vRAN

- 3.3. How VM-based and Container-based vRANs Compare?

- 3.3.1. NFV architecture

- 3.3.2. The Need for Containers

- 3.3.3. Microservices

- 3.3.4. Container Morphology

- 3.3.5. Container Deployment Methodologies

- 3.3.6. Stateful and Stateless Containers

- 3.3.7. Advantage Containers

- 3.3.8. Challenges Confronting Containers

- 3.4. RAN Virtualization - A Story of Alliances

- 3.4.1. O-RAN Architecture Overview

- 3.4.2. History of O-RAN

- 3.4.3. Workgroups of O-RAN

- 3.4.4. Open vRAN (O-vRAN)

- 3.4.5. Telecom Infra Project (TIP) OpenRAN

4. End-applications for AI in the RAN

- 4.1. O-RAN and AI

- 4.1.1. Introduction

- 4.1.2. RIC, xApps and rApps

- 4.1.3. WG2 and ML

- 4.2. AI Use-Case - Traffic Optimization

- 4.2.1. Background

- 4.2.2. Methodologies and Challenges

- 4.2.3. AI-based Approaches

- 4.3. AI Use-Case - Caching

- 4.3.1. Background

- 4.3.2. Methodologies and Challenges

- 4.3.3. AI-based Approaches

- 4.4. AI Use-Case - Energy Management

- 4.4.1. Background

- 4.4.2. Methodologies and Challenges

- 4.4.3. AI-based Approaches

- 4.5. AI Use-Case - Coding

- 4.5.2. AI-based Approaches

5. Vendor Initiatives for AI in the RAN

- 5.1. Introduction

- 5.2. Salient Observations

- 5.3. Company and Organization Summary

- 5.4. Aira Channel Prediction xApp

- 5.5. Aira Dynamic Radio Network Management rApp

- 5.6. AirHop Auptim

- 5.7. Aspire Anomaly Detection rApp

- 5.8. Cisco Ultra Traffic Optimization

- 5.9. Capgemini RIC

- 5.10. Cohere MU-MIMO Scheduler

- 5.11. DeepSig OmniSig

- 5.12. Deepsig OmniPHY

- 5.13. Ericsson Radio System

- 5.14. Ericsson RIC

- 5.15. Fujitsu Open RAN Compliant RUs

- 5.16. HCL iDES rApp

- 5.17. Huawei PowerStar

- 5.18. Juniper RIC/Rakuten Symphony Symworld

- 5.19. Mavenir mMIMO 64TRX

- 5.20. Mavenir RIC

- 5.21. Net AI xUPscaler Traffic Predictor xApp

- 5.22. Nokia RAN Intelligent Controller

- 5.23. Nokia AVA

- 5.24. Nokia ReefShark Soc

- 5.25. Nvidia AI-on-5G platform

- 5.26. Opanga Networks

- 5.27. P.I. Works Intelligent PCI Collision and Confusion Detection rApp

- 5.28. Qualcomm RIC

- 5.29. Qualcomm Cellwize CHIME

- 5.30. Qualcomm Traffic Management Solutions

- 5.31. Rimedo Policy-controlled Traffic Steering xApp

- 5.32. Samsung Network Slice Manager

- 5.33. ZTE PowerPilot

- 5.34. VMware RIC

6. Telco Initiatives for AI in the RAN

- 6.1. Introduction

- 6.2. Salient Observations

- 6.3. Company and Organization Summary

- 6.4. AT&T Inc

- 6.5. Axiata Group Berhad

- 6.6. Bharti Airtel

- 6.7. China Mobile

- 6.8. China Telecom

- 6.9. China Unicom

- 6.10. CK Hutchison Holdings

- 6.11. Deutsche Telekom

- 6.12. Etisalat

- 6.13. Globe Telecom Inc

- 6.14. NTT DoCoMo

- 6.15. MTN Group

- 6.16. Ooredoo

- 6.17. Orange

- 6.18. PLDT Inc

- 6.19. Rakuten Mobile

- 6.20. Reliance Jio

- 6.21. Saudi Telecom Company

- 6.22. Singtel

- 6.23. SK Telecom

- 6.24. Softbank

- 6.25. Telefonica

- 6.26. Telenor

- 6.27. Telkomsel

- 6.28. T-Mobile US

- 6.29. Verizon

- 6.30. Viettel Group

- 6.31. Vodafone

7. Quantitative Analysis and Forecasts

- 7.1. Research Methodology

- 7.2. Forecast Taxonomy

- 7.3. Global Market

- 7.3.1. Overall Market

- 7.3.2. Mobile Telephony Generations

- 7.3.3. Geographical Regions

- 7.4. Traffic Optimization

- 7.4.1. Overall Market

- 7.4.2. Mobile Telephony Generations

- 7.4.3. Geographical Regions

- 7.5. Caching

- 7.5.1. Overall Market

- 7.5.2. Mobile Telephony Generations

- 7.5.3. Geographical Regions

- 7.6. Energy Management

- 7.6.1. Overall Market

- 7.6.2. Mobile Telephony Generations

- 7.6.3. Geographical Regions

- 7.7. Coding

- 7.7.1. Overall Market

- 7.7.2. Mobile Telephony Generations

- 7.7.3. Geographical Regions

Figures & Tables

- Figure 1-1: Progression of revenue shares of AI end-applications in the RAN

- Figure 3-1: VNF versus CNF Stacks

- Figure 3-2: O-RAN High-Level Architecture

- Figure 3-3: O-RAN High-Level Architecture

- Figure 3-4: Architecture of vRAN Base Station as Visualized by TIP.

- Figure 4-1: Reinforcement learning model training and actor locations per O-RAN WG2

- Figure 4-2: AI/ML Workflow in the O-RAN RIC as proposed O-RAN WG2

- Figure 4-3: AI/ML deployment scenarios

- Table 5-1: AI in RAN Product and Solution Vendor Summary

- Figure 5-1: The Aira channel detection xApp functional blocks

- Figure 5-2: Modules of the Aspire Anomaly Detection rApp

- Figure 5-3: OmniPHY Module Drop in Typical vRAN Stack Overview

- Figure 5-4: Ericsson IAP

- Figure 5-5: HCL iDES rApp Architecture

- Figure 5-6: Working of the Net Ai xUPscaler

- Figure 5-7: Nokia RIC programmability via AI/ML and Customized Applications

- Figure 5-8: Timesharing the GPU in Nvidia Aerial A100

- Figure 5-8: Rimedo TS xApp in the O-RAN architecture

- Figure 5-9: Rimedo TS xApp in the VMware RIC

- Figure 5-10: PowerPilot Solution Evolution

- Table 6-1: AI in RAN Telco Profile Snapshot

- Figure 7-1: AI in the RAN Market Forecast Taxonomy

- Table 7-1: Addressable Market in Mobile RAN for AI and Related Technologies 2023-2028 ($ million)

- Table 7-2: Addressable Market in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028 ($ million)

- Figure 7-2: Share of Addressable Market in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028

- Table 7-3: Addressable Market in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028 ($ million)

- Figure 7-3: Share of Addressable Market in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028

- Table 7-4: Addressable Market in Traffic Optimization End-Application in Mobile RAN for AI and Related Technologies 2023-2028 ($ million)

- Table 7-5: Addressable Market in Traffic Optimization Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028 ($ million)

- Figure 7-4: Share of Addressable Market in Traffic Optimization End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028

- Table 7-6: Addressable Market in Traffic Optimization End-Application Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028 ($ million)

- Figure 7-5: Share of Addressable Market in Traffic Optimization End-Application Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028

- Table 7-7: Addressable Market in Caching End-Application in Mobile RAN for AI and Related Technologies 2023-2028 ($ million)

- Table 7-8: Addressable Market in Caching End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028 ($ million)

- Figure 7-6: Share of Addressable Market in Caching End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028

- Table 7-9: Addressable Market in Caching End-Application in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028 ($ million)

- Figure 7-7: Share of Addressable Market in Caching End-Application in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028

- Table 7-10: Addressable Market in Energy Management End-Application in Mobile RAN for AI and Related Technologies 2023-2028 ($ million)

- Table 7-11: Addressable Market in Energy Management End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028 ($ million)

- Figure 7-8: Share of Addressable Market in Energy Management End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028

- Table 7-12: Addressable Market in Energy Management End-Application in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028 ($ million)

- Figure 7-9: Share of Addressable Market in Energy Management End-Application in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028

- Table 7-13: Addressable Market in Coding End-Application in Mobile RAN for AI and Related Technologies 2023-2028 ($ million)

- Table 7-14: Addressable Market in Coding End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028 ($ million)

- Figure 7-10: Share of Addressable Market in Coding End-Application in Mobile RAN for AI and Related Technologies; by Mobile Telephony Generation 2023-2028

- Table 7-15: Addressable Market in Coding End-Application in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028 ($ million)

- Figure 7-11: Share of Addressable Market in Coding End-Application in Mobile RAN for AI and Related Technologies; by Geographical Region 2023-2028