|

市場調查報告書

商品編碼

1435985

驅蚊劑 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Mosquito Repellent - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

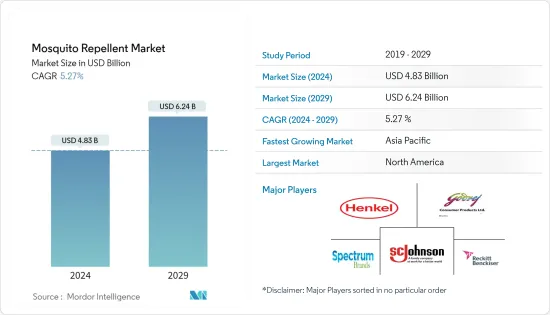

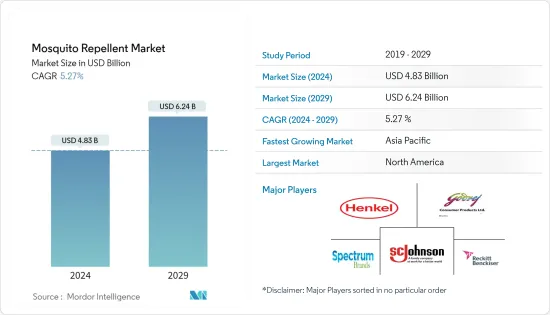

驅蚊劑市場規模預計到2024年為 48.3 億美元,預計到2029年將達到 62.4 億美元,在預測期內(2024-2029年)CAGR為 5.27%。

主要亮點

- 由於屈公病、登革熱、絲蟲病或黃熱病等蚊媒疾病發病率上升,以及許多政府採取蚊蟲控制計劃,驅蚊劑市場迅速成長。北美、亞太和歐洲等地區近年來出現了大量登革熱、瘧疾和屈公病病例。

- 然而,在各種驅蚊產品中使用低成本但有毒的化學物質來製造驅蚊劑,例如避蚊胺,會對人類健康造成不良影響,並可能會阻礙該市場的中期成長。

- 因此,越來越多的全球和本地製造商投資研發,以克服驅蚊劑中與有毒化學物質相關的普遍問題,並在具有競爭力的價格範圍內提供創新產品。例如,2016年,HealthPro品牌子公司Fit Organic推出了Fit Organic驅蚊噴霧,這是一種經過有機認證的驅蚊劑,經科學證明與避蚊胺一樣有效長達三個小時,而且對孕婦和兒童也安全。

- 登革熱和2019年冠狀病毒病(COVID-19)的同時流行可能會產生許多不利的結果,例如雙重感染。因此,衛生界和政策制定者製定積極主動的政策並分配充足的資源,以預防和管理新冠肺炎(COVID-19)新時代登革熱和其他媒介傳播疾病的死灰復燃。

- 因此,這種情況增加了全球驅蚊劑的銷售量,主要是在印度、美國、巴西和義大利等受災最嚴重的國家。

驅蚊劑市場趨勢

蚊媒疾病的發生率增加

全球驅蚊劑市場的主要驅動力是全球瘧疾、登革熱、屈公病、黃熱病、茲卡病毒等蚊媒疾病發生率的增加。2016年的特點是全球大規模爆發登革熱。根據世界衛生組織(WHO)統計,媒介傳播疾病佔所有傳染病的 17%以上,每年導致超過 70 萬人死亡。這些疾病可能是由寄生蟲、病毒或細菌引起的。在所有媒介傳播的疾病中,登革熱是最受普遍的病毒感染,每年估計導致 40,000 人死亡。此外,美洲地區2016年報告了超過 238 萬例病例,而僅巴西就貢獻了略低於 150 萬例的病例。同樣,2020年,泛美衛生組織(PAHO)報告僅在美洲地區就有 2206 612 例疑似和確診登革熱病例以及 900 人死亡。與2019年的數字相比,這相當於減少了 30%。報告病例最多的五個國家是:巴西(1 418 296例)、巴拉圭(221 544例)、墨西哥(114 642例)、玻利維亞(84 146例)和哥倫比亞(75 246例)。由於這些因素,競爭對手致力於透過電視、報紙、廣告看板、廣告看板和社交媒體等綜合傳播平台推廣其產品,以提高人們對蚊子相關疾病的認知。這又增加了對其驅蚊劑產品的需求。

亞太地區是成長最快的市場

由於人們對蚊媒疾病的高度認知、政府和非政府支持的減少蚊媒疾病的計劃等,預計亞太地區的驅蚊劑市場將出現最快的成長速度。在德里(印度),應對屈公病和登革熱等媒介傳播疾病,同時提高居民參與預防疾病傳播的力道。此外,現代驅蚊產品(如蒸發器、噴霧劑、霜劑、驅蚊織物等)的滲透率不斷提高,預計將進一步推動預測期內的市場成長。此外,隨著經濟的大幅成長,該地區在功能屬性方面出現了越來越多的產品創新,例如親膚、有機/天然、香料等。例如,2019年,Aunt Fannie's 推出了兩款新的驅蚊噴霧,不含避蚊胺,由精油製成,有效同時保護兒童和成人免受蚊蟲叮咬。

驅蚊劑產業概況

Reckitt Benckiser Group、The Godrej Company、Dabur International、Coglans Ltd.、SC Johnson & Son、Johnson and Johnson、Spectrum Brands、Jyothi Labs 等都是業界的主要參與者。在所研究的市場中營運的公司功能、成分、價格、氣味、包裝和格式方面對其產品進行差異化,以獲得競爭優勢。製造商致力於使用天然成分生產創新的驅蟲產品,以便為目標消費者提供廣泛、成熟的產品組合。例如,Godrej 推出了新的酸橙味滅蚊產品,最終可以殺死蚊子,甚至不會改變該地方的香氣。此外,廣告和付費促銷在該行業中發揮著重要作用。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究成果和研究假設

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

第5章 市場細分

- 依產品類型

- 噴霧/氣霧劑

- 乳霜和油

- 汽化器(液體和紙張)

- 其他產品

- 依最終用戶

- 住宅

- 商業

- 依配銷通路

- 超市/大賣場

- 便利商店

- 網路零售商

- 其他分銷管道

- 按地理

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太

- 印度

- 中國

- 日本

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 中東和非洲其他地區

- 北美洲

第6章 競爭格局

- 最活躍的公司

- 最常用的策略

- Market Positioning Analysis

- 公司簡介

- Spectrum Brands, Inc.

- Henkel AG & Co. KGaA

- Coghlans Ltd

- Godrej Consumer Products Ltd

- Enesis Group

- Jyothy Laboratories

- Dabur India Ltd

- SC Johnson & Son

- Reckitt Benckiser Group PLC

第7章 市場機會與未來趨勢

第8章 COVID-19 對市場的影響

The Mosquito Repellent Market size is estimated at USD 4.83 billion in 2024, and is expected to reach USD 6.24 billion by 2029, growing at a CAGR of 5.27% during the forecast period (2024-2029).

Key Highlights

- Mosquito repellent market is growing rapidly due to rise in incidence of mosquito-borne diseases as chikungunya, dengue, filariasis, or yellow fever followed by many governments initiatives for mosquito control programmes. Regions such as North America, Asia Pacific, and Europe have witnessed a large number of cases of dengue, malaria, and chikungunya in the past years.

- However, application of low-cost but toxic chemicals in manufacturing of mosquito repellent, such as DEET, in various mosquito repellent products causes ill effects on human health, and are likely to obstruct the growth of this market for medium term.

- Thus, an increasing number of manufacturers both global as well as local plyaers are investing in the research and development to overcome the prevailing problem associated with toxic chemicals in mosiquto repllent and offer innovative product offerings under competitive price range. For instance in 2016, Fit Organic, a subsidiary of HealthPro Brand, launched Fit Organic Mosquito Repellent Spray,which is a organic certified repellent scientifically proven as effective as DEET for up to three hours, yet safe for pregnant women and children.

- The concurrent circulation of dengue and coronavirus disease 2019 (COVID-19) may produce many unfavourable outcomes-such as co-infections. Consequently, the health community and policy makers are developing proactive policies and allocating adequate resources to prevent and manage the resurgence of dengue and other vector-borne diseases in the new era of COVID-19.

- Thus, such situations has increased the sales of mosiquto repellents across the globe primarly in worst hit countries such as India, United States, Brazil and Italy.

Mosquito Repellents Market Trends

Increased Incidence of Mosquito Borne Diseases

Key driver of the global mosquito repellent market is increased incidence of mosquito-borne diseases such as malaria, dengue, chikungunya, yellow fever, zika virus, and others across the globe. The year 2016 was characterized by large dengue outbreaks, worldwide. According to the World Health Organization (WHO), vector-borne diseases account for more than 17 percent of all infectious diseases, causing more than 700,000 deaths annually. These diseases can be caused either by parasites, viruses, or bacteria. Out of all vector-borne diseases, dengue is the most prevalent viral infection causing an estimated 40,000 deaths every year. Additionally, the American region reported more than 2.38 million cases in 2016, whereas, Brazil alone contributed slightly less than 1.5 million cases. Similarly, in 2020, the Pan American Health Organization (PAHO) reported 2 206 612 suspected and confirmed dengue cases and 900 deaths, in the Americas region alone. This corresponds to a 30% decrease compared to 2019 figures. The five countries reporting most cases are: Brazil (1 418 296 cases), Paraguay (221 544), Mexico (114 642), Bolivia (84 146) and Colombia (75 246). Owing to these factors, competitors are focusing on promoting their products through integrated communication platforms, such as TVs, newspapers, billboards, hoardings, and social media, to create awareness about mosquito-related diseases. This, in turn, increases the demand for their mosequto repellent offerings.

Asia Pacific is the Fastest Growing Market

Asia-Pacific is expected to witness the fastest growth rate in the mosquito repellent market, due to high awareness of mosquito-borne diseases, government and non-government supported programs to minimize the mosquito borne disease etc. For instance, the launch of the campaign in Delhi (India) to tackle vector-borne diseases like chikungunya and dengue while increasing the participation of residents in preventing their spread. Additionally, increasing penetration of modern mosquito repellent products such as vaporizers, sprays, creams, repellent fabrics, etc., is further anticipated to fuel the market growth during the forecast period. Also, with substancial growth, the region has witnessed an increasing number of product innoavtions in terms of functional attributes such as skin friendly, organic/natural, fragrance and others. For instance in 2019 Aunt Fannie's launched two new mosquito repellent sprays that are DEET-free and are made of essential oils, making it effective while protecting kids and adults from mosquito bites.

Mosquito Repellents Industry Overview

Reckitt Benckiser Group, The Godrej Company, Dabur International, Coglans Ltd., S.C Johnson & Son, Johnson and Johnson, Spectrum Brands, Jyothi Labs, and others are some of the major players in the industry. Companies operating in the market studied are differentiating their offerings in terms of functionalities, ingredients, price, odour, packaging, and format, in order to gain competitive advantage. Manufacturers are focusing on producing innovative insect repellent products by using natural ingredients, in order to have an extensive, established product portfolio for their target consumers. For instance, Godrej has launched its new lime flavor mosquito hit that eventually kills mosquitoes without even changing the aroma of the place. Additionally, advertisements and paid promotions play an important role in the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Produdct Type

- 5.1.1 Spray/ Aerosols

- 5.1.2 Cream & Oil

- 5.1.3 Vaporizer (Liquid and Paper)

- 5.1.4 Other Products

- 5.2 By End User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Convenience Stores

- 5.3.3 Online Retailers

- 5.3.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Positioning Analysis

- 6.4 Company Profiles

- 6.4.1 Spectrum Brands, Inc.

- 6.4.2 Henkel AG & Co. KGaA

- 6.4.3 Coghlans Ltd

- 6.4.4 Godrej Consumer Products Ltd

- 6.4.5 Enesis Group

- 6.4.6 Jyothy Laboratories

- 6.4.7 Dabur India Ltd

- 6.4.8 S. C. Johnson & Son

- 6.4.9 Reckitt Benckiser Group PLC