|

市場調查報告書

商品編碼

1130050

快捷郵件、小包裹的全球市場 (2022年)Global Express & Small Parcels 2022 |

||||||

全球快捷郵件、小包裹市場,受到國內、跨國EC的穩定發展所牽引,2021年成長12.2%。市場,由於影響成長和機會的許多要素,維持高競爭力。B2C持續成長,獨佔市場,另一方面世界規模的整合者獨佔國際市場,國內市場仍分散。

主要調查結果

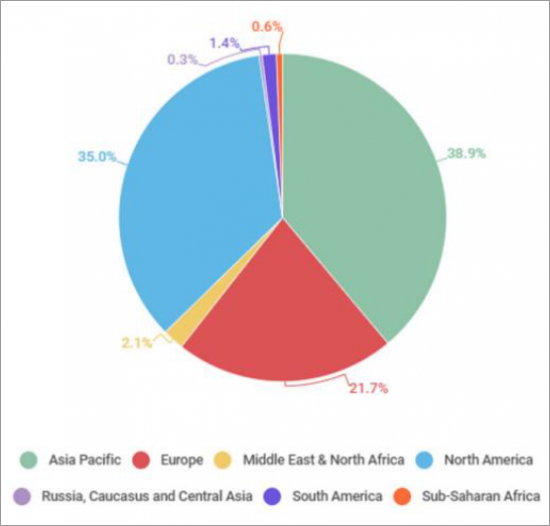

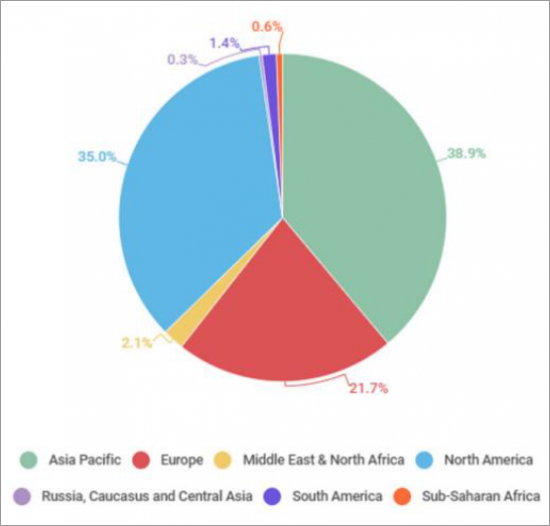

快遞的整體市場規模、各地區(2021年)

出處:Ti

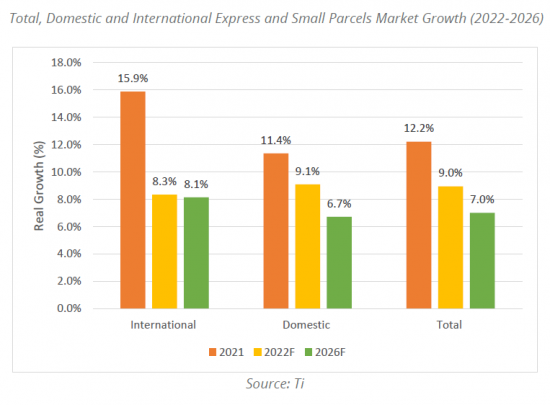

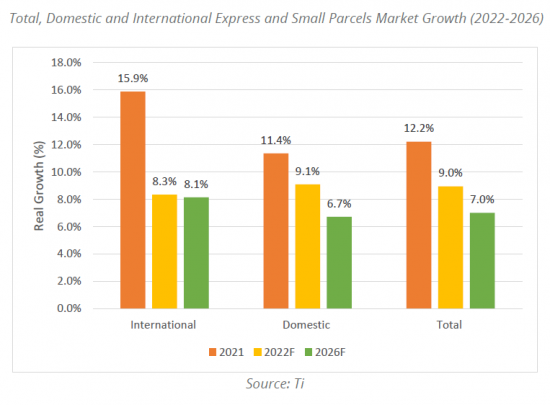

- 1. 2021年的全球快捷郵件、小包裹市場成長了12.2%,不過,2026年的預測悲觀。

- 2. 2021年的國際市場比國內急速擴大。

- 3. 2021年的快捷郵件市場,7個地區中6個地區成長2位數。

- 4. 最後一哩和跨國市場,預計至2026年的5年以2位數年複合成長率成長。

- 5. 預計2021年的B2C市場為2,785億6,590萬歐元,B2B市場為1,835億7,200萬歐元。

本報告提供全球快捷郵件、小包裹市場相關分析,整體市場規模與趨勢預測 (2021年~2026年) ,及各領域 (國內/國外,B2B/B2C等)、各地區的詳細趨勢,近來的市場主要趨勢,競爭情形 (各企業的銷售額、貨物運輸數量、收益率等),主要企業的簡介業績比較等彙整資訊,為您概述為以下內容。

目錄

第1章 市場規模

- 世界

- 國際、國內

- B2B/B2C

- 各地區的市場規模

- 亞太地區

- 歐洲

- 北美

第2章 市場趨勢

- GDP趨勢

- 歐洲

- 北美

- 亞太地區

- 電子商務

- 全球概要

- 亞太地區

- 北美

- 歐洲

- B2B 電子商務

- 永續性

- 電信業者的永續性簡介

- 電動車廠商

- PUDO (PickUp DropOff) 網路

- Hivebox

- InPost

- Deutsche Post DHL

- La Poste/GeoPost

- Amazon Hub

- 最後一哩發送的Start-Ups

- Beelivery

- Budbee

- Milkman Technologies

- Ninja Van

- Urbantz

- Veho

第3章 競爭情形

- 競爭企業排行榜

- 小包裹的收入

- 小包裹的數量

- 每一小包收益

- 整合者的比較

- 收益

- EBIT保證金的比較

- 成長率的比較 (以數量為準)

- 每1個的收益

- 整合者地上業務的比較

- 產業部門的成長牽引

- 小包裹的市場價格和收益

- 由於政府的政策,小包裹價格的降低有所放緩

第4章 企業簡介

- DHL Parcels

- UPS Parcels

- FedEx Parcels

- USPS

- Royal Mail (and GLS)

- La Poste (and DPD)

- Yamato

- Sagawa

- Correos

- Poste Italiane

- SF Express

- Yunda Express

- YTO Express

- ZTO Express

- STO Express

第5章 市場預測

- 市場預測 (以金額為準)

- 亞太地區

- 歐洲

- 北美

- GDP的預測

- 電子商務的預測

New report contains brand new express logistics market data, trend analysis and for the first time, B2C and B2B market splits.

New Ti data reveals the express and small parcels market grew by 12.2% in 2021, driven by strong domestic and cross-border e-commerce performance. The market remains highly competitive with many drivers influencing growth and opportunities. B2C continues to grow and dominate the market, global integrators control the international market whilst the domestic market remains much more fragmented.

Ti's Global Express & Small Parcels 2022 report provides a detailed, up to date view of the trends influencing the market.

The report contains:

- 2021 market sizes, 2022 growth rates and 2026 forecasts split by region, country, domestic, international and for the first time, B2B and B2C

- Market segmentation - domestic vs international and B2B v B2C

- Market trend analysis including e-commerce growth, sustainability trends, electric vans expansion, PUDO growth and last-mile start-ups

- GDP growth and forecasts , split by region

- Competitive analysis - revenues, parcel volumes and parcel yield

- Express provider profiles and comparative reviews.

Key Findings

Total Express Market Size by Region (2021)

Source: Ti

- 1. The global express and small parcels market grew 12.2% in 2021, but 2026 forecasts are pessimistic.

- 2. The international market expanded more rapidly than domestic in 2021.

- 3. Six out of seven regions saw double-digit express market growth in 2021.

- 4. Last-mile and cross-border markets are expected to grow by double digit CAGR's in the five years to 2026.

- 5. In 2021, Ti valued the B2C market at €278,565.9m, and the B2B market at €183,572m.

Word from the author

"Strong demand from the retail e-commerce sector, paired with recovering GDP, helped fuel growth in the express market during 2021. However, the market now faces several headwinds." Nia Hudson, Report Author & Research Analyst, Ti.

Table of Contents

1. Market Sizing

- 1.1. Global

- 1.1.1. International and Domestic

- 1.1.2. B2B/B2C

- 1.2. Market Size by Region

- 1.2.1. Asia Pacific

- 1.2.2. Europe

- 1.2.3. North America

2. Market Trends

- 2.1. GDP Trends

- 2.1.1. Europe

- 2.1.2. North America

- 2.1.3. Asia Pacific

- 2.2. e-commerce

- 2.2.1. Global Overview

- 2.2.2. Asia Pacific

- 2.2.3. North America

- 2.2.4. Europe

- 2.2.5. B2B e-commerce

- 2.3. Sustainability

- 2.3.1. Carrier Sustainability Profiles

- 2.3.2. Electric Vehicle Manufacturers

- 2.4. PickUp DropOff Networks

- 2.4.1. Hivebox

- 2.4.2. InPost

- 2.4.3. Deutsche Post DHL

- 2.4.4. La Poste / GeoPost

- 2.4.5. Amazon Hub

- 2.5. Last-Mile Start-Ups

- 2.5.1. Beelivery

- 2.5.2. Budbee

- 2.5.3. Milkman Technologies

- 2.5.4. Ninja Van

- 2.5.5. Urbantz

- 2.5.6. Veho

3. Competitive Landscape

- 3.1. Competitor Ranking

- 3.1.1. Parcels Revenue

- 3.1.2. Parcels Volume

- 3.1.3. Revenue Per Parcel

- 3.2. Integrator Comparison

- 3.2.1. Revenue

- 3.2.2. EBIT Margin Comparison

- 3.2.3. Volume Growth Comparison

- 3.2.4. Revenue Per Piece

- 3.2.5. Integrator Ground Operations Comparison

- 3.2.6. Vertical Sectors Driving Growth

- 3.3. Parcel Market Pricing and Yield

- 3.3.1. Parcel Pricing decline somewhat stalled by government policy

4. Company Profiles

- 4.1. DHL Parcels

- 4.2. UPS Parcels

- 4.3. FedEx Parcels

- 4.4. USPS

- 4.5. Royal Mail (and GLS)

- 4.6. La Poste (and DPD)

- 4.7. Yamato

- 4.8. Sagawa

- 4.9. Correos

- 4.10. Poste Italiane

- 4.11. SF Express

- 4.12. Yunda Express

- 4.13. YTO Express

- 4.14. ZTO Express

- 4.15. STO Express

5. Market Forecast

- 5.1. Market Forecast by Value

- 5.1.1. Asia Pacific

- 5.1.2. Europe

- 5.1.3. North America

- 5.2. GDP Forecast

- 5.2.1. Europe

- 5.2.2. North America

- 5.2.3. Asia Pacific

- 5.3. e-commerce Forecast

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe