|

市場調查報告書

商品編碼

1272691

自動貼標機市場-增長、趨勢、COVID-19 的影響和預測 (2023-2028)Automatic Labeling Machine Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,自動貼標機市場預計將以 3.32% 的複合年增長率註冊。

由於技術進步和數字化進步,對標籤的需求與時俱進。 化妝品和家庭必需品有多種包裝和材料可供選擇。 不斷變化的環境增加了對更快、更自動化的貼標設備的需求。

主要亮點

- 市場的主要驅動力是食品和飲料行業對快速準確的標籤解決方案和自動化的需求不斷增長。 隨著標籤設備市場的快速擴張,頂級製造商正在努力融入最新的技術趨勢並改進產品功能。 據 Packaging World News 報導,終端客戶對 RFID(射頻識別)標籤解決方案的需求正以健康的速度增長,佔貼標機市場近四分之一的收入份額。

- 標籤跟蹤和防偽功能使產品製造商可以輕鬆跟蹤發貨情況。 標籤還可以通過確保產品在不中斷的情況下到達客戶手中來防止篡改。 對防止欺詐和盜竊的安全標籤的需求不斷增長,預計也將推動對該設備的需求。

- 客戶對產品多樣性的需求不斷增加,這是推動貼標機市場擴張的一個主要因素。 每天都有更多的產品被生產並推向市場以滿足消費者的需求。 智能和有效的標籤越來越受歡迎,以確保收入和保持產品相關性。 為了應對這些挑戰,消費品製造商越來越需要能夠處理不同材料並支持不同技術的適應性強的貼標機。

- 為了適應產品多樣性,工程公司正在開發針對不同包裝具有不同功能的貼標機。 由於投資成本高,而且需要訓練有素的專業人員來操作機器,小型企業引進貼標機是負擔不起的。 與包裝、標籤和其他操作一樣,對一台機器上的一體化解決方案的需求可能會推高機器成本並影響市場增長。

- 由於線上和線下渠道對各種食品和醫藥產品的需求增加,COVID-19 大流行的出現正在推動市場增長,尤其是食品和飲料包裝機械以及醫藥包裝機械。

自動貼標機市場趨勢

食品和飲料包裝自動化需求的增長推動了增長

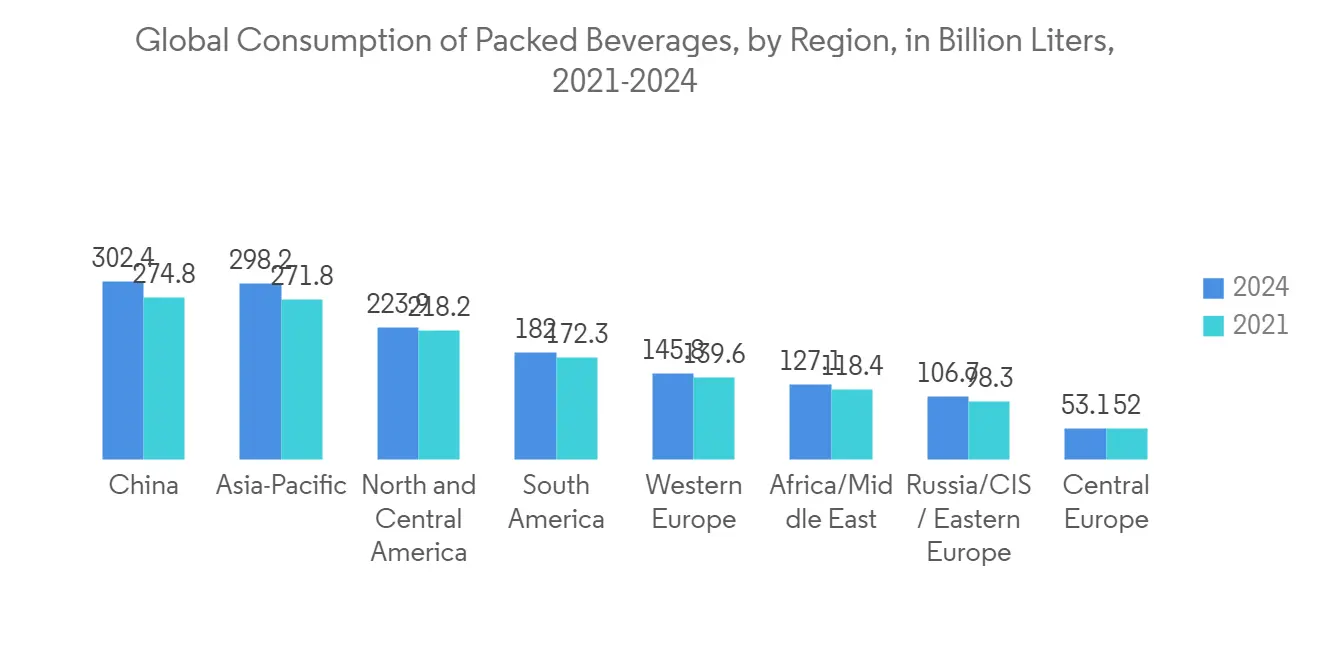

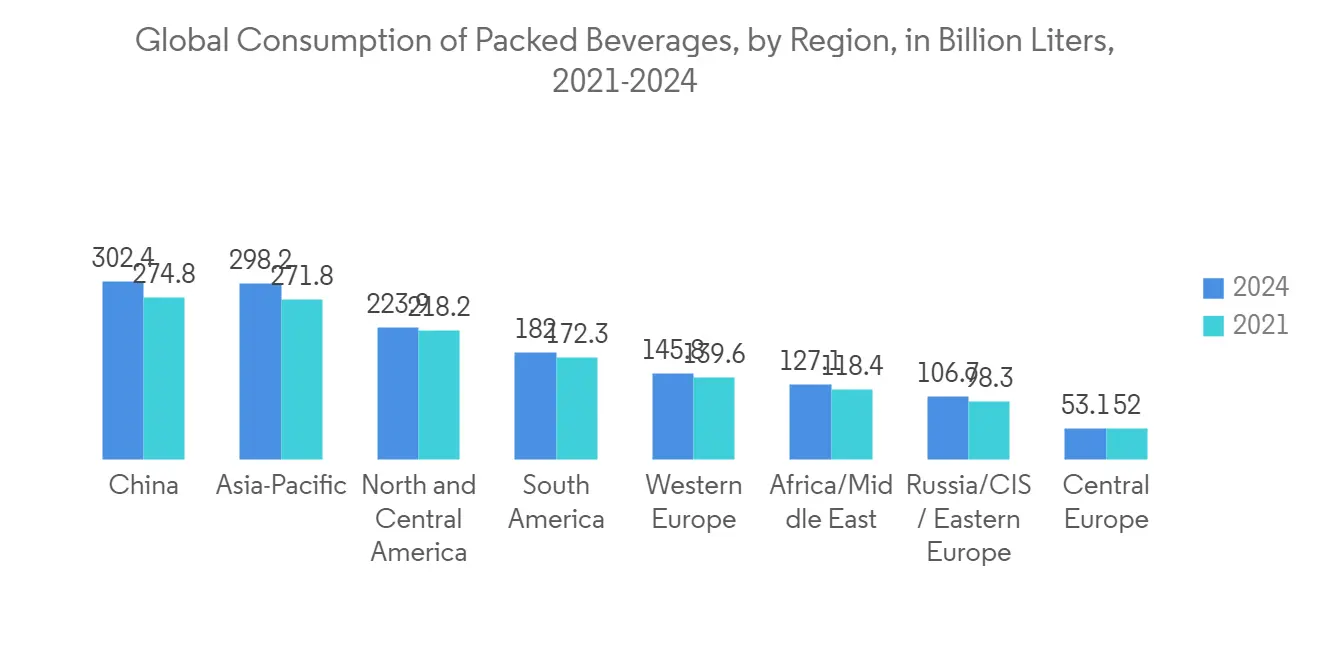

- 食品和飲料行業對自動化的需求正在推動所研究的市場。 隨著消費者對產品細節的關注度越來越高,標籤在提供產品信息和增加銷量方面發揮著重要作用。 製造商現在正在遷移到自動化標籤系統,以滿足食品和飲料行業不斷增長的需求。

- 食品和飲料製造商面臨多項挑戰,包括勞動力短缺、需求增加以及供應鏈持續中斷。 食品包裝自動化對這些公司起著重要作用,因為它可以在不增加勞動力的情況下提高生產率。 隨著未來幾年需求的增加和勞動力短缺的持續,包裝自動化將變得更加重要。 這就是製造商轉向技術的原因。 未來十年,工業 4.0 技術的發展可能會顯著改變食品製造業。

- 自動化包裝還可以提高食品和飲料的一致性以及對員工和消費者的安全性。 質量控製程序通常耗時且重複。 從事這些工作的工人在輪班期間可能會行動遲緩且容易出錯,從而導致有缺陷或不安全的產品繼續在生產線上流下。

- 儘管 COVID-19 大流行導致勞動力短缺,但對自動化的投資仍在增加。 技術正在使食品公司更加敏捷和響應變化。 隨著技術的進步,新機器被用於所有同時手工完成所有工作的行業。 食品包裝是最受認可的行業之一,它完全接受了當今的科學進步。

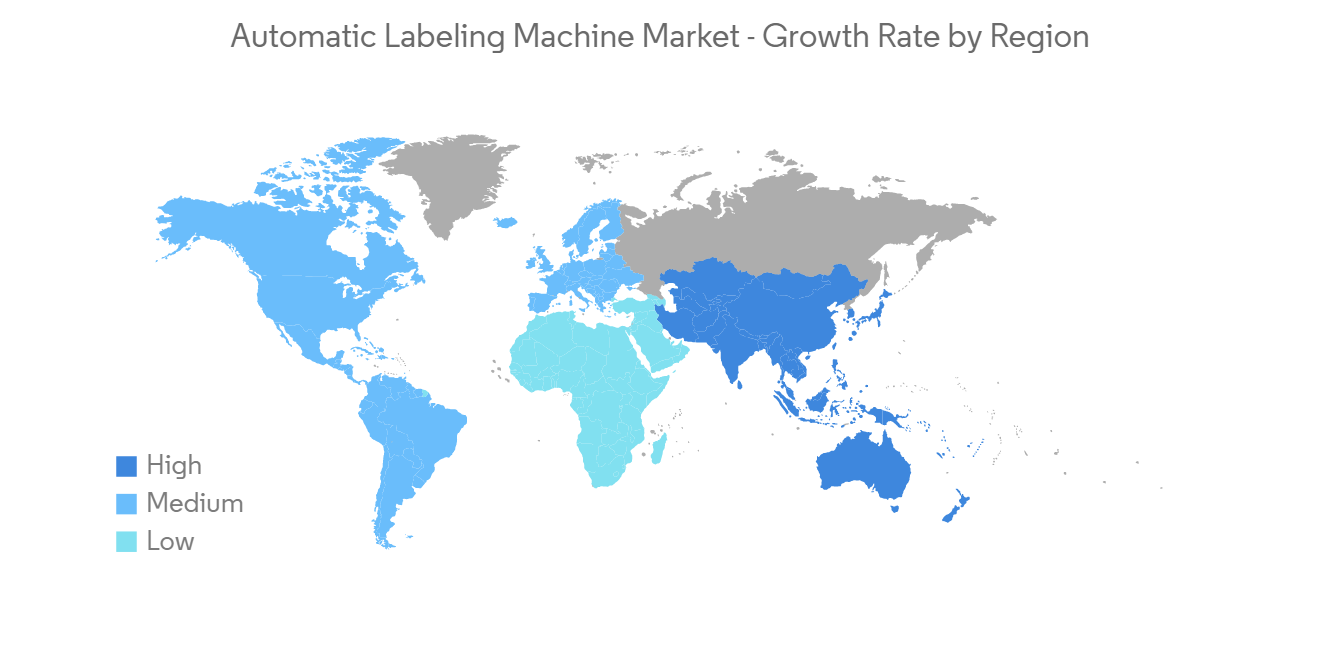

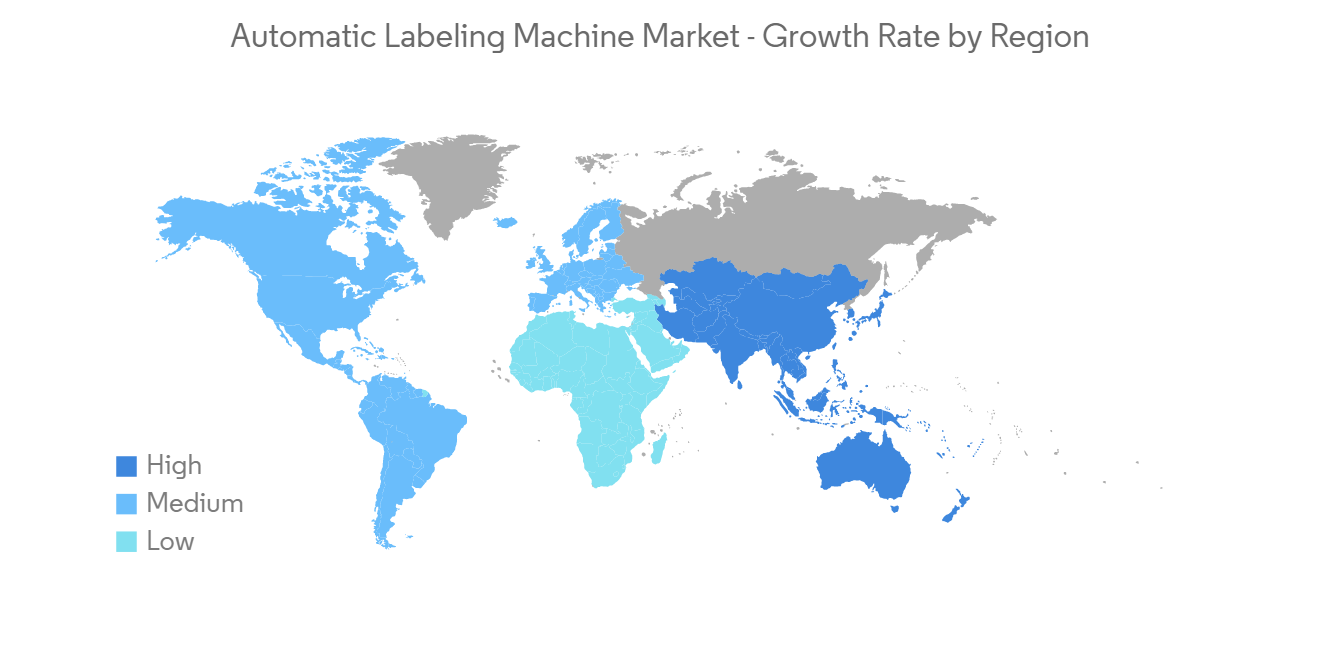

具有高增長潛力的亞太地區

- 亞太地區是世界上人口最多的地區。 隨著消費者對包裝意識的增強,食品行業對包裝和高速、高質量標籤解決方案的需求也在增加。 在亞太地區,中國和台灣已成為自動貼標機的主要出口國。

- 食品和飲料、製藥和化工等行業對提高生產力的需求不斷增長以及技術進步是推動中國貼標機需求的主要因素。 中國監管機構要求在進出口糖果、葡萄酒、堅果、罐頭食品和奶酪等食品時進行標籤驗證和產品質量檢驗。

- 近年來,貼標機在印度發展迅猛。 2022 年 6 月,總部位於孟買的 Printgraph Converting Machinery 與 Macrt 和 Perfect Printgraph Engineers 在第 15 屆 Printpack India 上推出了數字標籤印刷機。 這台名為 TruWo 的機器滿足了印刷和包裝行業的需求,他們正在尋找技術來補充他們現有的印刷能力。

- 在過去二十年中,日本威士忌越來越受歡迎,導致出口到世界各地的威士忌數量增加。 然而,已經證實日本威士忌生產的法規和傳統不一定與其他國家相匹配。

自動貼標機行業概況

自動貼標機市場擁有大量公司和中等盈利能力 (CAGR),導致市場競爭激烈。 總體而言,競爭對手之間的競爭強度預計在預測期內會增加。 市場上的主要參與者是 Accutek Packaging Equipment、SIDEL(Tetra Laval Group)、Barry-Wehmiller Group 和 Krones AG。

- 2022 年 7 月 - 為了提供化學品桶的可追溯性,德國密封桶專家 Duttenhofer 投資了 Herma 的集成二維碼標籤和打印應用系統。底部。 該公司使用 Herma 的標籤解決方案已有一段時間,對根據 VPA 9 法規生產的技術和標籤材料感到滿意。

- 2022 年 6 月,BOBST 集團宣布推出首個 BOBST Connect 訂閱計劃。 這個以用戶為中心的平台將加工商和品牌所有者與自動化數字工作流程聯繫起來,使他們能夠完全訪問和控制製造過程。 BOBST Connect 通過提供洞察力和解決方案來提高生產率、質量和效率,幫助您充分利用設備生成的大量數據。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 研究假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第 4 章市場洞察

- 市場概覽

- 價值鏈分析

- 行業吸引力 - 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 評估 COVID-19 對行業的影響

- 價格分析

- 進出口分析

- 貼標機分銷商和備件供應商

- 售後服務分析

第 5 章市場動態

- 市場驅動因素

- 對食品和飲料包裝自動化的需求增加

- 擴大對自動貼標機的採用

- 市場製約因素

- 應對與貼標機相關的高成本和趨勢

第 6 章市場細分

- 按類型

- 壓敏/不干膠貼標機

- 套標機

- 不干膠貼標機

- 其他類型

- 最終用戶

- 醫藥

- 食物

- 飲料

- 個人護理

- 化學品

- 其他最終用戶

- 按地區

- 北美

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲地區

- 中東和非洲

- 阿拉伯聯合酋長國

- 沙特阿拉伯

- 其他中東和非洲地區

- 北美

第七章競爭格局

- 公司簡介

- Sacmi Imola S.C.

- Accutek Packaging Equipment Companies Inc.

- Krones AG

- SIDEL(Tetra Laval Group)

- Barry-Wehmiller Group Inc.

- Herma HMB

- Nita Labeling Systems

- World pack Automation Systems

- Bobst Group SA

- KHS GmbH

- ProMach Inc.

第八章投資分析

第九章市場機會與未來趨勢

The automatic labeling machine market is expected to register a CAGR of 3.32% over the forecast period. The necessity of labeling has significantly increased over time due to technological improvements and the digital transition. Cosmetics and home essentials come in a variety of packaging and material options. The need for more rapid and automated labeling equipment has grown due to the shifting environment.

Key Highlights

- The market is primarily driven by the growing demand for high-speed and accurate labeling solutions and automation in the food and beverage industry. While the labeling machine market is expanding quickly, top manufacturers are working to improve their product features by incorporating cutting-edge technological trends. The demand for RFID (radio frequency identification) labeling solutions among end customers is growing at a healthy rate, accounting for close to one-fourth of the revenue share of the market for labeling machines, according to Packaging World News.

- The tracking and anti-counterfeiting functions on labels make it simple for product manufacturers to keep track of shipments. Labels also protect against tampering by guaranteeing that products are delivered to clients without disruption. The growing demand for security labeling to prevent fraud and theft is also expected to increase the demand for this equipment.

- The rising customer demand for increased product diversity is a major factor driving the market expansion for labeling machines. More products are produced and introduced to the market daily to cater to consumer demand. To ensure revenue and keep products relevant, smart and effective labeling is becoming increasingly popular. Manufacturers of consumer goods are increasingly in need of adaptable labeling machines that can work with a variety of materials and support various technologies to solve these challenges.

- To address product variability, engineering companies have developed labelers with different capabilities that address various packages. Labeling machine installation in small-scale businesses is not affordable, as it requires significant investment costs and trained professionals to operate the machine. The demand for all-in-one solutions in one machine, like packaging, labeling, and other operations, has raised the cost of machines, which can impact the market's growth.

- The emergence of the COVID-19 pandemic has boosted market growth, particularly for food and beverage packaging and pharmaceutical packaging machinery, due to increased demand for various foods and medicines through online and offline channels.

Automatic Labeling Machine Market Trends

Increasing Demand for Automation in Food and Beverage Packaging to Witness Growth

- Demand for automation in the food and beverage industry is driving the market studied. As consumers become more conscious about product details, labels play a crucial role in providing information about the product and boosting sales. Manufacturers are now shifting to automated labeling systems to meet the growing food and beverage industry demand.

- Food and beverage manufacturers face several issues, including labor shortages, increased demand, and persistent supply chain disruptions. Food packaging automation can be critical for these organizations since it increases manufacturing productivity without the need for additional labor. Packaging automation will likely become more important as demand rises over the next few years and manpower shortages persist. Thus, manufacturers are turning to technology. Developments in Industry 4.0 technologies may transform food manufacturing in the coming decade.

- Packaging automation can also improve the consistency and safety of food and beverage items for workers and consumers. Quality control procedures are frequently time-consuming or repetitive. Workers allocated to these jobs tend to slow down and make mistakes throughout a shift, potentially allowing defective or unsafe products to progress further along the manufacturing line.

- Despite the COVID-19 pandemic-related labor scarcity, investments in automation are increasing. Technology allows food enterprises to be more agile and adaptable to change. With the advancement of technology, new machines are being used in all industries where everything is done manually simultaneously. Food packaging is one of the most recognized businesses fully embracing today's scientific evolution.

Asia-Pacific is Expected to Have a High Growth Rate

- Asia-Pacific is home to the largest population in the world. With increasing consumer awareness regarding packaging, the demand for packaging in the food industry and high-speed and high-quality labeling solutions is increasing. China and Taiwan are the major exporters in the Asia-Pacific region for automatic labeling machines.

- Increasing demand for productivity improvements across industries like food and beverage, pharmaceutical, and chemical, as well as technological advancements, are some of the main factors driving labeling machine demand in China. Chinese regulators require imported and exported (but not domestic) food items such as candy, wine, nuts, canned food, and cheese to have labels verified and products tested for quality before goods can be imported or exported.

- In India, labeling machinery witnessed significant growth in recent years. In June 2022, Printgraph Converting Machinery, a Mumbai-based company, along with Macrt and Perfect Printgraph Engineers, launched a digital label printer at the 15th Printpack India. The machine, known as TruWo, will meet the printing and packaging industry demand, which is looking for complementing technology to add to its existing print capabilities.

- The rising popularity of Japanese whisky over the past two decades has increased the spirit being exported worldwide. It has been observed that the Japanese regulations and traditions of whisky-making do not necessarily line up with that of other countries.

Automatic Labeling Machine Industry Overview

The automatic labeling machine market has many companies and moderate profitability (CAGR), creating strong market share competition. Overall, the intensity of competitive rivalry is expected to be high during the forecast period. The key players in the market are Accutek Packaging Equipment, SIDEL (Tetra Laval Group), Barry-Wehmiller Group, and Krones AG.

- July 2022 - To offer traceability for drums carrying chemicals, German tight-head drum specialist Duttenhofer invested in an integrated solution from Herma comprising the labels for QR codes and a print-and-apply system. It has been utilizing Herma's labeling solution for some time and is pleased with both using the technology and the label material, which was created following VPA 9 regulations.

- In June 2022, BOBST Group announced the launch of the first subscription plan of BOBST Connect. This user-centric platform links converter and brand owners to an automated and digital workflow and grants them full access and control of the manufacturing process. BOBST Connect assists customers in making the most of the quantity of data their equipment generates by offering insights and various solutions to improve productivity, quality, and efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

- 4.5 Pricing Analysis

- 4.6 Import and Export Analysis

- 4.7 Distributors and Spare Parts Providers of Labeling Machines

- 4.8 After-Sales Service Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Automation in Food and Beverage Packaging

- 5.1.2 Growing Adoption of Automatic Labeling Machine

- 5.2 Market Restraints

- 5.2.1 High Cost Associated with Labeling Machines and Coping with Trends

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Pressure-sensitive/Self-adhesive Labelers

- 6.1.2 Sleeve Labelers

- 6.1.3 Glue-based Labelers

- 6.1.4 Other Types

- 6.2 By End User

- 6.2.1 Pharmaceutical

- 6.2.2 Food

- 6.2.3 Beverages

- 6.2.4 Personal Care

- 6.2.5 Chemicals

- 6.2.6 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Mexico

- 6.3.4.2 Brazil

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Rest of Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Sacmi Imola S.C.

- 7.1.2 Accutek Packaging Equipment Companies Inc.

- 7.1.3 Krones AG

- 7.1.4 SIDEL (Tetra Laval Group)

- 7.1.5 Barry-Wehmiller Group Inc.

- 7.1.6 Herma HMB

- 7.1.7 Nita Labeling Systems

- 7.1.8 World pack Automation Systems

- 7.1.9 Bobst Group SA

- 7.1.10 KHS GmbH

- 7.1.11 ProMach Inc.