|

市場調查報告書

商品編碼

1431788

EaaS(設備即服務)市場:2024-2028Equipment as a Service Market Report 2024-2028 |

||||||

本報告根據對 EaaS(設備即服務)供應商和最終用戶的訪談結果,調查了全球 EaaS 市場的趨勢,並提供了 EaaS 的定義、市場規模趨勢和預測以及市場推廣因素。總結了因素分析、供應商分析、案例分析、主要趨勢和問題等。

列出的公司:

|

|

目錄

第 1 章執行摘要

第 2 章主題概述

- 起點:即用即付和 EaaS:OEM 數位化路線圖的主要趨勢

- 實施 □□EaaS 的公司的四個代表性範例

- 什麼是 EaaS?

- 為什麼消費者能從 EaaS 中受益?

- EaaS 如何為最終用戶提供服務?

- OEM 實現 EaaS 的常見途徑

- 如何建立通用 EaaS 解決方案

- 為什麼 OEM 提供 EaaS?

第三章市場規模與展望

- EaaS 細分市場:定義

- OEM 市場、EaaS 市場和 EaaS 採用率的定義

- 全球市場規模與前景:概覽

- 全球 EaaS 市場的規模與前景:分析師對市場成長的看法

- 全球市場規模與前景:按地區劃分

- 深入探討 1:機器即服務

- 深入探討 2:電腦、週邊設備和本地資料中心即服務

- 深入探討 3:商用車、飛機及相關零件服務 - 市場預測

- 深入探討 4:電氣照明設備即服務

- 深入探討 5:發電、輸電和配電即服務

- 影響全球 EaaS 市場成長的順風與逆風:概述

- 1. 通貨膨脹/利率上升推動輕資產訂閱經濟

- 2. 勞動力短缺增加了按小時使用設備的需求

- 3.資本投資類投資政府專款補貼

- 4. 對提高靈活性的需求不斷增長

- 5.IIoT技術提升

- 市場成長分析

- 世界市場規模與前景:詳細信息

第四章EaaS介紹

- 採用 EaaS 的促進因素

- EaaS 採用率依詳細類別劃分

- EaaS 機會概述 (1/2):目前與未來的部署

- EaaS 機會概述 (2/2):當前部署和未來部署 - 機械詳細信息

第 5 章已知雇主和供應商

- 實現EaaS的基礎設施狀況

- 已知招募公司的狀況

- 深入探討 1:機器人即服務

- 深入探討 2:壓縮機即服務

- 深入探討 3:EaaS 先驅

- 深入探究 4:成功案例:Heidelberger Druckmaschinen

- Deep Dive 5:挫折的故事:Festo

第 6 章 EaaS 融資

- 金融機構:推出按量付費金融產品,符合 EaaS 規範

- 背景:按使用付費融資是一種表外融資

- 原始設備製造商 (OEM) 一般如何看待設備融資?

- 資助 EaaS 的三種理論選擇:從使用者的角度來看

- 提供專門EaaS服務的金融機構狀況

- OEM 自籌資金的 EaaS 範例 (1/2):Kaeser

- OEM 自籌資金 EaaS 範例 (2/2):Caterpillar

- OEM 與第三方合作資助 EaaS 的範例:Trumpf

- 使用 SPV Symbotic 的 OEM 融資 EaaS 範例

第 7 章個案研究

- EaaS 個案研究 (95)

- 個案研究 1:Heller

- 案例研究 2:開利商業冷凍

- 案例研究 3:Kaeser 壓縮機

- 案例研究 4:海德堡印刷機械

- 案例研究 5:卡爾

- 案例研究 6:惠普企業

- 案例研究 7:Signify

- 案例研究 8:歐洲三菱電梯

第 8 章趨勢與問題

- 趨勢 1:OEM 使用 EaaS 為第三方挽回收入損失

- 趨勢 2:績效保證合約提供 EaaS 的替代方案

- 趨勢 3:OEM 使用 EaaS 推動永續發展議程

- 趨勢 4:EaaS 已成為商用電動/氫能汽車的重要商業模式

- 趨勢 5:EaaS 採用將出現在產業群聚中

- 趨勢 6:重複使用備用零件作為 EaaS 設定的一部分

- 趨勢 7:EaaS 正成為商用電動/氫動力汽車的主導商業模式

- 挑戰 1:建立 EaaS 定價/合約

- 挑戰 2:從現有業務模式遷移

- 挑戰 3:取得彈性的資金來源

- 挑戰 4:管理更大的資產負債表

- 挑戰 5:最終使用者沒有正確使用 EaaS 設備

- 挑戰 6:缺乏融資最佳實踐

第 9 章研究見解

- EaaS:OEM 採用情況(依類別)

- 客戶實施 EaaS

- 客戶為何採用 EaaS

- 確保成功轉向 EaaS 所需採取的行動

- 遷移到 EaaS 時的常見錯誤

- 受訪者簡介與調查摘要

第七章研究方法

第 8 章關於 IoT 分析

Comprehensive 147-page analysis on OEMs' transition to pay-per-use models. Includes market forecasts, vendor analyses, adoption drivers, case studies, key trends, and challenges.

The "Equipment as a Service Market Report 2024-2028" is part of IoT Analytics' ongoing coverage of Industrial IoT. The information presented in this report is based on the results of multiple surveys, secondary research, and qualitative research, i.e., interviews with Equipment as a Service (EaaS) vendors and end users from between August 2023 and February 2024. The document includes a definition of EaaS, market projections, analysis of vendors, adoption drivers, case study analysis, key trends and challenges, and insights from relevant surveys.

SAMPLE VIEW

The main purpose of this document is to help our readers understand the current EaaS landscape by defining, sizing, and analyzing the market.

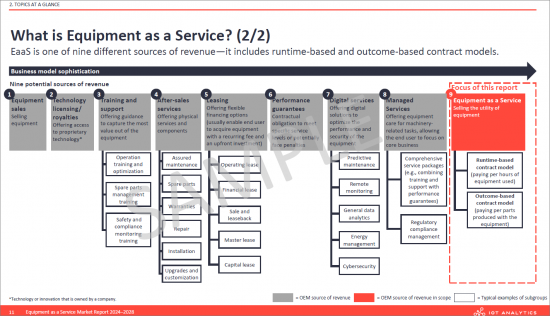

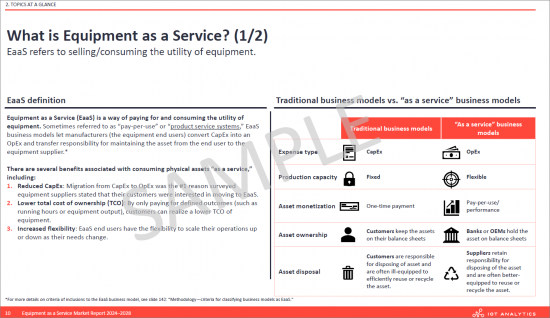

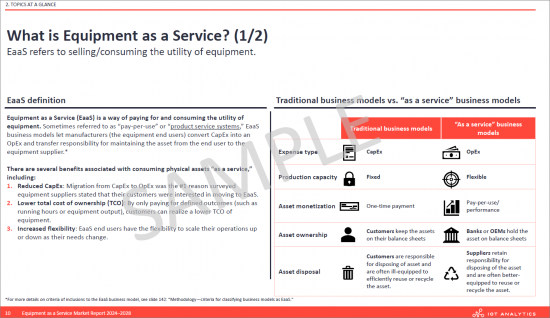

What is Equipment as a Service?

Equipment as a Service (EaaS) is a way of paying for and consuming the utility of equipment. Sometimes referred to as "pay-per-use" or "product service systems," EaaS business models let manufacturers (the equipment end users) convert CapEx into an OpEx and transfer responsibility for maintaining the asset from the end user to the equipment supplier.*

There are several benefits associated with consuming physical assets "as a service," including:

- 1. Reduced CapEx: Migration from CapEx to OpEx was the #1 reason surveyed equipment suppliers stated that their customers were interested in moving to EaaS.

- 2. Lower total cost of ownership (TCO): By only paying for defined outcomes (such as running hours or equipment output), customers can realize a lower TCO of equipment.

- 3. Increased flexibility: EaaS end users have the flexibility to scale their operations up or down as their needs change.

The Equipment as a Service (EaaS) market has been experiencing growth and is poised to continue growing in the coming years. This market encompasses a wide range of segments, with commercial vehicles, aircraft, and related parts leading the way. Closely followed by computers, peripheral equipment, and on-premises data centers, machinery, electric power generation, transmission, and distribution, and electrical lighting equipment.

Geographically, the Americas hold the largest share of the EaaS market, with EMEA and APAC regions also contributing substantial portions. The EaaS market's robust growth can be attributed to the increasing adoption of this business model across various industries, offering them the flexibility to use high-quality equipment without the upfront costs of ownership.

As we move forward, the EaaS market is expected to maintain its upward trajectory, driven by technological advancements, evolving business needs, and the increasing recognition of the benefits of this service model.

Questions answered:

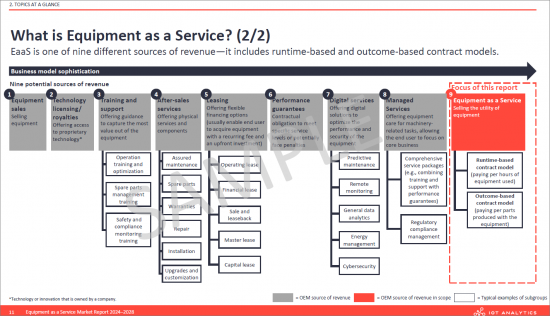

- What is EaaS? (Definition, how it works for consumers and original equipment makers (OEMs), why and how consumers benefit from EaaS; and why OEMs offer EaaS)

- Where does EaaS fit compared to other services provided by OEMs?

- How big is the EaaS market, and how is it expected to evolve?

- Who are the OEMs leading EaaS adoption, and what is their market share?

- What macro trends impact the market growth, and what are the headwinds/tailwinds?

- What are the drivers for EaaS adoption?

- How are EaaS solutions created?

- How are OEMs financing EaaS? How are they making EaaS successful?

- What are some best-in-class case studies of EaaS?

Companies mentioned:

A selection of companies mentioned in the report.

|

|

Table of Contents

1. Executive summary

2. Topic at a glance

- 2.1. Starting point: "Pay-per-use" and "Equipment as a Service" are important trends on the OEM digitization roadmap

- 2.2. 4 prominent examples of companies that have introduced EaaS

- 2.3. What is Equipment as a Service (EaaS)?

- 2.4. Why do consumers theoretically benefit from EaaS?

- 2.5. How does Equipment as a Service work for end users?

- 2.6. OEM's typical path towards Equipment as a Service

- 2.7. How typical EaaS solutions are created

- 2.8. Why do OEMs offer Equipment as a Service?

3. Market size & outlook

- 3.1. EaaS market segments definitions

- 3.2. Definitions of OEM market, EaaS market and EaaS adoption rate

- 3.3. Global market size and outlook - Overview

- 3.4. Global EaaS market size and outlook - Analyst's opinion on market growth

- 3.5. Global market size and outlook - by region

- 3.6. Deep-dive 1: Machinery as a Service

- 3.7. Deep-dive 2: Computers, peripheral equipment and on-premises data centers as a Service

- 3.8. Deep-dive 3: Commercial vehicle, aircrafts and related parts as a Service - Market forecast

- 3.9. Deep-dive 4: Electrical lighting equipment as a Service

- 3.10. Deep-dive 5: Electric power generation, transmission and distribution as a Service

- 3.11. Overview of headwinds and tailwinds impacting the global EaaS market growth

- 3.12. 1. Rising inflation/interest rates driving the asset-light subscription economy

- 3.13. 2. Labor shortages pushing the need for hourly equipment usage

- 3.14. 3. Governments subsidizing CAPEX-type investments

- 3.15. 4. Rising demand for increased flexibility

- 3.16. 5. IIoT technology improvements

- 3.17. Analysis of the market growth

- 3.18. Global market size and outlook - Further information

4. EaaS adoption

- 4.1. EaaS adoption drivers

- 4.2. EaaS adoption rate split by sub-segments

- 4.3. Overview of the EaaS opportunity (1/2): Current adoption vs future adoption

- 4.4. Overview of the EaaS opportunity (2/2): Current adoption vs future adoption - Deep dive on machinery

5. Known adopters & vendors

- 5.1. Landscape of the EaaS enabling infrastructure

- 5.2. Landscape of known adopters

- 5.3. Deep-dive 1: Robotics as a Service

- 5.4. Deep dive 2: Compressor as a Service

- 5.5. Deep dive 3: EaaS pioneer

- 5.6. Deep dive 4: Success story - Heidelberger Druckmaschinen

- 5.7. Deep dive 5: Setback story - Festo

6. Financing EaaS

- 6.1. Financial institutions are introducing pay-per-use financial products to cater to EaaS specifics

- 6.2. Background: Pay-per-use financing is a form of off-balance sheet financing

- 6.3. How OEMs generally think about equipment financing

- 6.4. 3 theoretical options to finance equipment as a service from the user's point of view

- 6.5. Landscape of financial institutions with dedicated EaaS offerings

- 6.6. Example of an OEM self-financing EaaS (1/2): Kaeser

- 6.7. Example of an OEM self-financing EaaS (2/2): Caterpillar

- 6.8. Example of an OEM financing EaaS with a 3rd party : Trumpf

- 6.9. Example of an OEM financing EaaS with an SPV Symbotic

7. Case studies

- 7.1. 95 EaaS case studies have been identified across variety of industries

- 7.2. Case study 1: Heller

- Successful OEMs focus on software add-ons with a freemium model

- 7.3. Case study 2: Carrier Commercial Refrigeration

- 7.4. Case study 3: Kaeser Compressors

- 7.5. Case study 4: Heidelberg Druckmaschinen

- 7.6. Case study 5: Kaer

- 7.7. Case study 6: Hewlett Packard Enterprise

- 7.8. Case study 7: Signify

- 7.9. Case study 8: Mitsubishi Elevator Europe

8. Trends & Challenges

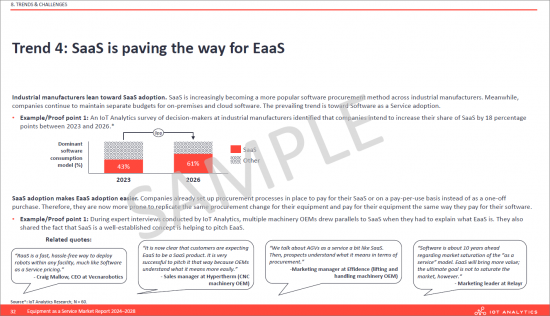

- 8.1. Trend 1: OEMs are using EaaS to capture revenue lost to 3rd parties

- 8.2. Trend 2: Guaranteed performance contracts offer alternative to EaaS

- 8.3. Trend 3: OEMS are using EaaS to push their sustainability agenda

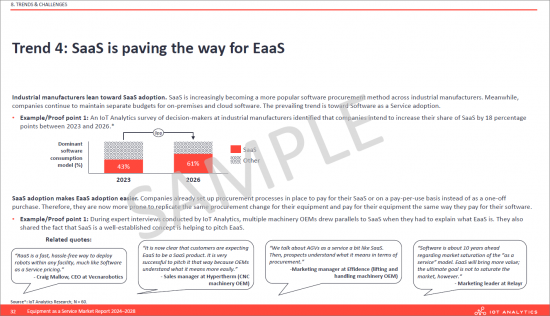

- 8.4. Trend 4: EaaS has become the prominent business model for commercial electric/hydrogen vehicles

- 8.5. Trend 5: EaaS adoption happens in industry cluster

- 8.6. Trend 6: Re-using spare parts as part of the EaaS setup

- 8.7. Trend 7: EaaS becoming the prominent business model for commercial electric/hydrogen vehicles

- 8.8. Challenge 1: Establishing EaaS pricing / contracts

- 8.9. Challenge 2: Transitioning from existing business models

- 8.10. Challenge 3: Procuring flexible financing sources

- 8.11. Challenge 4: Managing larger balance sheets

- 8.12. Challenge 5: End-users don't treat EaaS equipment well

- 8.13. Challenge 6: There are no financing best-practices

9. Survey insights

- 9.1. EaaS OEM adoption status-by segment

- 9.2. Customer adoption of EaaS

- 9.3. Reasons why customers adopt EaaS

- 9.4. Necessary actions to guarantee a successful pivot to EaaS

- 9.5. Common mistakes when transitioning to EaaS

- 9.6. Respondents' profile and survey overview